A Tokenomics Beginner’s guide

Introduction:

Welcome to TokenUnlocks! We're crypto pioneers, driven to unlock the secrets of tokenomics and vesting schedules.

Embark on a journey to discover the intricacies of tokenomics. From its foundational basics to the unique roles tokens play in the crypto universe, this comprehensive guide is your go-to reference to comprehend the dynamic world of tokens.

Background Information:

In the world of decentralized digital currencies, tokens play a central role. Their importance isn't just based on their count or appearance; it's also about their design and purpose, commonly referred to as "tokenomics." As we explore this, we'll see how various factors give each token its unique identity.

Analysis and Discussion:

Understanding Tokenomics: Tokenomics, a blend of 'token' and 'economics,' studies the characteristics and behavior of tokens in a decentralized environment. It's about understanding why a token holds value, how it's used, and how it interacts within the broader system.

Core Principles of Tokenomics:

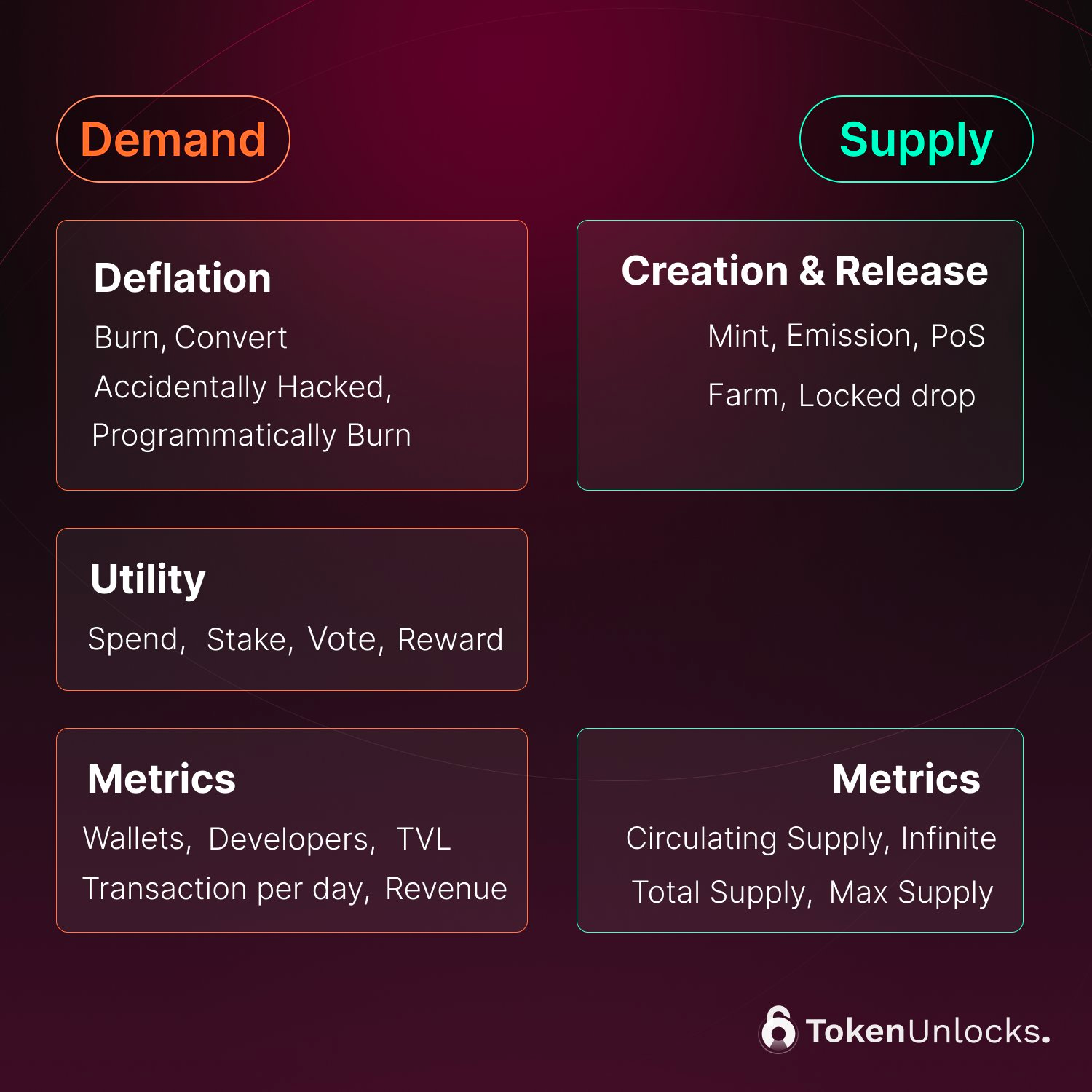

a. Supply: It’s not just about the number of tokens available. It’s also about how they’re released (e.g., all at once or gradually) and what can cause them to be sold or held.

b. Demand: Here, it's about the utility of a token. Does it give access to a service? Can it be used in voting? Such factors can influence how much it's desired.

Roles of Tokens:

Tokens aren't just digital currency. They can represent ownership in assets like property, grant access to specific platforms or services, or serve as rewards in a system. Their versatility helps drive participation, enable growth, and decentralize power within digital platforms.

In this series, we will uncover the secrets of tokenomics and token unlocks from the fundamentals to advanced topics. We will cover why tokenomics is important and how to manage your risk. After completing this series, you will gain a lot of knowledge about tokenomics that will help you prepare for unlock events.

Basics of Tokenomics

Tokenomics is the combination of 'token' and 'economics'. Tokenomics explores concepts such as token supply, demand, utility, and how these factors interact to determine the value of tokens within the decentralized ecosystem.

A Token Unlocks definition.

Tokenomics is the topics of understanding fundamental characteristics of cryptocurrency. covering the area to understand its supply, demand, mechanics of token, the dynamics of token, utility, how its operate and governs.

To establish a solid foundation of understanding, let's start with the fundamentals

Supply : Area that describe token amount, release rate, boundary (increase token, sell pressure)

Demand : Area that describe token adoption (increase holding/ using, buy pressure)

In terms of TokenUnlocks focus

We have developed a product to ensure that you never miss any supply side information and to make it easier for you to comprehend. token.unlocks.app

Role of Tokens

In the crypto world, tokens wear many hats. From representing assets (like real estate) and enabling access to certain platforms, to acting as rewards or credits within an ecosystem, tokens are the diverse players that drive the decentralized world.

Why do Token matters?

For Project: 🪙 👨🏻💻

• Align incentive structure

• Growth adoption (utility, airdrop)

• Protocol design (security, network effect, economics of scale, automation)

• Operation flexibility

• Decentralization and governance

For Investors/ Traders: 🪙 💰

• A comparison tool for projects, like stock rules.

• Helps guide trading decisions based on liquidity and market conditions.

• Assesses project risks by providing insights into token supply and distribution.

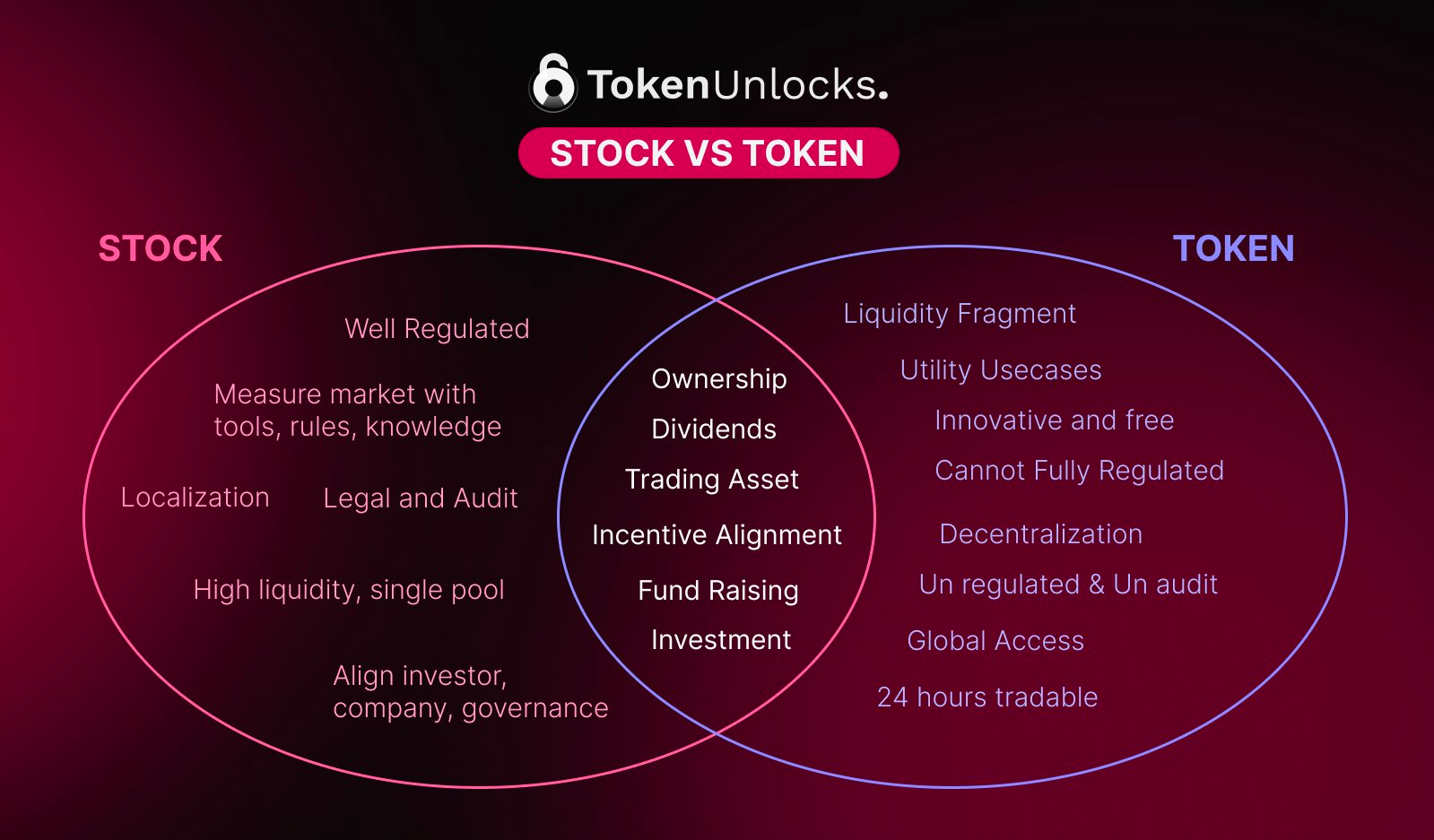

Stock vs Token

Many people might be curious about the difference between stocks and tokens. Sometimes it can be hard to explain because from some angles, they share similar characteristics.

So, with this diagram, you can explain it more easily to others. 👥

Token Utility

Today, let's explore the concept of Token Utility, a crucial aspect that sets tokens apart from one another and enhances their value. 🧐💡

The examples below illustrate some instances of token utility, but they are not exhaustive.

- Value Storage: Some tokens are like digital gold, providing a way to store value over time. Think $BTC. 🏦

- Access Rights: Certain tokens grant you special access within a network. Like VIP tickets, but for blockchain platforms. 🎫

- Governance: Tokens like $APE or $AAVE let you propose or vote on changes within the ecosystem. Democracy in action! 🙋🏾♂️

- Reward Mechanism: Ever heard of liquidity mining or staking rewards? Tokens can be incentives that reward network participation.

- Interoperability: Tokens enable seamless interactions across blockchains, breaking down silos and creating a more connected crypto world. Think $DOT and $ATOM 🌐

- DeFi Utility: From lending and borrowing to yield farming, tokens are the backbone of decentralized finance. 💸

A single token can serve multiple functions. For example, $ETH is used for transactions, smart contracts, and as collateral in DeFi applications.

Why It Matters:

Understanding a token's utility helps you make educated investment decisions. Are you buying a 'fundamental' or 'emotional' ?

Make sure you fully understand this before making any investment.💰

Our platform not only tracks vesting schedules but also provides insights into token utility, helping you understand the 'why' behind the 'what'. 🕵🏻

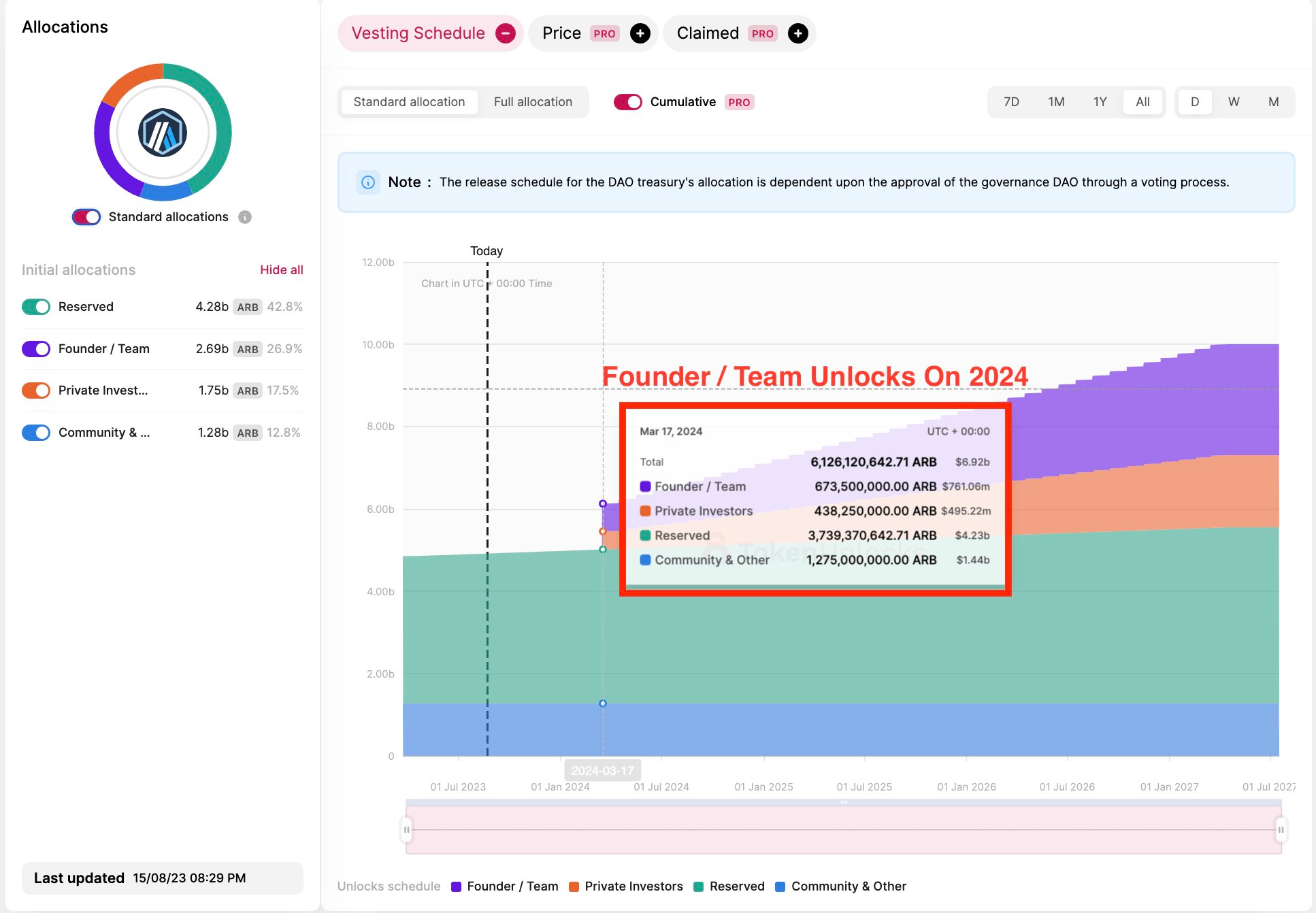

Vesting Tokens

Founders receive project tokens gradually to stay motivated and avoid premature selling. It's crucial for founder tokens to vest over a long period.

That's why founder tokens should vest over a long period.

Example : $ARB

Founder/Team Allocation: 26.9%

Since the project launch in early 2023, the project has scheduled the vesting of founders/team and private investors 1 year after the project launch. This approach promotes transparency and helps maintain team motivation.

Example 2: Re-Lock

Some tokens have relocked up to increase the trust of projects. And $IMX is one of the projects that has relocked up their token.

This demonstrates that the founder/team still has skin in the game and gives users peace of mind.

Why Vesting ?

Vesting means tokens are released methodically, assuring stakeholders of the project's long-term vision and preventing a flood of tokens into the market, which can crash prices.

Vesting serve not only to prevent token flooding, but also to allow more time for building products, expanding ecosystems, and growing the user base.

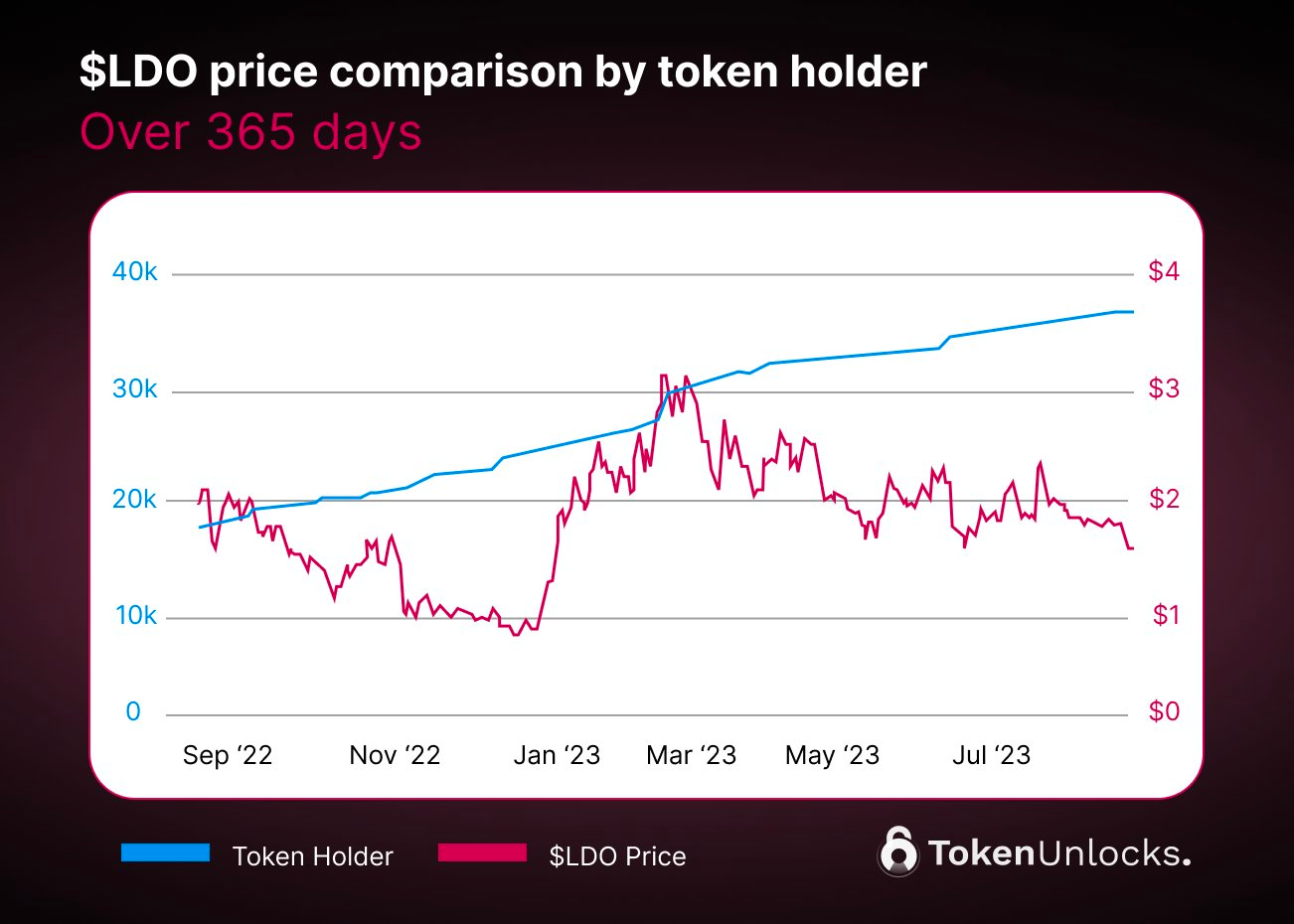

Example: $LDO

In 365 days, $LDO token holders increased by 102%, which implies that they expanded their user base around 2 times.

representation. As we journey through the world of tokenomics, understanding these nuances helps make informed decisions, whether you're an investor or a crypto enthusiast.

This is the first of five episodes in this series. The next four episodes will take you to the next level.

References or Sources:

Disclaimer: This article provides information and should not be construed as financial advice. Always conduct your research before making any investments. This is not sponsored content.