Mystery of Unlocks and Impact

Introduction:

Dive into the dynamics of token unlocks, an essential component of the ever-evolving crypto landscape. Discover the ins and outs of token release mechanisms, their implications on the market, and arm yourself with knowledge to navigate with confidence.

Background Information:

Token unlocks have their roots deeply embedded in the foundations of tokenomics – the study of the economic models behind tokens. As tokens became a primary means of value transfer, compensation, and incentivization in the decentralized world, the need for their systematic release emerged. Unlock events became significant moments in a token's lifecycle, significantly influencing its demand, supply, and market price.

Unlocking Tokens

When locked tokens become available for trading, it's referred to as an unlock event.

Tokens can be locked for various reasons: rewards, founder allocations, or partnerships.When these become liquid, they influence the market supply, demand, and consequently, the token's price.

Unlock events happen, but sometimes there's no activity for a while.

Our standard: "Unlock Events," is based on on-chain data or the timeline in the whitepaper. And when it is released to the circulating supply, that's what we call "Claimed."

By staying updated on unlock events and understanding how they affect token circulation, one can navigate the market with greater confidence and seize potential opportunities for profit or portfolio adjustments.

Mechanics of Unlocks

Unlocks can be complex. Projects use EOA wallets (Externally-Owned-Address) for token flexibility, multi-sig treasuries for security, and smart contracts for automated, ensuring predetermined, transparent releases.

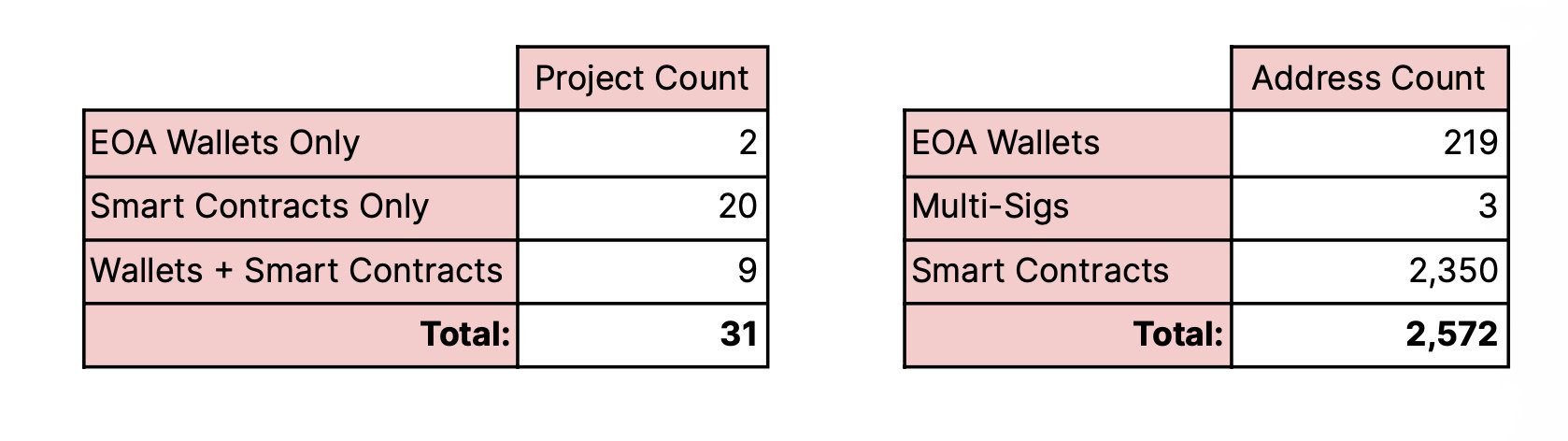

Fun Fact : According to TokenUnlocks annual report 2022

- 29/31 project use smart contract to vest their tokens

- 2,350 address use smart contract

It can be seen that many projects prioritize security and credibility.

Cliff vs. Linear

In the world of TokenUnlocks, not all release methods are the same. Two primary types dominate : Linear and Cliff.

Both methods serve different strategic purposes, depending on a project’s goals and its message to the investors.

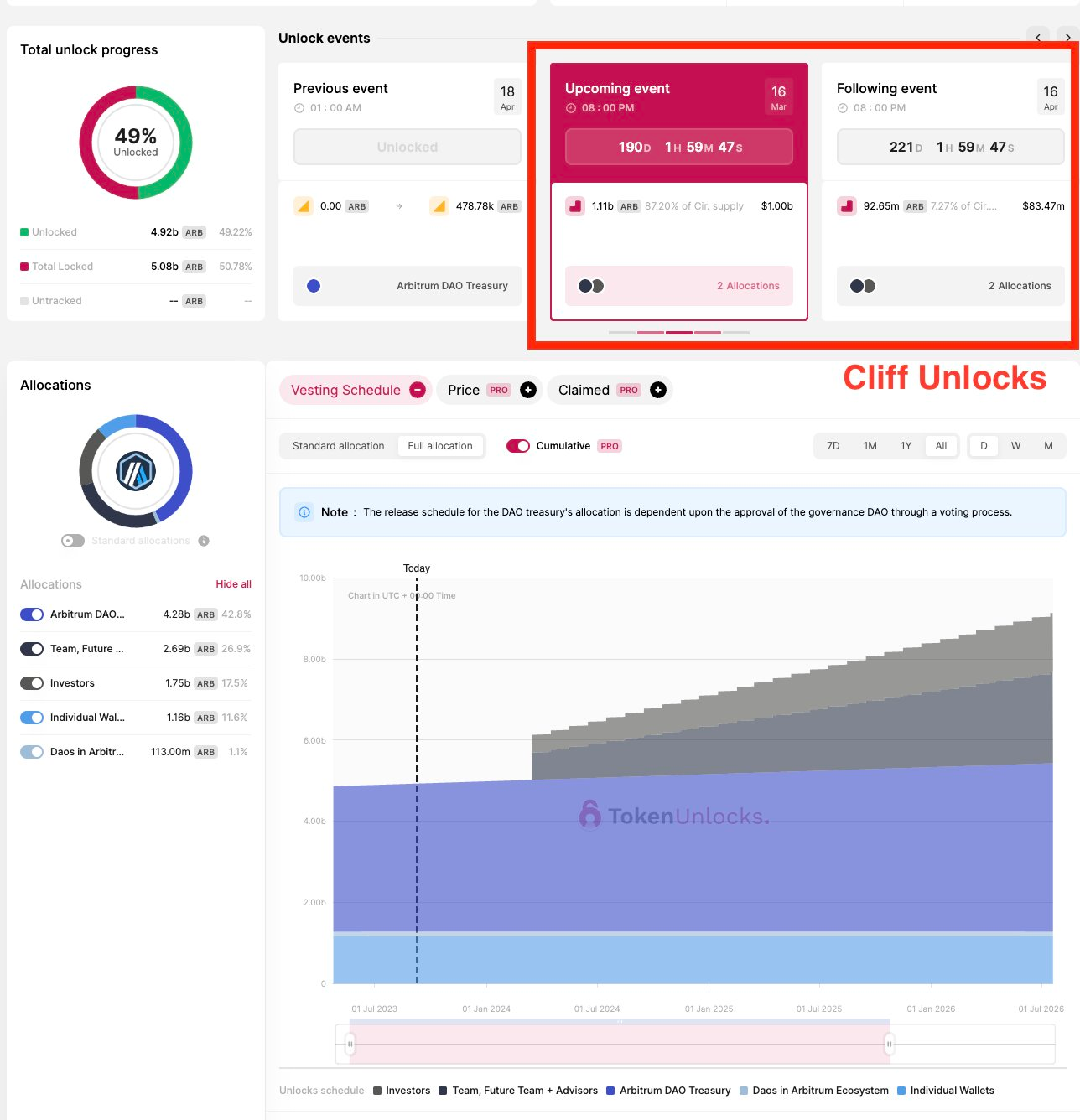

Imagine waiting 2 or 3 months without any tokens, then getting a batch. That's a 'Cliff'.

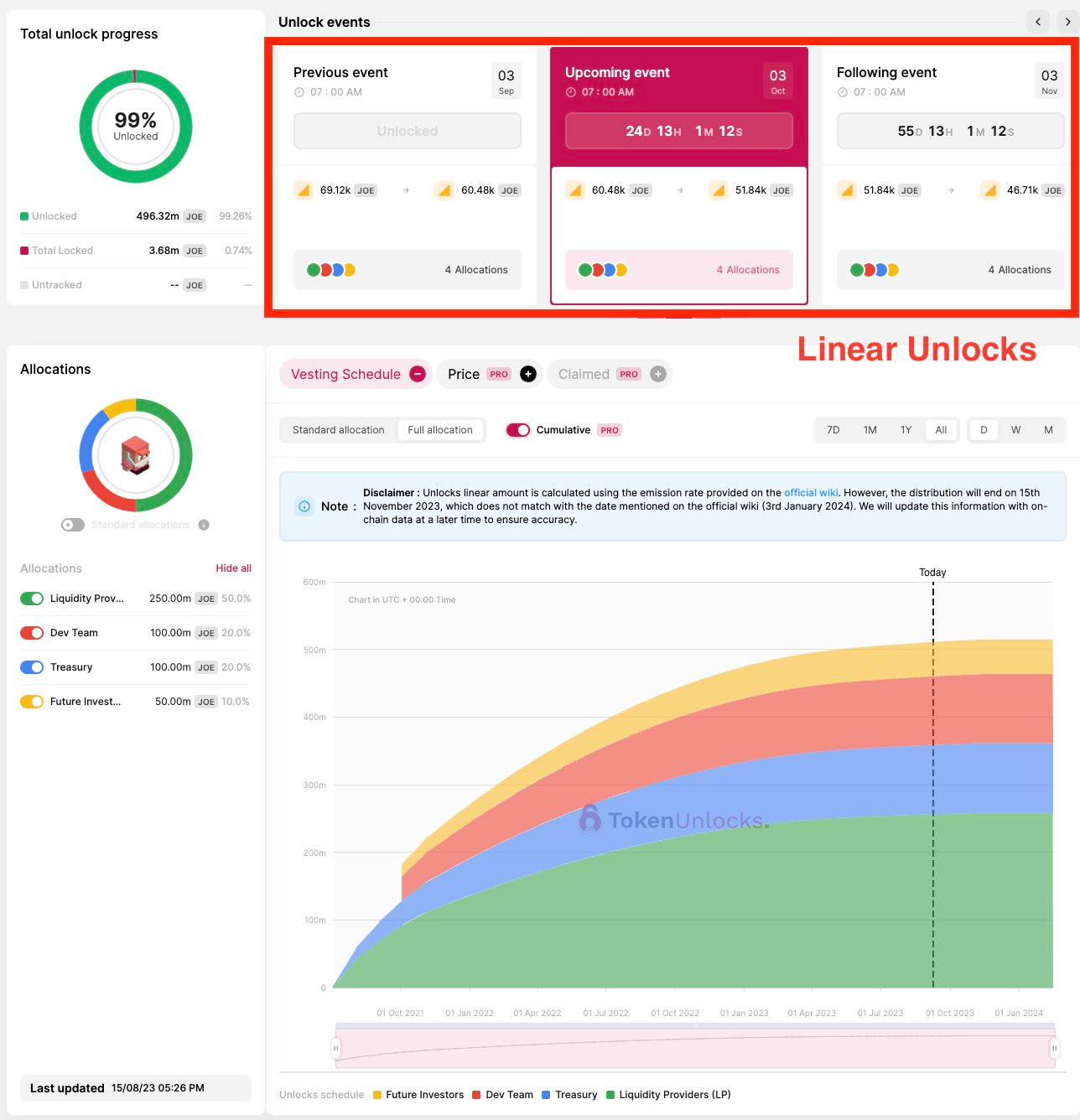

Now, picture getting tokens every day over a month. That's 'Linear'.

Understanding how a token’s release schedule is structured is key to predicting its market dynamics."

The cliff unlocks often unlocks a significant amount and specific number of tokens, with timelines that can range from weeks to months or even years. It depends on the project's direction for how many tokens are allocated and to whom, without rigid requirements.

Linear unlocks often unlocks daily, with equal amounts. However, the unlock rate may vary based on project documentation or on-chain data.

These unlocks are commonly used in DeFi tokens to distribute APR to users in the community.

Importance of Transparency

In crypto, opacity can spell disaster. Transparency in token distribution, lockups, and unlocks is vital.

At TokenUnlocks, we prioritize clear, accessible information, so you can make informed decisions. Transparency isn’t just a buzzword in the crypto landscape; it’s the backbone of trust.

Investors and stakeholders demand clear insights into token management and release strategies. That’s where TokenUnlocks shines.

We provide users with tools: 🛠️

- Unlock Schedule: Calendar with upcoming token releases for planning.

- Unlock Dashboard: Overview of project details, including token distribution and vesting schedules.

- UnlocksInsights: Get in-depth knowledge from Tokenomist articles.

Impact on Your Portfolio

Unlock events can affect your portfolio. Large unlocks can flood the market, causing price declines.However, if a reputable project releases tokens while maintaining strong demand, prices might significantly increase.

Distribution is a fine art in the token world. It’s not just about how many tokens are released, but also who gets them and when.

As investors, understanding these dynamics is crucial for portfolio health.

Tokens can be set aside for team, advisors, early backers, reserves, or for community incentives. Different categories may have varying vesting periods and release mechanisms. A balanced strategy ensures project longevity by considering immediate needs and future growth.

In each unlock event, TokenUnlocks calculates and displays the unlocked tokens as a percentage of the circulating supply. This helps with decision-making.

However, sometimes the percentage of circulating supply doesn't align with token demand, which could affect the price.

Release Mechanism

Distribution determines centralization. Equitable distribution ensures decentralization, reducing market manipulation and increasing trustworthiness

The question is how projects release tokens and the differences in each approach

Ensuring the security and transparency of token unlocks is crucial.

EOA > Multi Sig > Smart Contract

Some projects might simply store tokens in a standard EOA wallet, offering flexibility but lesser security. Instead of an EOA, some projects use a multi-signature wallet, requiring approval from multiple team members for transactions, safeguarding against rogue actions. Advanced projects might use smart contracts for unlocks, setting transparent and immutable rules for token release

All in all, some projects might use more than one mechanism to release their token. It depends on the use case, conditions, and owner's intentions as well.

Conclusion:

Token unlocks, while complex, are a fundamental aspect of tokenomics. By understanding their mechanics, importance, and impact, you equip yourself with valuable knowledge, crucial for informed decision-making in the crypto space. As with any investment, thorough research and understanding are essential.

References or Sources: