Standardizing Token Allocations: A Better Investment Framework

TL;DR

⚠️ Problem: Token allocations vary by project with no standard, making comparisons messy.

✅ Solution: We introduce Standard Allocation, grouping all tokens into 6 clear categories for easier benchmarking.

💡 Insights:

- Derivatives sector shows the highest community allocation (~49%), driven by the need to bootstrap liquidity.

- Liquid Staking sector has the highest insider allocation (~51%), raising centralization risks but requiring vesting analysis.

The crypto industry is flooded with tokens, yet there is no clear standard for token design. In traditional equity markets, investors compare financial statements and performance metrics among peers before making decisions. These benchmarks signal how value may flow back to shareholders, i.e., their return on investment.

In the same way, tokenomics design and distribution models are critical factors to evaluate before investing in a token.

Since the ICO boom, and later the launchpad meta, it has become increasingly easy for projects to issue tokens. But with this ease comes inconsistency. Teams often publish varying documentation and use different names for allocation categories, creating confusion for investors trying to compare projects or benchmark across sectors.

Consider this scenario: a new project launches with an ICO round, offering 33% of tokens to investors at an attractive price. At first glance, this may sound like a good deal — but how do we really know? Is 33% high or low compared to other tokens? How does it stack up against the sector average? Without a standard, it’s hard to tell.

Introducing Standard Allocation

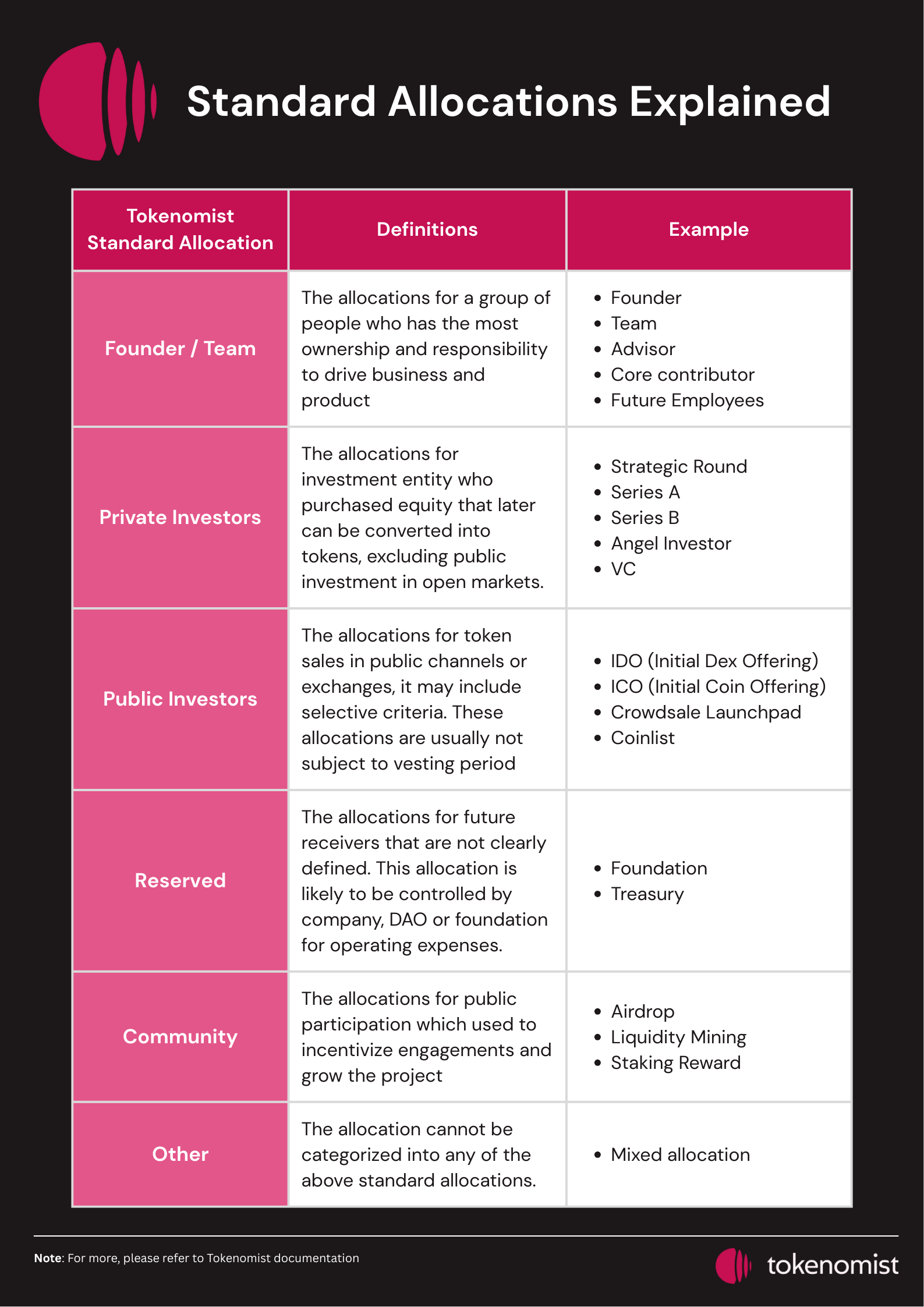

To address this challenge, we propose a standardized framework that groups token allocations into six clear categories. By organizing allocations this way, investors and analysts can more easily compare projects and benchmark across sectors.

Below are the six standard allocation categories along with their definitions:

For more, please refer to Tokenomist Documentation.

Features Powered by Standard Allocation

Standard Allocation is integrated across multiple features on our platform, making token analysis more consistent, comparable, and actionable.

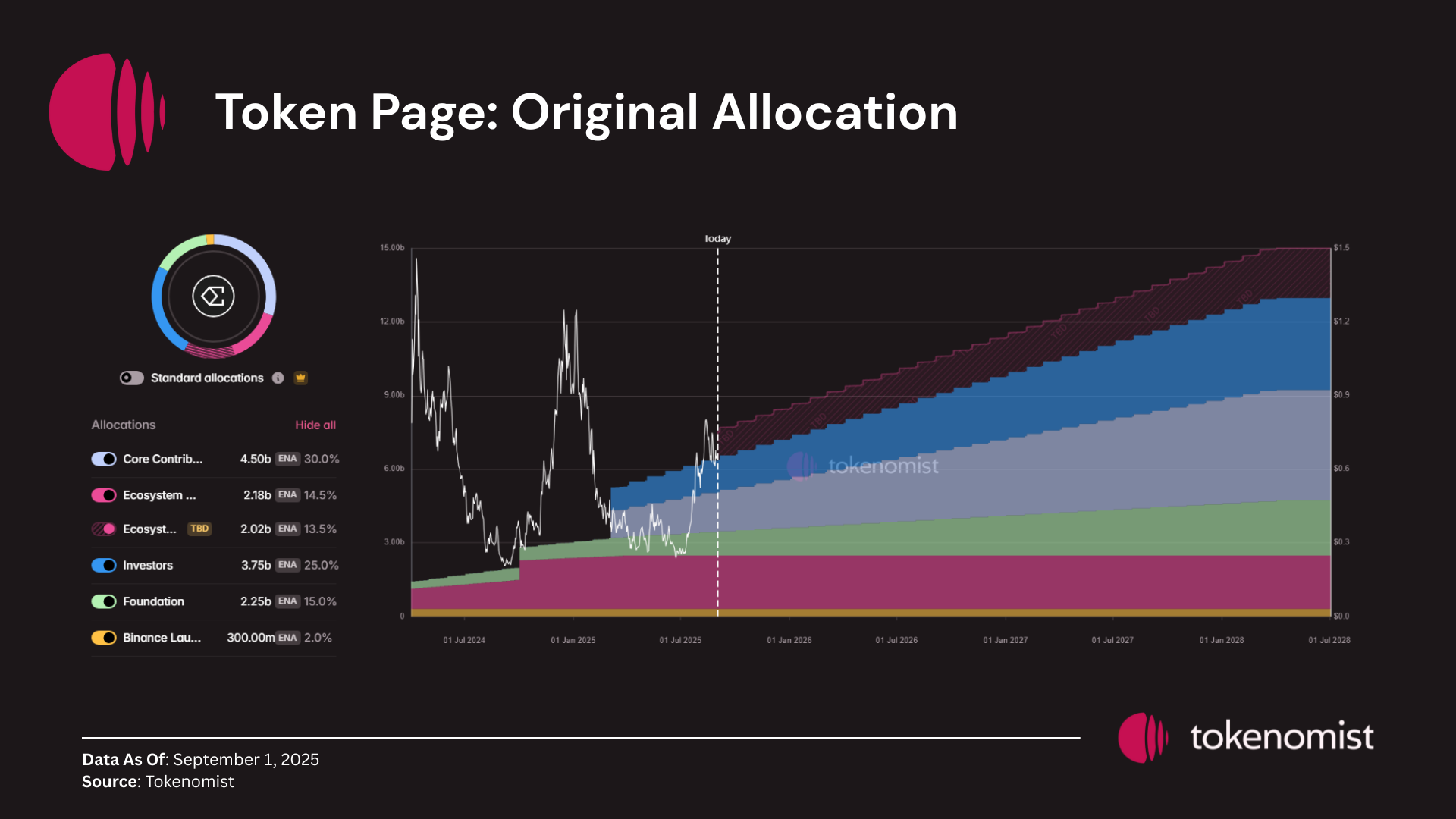

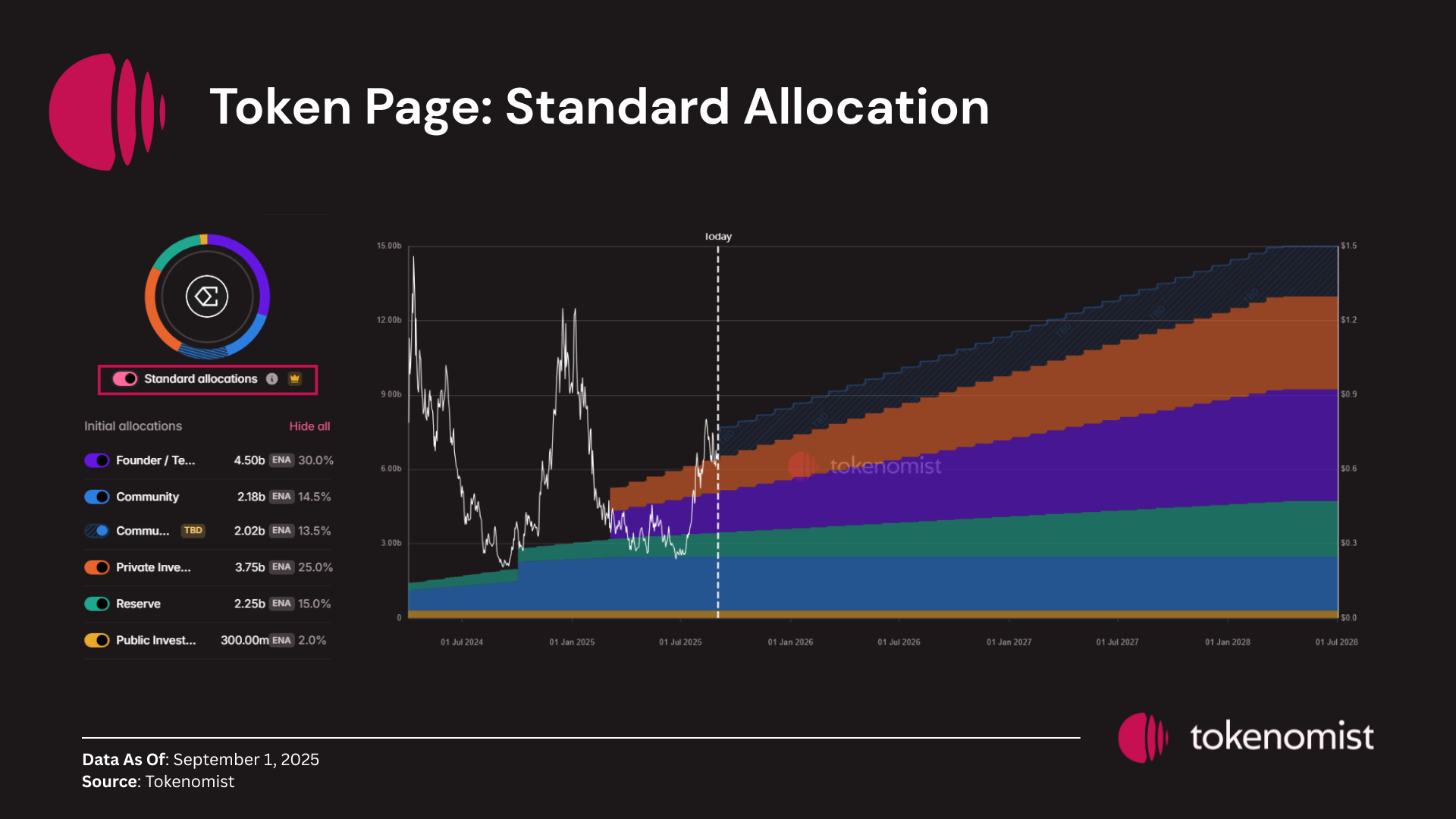

Token Page

On each token page, the Allocations section includes a toggle to switch into Standard Allocation view. This groups allocations by stakeholder categories, giving you a clear and objective picture of how tokens are distributed. Instead of relying on individual project labels, you get a standardized view for easier evaluation.

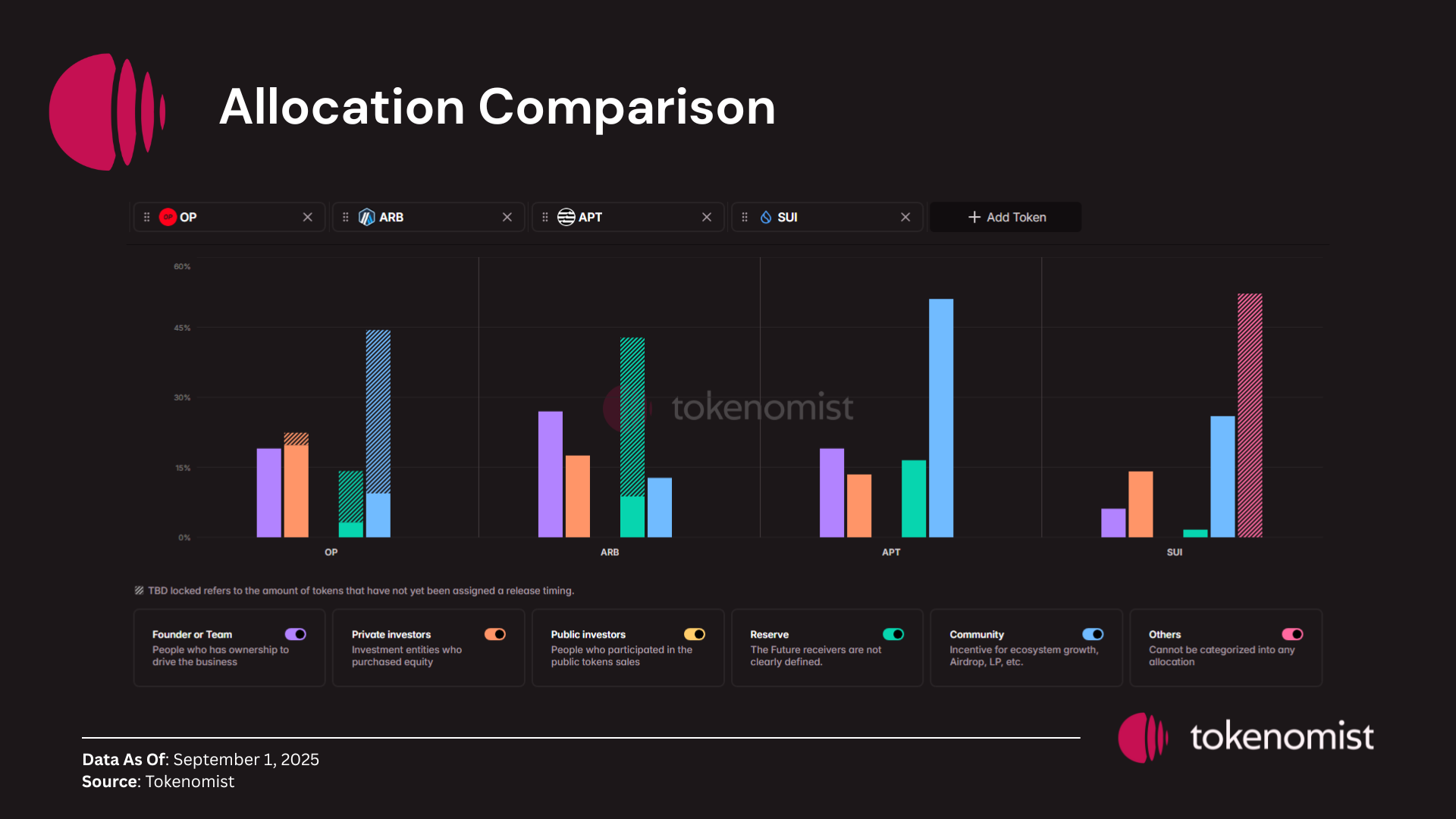

Allocation Comparison

With the Allocation Comparison feature, you can benchmark multiple projects side by side. This visualization helps you quickly spot distribution strategies, identify patterns across sectors, and detect outliers that may pose risks or opportunities.

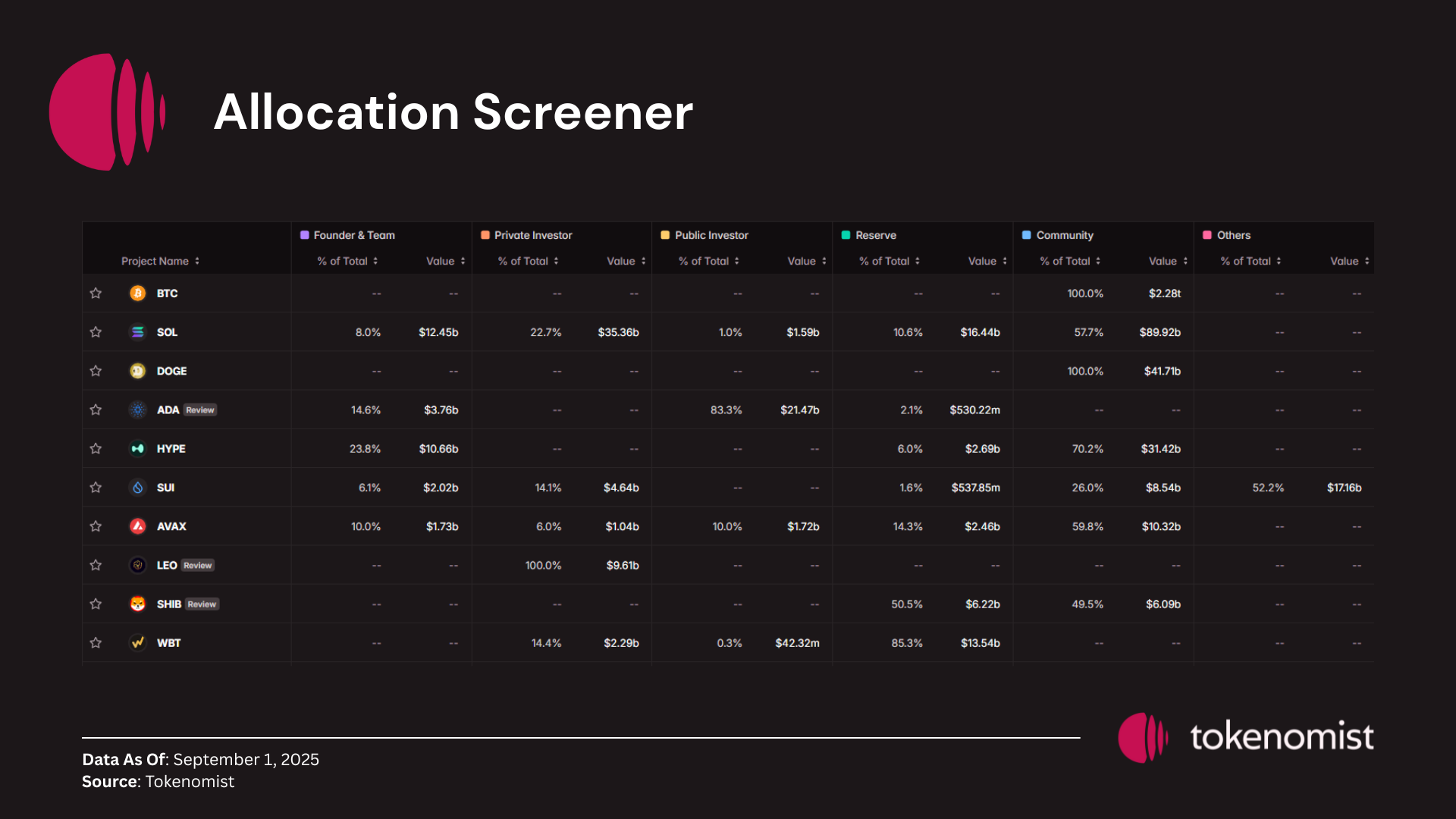

Allocation Screener

The Allocation Screener allows you to filter the market using Standard Allocation metrics. For example, you can sort by projects with the highest Founder & Team allocation, or filter for Layer 1 protocols with the largest share of unlocked Community tokens. This makes it easier to align your research with your investment thesis.

Use Cases for Token Analysis

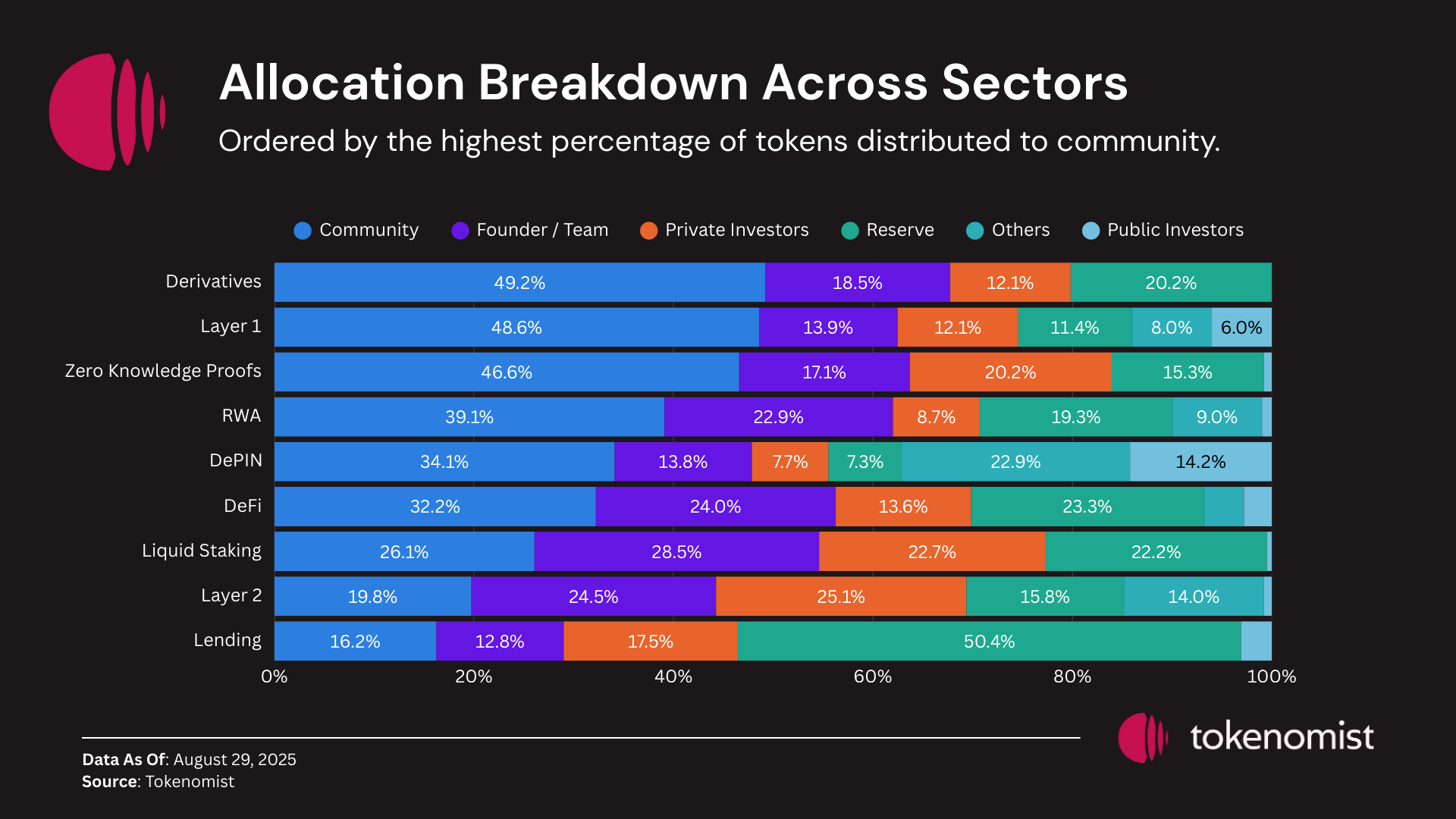

One practical use case of standard allocation is comparing token distributions across sectors. A common perception among investors is that tokens with a high community allocation are “good,” while those with a higher share for private investors and the team are “bad.” But is this assumption really true?

Sector with the Highest Community Allocation

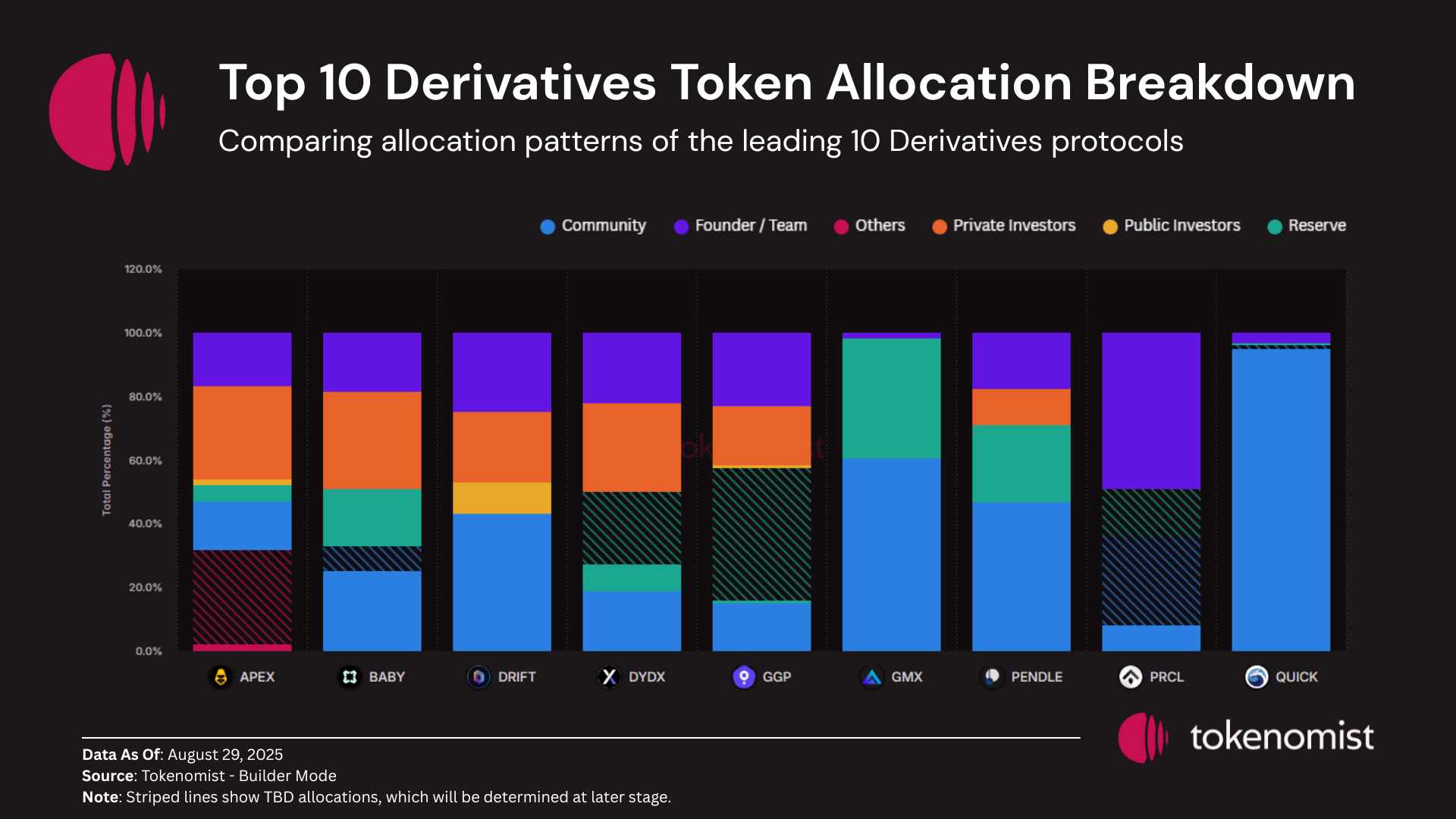

The data shows that Derivatives projects have the highest average community allocation — around 49% of total supply. To better understand this, we look deeper into the top 10 Derivatives tokens by market cap.

Key Takeaways:

🗝️ In the derivatives sector, QUICK, GMX, and PRCL allocate the highest share to community. These projects rely on liquidity and use tokens as incentives to attract users.

📈 While high community allocation is often viewed positively, most derivative tokens have underperformed. The sector is highly competitive, and users quickly shift to platforms offering better incentives — leaving weaker products struggling to retain traction.

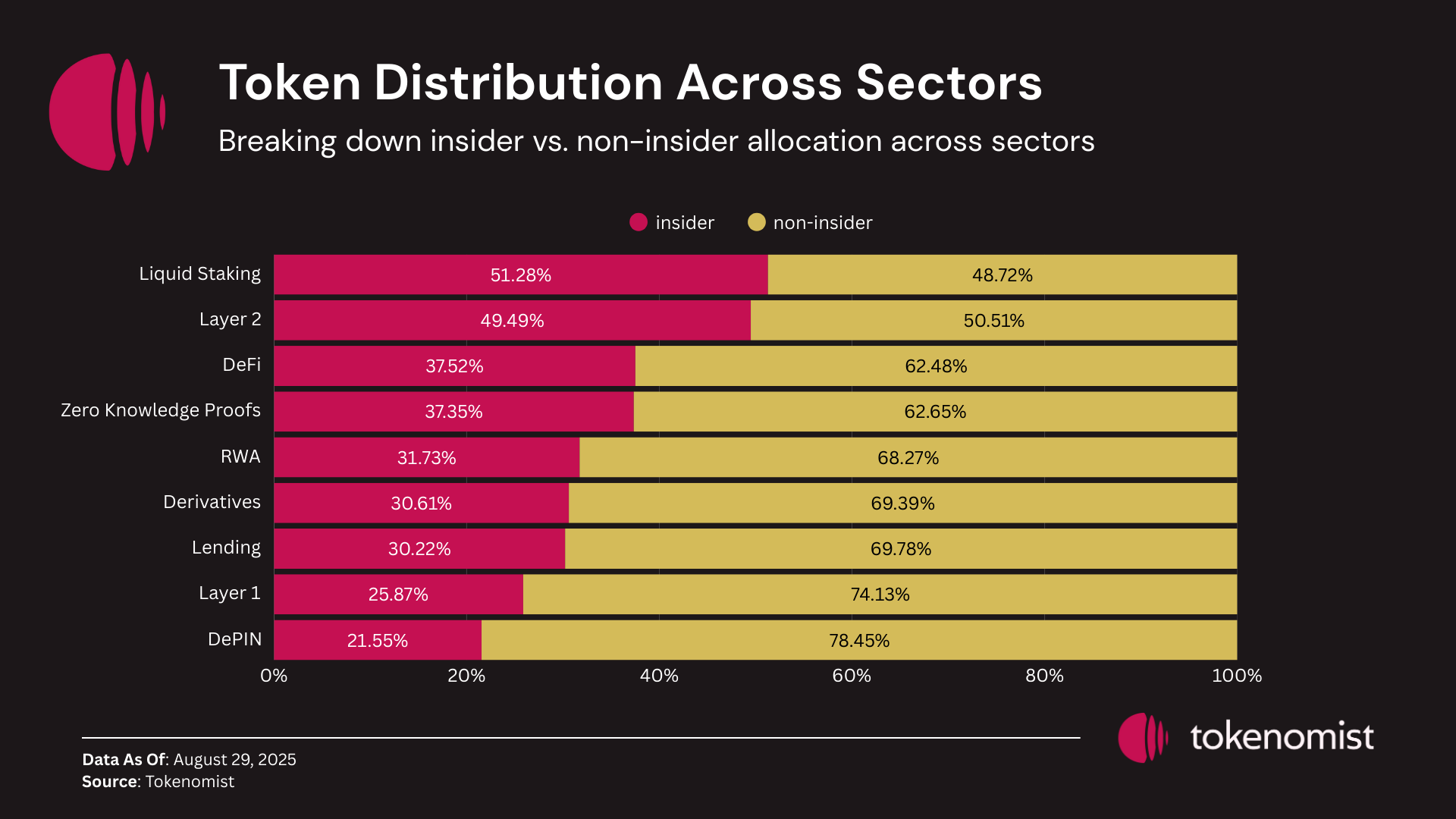

Sector with the Highest Insider Allocation

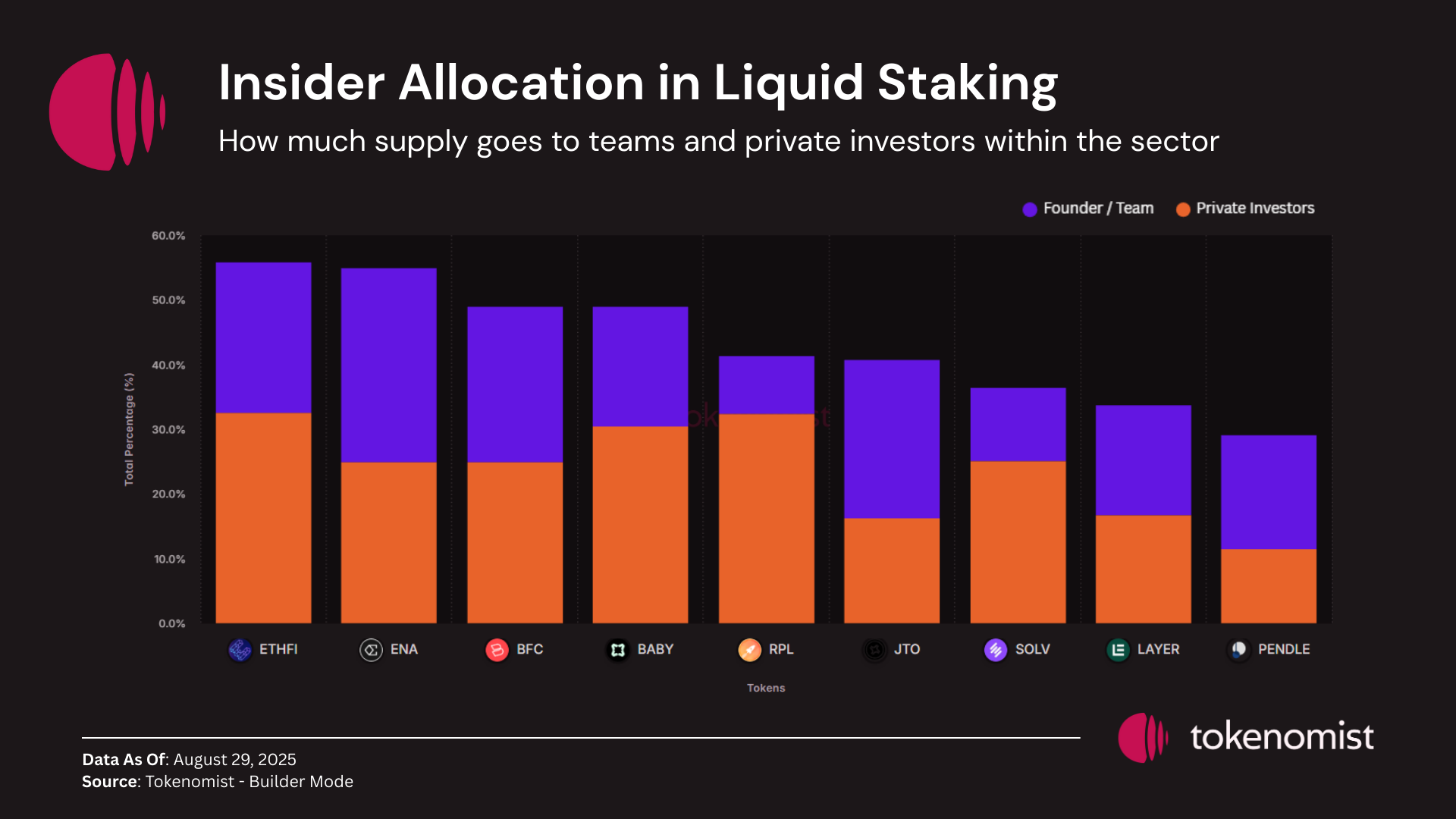

Standard allocation can also be grouped into insider vs. non-insider categories, where insiders include private investors and the founding team. Among all sectors, Liquid Staking has the highest average insider allocation — over 51% of total supply.

If we take a closer look at the top 10 liquid staking tokens, several key patterns emerge that help explain the sector’s allocation dynamics.

Key Takeaways:

💰 Liquid staking tokens have raised substantial amounts of capital, averaging over $55M, with some raising more than $170M.

🔑 A high insider allocation does not necessarily signal poor tokenomics. Some projects still deliver strong performance, especially when insiders choose not to sell aggressively.

However, large insider allocations increase centralization risk. If unlocked tokens are sold, the resulting supply overhang can create significant sell pressure. This leads to a key question: When will insiders be able to sell?

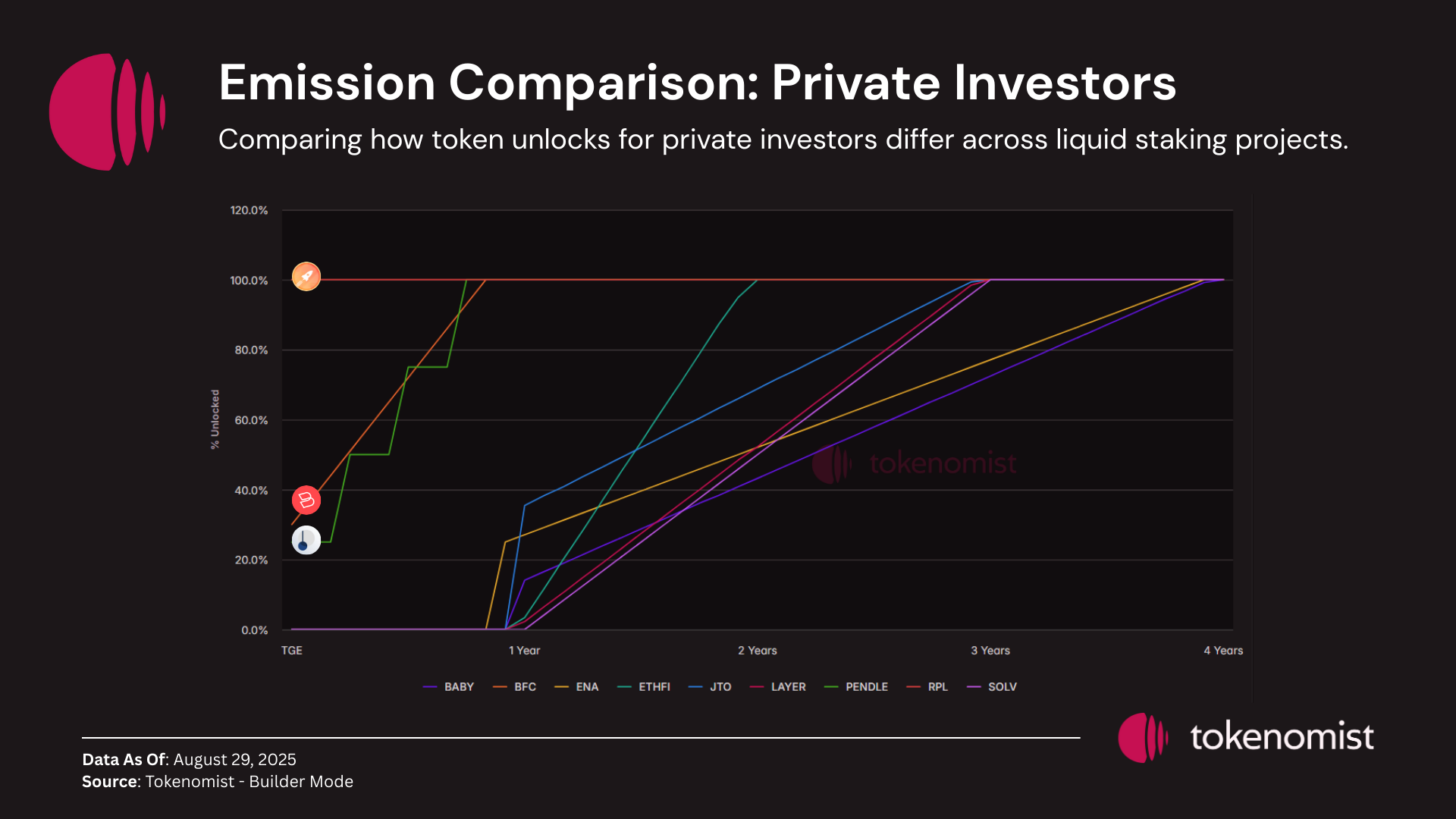

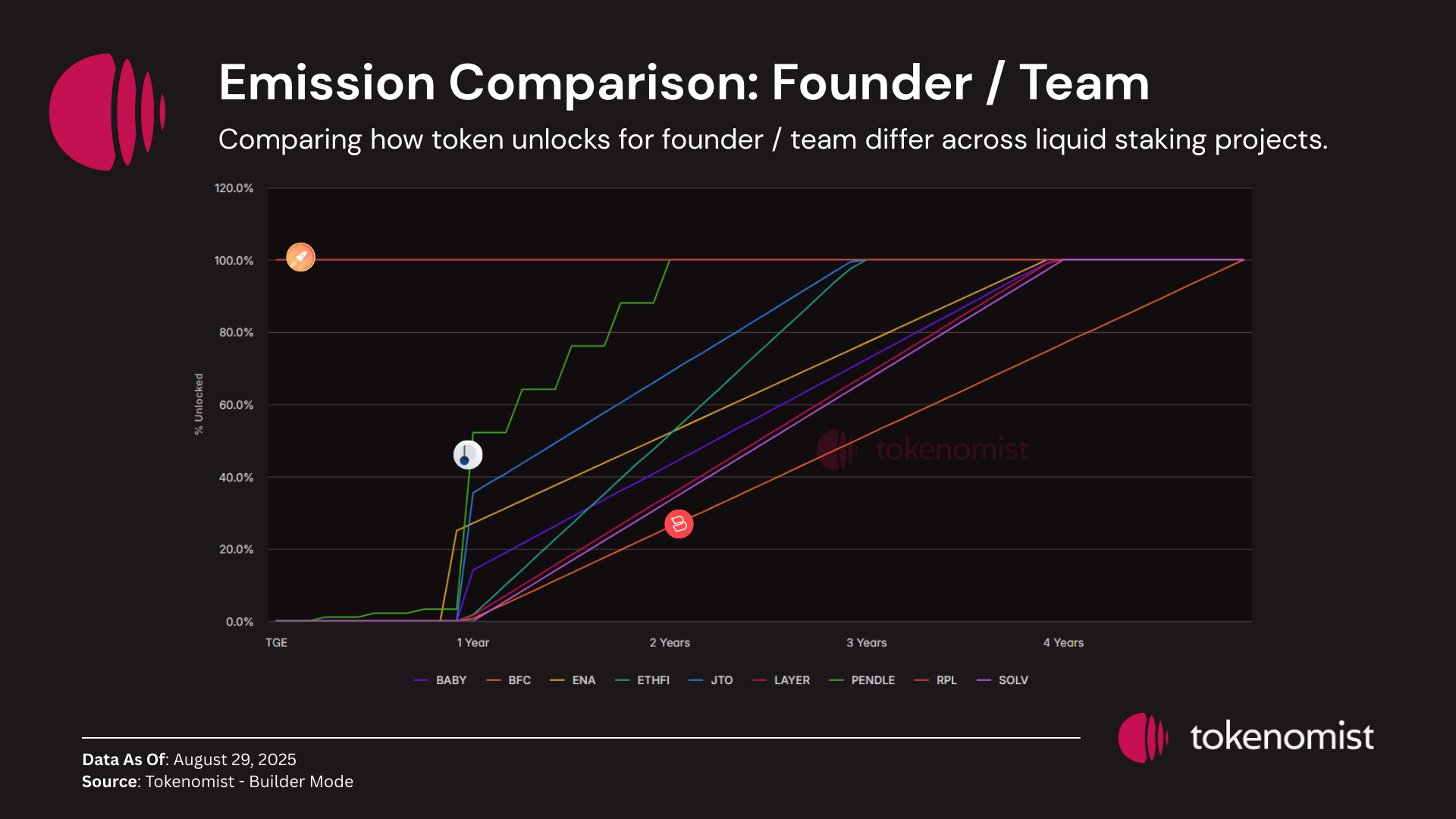

To answer this, we can examine vesting schedules — another feature enabled by the standard allocation framework.

The data reveals that most tokens in this sector share a similar release pattern: founder/team and private investor tokens typically unlock one year after TGE. Yet, there are notable exceptions:

- RPL released both team and private investor allocations at launch.

- BFC and PENDLE partially unlocked private investor allocations at launch.

Conclusion

Token design may vary widely across projects, but without a common standard it’s difficult to compare allocations or benchmark sectors. Standard Allocation provides a clear framework to bring consistency, helping investors cut through noise and understand the true distribution of tokens.

By integrating Standard Allocation into our platform — from token pages, comparison tools, to the allocation screener — we make it easier to evaluate projects objectively, spot risks and opportunities, and refine investment theses.

For deeper tokenomics insights powered by Standard Allocation, explore more on our platform here.