Deep Dive: Aster Dex(ASTER) Tokenomics – Emissions, Buybacks & Burn Cycles

Key Insights

- Short-term supply stays tight as insider unlocks remain inactive until Sep 2026 and ecosystem emissions are delayed.

- Buybacks now drive supply dynamics, with S3 alone removing ~3% of circulating supply.

- Airdrop emissions are discretionary, reducing mechanical sell pressure.

- Future dilution depends on volume, not vesting — more trading feeds more burns.

Overview

Aster’s token design has evolved rapidly over the past three seasons, shifting from a high-incentive airdrop model to a buyback-driven, deflation-leaning supply structure. With unlocks pushed outward, seasonal burns introduced, and fee-powered buybacks now live under S4, ASTER has one of the most actively adjusted tokenomics frameworks among new-generation perpetual DEX tokens.

This report breaks down Aster’s supply model across emissions, unlocks, airdrops, and burn cycles — along with what these changes mean for long-term dilution and value capture.

Core Token Details

- Total Supply (Post Burn): 7,922,139,508 ASTER

- Total Burned to Date: 77,860,491 ASTER

- Initial Circulating Supply: 1.6B (20.75% of original 8B)

- 706M Airdrop

- 360M Liquidity

- Circulating Supply: 2.09B ASTER

- Model: Deflationary (airdrop-heavy incentives+ fees driven buybacks & burns)

Inflation / Emission Structure

Aster uses a deflationary model, powered by:

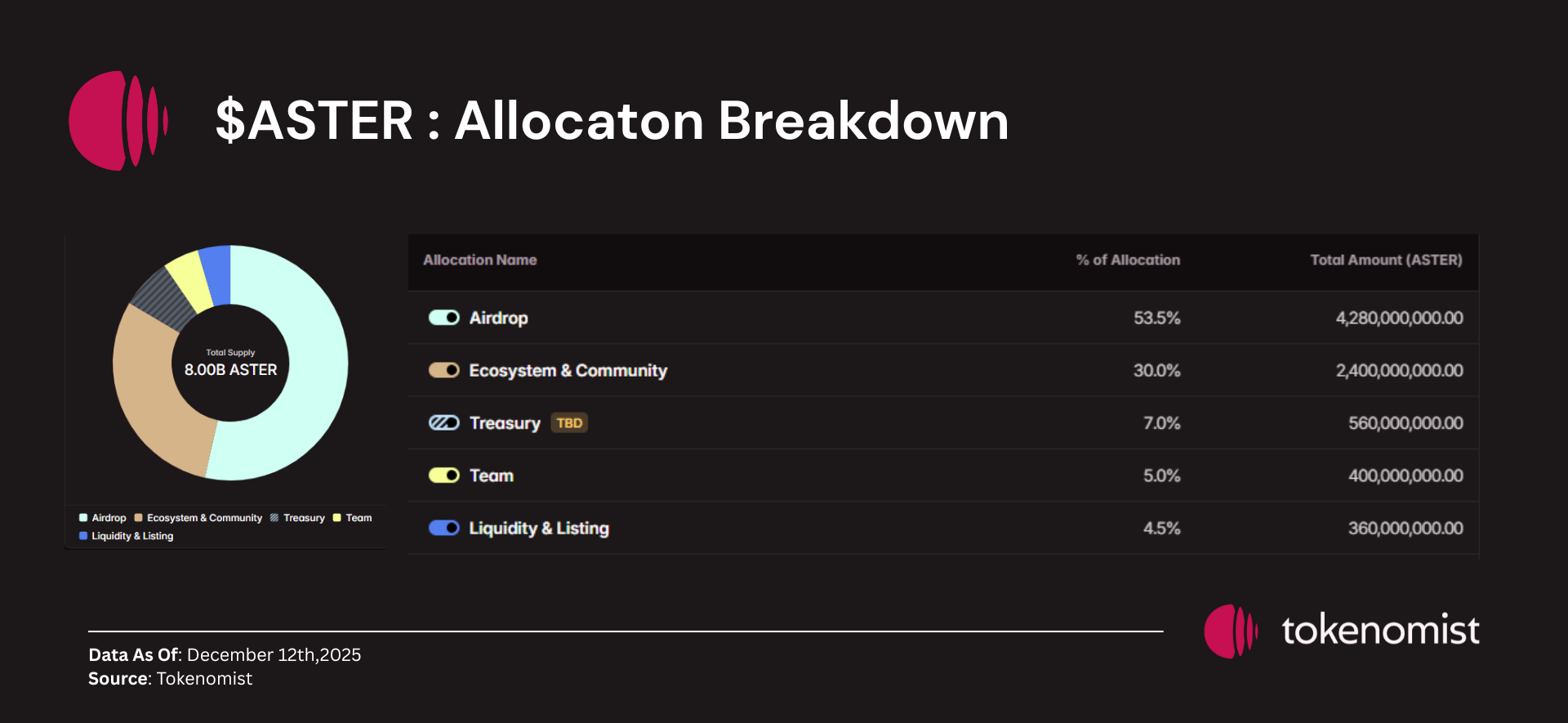

- 53.5% of supply allocated to airdrops & community incentives

- 60-90% of platform trading fees used for buybacks, part of which is burned

- Seasonal burn cycles (S3, S4…) that remove supply over time

Burn Model

- 60-90% of trading fees → buybacks

- Repurchased tokens are:

- 50% burned

- 50% moved to community / airdrop reserves

This creates a volume-linked deflation engine: more trading → more fees → more buybacks → more burn.

Allocation Breakdown

Majority of the supply is directed to the community through airdrops and Community incentive programs.

Note: Allocation percentages remain based on the original 8B design. Burned tokens reduce total supply but do not proportionally alter allocation share.

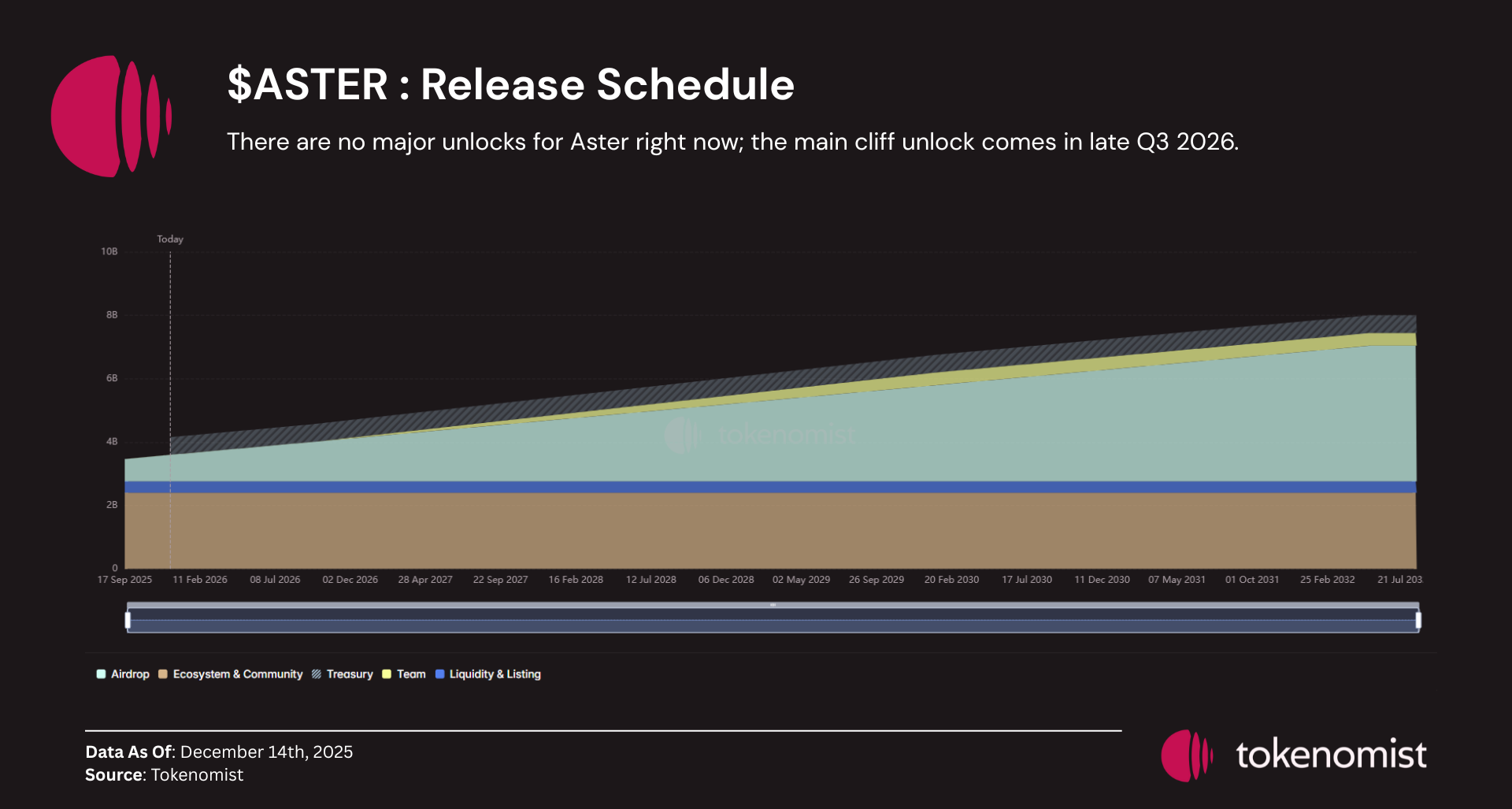

Full Unlock Timeline

Aster’s unlock design has already undergone major revisions to reduce dilution pressure and extend runway.

Original Unlock Schedule (2025–2032)

- TGE: 17 Sep 2025

- Heavy airdrop emissions front-loaded

Updated Unlock Schedule (2026–2035)

Aster pushed several 2025 unlocks to later seasons, creating a much smoother emission curve:

Key Changes

- Ecosystem unlocks paused

- Unlock revised to Summer 2026 to 2035

Source : https://bitcoinworld.co.in/aster-tokenomics-unlock-delay/

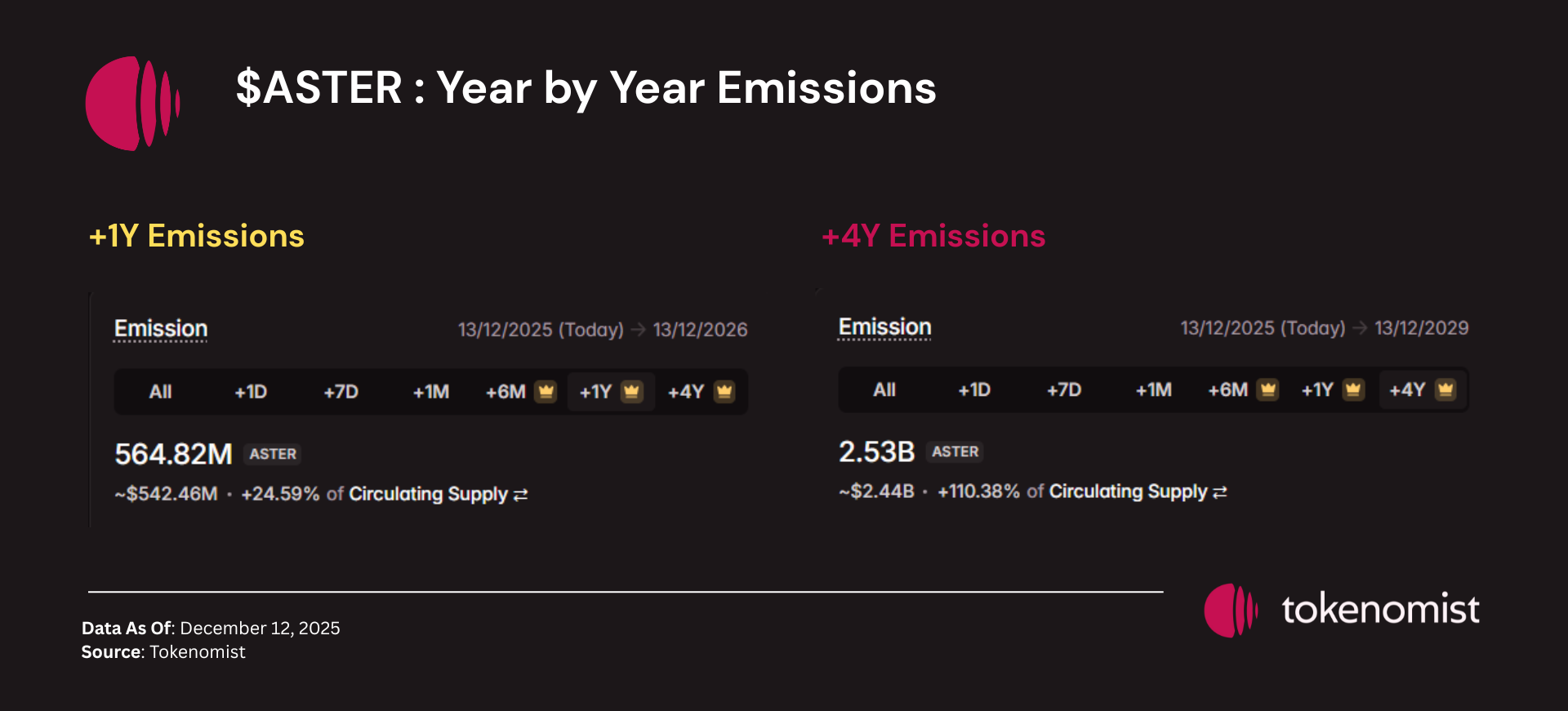

Emissions Overview

- Monthly Emissions: ~$42.58M (2.17% of circ. supply)

Note: These tokens often do not immediately enter circulating supply — they remain under team-controlled airdrop programs.

- Insider Emissions: 0% until Sep 18, 2026

- Expected 1-Year Dilution: +27% of circulating supply

Cliff Unlock: Team cliff ends - 18 Sep 2026

Full Dashboard : https://tokenomist.ai/aster-2/tokenomics

Season-by-Season Unlock Changes

- +1 Year: +27% circulating supply (≈ $500M in unlock value)

- +4 Years: +120% circulating supply (≈ $2B in unlock value)

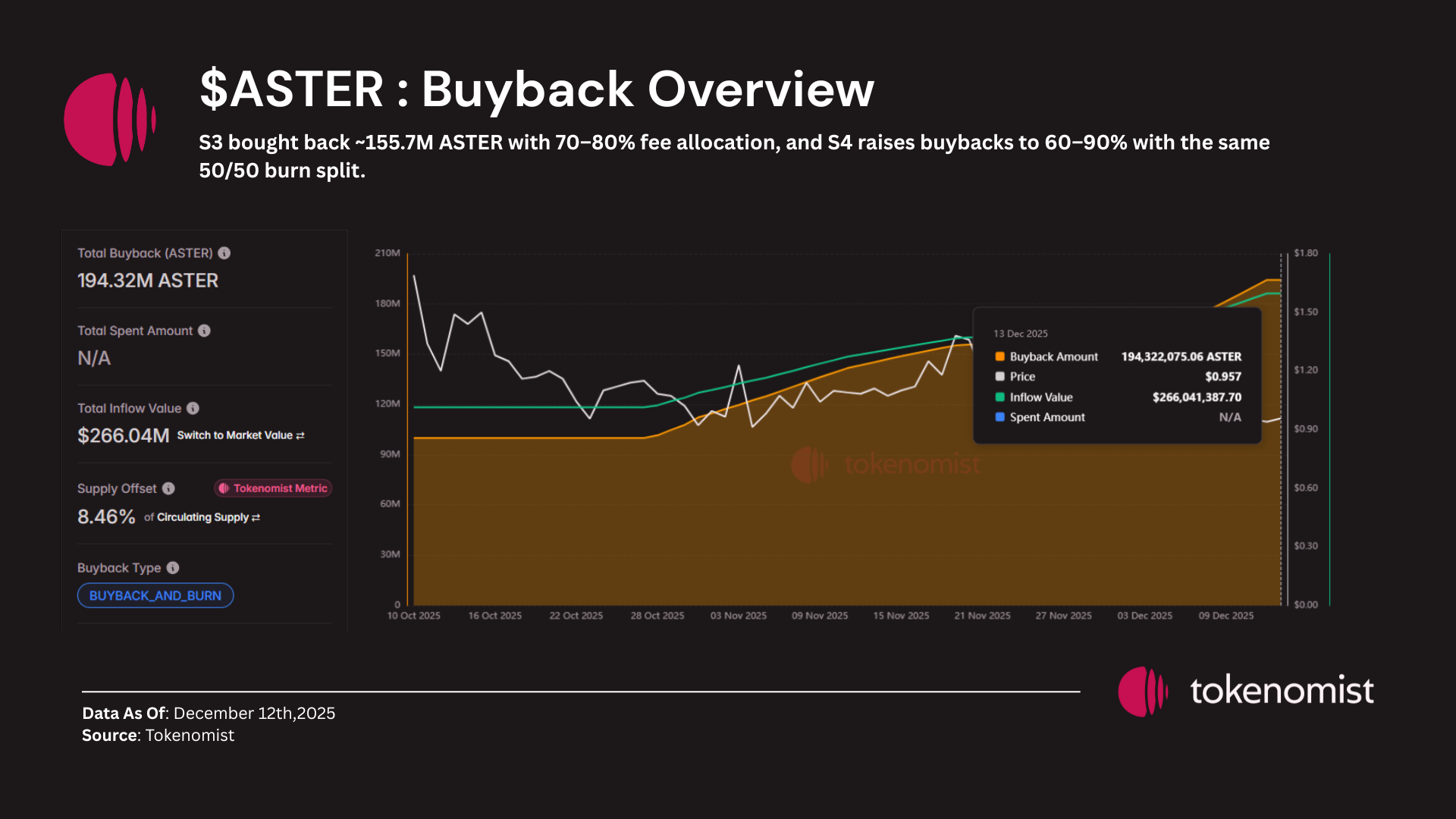

Buyback & Burn Mechanism (Season-by-Season)

Aster’s burn model is one of the strongest deflation levers in new-gen DEX tokens.

Season 3 (Completed – Nov 9)

- Total Fees Generated : >$280M

- % of Fees Used for Buybacks: 70-80%

- Total Tokens Bought Back: ~155.7M

- Total Tokens Burned: 77.8M

- Burn Rate: ~3.28% of Circulating supply ( supply as of Dec 5)

S3 demonstrated strong fee-linked burn efficiency for a newly launched token.

Season 4 (Live)

- 60–90% of fees redirected to buybacks

- Started early: Dec 2–10, 2025

- Model aims for more aggressive and sustained buybacks compared to S3

Cumulative Buybacks & Burns

- 194.322M ASTER buybacks to date

- 77,860,491 ASTER burned to date

(does not include currently locked buyback reserves)

Full Dashboard : https://tokenomist.ai/aster-2/buyback

Airdrop Events

| Phase | % of Supply | Amount | Status |

|---|---|---|---|

| Phase 1 – TGE | 8.8% | 704M | Completed |

| Phase 2 – Stage 2 | 4% | ~320M | Completed |

| Phase 3 – Stage 3 | ~2.5% | ~200M | Not Live Yet |

Airdrops remain the largest structural source of supply expansion — but much of it moves through controlled distribution rather than free-floating circulation.

Utility of the ASTER Token

- Governance: Vote on protocol upgrades & fee parameters

- Staking: Yield, reward boosts, and protocol influence

- Incentives: Distributed for trading, liquidity, and ecosystem growth

- Fee Discounts: Reduced trading fees for holders

- Buyback Participation: Access to a burn-heavy model that compounds value capture

Comparative Tokenomics Snapshot

| Project | Emissions | Buyback / Burn Model |

|---|---|---|

| Aster | Large community emissions; multi-season airdrops; delayed unlocks | 60–90% fees → buybacks; 50% burned; high deflation |

| Hyperliquid | Minimal emissions | Aggressive burn engine tied directly to fees |

| Aevo | Standard emissions | Fees routed to liquidity + growth, not burns |

| Drift | Standard DeFi vesting + incentives | Limited burn, governance-led |

Bull Case for ASTER (Short & Data-Based)

1. Delayed Unlocks

Major unlocks moved to later seasons (2026–2035), reducing short-term dilution.

2. High Burn Velocity

S3 alone burned 3.3% of circulating supply, a strong deflation signal for a new token.

3. Trading Volume → Buybacks Flywheel

More trading → more fees → more buybacks → more burns → tighter supply.

4. Strong Community Traction

Large airdrops + staking adoption support liquidity and participation.

5. Active Tokenomics Iteration

pause of ecosystem unlocks, seasonal buybacks, revised vesting

Conclusion

Aster’s supply design now centers on long-term unlock delays and fee-driven buybacks, creating a deflationary framework in the near term. S3 proved the model’s strength with a 3%+ circulating supply burn, while S4 pushes the mechanism further with higher fee allocation. With insider unlocks inactive until 2026 and major emissions pushed out, Aster’s next chapters depend on sustained trading volume — the key catalyst that fuels its entire burn flywheel.