The Interoperability War: $DOT Polkadot

Key Takeaways

- Interoperability: Polkadot enables seamless data transfer across various blockchains.

- Scalability: Sharded design allows Polkadot to support a wide range of applications.

- DeFi & Web 3.0: Polkadot is well-positioned for the rise of DeFi and the decentralized web.

- Challenges: Faces competition and regulatory uncertainties in the blockchain space.

- Use Cases: Supports diverse applications from DeFi to gaming.

- Tasks: Must navigate complex global regulatory, compliance issues, and integration with deep-techs.

Introduction

Polkadot, a groundbreaking blockchain initiative, aims to address the major problem of interoperability within the blockchain community. Designed to enable different blockchains to communicate and interact seamlessly and securely, Polkadot represents a significant advance in blockchain technology. This article provides an in-depth exploration of Polkadot's origins, features, and potential applications.

The Genesis of Polkadot

Polkadot was created by Dr. Gavin Wood, a co-founder and former CTO of Ethereum. He was instrumental in Ethereum's development, penning the yellow paper for Ethereum’s virtual machine (EVM), which lies at the heart of Ethereum’s smart contract functionality. In 2016, Wood co-founded Web3 Foundation and Parity Technologies, which were instrumental in the creation and development of Polkadot.

Wood envisioned Polkadot as a scalable and interoperable multi-chain infrastructure capable of solving the issues of scalability, security, and interoperability that plague many existing blockchain platforms. Polkadot’s initial coin offering (ICO) was carried out in 2017, and its mainnet was launched in May 2020.

The Polkadot Network Structure

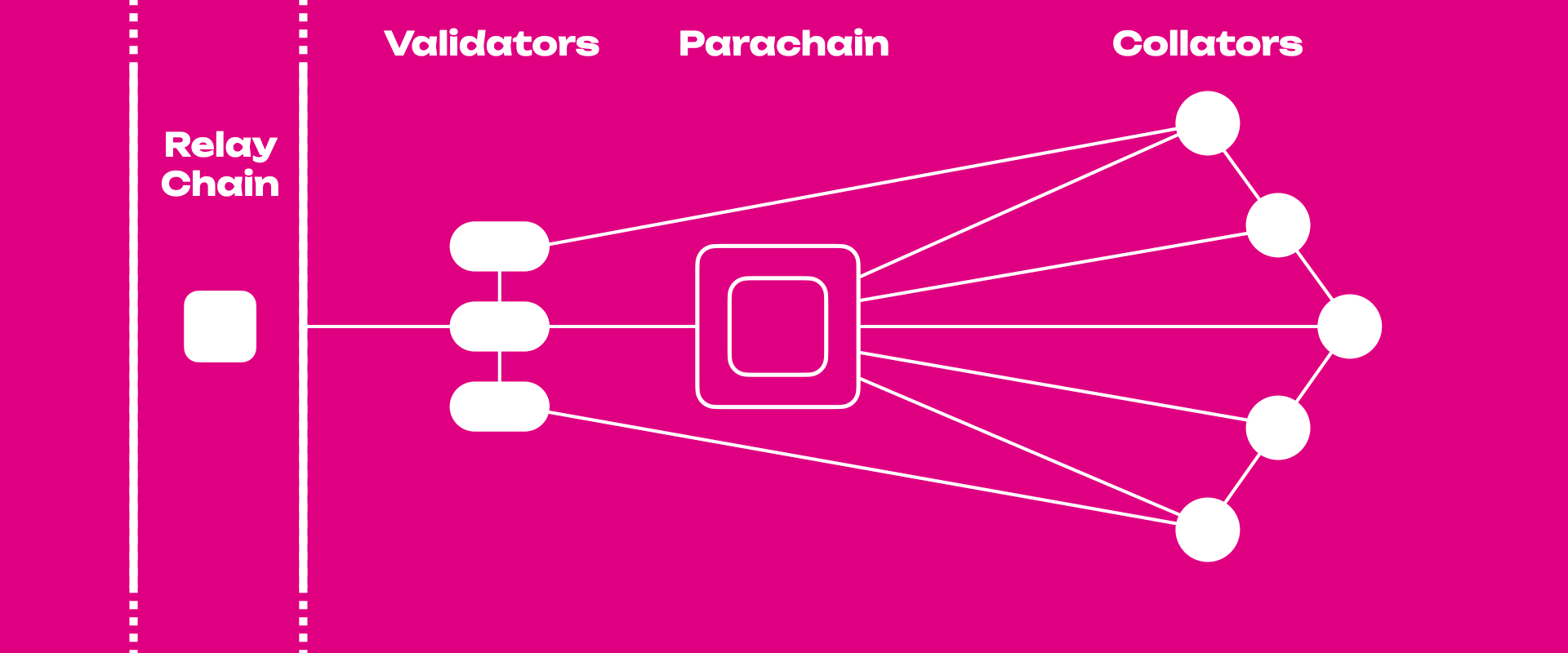

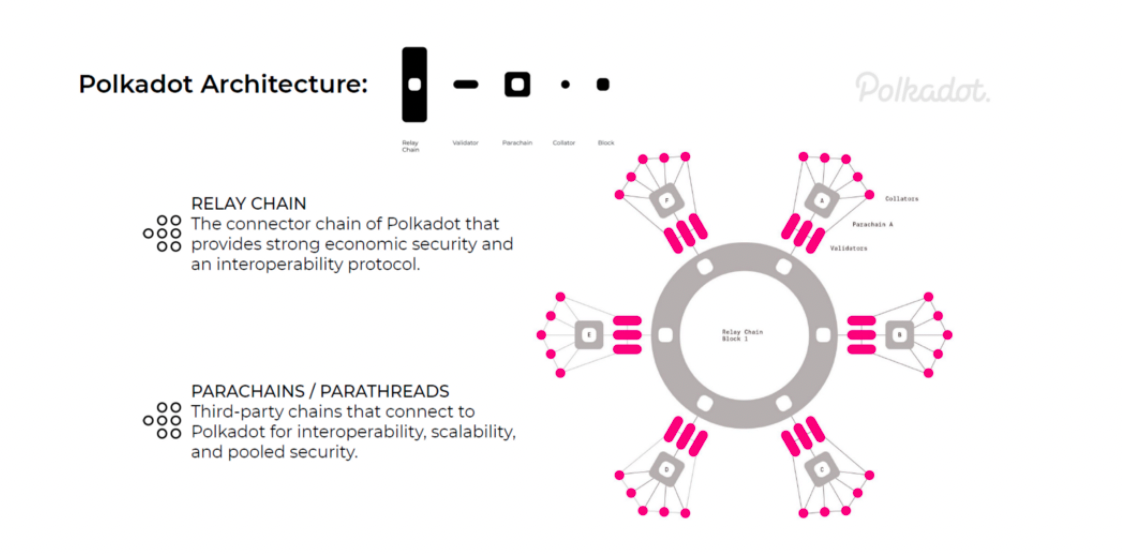

The architecture of the Polkadot network is unique and differs significantly from traditional blockchain networks. It utilizes a sharded multi-chain model consisting of various interconnected chains known as parachains. Each parachain can operate independently, yet all are interconnected within the Polkadot ecosystem.

The network comprises several components: the Relay Chain, Parachains, Parathreads, and Bridges. The Relay Chain is the heart of Polkadot, responsible for network security, consensus, and cross-chain interoperability. Parachains are individual blockchains that run parallel to the Relay Chain, each with its unique design and use case. Parathreads provide flexible, pay-as-you-go connectivity to the Relay Chain, while Bridges allow Polkadot to interact with external blockchains like Ethereum and Bitcoin.

The Key Ingredient: Nominated Proof-of-Stake (NPoS)

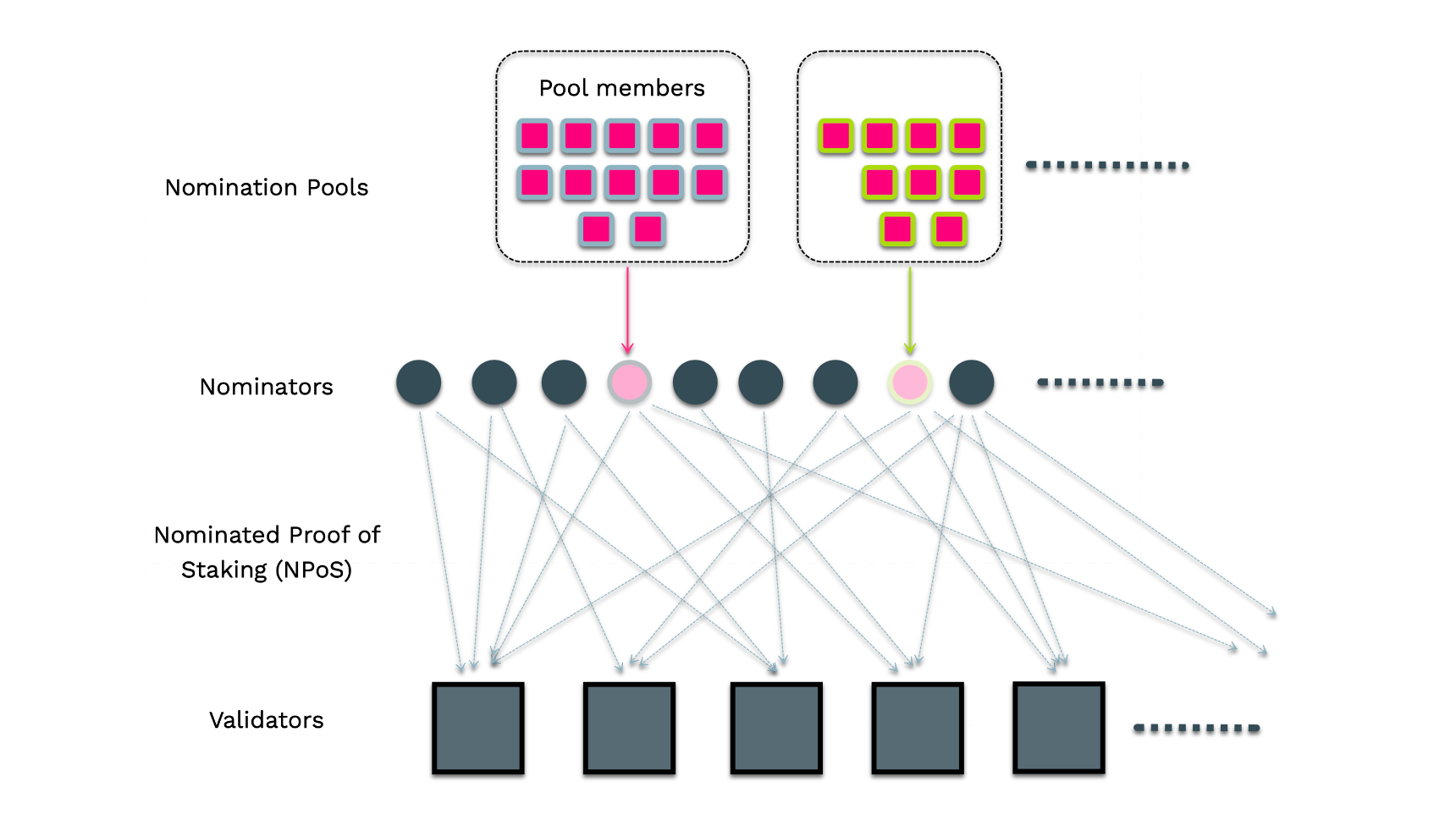

Polkadot's Nominated Proof-of-Stake (NPoS) consensus mechanism is a variation of the standard Proof-of-Stake model. Validators, who are chosen based on the amount of $DOT they hold, are responsible for validating proofs from collators and producing new blocks. Nominators, on the other hand, secure the network by nominating one or more trusted validator candidates with their stake. Malicious validators can be 'slashed,' losing a portion of their stake and that of their nominators, which provides a strong deterrent against misbehavior.

Understanding Polkadot's Core Types

Polkadot's code, written in the Rust programming language, provides key insights into the network's structure and operations. The BlockNumber, Moment, and Signature types are fundamental to Polkadot's code and offer a foundation for understanding the mechanisms and functionality of the Polkadot network.

$DOT

$DOT, the native token of the Polkadot ecosystem, serves several crucial functions: governance, staking, and bonding. $DOT holders can vote on proposed changes to the network, stake their tokens to help secure the network, and "bond" new parachains by locking up a certain amount of $DOT.

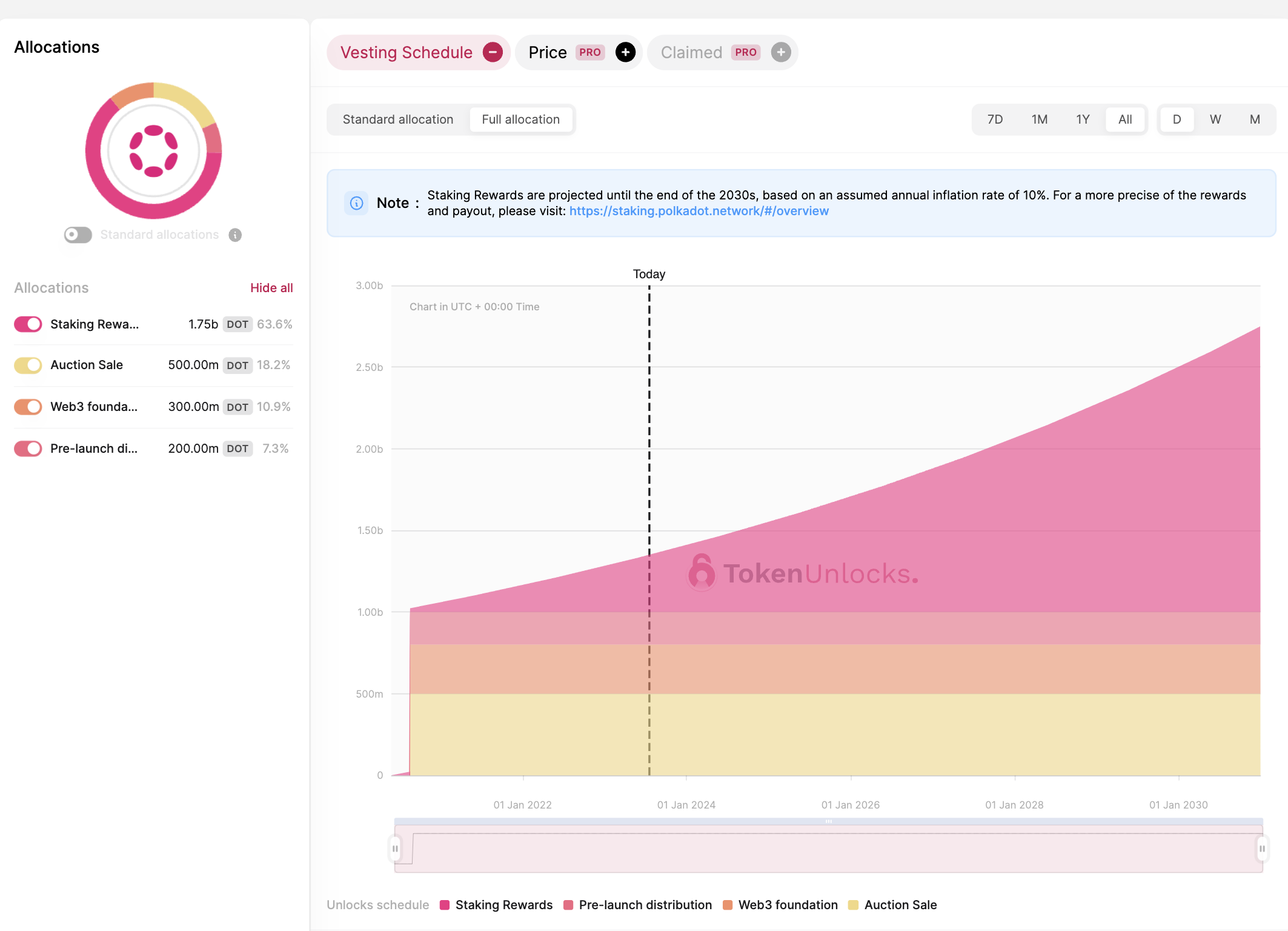

Polkadot was set to have a maximum supply of 1 billion $DOT tokens. However, this supply is not fixed and can be inflated over time, with the inflation rate determined by network governance. Currently, the circulating $DOT are estimated to be around 1.23 billion. The initial allocation of $DOT was distributed during the initial token sale (50%), retained by the Web3 Foundation for future use (30%), and given to the founders and early contributors to the project (20%).

$DOT's inflation rate encourages staking, with the rate increasing to encourage more staking if less than 50% of the $DOT supply is staked and decreasing if more than 50% is staked. The Polkadot network also uses transaction fees, which, unlike Ethereum's gas system, are a flat fee that can be lowered if the network is less busy. This system provides predictability for users in terms of costs.

Finally, parachain auctions, where projects compete to secure a parachain slot by locking up the most $DOT, are a key aspect of Polkadot's economics. This process creates a market-driven mechanism for allocating resources on the Polkadot network.

In summary, Polkadot's economics revolve around incentivizing network participation and security through staking rewards, penalties for bad behavior, parachain auctions, and an adaptive inflation rate. This design aims to create a sustainable and thriving ecosystem. The future of Polkadot, with its highly active community, competent team, and focus on scalability and interoperability, certainly seems promising.

Polkadot’s Positioning

Polkadot's use cases are diverse and far-reaching, thanks to its unique features such as interoperability, scalability, and governance. Some examples include:

- Decentralized Finance (DeFi): Polkadot's high scalability and interoperability make it an ideal platform for DeFi applications, like the Acala Network.

- Interchain Communication: Polkadot's bridge functionality enables seamless interaction with other blockchains, as seen in Chainsafe's BTC-Parachain.

- Web 3.0 Infrastructure: Polkadot can support a new generation of decentralized applications (dApps) across multiple sectors.

- Cross-Chain NFTs: Polkadot's interoperability makes it possible to transfer Non-Fungible Tokens (NFTs) across different blockchain platforms.

- Data Curation and Identity Verification: Projects like Litentry are developing identity verification solutions on Polkadot.

- Gaming and Metaverse: Polkadot's scalable and interoperable infrastructure can facilitate the development of blockchain-powered virtual realities or metaverses.

Regulatory and Compliance Concerns

Like any technology dealing with cryptocurrencies, Polkadot is subject to a variety of regulatory and compliance concerns. These potential concerns span Anti-Money Laundering (AML), Counter-Terrorist Financing (CTF), security laws, consumer protection, data protection, privacy, and taxation.

Compatibility with Deep-techs

While there's no explicit design feature for compatibility with AI applications or quantum computing hardware in Polkadot, this doesn't mean they can't interact or be developed to suit these technologies in the future.

- Artificial Intelligence (AI): Polkadot's interoperability could be leveraged for AI applications built on blockchain technology.

- Quantum Computing: The impact on Polkadot would depend on the specific cryptography it employs and how susceptible it is to quantum attacks.

Conclusion (in relation to $ATOM vs $DOT)

Both Polkadot and Cosmos (ATOM) share a common goal of enhancing interoperability among various blockchains. Both are relatively young networks, offer strong scalability solutions, and present a solid foundation for the development of DeFi applications and Web 3.0.

However, they approach these goals with different architectural designs and governance structures. Polkadot's relay chain-parachain structure and shared security model offer a high degree of interoperability at the potential cost of some complexity. On the other hand, Cosmos operates on a hub and spoke model, which gives individual blockchains more independence but might limit the depth of interoperability.

In terms of governance, Polkadot employs a more on-chain democratic model where $DOT token holders have direct influence over the network's direction. Cosmos, in contrast, relies more on off-chain governance, although recent upgrades have begun to implement on-chain governance features.

While both projects face competition from other interoperability projects, Polkadot's more comprehensive interoperability might position it better to become a backbone for the DeFi sector and the development of a decentralized web. However, Cosmos, with its more modular approach, can also provide a great deal of flexibility for developers.

In conclusion, both Polkadot and Cosmos have their unique strengths and weaknesses, and each could be better suited for different use cases depending on the specific requirements of the developers and users. Both projects continue to innovate and evolve, contributing significantly to the broader blockchain ecosystem.

This is NOT financial advice NOR a sponsored article.

References: