Strategic Portfolio Management

Introduction:

Step into the world of tokenomics. We unravel the past to anticipate the future. Historical data, a treasure trove of insights, guides us in understanding how token unlocks shape market dynamics. In this journey, we not only analyze significant events but also equip you with strategies to navigate the unpredictable seas of tokenomics.

Background Information:

Tokens, the foundation of decentralized ecosystems, go through unlocking processes that influence market behavior. Examining historical events, preparing for upcoming unlocks, and utilizing tools and platforms are all part of unraveling this phenomenon.

Exploring Historical Impacts. By understanding past events, investors gain valuable foresight into potential market movements.

Analysis and Discussion

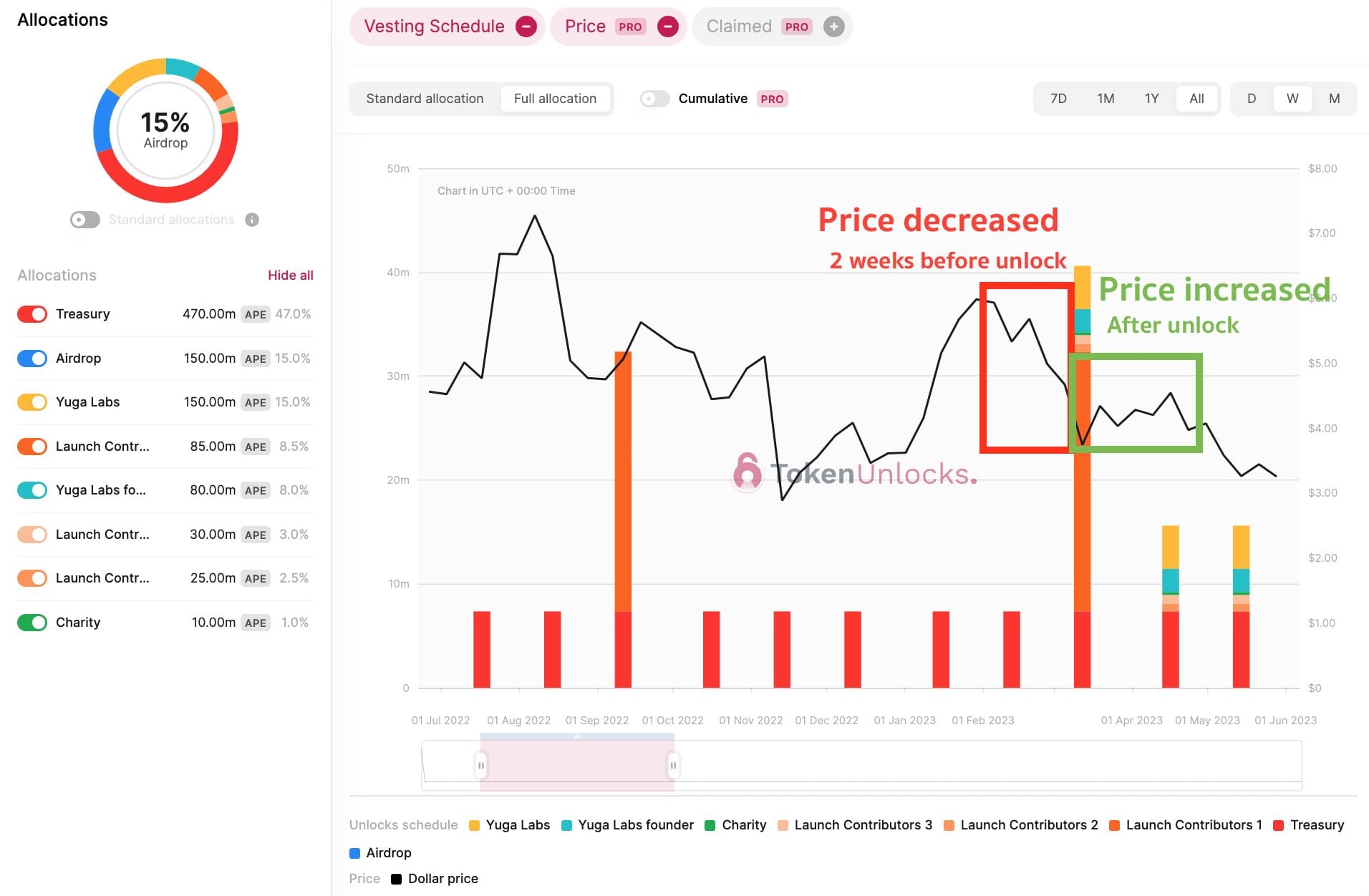

Analyzing token unlocks from projects like $APE reveals price impacts.

Example: $APE

On 17th Mar 23 unlock, the Price initially dipped 2 weeks before unlock but recovered quickly.

Let's see the case study📕

Anticipating future unlocks requires thorough planning. Using 'CryptoXYZ' as an imaginary case, we detail a complete approach:

- Risk Assessment: Evaluate the percentage of 'CryptoXYZ' in your portfolio to measure potential impacts.

- Fundamental Analysis: Assess project health, development milestones, and community engagement for informed decisions.

- Market Sentiment: Utilize sentiment analysis to evaluate community sentiment and understand market dynamics.

- Liquidity Check: Ensure 'CryptoXYZ' has sufficient liquidity to avoid significant price drops.

- Set Up Alerts: Utilize price alert tools for real-time updates and quick decision-making.

- Exit Strategy: Establish a clear exit plan, whether through stop-loss orders or predetermined selling points.

6 Tips or Strategies for Successful Token Unlock Navigation

Explore the nuanced dynamics of token unlocks with a focus on short-term and long-term impacts. Gain insights into market correlations, understanding how unlocks relate to broader market events. Stay awake by monitoring key indicators such as trading volume, buy-sell ratios, and order book depth. Observe investor behavior, particularly large holders, for strategic insights. Implement protective measures like stop-loss orders or hedging through derivatives. Leverage unlock events to optimize your portfolio through a thoughtful rebalancing strategy.

Deciphering Price Impact: A Step-by-step Guide:

Ever wondered how token unlocks ripple through prices? Delve into a captivating guide:

- Check Unlock Dates: Mark your calendar for upcoming unlock event.

- Assess Tokens: Calculate the unlock amount and value for potential market impact.

- Track Previous Unlocks: Analyze past trends or impacts for actionable insights.

- Community Sentiment: Dive into forums to gauge the pulse of public opinion.

- Tokenomics: Grasp the dynamics of mechanics, supply, demand, and utility.

- Technical Analysis: Navigate market conditions using indicators like Moving Averages and RSI.

- Risk Management: Safeguard investments with strategic stop-loss orders.

- Review Post-Unlock: Fine-tune your strategies based on post-event analysis.

Conclusion:

Being informed and prepared for token unlocks is critical in the ever-changing crypto landscape. TokenUnlocks, a platform that provides insights, historical data, and educational resources, enables both new investors and traders to successfully navigate unlocks. Stay informed, be prepared, and manage risks wisely for the best investment results.

References or Sources:

Disclaimer: This article provides information and should not be construed as financial advice. Always conduct your research before making any investments. This is not sponsored content.