2025 Token Unlocks Review — A Complete Breakdown of Emissions, Insider Vesting, and Market Impact

Key Insights (Summary)

- Massive year: 2025 saw $97B in total unlocks — one of the largest emission years to date.

- Non-insider dominance: 80%+ of unlocks came from community, ecosystem, treasury, rewards, listings, and liquidity allocations.

- Concentration at the top: A handful of tokens (WBT, SUI, CONX, WLD) accounted for a large share of total value unlocked.

- AI, Meme, and L1 projects led TGEs: Several TGE unlocks crossed the $1B mark.

- Infrastructure-heavy emissions: Infra + L1 accounted for the majority of yearly token release.

- Linear unlocks persist: WLD, DOGE, TRUMP, AVAX, and TAO formed the largest continuous flows.

Overview

2025 was one of the largest emission years on record, with $97.43B in total tokens released across major sectors. This report breaks down the year’s unlock activity across value, supply, insiders vs. non-insiders, sectors, and the heaviest single-event unlocks.

1. Market-Wide Unlock Summary

Total Unlock Value (2025)

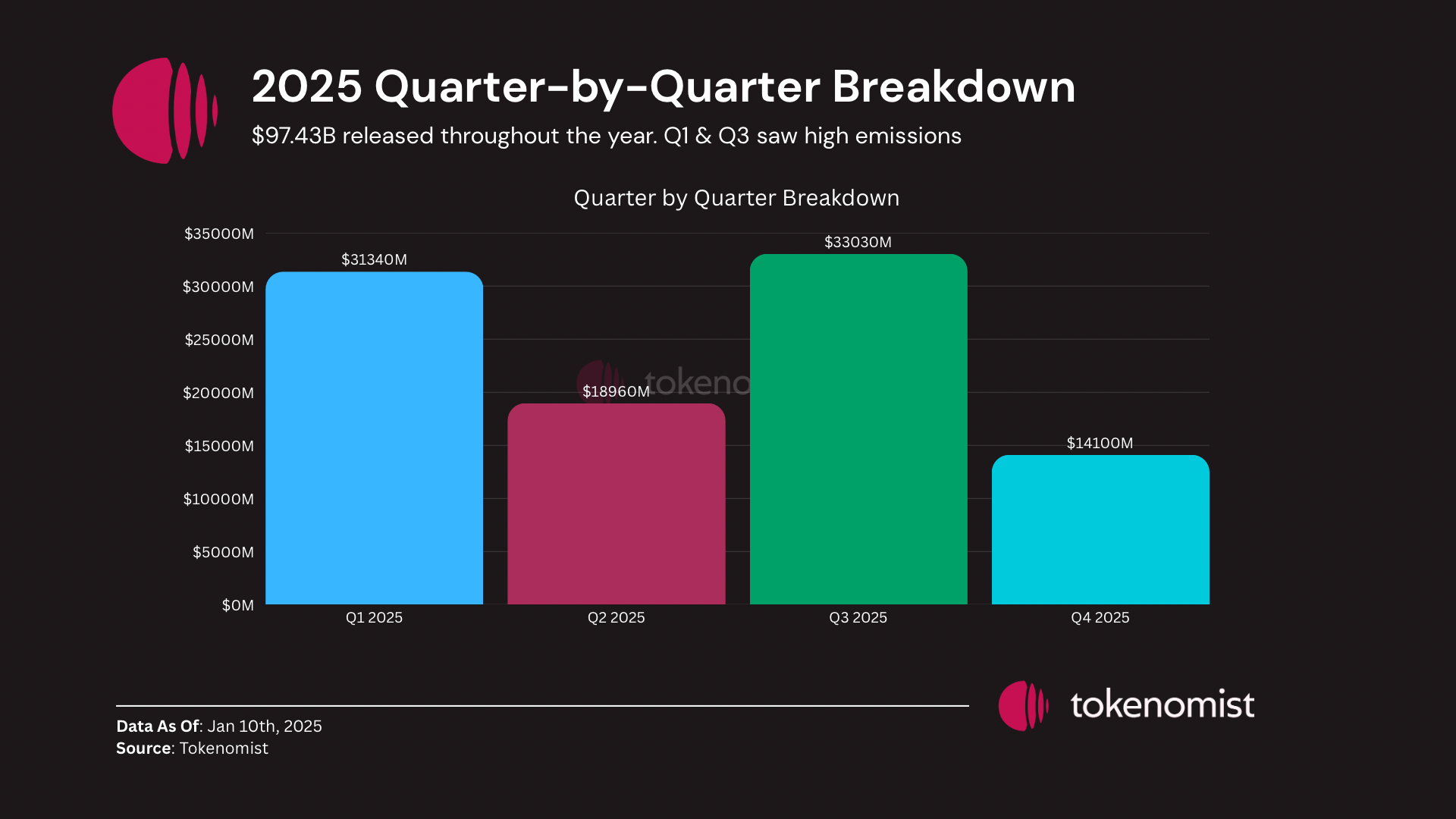

- $97.43B released throughout the year

- Activity peaked in Q1 ($31.34B) and Q3 ($33.03B)

- Q4 saw the lowest emissions at $14.10B, driven by delayed/shifted unlock schedules

Quarter-by-Quarter Breakdown

2. Insider vs Non-Insider Unlocks

Insider unlocks came in far lower than non-insider emissions — indicating that the majority of 2025 supply flow came from ecosystem, community, liquidity, and treasury allocations.

Totals

- Insider Unlocks: $18.77B

- Non-Insider Unlocks: $78.66B

3. Top 10 Emission Percentages

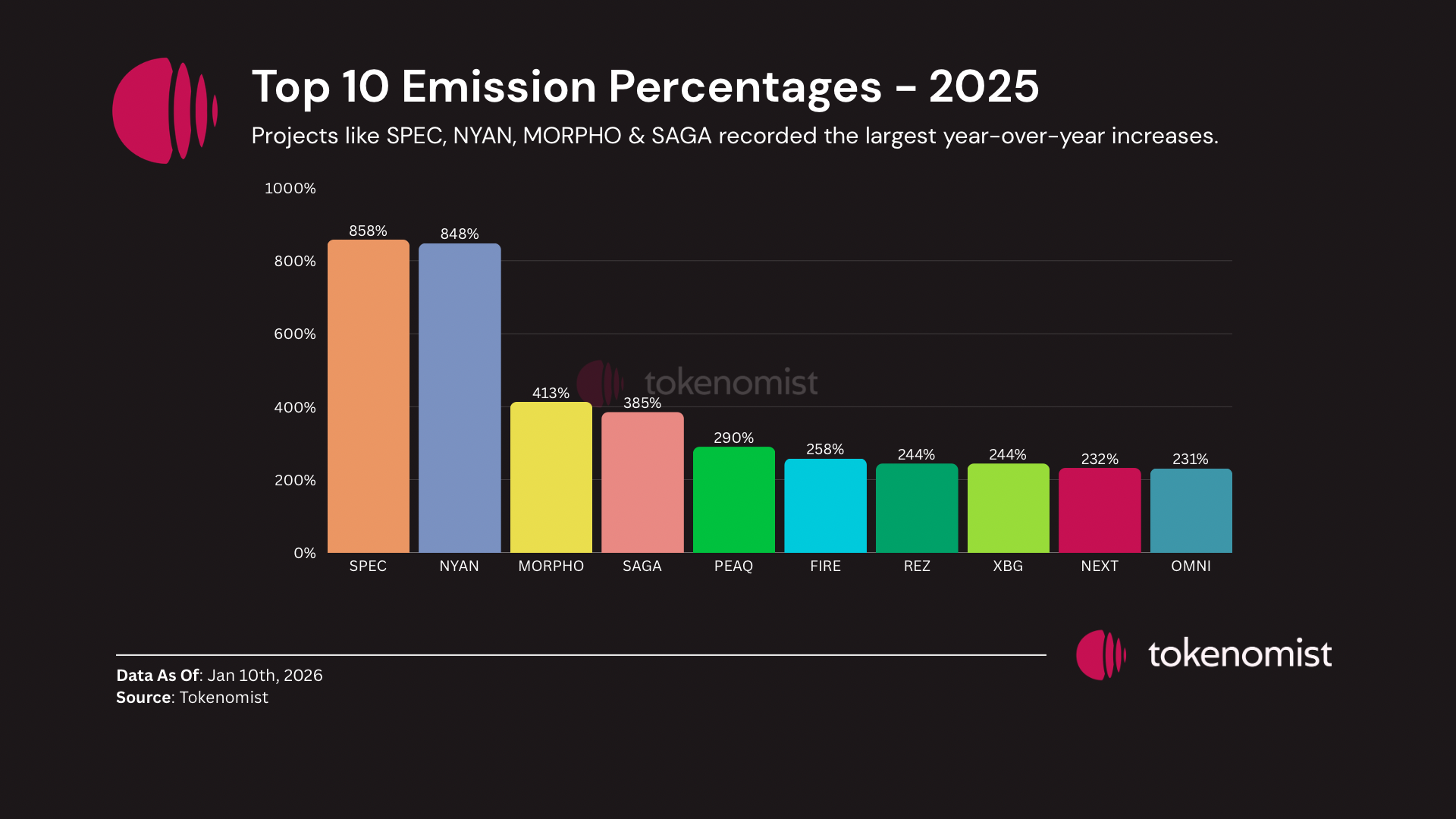

2025’s highest emission percentages came from tokens whose circulating supply expanded sharply due to scheduled unlocks. Projects like SPEC, NYAN, MORPHO and SAGA recorded the largest year-over-year increases as part of their predefined vesting and distribution plans.

By Supply Growth (%)

- SPEC — 858.22%

- NYAN — 848.16%

- MORPHO — 412.76%

- SAGA — 384.58%

- PEAQ — 290.76%

- FIRE — 257.72%

- REZ — 244.17%

- XBG — 243.87%

- NEXT — 231.53%

- OMNI — 230.66%

4. Top 10 Emission Values

Large-cap ecosystems and exchange tokens led total release value, with WBT, SUI, CONX, WLD and ENA contributing a disproportionate share of 2025’s supply expansion.

By USD Released :

- WBT — $2.30B

- SUI — $1.19B

- CONX — $1.01B

- WLD — $997M

- ENA — $891M

- BGB — $774M

- ONDO — $770M

- DOGE — $661M

- AVAX — $529M

- HYPE — $496M

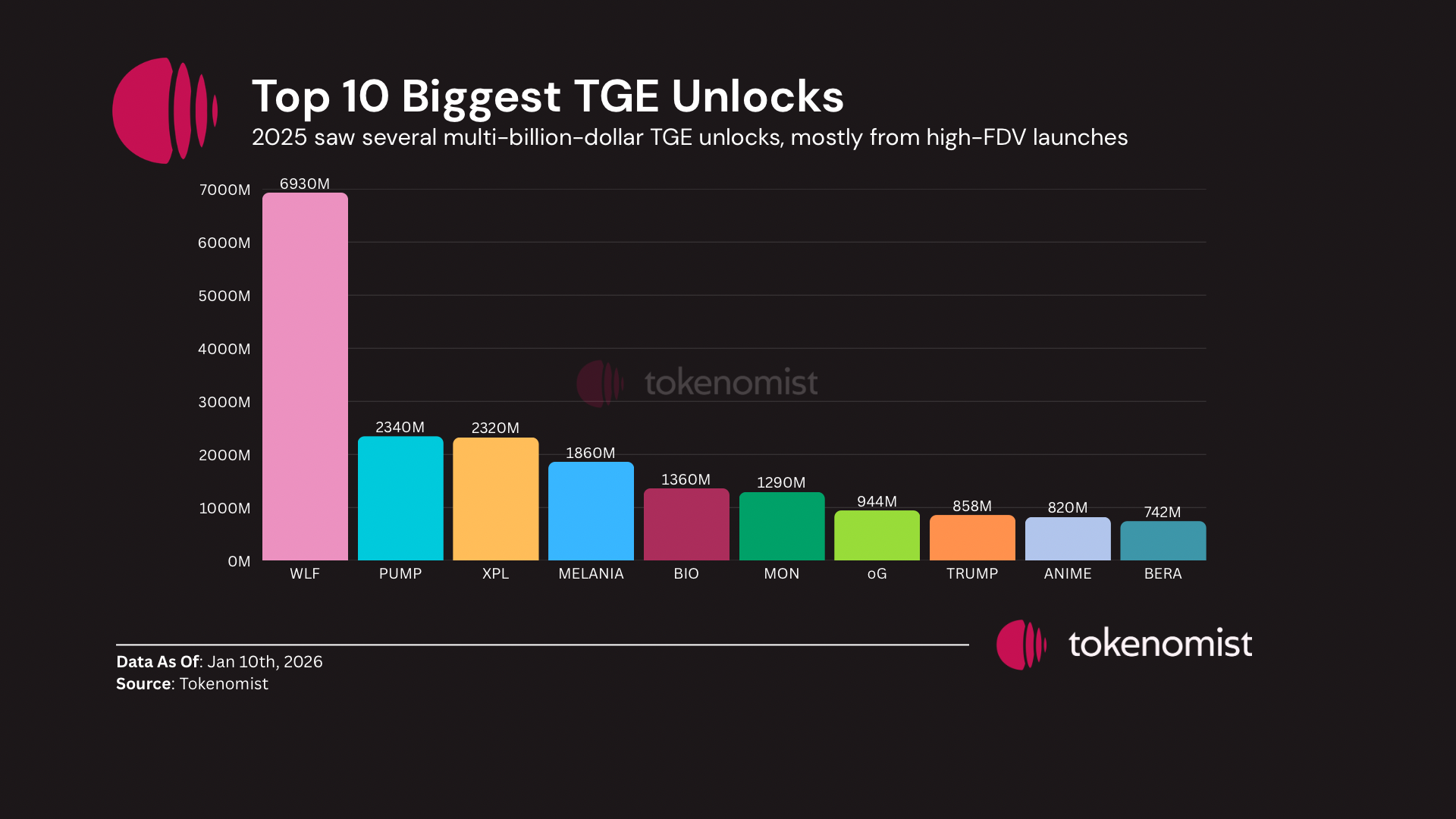

5. Top 10 Biggest TGE Unlocks

2025 saw several multi-billion-dollar TGE unlocks, mostly from high-FDV launches in AI and infrastructure sectors.

WLFI, PUMP, XPL and MELANIA set the tempo early in the year, creating some of the largest day-one floats in recent cycles.

Largest Unlocks at TGE

- WLFI — $6.93B

- PUMP — $2.34B

- XPL — $2.32B

- MELANIA — $1.86B

- BIO — $1.36B

- MON — $1.29B

- 0G — $944M

- TRUMP — $858M

- ANIME — $820M

- BERA — $742M

6. Top 10 Largest Unlock Events

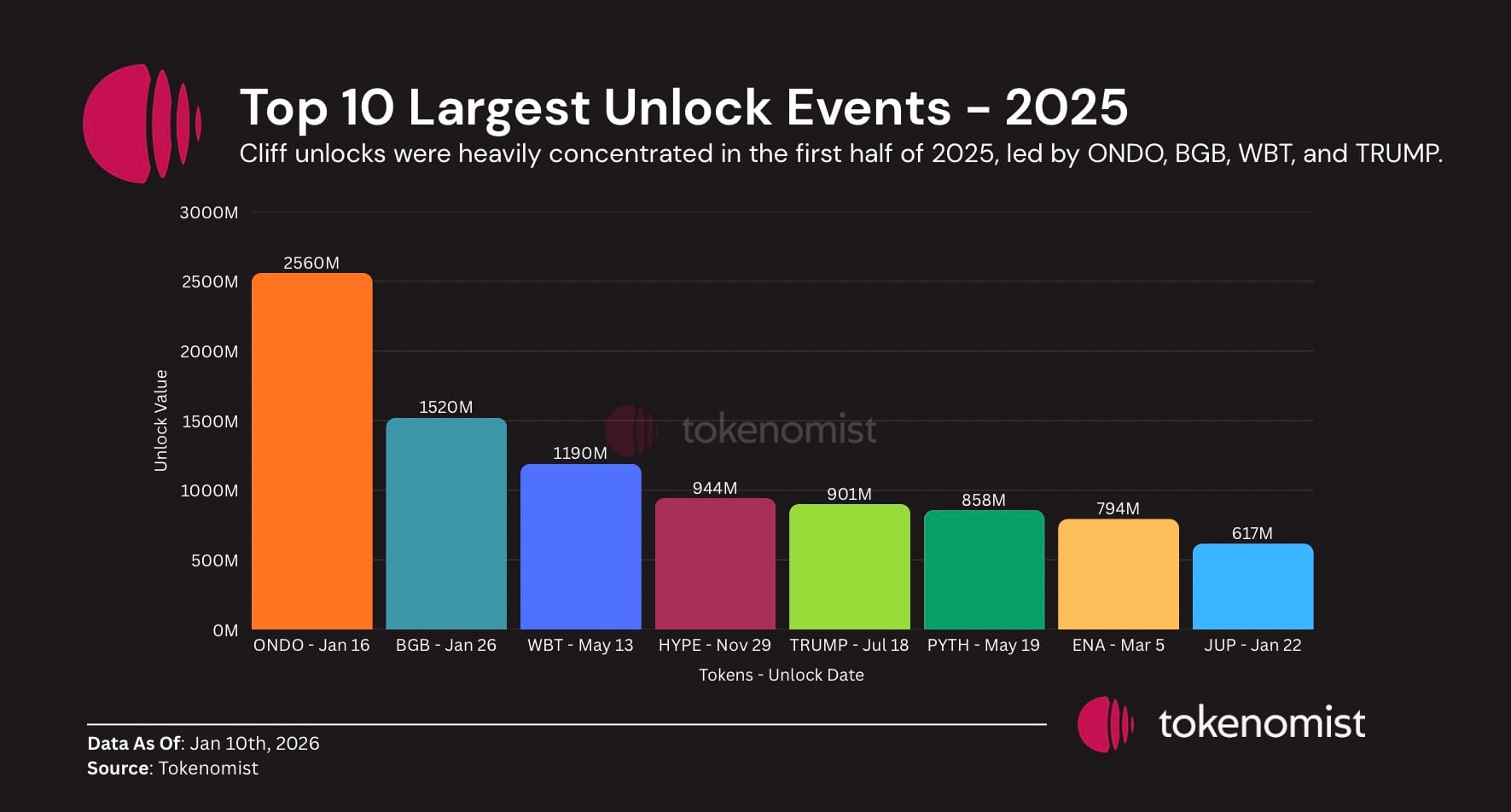

Cliff unlocks were heavily concentrated in the first half of 2025, led by ONDO, BGB, WBT, and TRUMP.

These large events often aligned with major vesting cliffs or ecosystem allocation releases, creating the most visible supply shocks of the year.

Cliff Unlock Value :

- ONDO — $2.56B (Jan 18)

- BGB — $1.52B (Jan 26)

- WBT — $1.19B (May 13)

- TRUMP — $900.9M (Jul 18)

- ENA — $793.8M (Mar 5)

- JUP — $616.7M (Jan 22)

- HYPE — $345.8M (Nov 29)

- PYTH — $327.3M (May 19)

7. Top 10 Linear Unlock Flows

Linear unlocks were dominated by high-circulation ecosystem tokens like WLD, DOGE, TRUMP, AVAX, TIA, and TAO.

Their predictable monthly emissions formed a significant portion of the market’s baseline supply growth, with AI and L1 networks contributing heavily.

By Total Yearly Emissions

- WLD — $2.11B

- DOGE — $1.08B

- TRUMP — $1.00B

- AVAX — $854M

- TIA — $807M

- TAO — $788M

- RAIN — $689M

- SUI — $573M

- STORY — $530M

- DOT — $512M

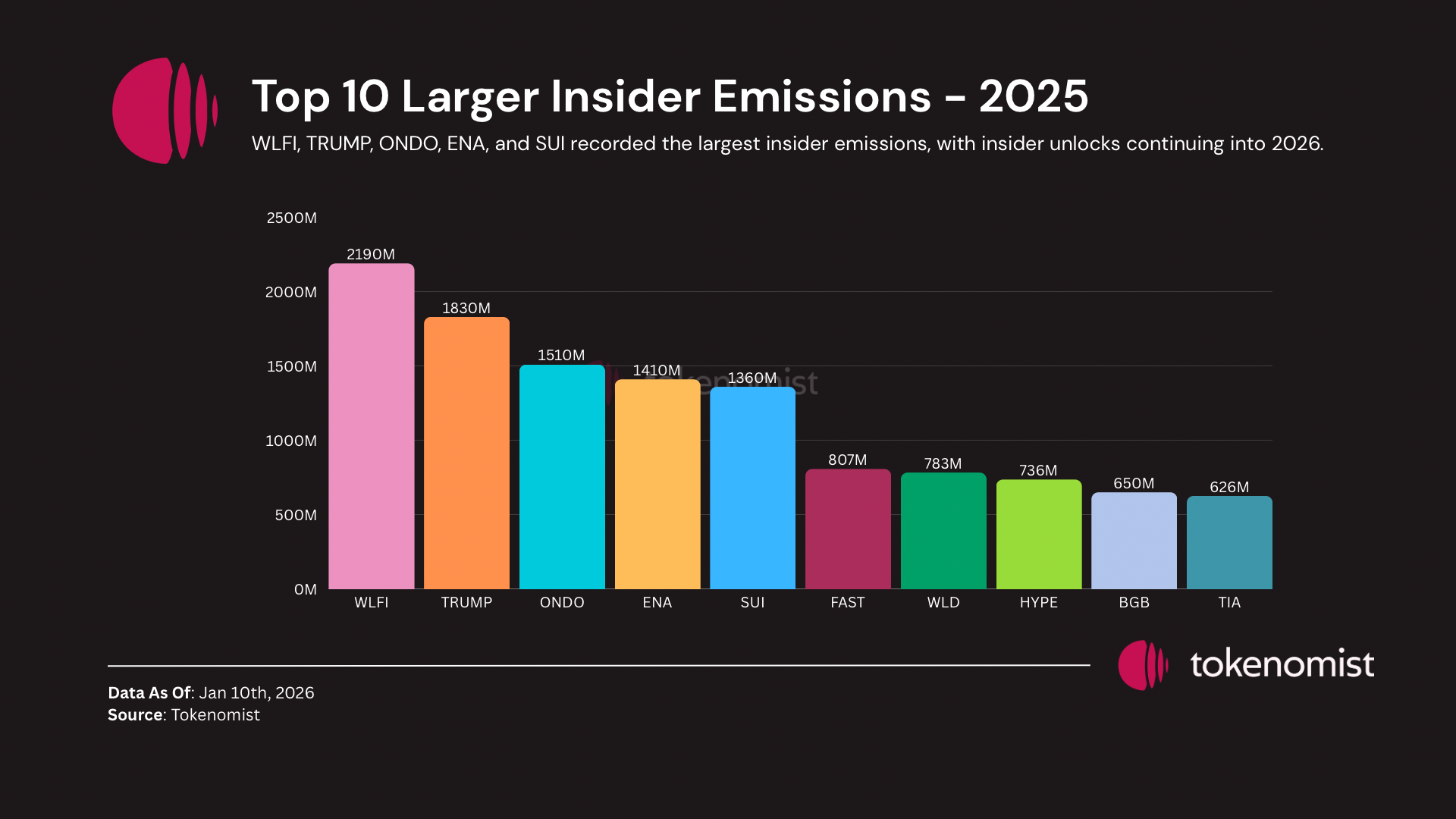

8. Top 10 Larger Insider Emissions

Insider vesting was most pronounced in WLFI, TRUMP, ONDO, ENA, and SUI — all of which maintained sizable investor and team allocations.

Even with large totals, most projects followed multi-year schedules, with steady monthly vesting.

AI, L1s, and infrastructure sector saw the highest insider unlock volumes

Largest Insider Vesting (Team + Investors)

- WLFI — $2.19B

- TRUMP — $1.83B

- ONDO — $1.51B

- ENA — $1.41B

- SUI — $1.36B

- FAST — $807M

- WLD — $783M

- HYPE — $736M

- BGB — $650M

- TIA — $626M

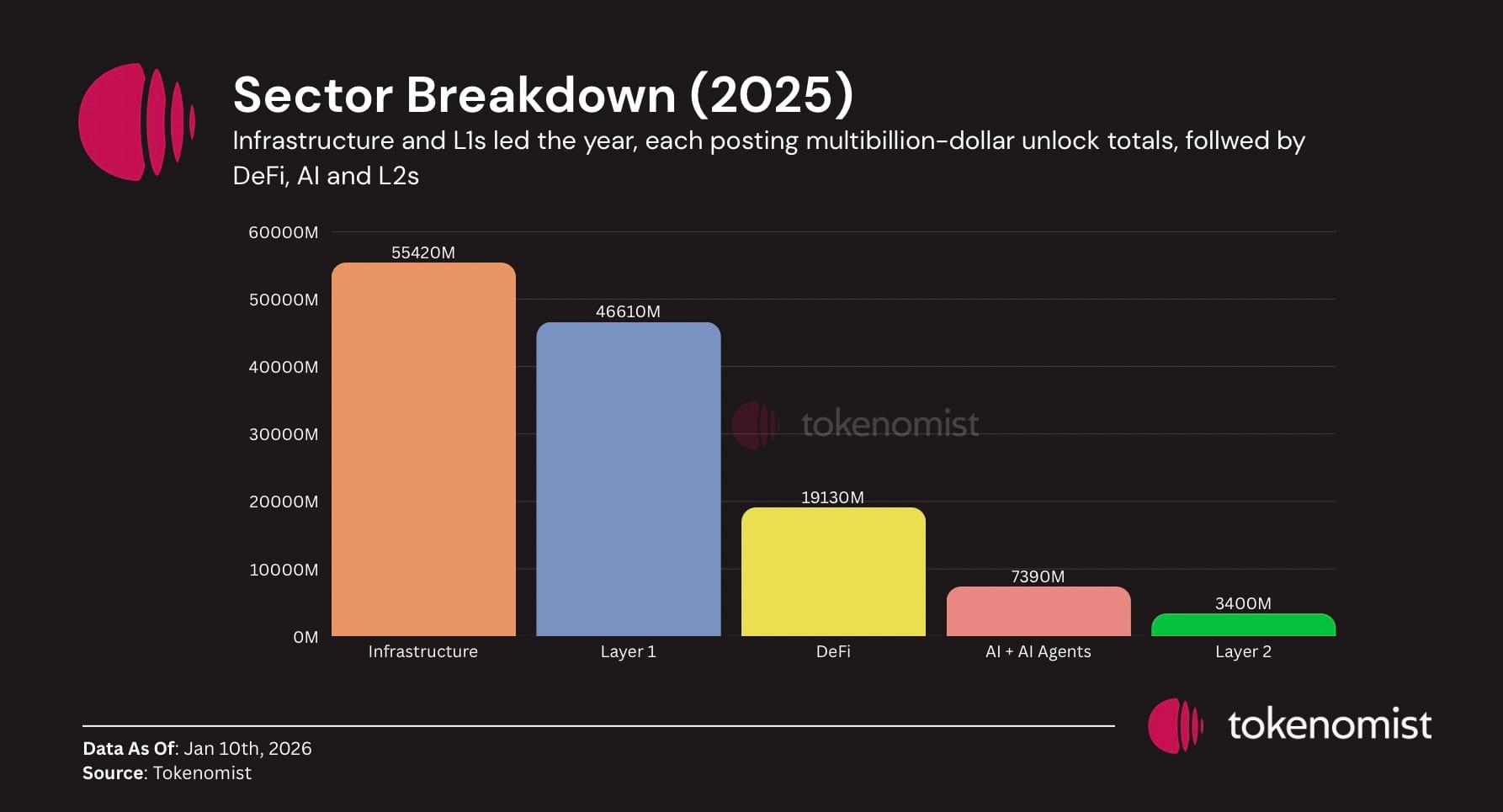

9. Sector Breakdown (2025)

Unlock value in 2025 was heavily concentrated in a few categories. Infrastructure and L1s led the year, each posting multibillion-dollar unlock totals, followed by DeFi, AI and L2s with steady multi-month vesting cycles. Perpetual trading ecosystems also recorded one of the largest annual unlock sums.

• Infrastructure — $55.42B

• Layer 1 — $46.61B

• DeFi — $19.13B

• AI — $7.39B

• Layer 2 — $3.40B

Conclusion

2025 delivered one of the most active unlock calendars to date, with a handful of major events driving the bulk of yearly value. As emissions slow and several projects shift toward revenue-linked models or delayed unlocks, 2026 is set to be shaped less by supply shocks and more by fundamentals and ecosystem execution.