What $6B Lost on $OM Taught Us About Tokenomics

Early on April 14th 2025, the price of $OM plummeted from over $6 to just $0.60 within hours—wiping out more than $6 billion in market capitalization. The collapse dealt a significant blow to investors, especially given that Mantra was previously regarded as one of the leading projects in the Real World Asset (RWA) narrative. The resulting liquidity crunch triggered a cascading effects across the ecosystem, as $OM had been widely used as collateral—revealing layers of hidden leverage not immediately visible on-chain. The situation has drawn comparisons to the $LUNA collapse and its leverage spiral. The question now is: Will history repeat itself?

Timeline of the Incident

Between November 2024 and April 2025, $OM experienced a more than 5x rally, fueled by the rising RWA narrative and growing speculation around the return of a Trump administration, which many believed would usher in a more favorable regulatory environment. Mantra Chain positioned itself as an RWA-focused infrastructure platform, offering developer modules and toolkits built on the Cosmos SDK. This surge in price and narrative strength propelled $OM into the spotlight, making it one of the top-performing tokens during that period and drawing significant attention from crypto investors.

Unfortunately, the gains were swiftly erased in a matter of hours following a sharp and coordinated sell-off. According to LookOnChain, at least 17 wallets deposited over 40 million $OM (valued at over $200 million at the time) into centralized exchanges—equivalent to approximately 4.5% of the circulating supply. Shortly after these deposits, $OM experienced a steep price drop, exacerbated by low market liquidity, which amplified the price impact.

Who dropped the price of $OM?

— Lookonchain (@lookonchain) April 14, 2025

Before the $OM crash(since Apr 7), at least 17 wallets deposited 43.6M $OM($227M at the time) into exchanges, 4.5% of the circulating supply.

According to Arkham’s tag, 2 of these addresses are linked to Laser Digital.

Laser Digital is a strategic… pic.twitter.com/zB8yAPRPSO

The sell-off triggered a wave of cascading liquidations. Due to the presence of hidden leverage across DeFi platforms, the full extent of risk exposure was not immediately visible—intensifying the drawdown.

Mantra’s team addressed the incident on X, stating that neither their investors nor team members are selling, and that Arkham Intelligence has misattributed wallet ownership. On-chain analyst ZachXBT also noted the wallets are likely linked to Denko Mancheski, CEO of Reef Finance—a project previously involved in market manipulation allegations, a Binance delisting in Oct 2024, and an $80M OTC deal with Alameda in 2021.

While it’s unclear if this was a rug pull, the event highlights the need to identify red flags and improve preventative measures.

Red Flags and What We Should Watch For

One notable red flag with Mantra is the mismatch between its fundamentals and market valuation. While its total value locked (TVL) is just over $4 million, the token reached a market capitalization of $8 billion. In comparison, a more established RWA project like Ondo Finance had around $1 billion in TVL at its peak, with a market cap of $5 billion. This discrepancy raises concerns about potential price manipulation or excessive speculation.

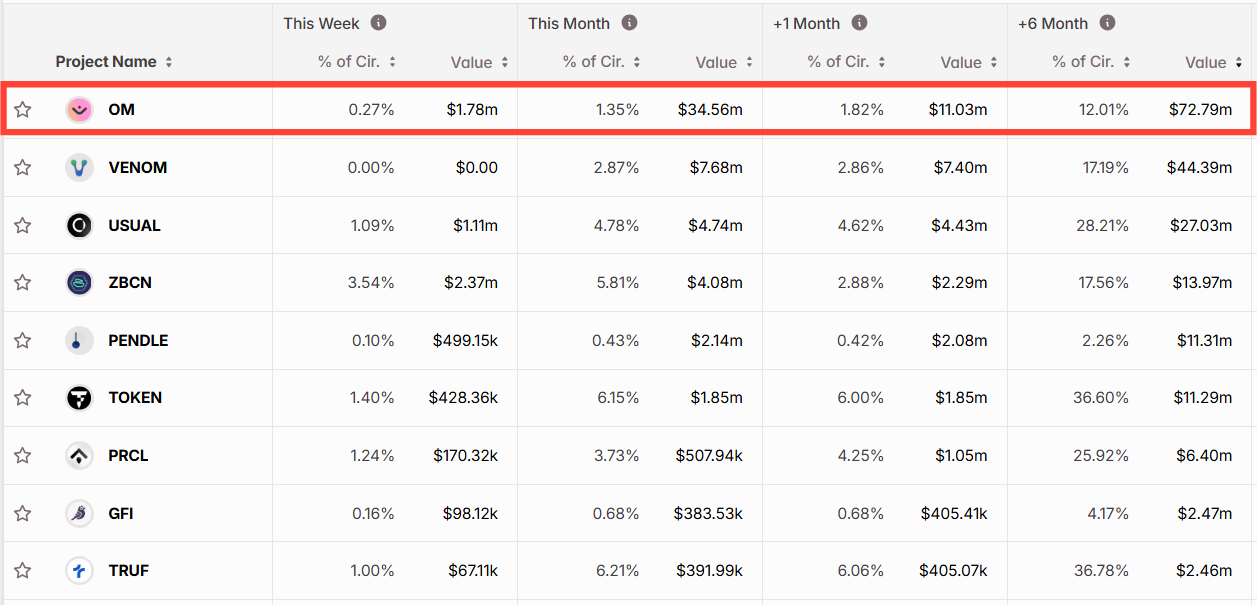

From a tokenomics perspective, $OM has one of the most aggressive upcoming unlock schedules in the RWA sector. Over the next six months, approximately 12% of the circulating supply—equivalent to $73 million—will be unlocked. Although most of these unlocks are set to occur linearly, the potential market impact remains significant, especially given that there is no defined maximum supply.

Conclusion

While it is impossible to predict with certainty whether a project will engage in insider selling or a rug pull, there are key metrics that can help investors assess risk. Comparing a project’s fundamentals with its current valuation, and benchmarking it against competitors, can reveal potential overvaluation. Additionally, examining liquidity levels helps identify tokens vulnerable to price manipulation or excessive speculation. Large upcoming token unlocks, particularly when not accompanied by new demand, can lead to significant price dilution. By closely monitoring these factors, investors can better protect themselves from potential pitfalls in the market.