Weekly Unlocks Digest: Dec 15–21, 2025

This week’s report comes as crypto markets stabilize following a volatile macro stretch. BTC fell 2.6% over the past seven days, while total liquidations cooled to approximately $2.08B, down from last week’s elevated levels. Markets largely absorbed the 25 bps FOMC rate cut, with attention shifting toward global inflation data and central bank policy divergence.

On the token side, focus turns to $ZRO, which posts the largest unlock relative to circulating supply this week, alongside $ARB, where all scheduled emissions flow directly to insiders.

Weekly Unlocks Recap

BTC declined 2.6% this week as markets digested the Fed’s expected rate cut. More notably, the Fed announced $40B in Treasury bill purchases over the next 30 days, beginning Dec 12, aimed at maintaining ample liquidity in the banking system. Despite the dovish liquidity signal, risk assets remained range-bound.

Macro attention now centers on US CPI, the ECB Interest Rate Decision, and a potential Bank of Japan rate hike, which could mark its highest policy rate in over 30 years.

On the token side, several protocol-specific catalysts stand out:

- $PYTH launched a token buyback program

- $LIGHTER is rumored to launch its token this month after being added to Coinbase’s listing roadmap

- Tether reportedly plans to raise up to $20B at a $500B valuation

- $AEVO’s legacy Ribbon DOV vaults were exploited for ~$2.7M

- Sushi DAO is voting to raise annual emissions from 1.5% to 5%

- $VSN undergoes its quarterly burn on Dec 18

Top Supply Growth (Last 30 Days)

Supply expansion continues to pressure price performance across several mid-caps:

- RIVER (+22.8% supply) shows resilience, with price up 6.3%

- STBL, PUFFER, and MMT each expanded supply by 15–19%, while prices declined 28–46%

- RAIN stands out with a 16.2% supply increase alongside a +144.6% price move, reflecting demand temporarily outpacing dilution

Overall, most supply growth over the past month continues to be driven by vesting and scheduled emissions rather than organic demand expansion.

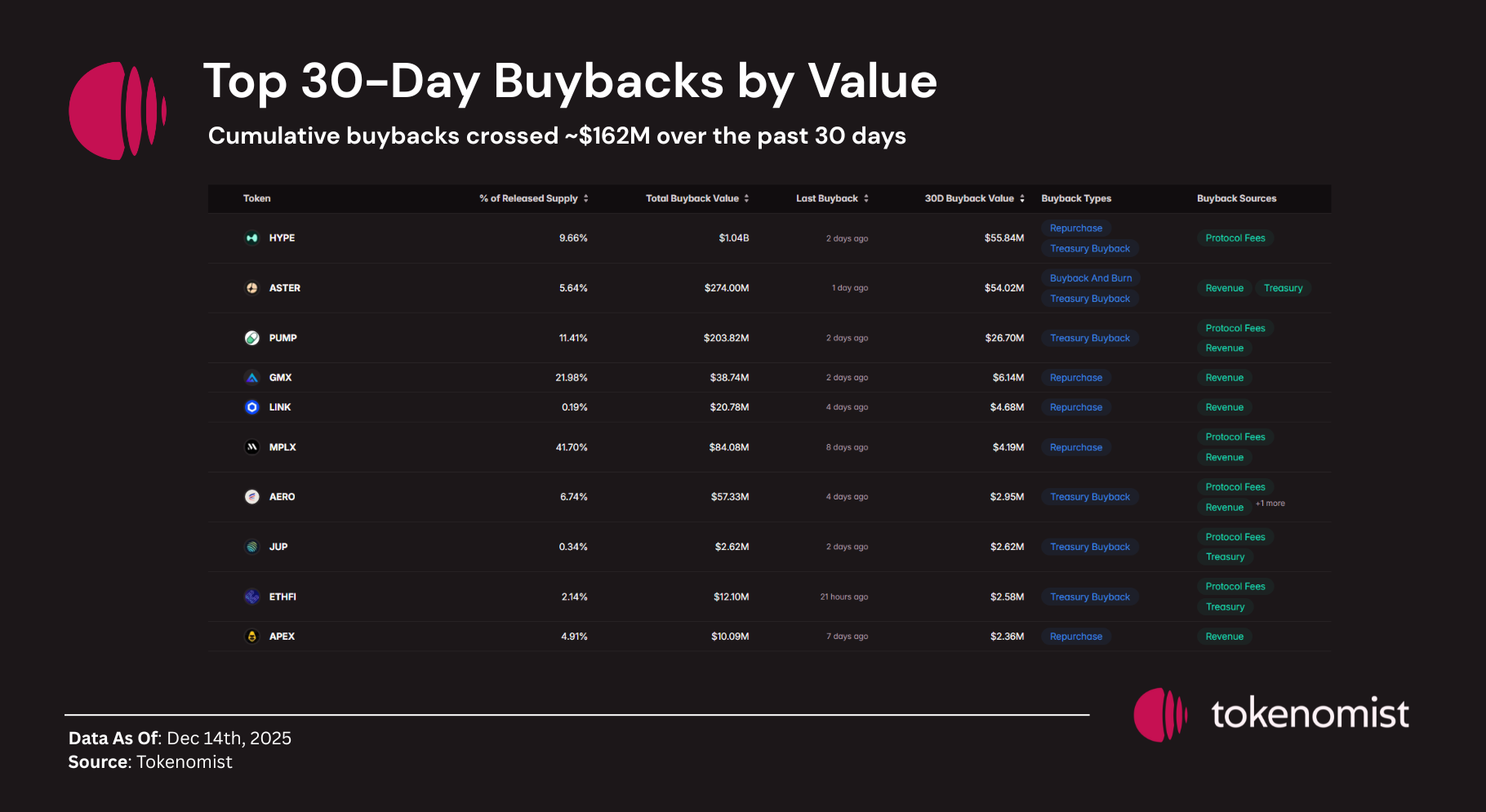

Top 30D Buybacks

Buyback activity remained concentrated among a small group of high-revenue protocols.

- HYPE continues to dominate, with over $55M in buybacks over the past 30 days

- ASTER follows with ~$54M, supported by burn-and-buyback mechanics

- PUMP adds another $27M+, funded primarily by protocol fees

GMX, LINK, MPLX, and AERO maintain steady but smaller repurchase activity

Full Dashboard : https://tokenomist.ai/buyback/screener

Cumulatively, 30-day buybacks across major protocols exceed $162M, reinforcing the divergence between revenue-generating platforms and inflation-heavy token models.

Upcoming Events

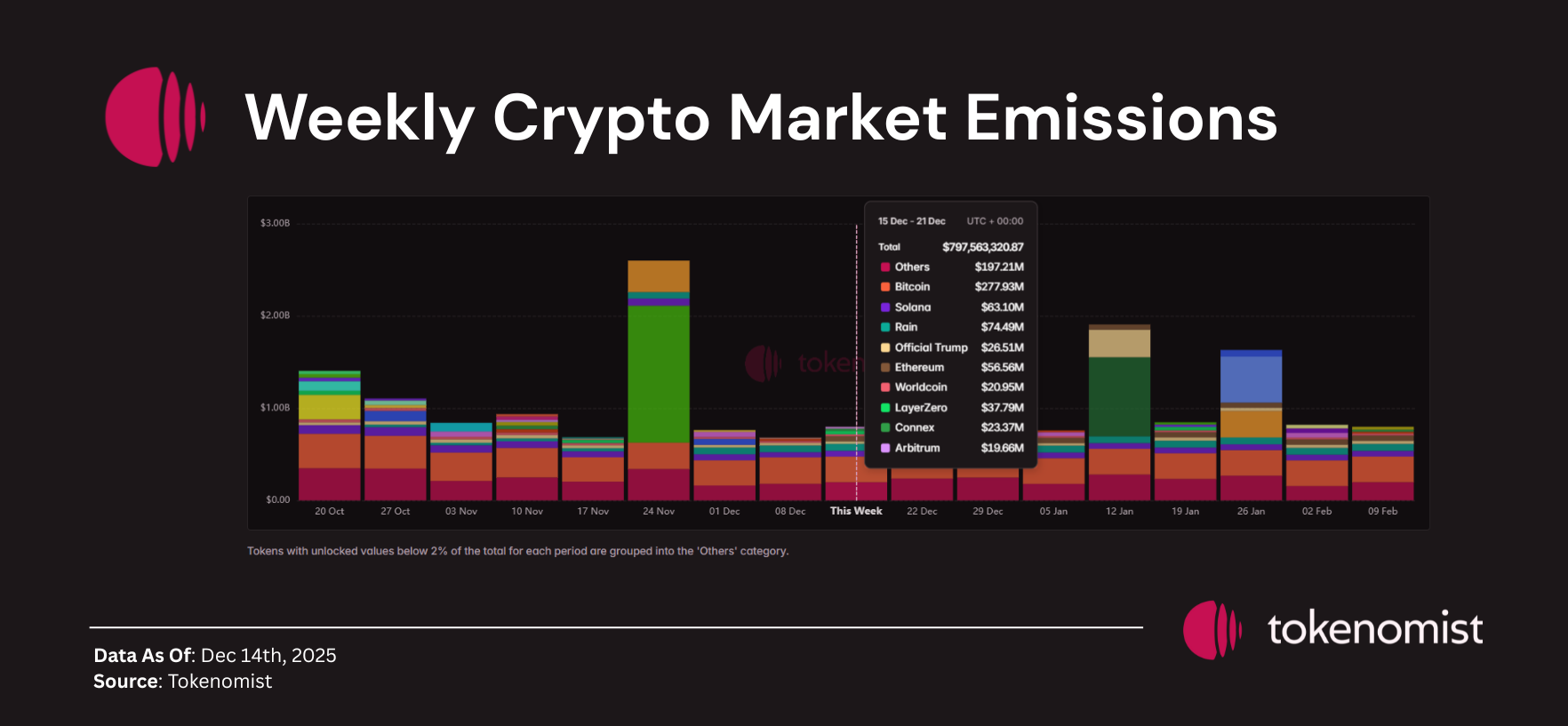

This week’s scheduled unlocks total approximately $797M, rising from last week’s ~$680M as LayerZero and Arbitrum emissions re-enter the schedule.

Unlock contributions are spread across BTC, SOL, ETH, RAIN, ZRO, and ARB, with no single asset dominating aggregate emissions. While higher than last week, overall emissions remain modest relative to October–November peaks.

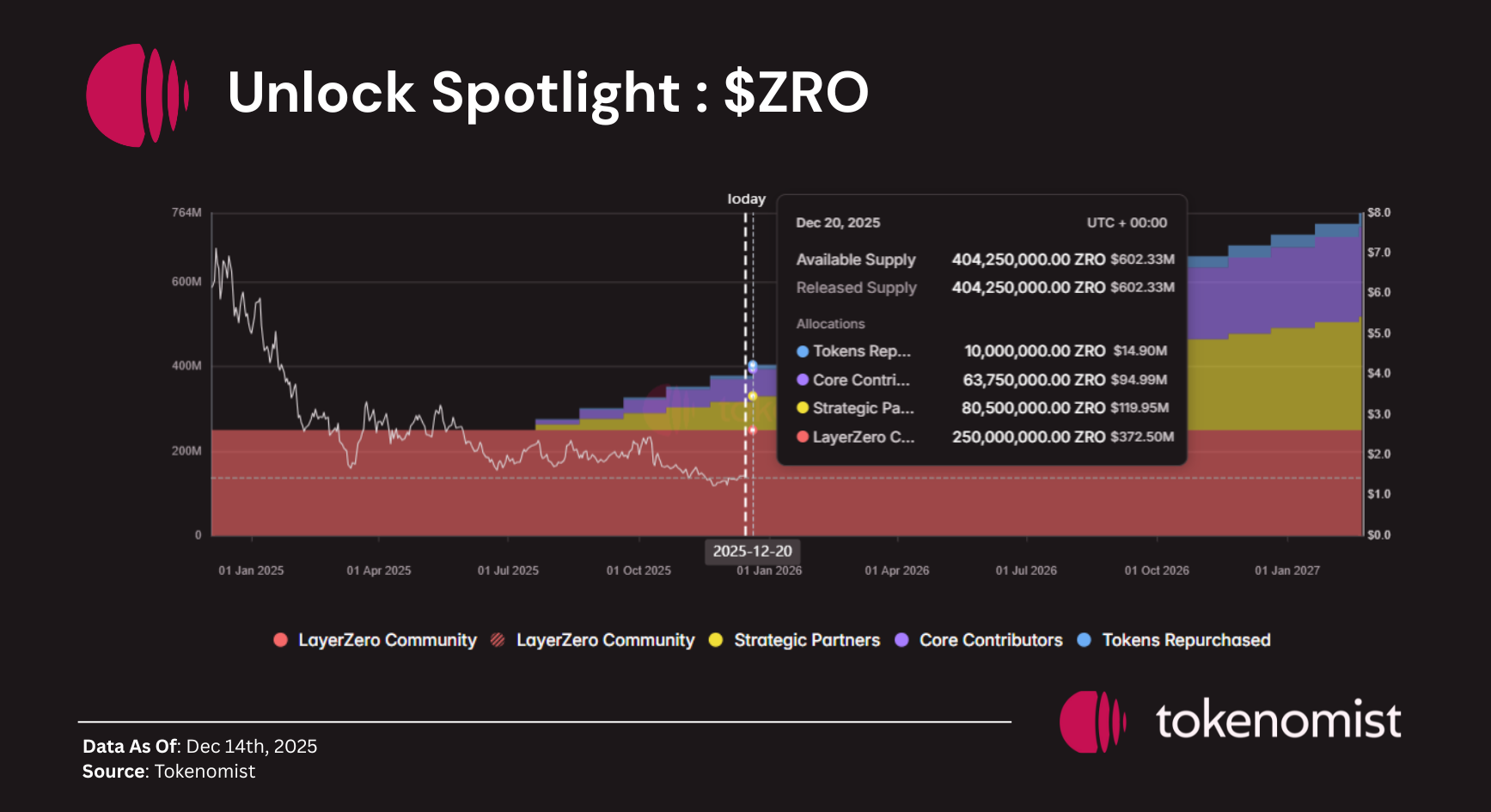

Unlocks Spotlight: $ZRO

Unlock Date: Dec 20, 2025

Amount: $38.31M

Unlock % of Circulating Supply: 6.79%

Allocations: Investors & Core Contributors

$ZRO records the largest unlock both by value and relative circulating supply this week, with all emissions tied to insider allocations.

Full Dashboard : https://tokenomist.ai/layerzero

A significant portion of $ZRO’s supply remains locked under a multi-year vesting schedule, with insider allocations releasing monthly. As of now, roughly 38% of total supply is unlocked, and this week’s release alone adds 6.79% to circulating supply—marking a notable short-term dilution event.

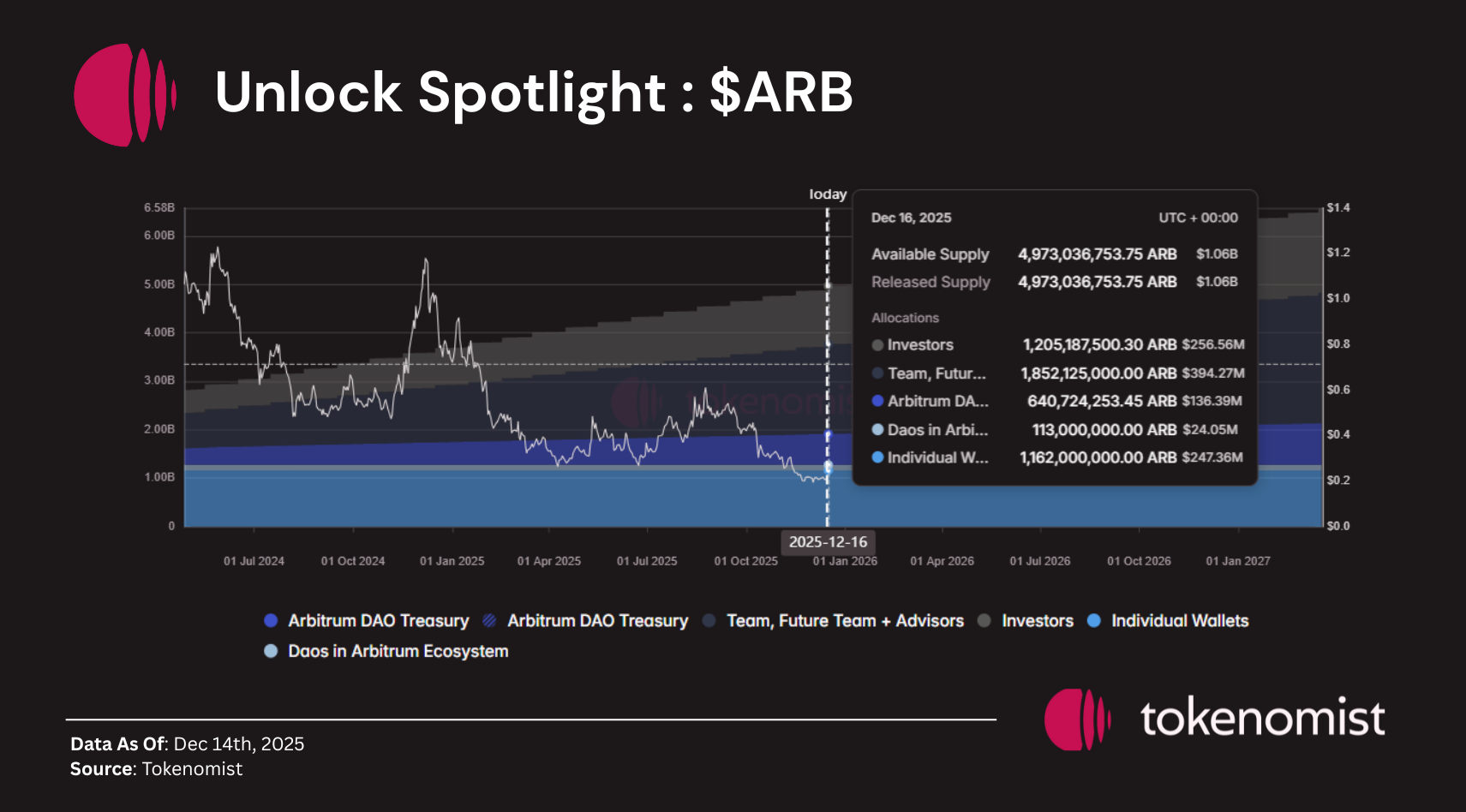

Unlocks Spotlight: $ARB

Unlock Date: Dec 16, 2025

Amount: $19.66M

Unlock % of Circulating Supply: 1.9%

Allocations: Investors & Core Contributors

$ARB’s entire weekly unlock is directed toward insider allocations.

Full Dashboard : https://tokenomist.ai/arbitrum

Approximately 50% of ARB’s total supply remains locked, following a multi-year vesting schedule with monthly releases. This week’s emission adds 1.9% to circulating supply, continuing the protocol’s steady insider-led dilution pattern.

Notable Crypto News

- Michael Saylor’s Strategy made its second consecutive $1B Bitcoin purchase last week (https://www.coindesk.com/markets/2025/12/15/michael-saylor-s-strategy-made-second-consecutive-usd1b-bitcoin-purchase-last-week))

- Coinbase set to unveil prediction markets powered by Kalshi (https://www.cnbc.com/2025/12/12/coinbase-to-soon-unveil-prediction-markets-powered-by-kalshi-source-says.html)

- Sushi DAO votes to increase annual emissions to ~14.25M SUSHI/year (https://snapshot.box/#/s:sushigov.eth/proposal/0x50ebd0803c290d08b566a6c18a9778f705312223a56ae6876b63874898f55bf0)

- Jupiter to launch JupUSD stablecoin next week (https://bitcoinethereumnews.com/tech/jupiter-to-launch-jupusd-stablecoin-next-week/)

- Bank of Japan signals potential rate hike to a 30-year high, adding macro pressure to BTC ( https://www.coindesk.com/markets/2025/12/13/bank-of-japan-set-to-hike-rates-to-30-year-high-posing-another-threat-to-bitcoin )

- UK plans to begin formal crypto regulation in 2027 ( https://www.coindesk.com/policy/2025/12/15/uk-to-plans-to-start-regulating-cryptocurrency-in-2027)