The Complete Tokenomics Playbook: How to Design and Launch

Since the beginning of 2024, the overall crypto market cap has more than doubled. Yet, newly launched tokens during this period have lost more than half their value, despite favorable market conditions. The issue isn’t weak technology—it’s poor token design. We build Builder Mode to solve this problem and help you find key answers for launching token: What drive Price and Volume?

From inflated FDVs , misaligned allocations to ineffective listings, the same mistakes keep repeating. Retail investors are left burned, while projects struggle to build momentum.

On the other hand, projects that executed strong launches—such as $HYPE—demonstrate that a well-crafted token design can be a project’s loudest advertisement, amplifying both product adoption and market credibility.

With mainstream crypto adoption on the horizon, the key question becomes: what lessons can investors and builders learn from past mistakes to design more effective token launches?

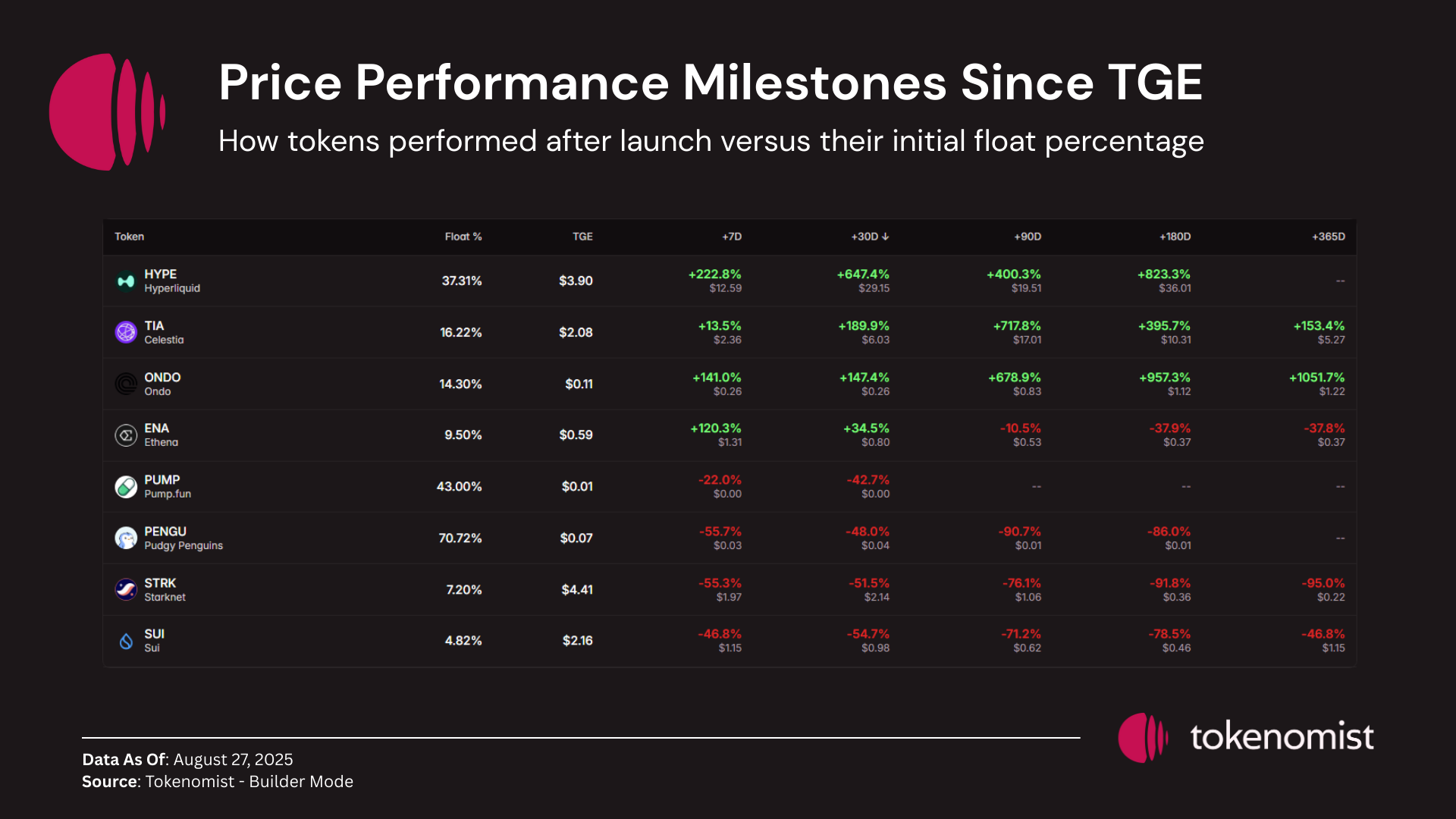

To understand why so many tokens underperform despite favorable market conditions, we examined a representative set of high-profile launches: $HYPE, $ENA, $ONDO, $PENGU, $PUMP, $STRK, $TIA, and $SUI.

These tokens were selected based on three criteria:

- Market context: launched during a bull market (defined as a period when the market rose more than 20% from bottom to top).

- Narrative strength: each token carried a compelling story or positioning.

- Market attention: at launch, they were “talk-of-the-town” projects with significant investor mindshare.

Despite meeting these favorable conditions, many of these tokens stumbled after launch because of structural flaws in token design. By analyzing their performance, we uncover the recurring mistakes that builders should avoid and investors should watch for.

Section 1: Common Token Design Mistakes

Highly Inflated FDV

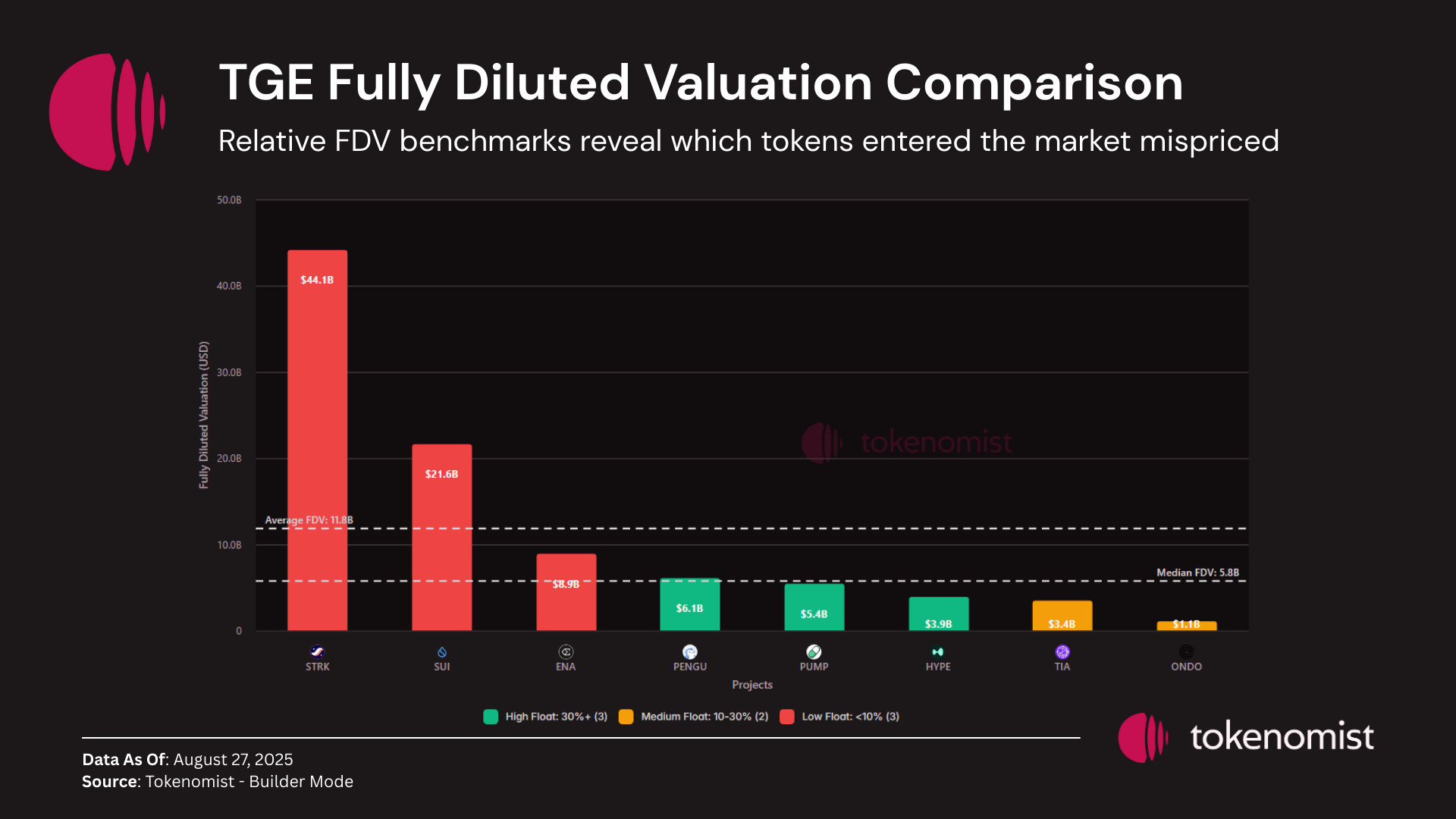

Since mid-2024, the narrative of “low float, high FDV” has become the defining feature of new token launches. In practice, this means projects launch with only a small portion of tokens circulating while attaching a massive FDV, leaving little upside for public investors. [Cobie, 2024]

This structure overwhelmingly benefits private investors who captured most of the value in earlier rounds, while retail enters at already inflated levels. Our analysis of selected tokens confirms this dynamic:

- Winners: Only HYPE, TIA, ONDO, and ENA managed to deliver positive performance 30 days post-TGE.

- Underperformers: Tokens such as SUI, STRK, and PENGU saw sharp declines, despite strong narratives and market attention.

The key differentiator? Launch valuation.

- 3 out of 4 top-performing tokens debuted with FDVs between $1–5B, leaving room for appreciation.

- In contrast, SUI and STRK launched with FDVs above $20B, and both ranked among the worst performers.

One root cause lies in fundraising pressure: projects are often forced to raise at higher valuations in each round to satisfy previous investors. By the time of TGE, valuations become so inflated that public investors are left with little opportunity since most of the value has already been extracted.

Takeaway for builders: By benchmarking TGE valuations against successful past launches, teams can not only avoid the overvaluation trap, but also plan a realistic launch valuation that leaves room for growth post-listing. This ensures healthier market performance and stronger alignment between early investors, retail participants, and the project’s long-term success.

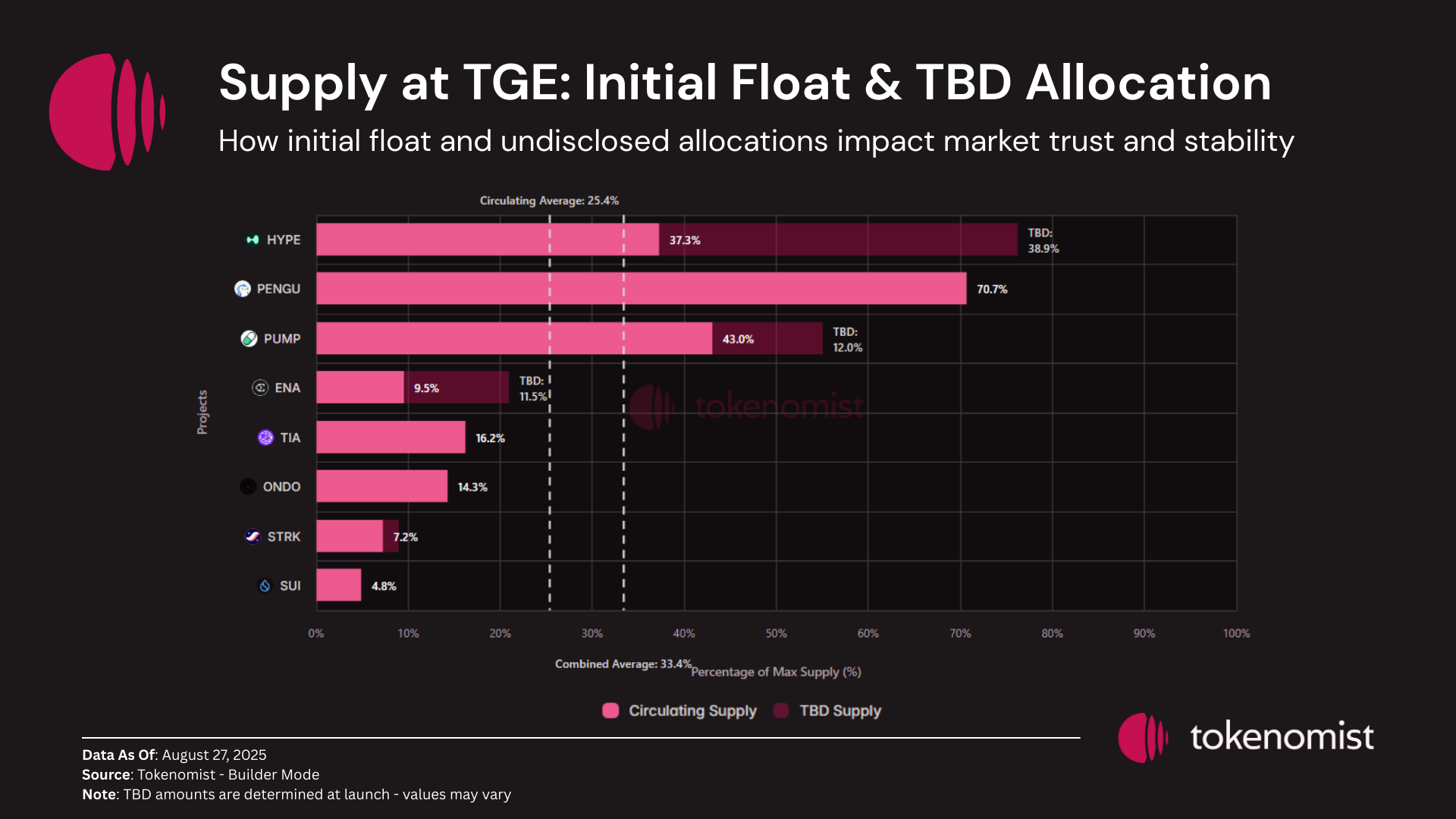

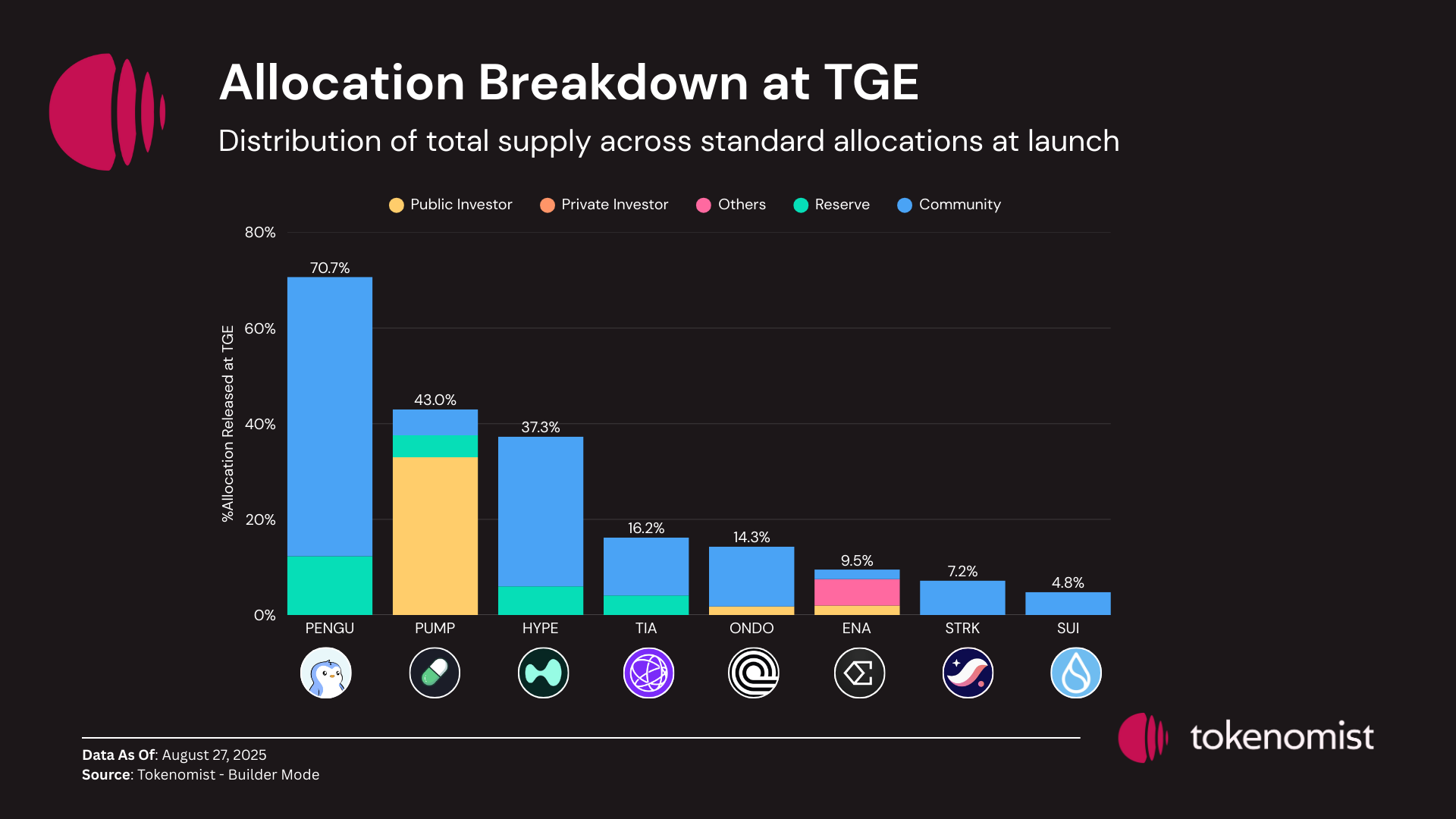

Does Initial Float Matter?

Initial float is a key factor that often drives overly high FDVs at launch. There’s a common misconception that a lower initial float makes it easier for market makers to corner the price. However, its effect is more nuanced. Low float doesn’t automatically lead to artificial pumps, and high float doesn’t prevent strong price performance when other design factors are aligned.

Our analysis illustrates this nuance. Tokens like HYPE and PENGU launched with relatively high initial supply. While $HYPE performed exceptionally well, $PENGU showed slightly negative performance post launched.

This observation highlights that initial float interacts closely with token allocation and distribution, which often becomes the next decisive factor in determining token design success.

Token Allocation and Distribution

Setting aside demand-side factors, key supply-side components that influence post-launch token performance include:

- How many tokens are available for sale or dump

- Who holds the tokens and when they can sell

Analyzing initial float alongside token allocation helps both investors and project builders understand potential price dynamics and plan launches more effectively.

Key takeaways from allocation and float analysis:

- SUI and STRK – The worst performers among the selected tokens. Both launched with small initial supply, entirely allocated to the community. Combined with unmet expectations from airdrop events, this caused massive sell pressure and limited traction post-launch.

- PUMP – Launched with a relatively high float, but a large portion was allocated to public investors in ICO rounds. Early investors realizing profits may have contributed to negative price action.

- HYPE – One of the most successful launches. It featured a moderate initial float allocated primarily to the community and reserve. Coupled with a strong product and a community that held airdrops, the token saw massive post-launch price appreciation, attracting new users and enhancing project traction.

Section 2: Best-in-class Launches

Among the selected tokens, the 30-day post-launch winners are $HYPE, $TIA, $ONDO, and $ENA.

Allocation Breakdown of the Winners

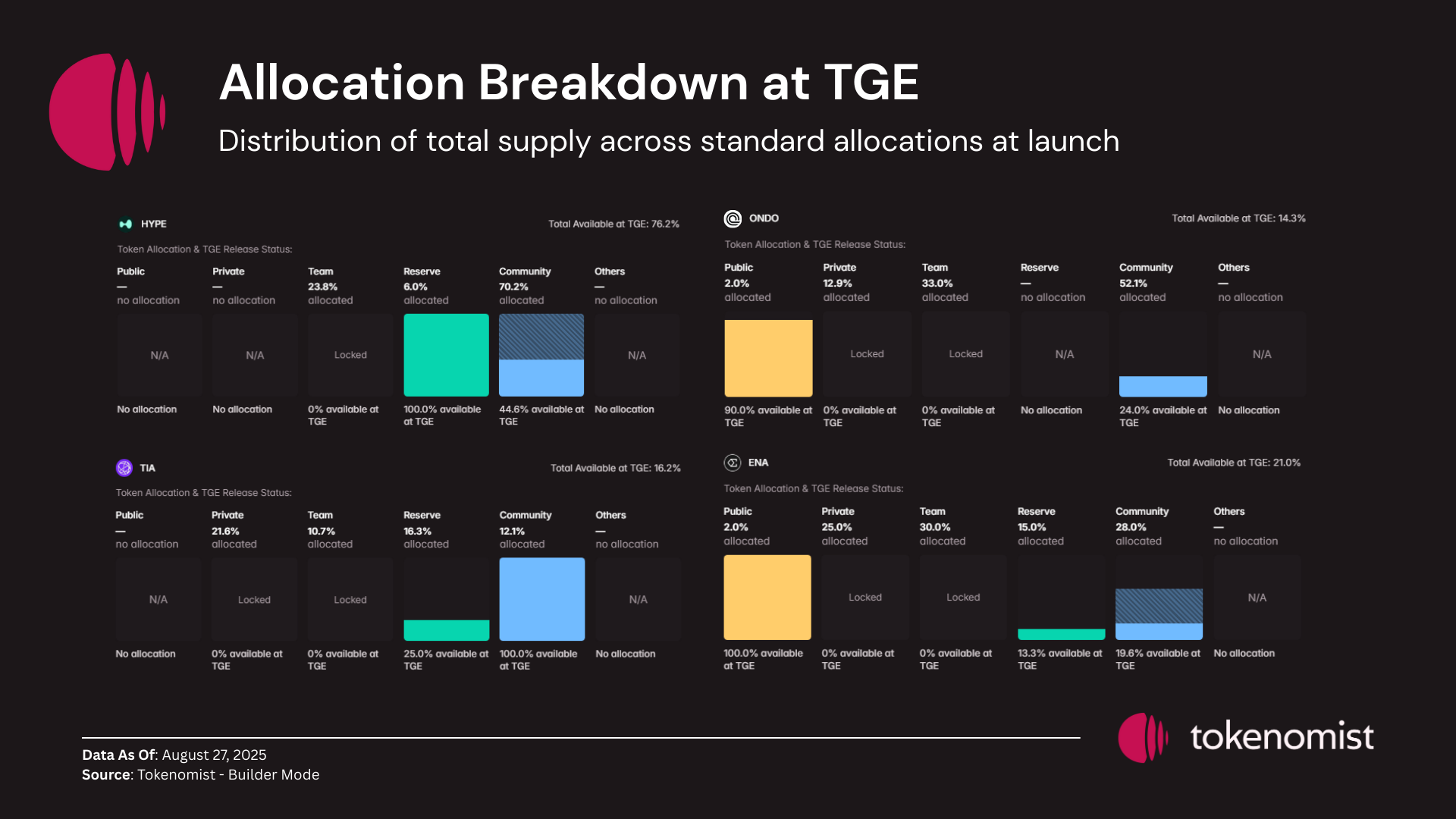

Looking at the TGE allocation of these successful launches, we see a few consistent themes:

- All winners reserved a meaningful portion for the community and ecosystem from day one.

- Public investors were only given modest allocations (e.g. just 2% for both ONDO and ENA), but most of these were unlocked immediately at TGE.

This shows a balance: tokens seeded their community early, while still keeping investor supply tightly managed.

Initial Float & Release Schedule

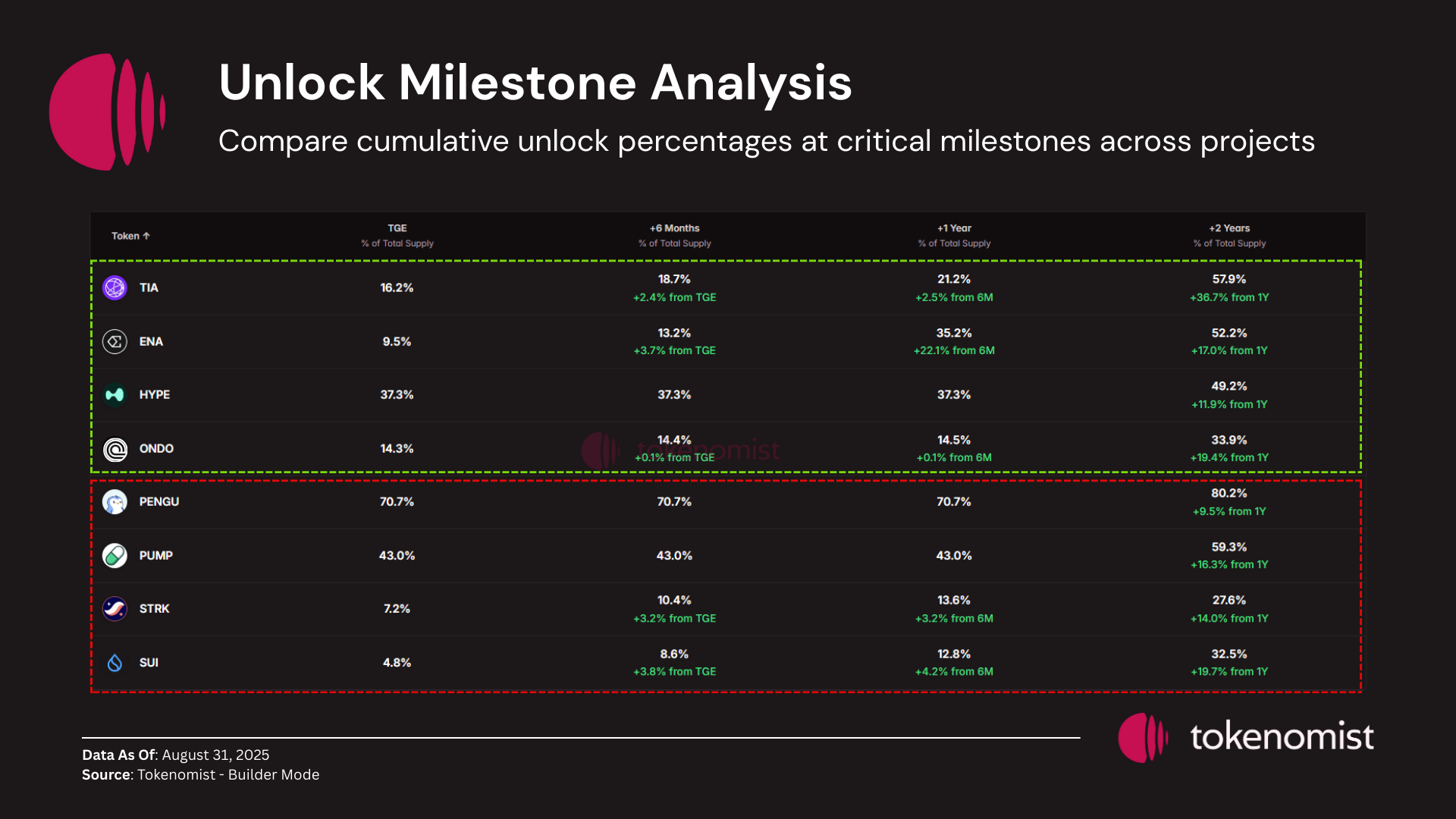

From earlier, we know float size alone can’t fully explain price action. To understand outcomes, we also need to consider how unlocks are scheduled relative to circulating supply growth.

Key takeaways from the winners:

- HYPE: The cycle’s strongest performer. No unlocks scheduled until after 1+ year, and even then, the releases are modest relative to circulating supply. This created strong scarcity dynamics.

- ONDO: Similar pattern—minimal unlocks in the first year meant limited sell pressure, helping stabilize price momentum.

- ENA and TIA: Both started with smaller floats. This made early unlocks feel larger in relative terms, creating volatility and short-term price swings. Still, strong narratives and solid community allocations allowed them to recover and sustain momentum.

Key takeaways from underperformers:

- PENGU & PUMP: Both had high initial float and no unlocks for the first year. Yet performance diverged from expectations. Why? Allocation mattered.

- PENGU’s community-heavy allocation led to sell pressure as users took quick gains.

- PUMP’s early investor allocation meant investors rapidly realized profits from cheap entry points.

- STRK & SUI: Both launched with extremely low float. The problem came later: early unlocks were massive relative to circulating supply. STRK in particular faced heavy sell pressure as team and private investor tokens unlocked within 6 months, eroding price stability.

Section 3: Exchange Listing Strategy Deep Dive

Exchange listings are often seen as a decisive factor in token launches because liquidity is one of the first things investors care about. A token with multiple liquid markets is easier to buy, sell, and trade — which usually attracts more participants.

But this liquidity comes at a cost. Projects typically face two types of trade-offs:

- Direct listing costs paid to exchanges.

- Token allocation to launchpads/launchpools, which dilutes supply.

This raises a key question: is it really worth paying listing costs upfront?

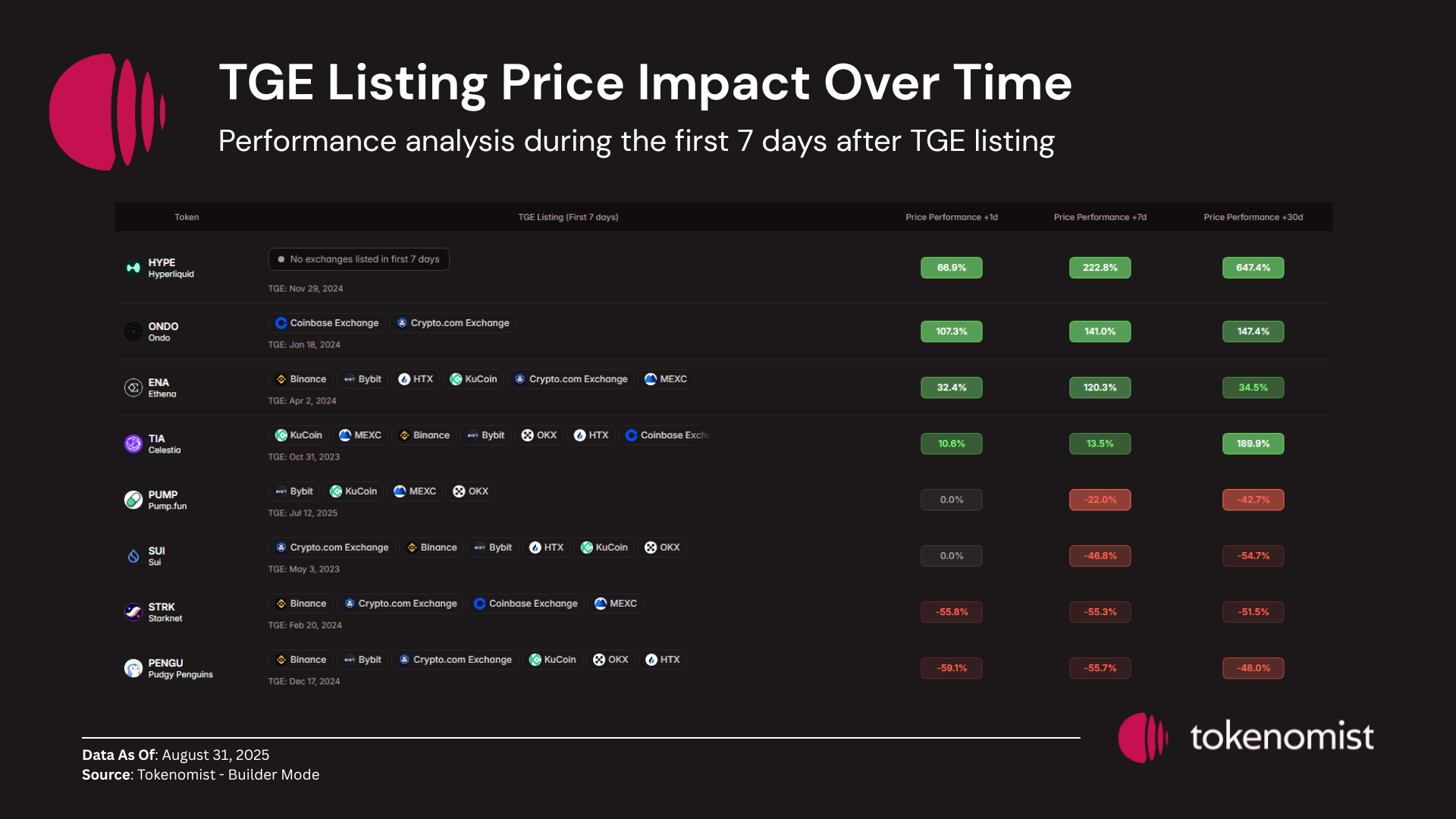

Listing Decision at TGE

The launch of HYPE became a case study in breaking conventions. It listed on no major exchange at TGE — and yet, the launch was a resounding success.

Why did it work?

- The only place to buy HYPE was on Hyperliquid itself, which created a forced onboarding loop.

- Coupled with a strong product, this funneled liquidity directly into the platform, boosting both user traction and stickiness.

This strategy flipped the usual playbook: instead of paying exchanges for access, the project turned scarcity into a feature, using its own ecosystem as the exclusive trading venue.

Of course, $HYPE is the exception, not the norm. Most tokens that delivered strong performance opted for broad exchange distribution from day one.

- TIA is the standout example: it listed on 7 exchanges at launch, the most among the sample group.

- This wide access translated into strong initial liquidity and visibility, driving a +270% performance within 30 days post-listing.

The takeaway: broad exchange listing can work extremely well if aligned with reasonable FDV and strong demand.

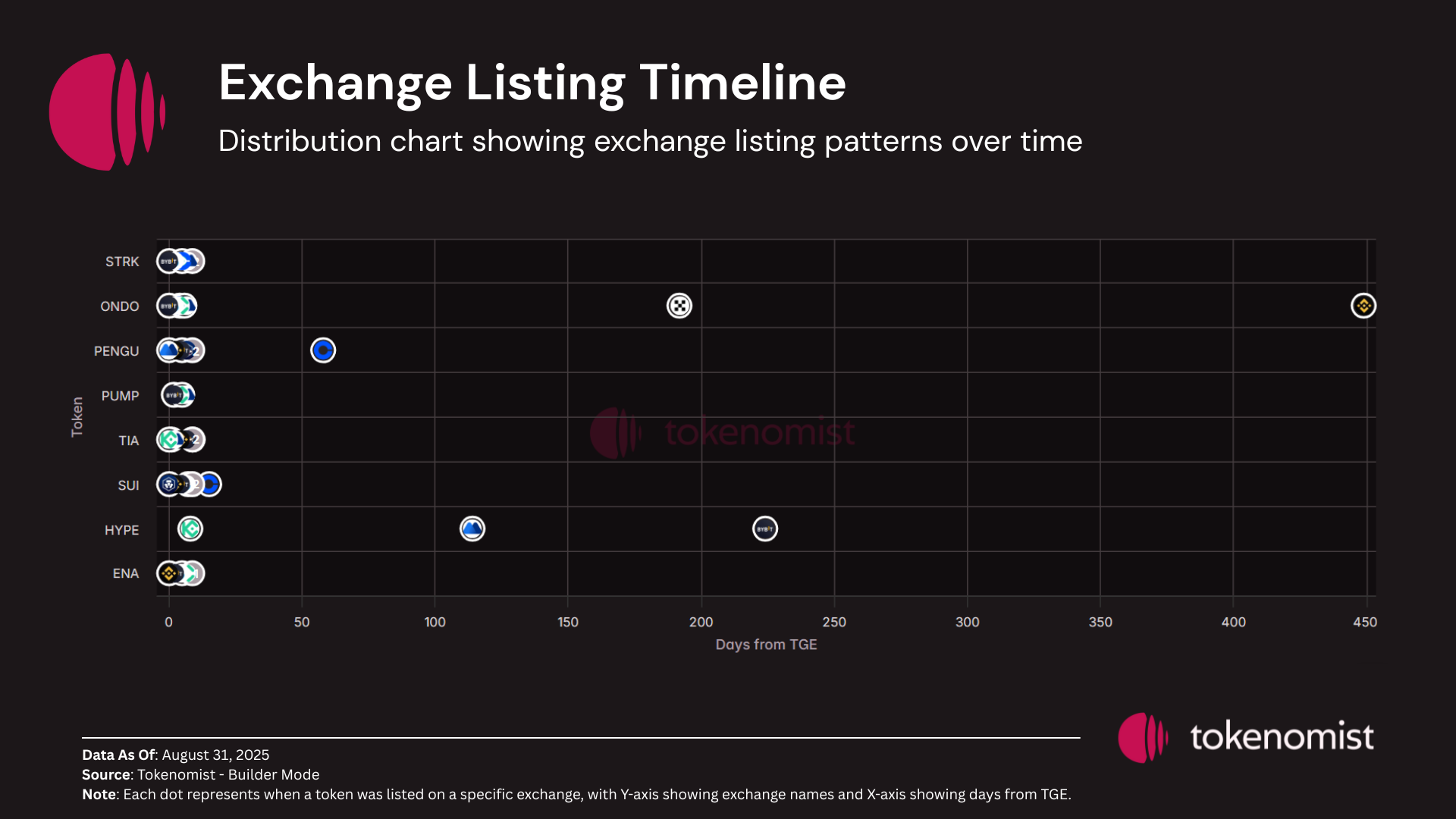

Listings Over Time (Post-TGE)

When zooming out, another pattern emerges: successful tokens eventually get listed widely, even if not at TGE.

- Tokens like HYPE and ONDO were later picked up by multiple exchanges organically.

- Why? Because exchanges chase volume — if a token is in high demand, exchanges want a share of the trading fees.

This creates a win-win dynamic: projects save on upfront listing costs, while exchanges still onboard the token later due to market pull.

On the other side of the spectrum, we see tokens like STRK, PENGU, PUMP, and SUI. Despite launching with multiple exchange listings, their 30-day performance was weak.

The culprit wasn’t a lack of liquidity — it was overstretched initial FDV. Even the best listing strategy couldn’t compensate for valuations that priced in too much optimism too early.

Key Takeaways

- Exchange listings are important, but not a silver bullet.

- Strong projects with organic demand (e.g., $HYPE, $ONDO) can afford to delay listings and let exchanges come to them.

- Broad TGE listings (e.g., $TIA) can supercharge early momentum if FDV is reasonable.

- Overpriced launches (e.g., $STRK, $SUI) show that valuation discipline matters more than listing count.

Overall, the data shows that while the average 30-day post-listing performance across the 8 tokens was still solid at +25%, the quality of token design and valuation mattered far more than how many exchanges were involved.

Conclusion

Winning token launches don’t happen by chance. They’re built on three pillars:

- Right FDV → leaves room for upside.

- Smart float design → balances liquidity with scarcity.

- Listing strategy → fits the project’s growth goals, not just “more exchanges.”

The lesson: launch is strategy, not luck.

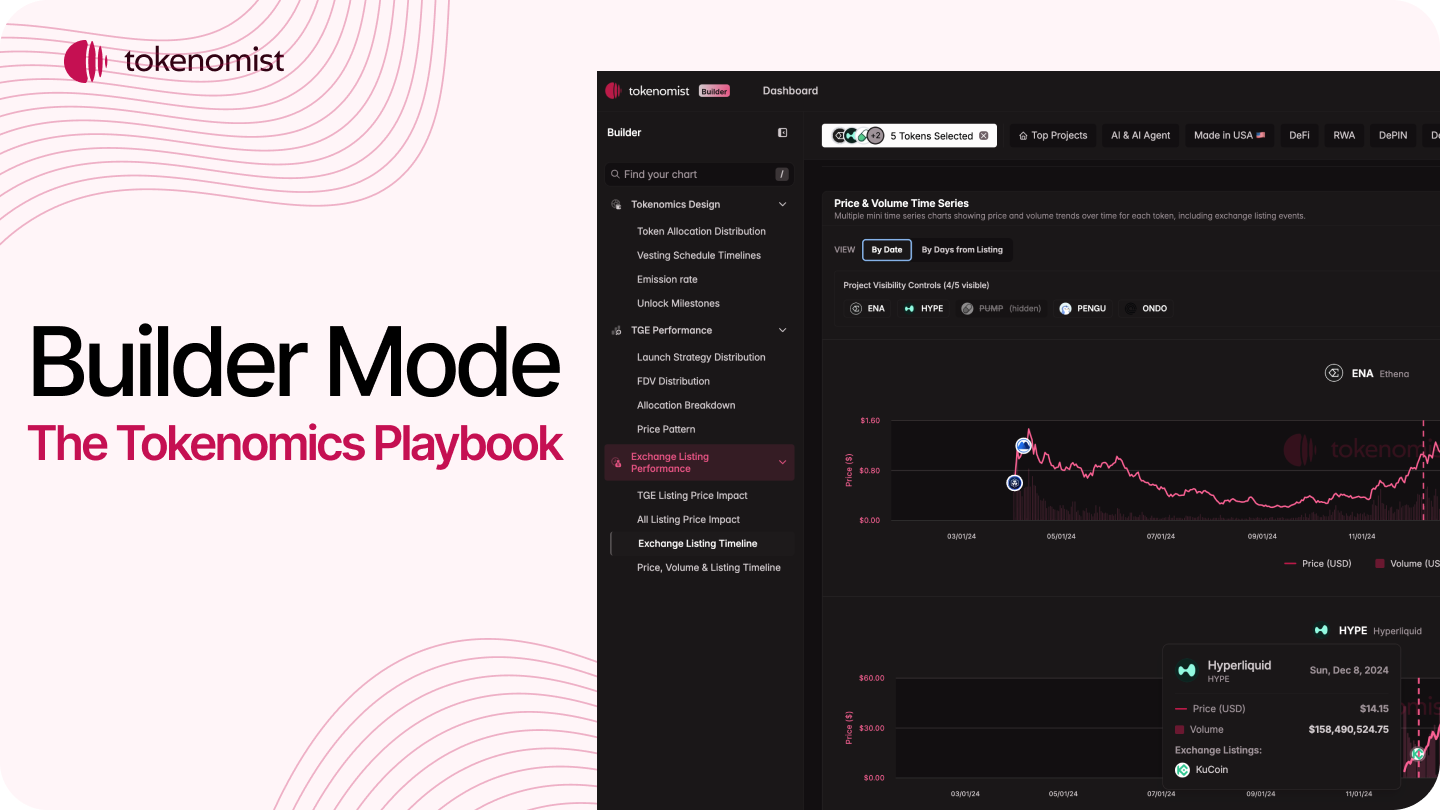

That’s why we built Builder Mode—a toolkit for token design so projects can launch like $HYPE, $TIA, or $ONDO instead of becoming another failed new-cycler.

🚀 Build smarter. Launch stronger.

We're giving discount for few seats as a beta users. Please feel free to talk to us via consulting@tokenomist.ai