The Hidden Token Inflation No One Talks About

A comprehensive understanding of token inflation is critical for evaluating dilution risk and the long-term health of a crypto asset. While vesting schedules are a helpful starting point, they don’t capture emissions from other mechanisms like mining or staking. Ignoring these can lead to inaccurate assumptions about scarcity, value, and inflation.

For investors, this matters because dilution directly affects portfolio value. Token holders who don’t participate in issuance-related activities may see their ownership diluted, even in the absence of scheduled unlocks. This is especially relevant in ecosystems with high emission rates or aggressive reward structures.

The Classic: Token Unlocks

Token unlocks refer to the release of tokens into circulation based on predefined timelines, often outlined in project documentation or smart contracts. These releases are time-based, transparent, and relatively predictable. Market participants typically track these events using vesting schedules, which detail the size and timing of upcoming unlocks. However, while unlocks remain a key part of supply analysis, focusing solely on them provides an incomplete picture—other mechanisms can gradually increase circulating supply in less obvious ways.

Because of their visibility, unlocks can influence short-term price expectations. Large unlock events may raise concerns about increased selling pressure, especially if a significant portion of the supply is released at once.

Outlook Beyond Unlocks

Unlike scheduled unlocks, other release mechanisms can operate continuously and scale with network activity. As a result, they may cause ongoing dilution for holders, especially those who aren’t actively participating in the network mechanism.

Let’s take a closer look at two common release mechanisms:

1. Mining Rewards

In proof-of-work (PoW) and hybrid consensus networks, mining is a primary method of token issuance. New tokens are created as block rewards and distributed to miners who contribute computing power to secure the network.

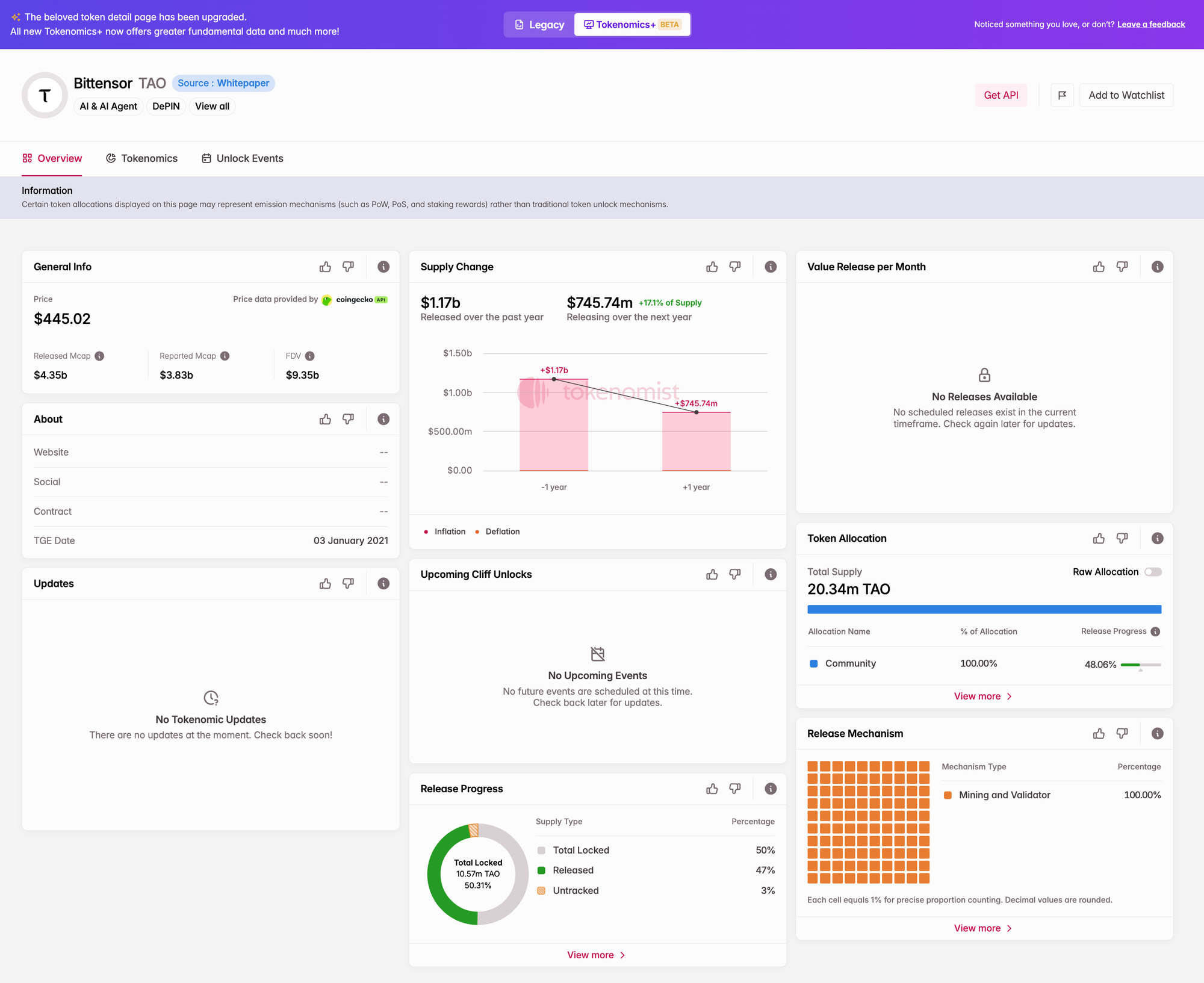

These emissions are not tied to any unlock schedule, but are instead continuously released by the protocol based on rules like block time and reward rate. Projects like Kaspa ($KASPA) and Bittensor ($TAO) rely heavily on this mechanism, with a substantial share of their supply originating from mining.

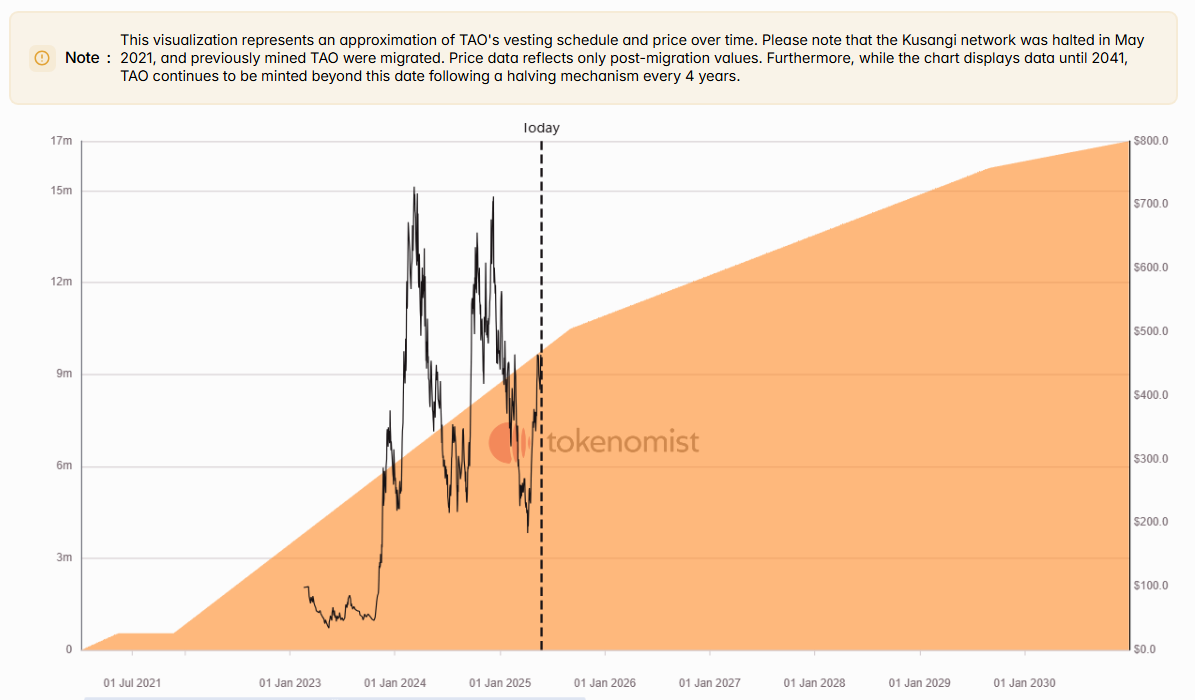

In the case of Bittensor, Tokenomist has broken down TAO’s block reward emissions into a projected release schedule. This allows investors to estimate future supply changes with greater confidence, offering a clearer view of how its circulating supply will evolve over time—despite the absence of a formal unlock calendar.

While essential for network security, mining introduces a constant stream of new supply, which can dilute token holders who do not participate. Unlike scheduled vesting, mining rewards are harder to track, but their inflationary impact can be just as significant.

2. Staking Rewards

Staking is another widely used mechanism for releasing new tokens. In proof-of-stake (PoS) networks, validators or delegators lock up tokens to help secure the protocol. In return, they earn staking rewards — newly minted tokens issued over time based on their contribution.

These rewards are typically inflationary by design. Protocols like Cosmos ($ATOM) and NEAR Protocol ($NEAR) issue new tokens at a fixed or variable rate, which are distributed among active stakers.

This means that token supply grows even without any scheduled unlocks. Holders who don’t stake can experience dilution, as their proportional ownership declines. This dynamic also creates implicit pressure to stake, affecting user behavior and token utility.

What Does This Mean?

Given the variety of ways tokens can enter circulation, having access to a complete and transparent view of supply dynamics is crucial. That’s why Tokenomist goes beyond traditional “vesting schedules” and instead offers a comprehensive release schedule — one that captures all forms of token distribution, not just time-based unlocks.

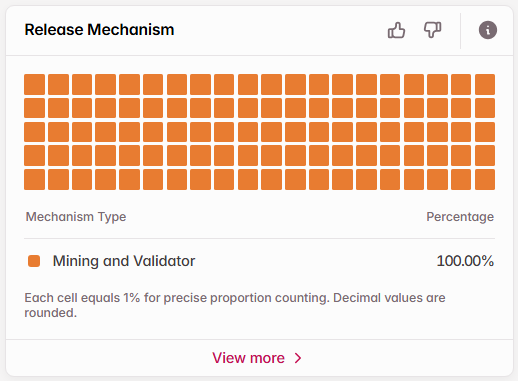

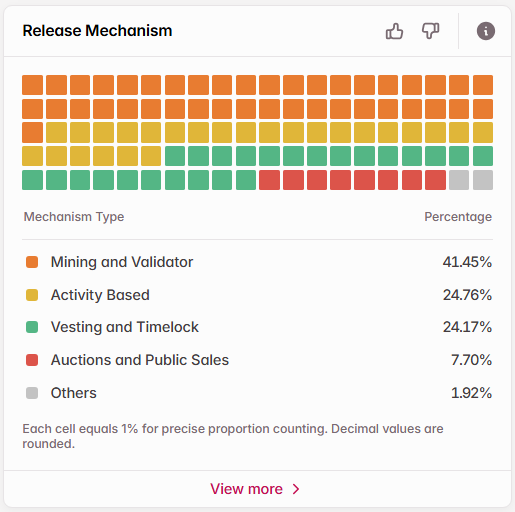

The newly introduced release mechanism chart (BETA available to Pro users) breaks down how tokens are distributed — including mining, staking, activity-based rewards, yield farming, protocol incentives, auctions, and more. These tools make it easier to assess where inflation risk might arise and how token supply is structured over time.

For those who want to explore these classifications in detail, you can refer to our documentation. Understanding token release isn’t just about tracking dates — it’s about seeing the full picture.