The HYPE Supply Cut Proposal: Analyzing a Controversial Tokenomics Restructuring Plan

TL;DR

🗒️ The Proposal: DBA Asset Management suggests Hyperliquid cut HYPE's total supply by over 45% through three strategic moves: revoking 421M future emission tokens, burning 21M treasury tokens, and removing the supply cap.

⚠️ The Problem: Current crypto valuation metrics are broken. Market cap ignores known dilution risks, while FDV includes tokens that may never circulate. This creates a "valuation trap" where HYPE's $59B FDV makes it look overvalued despite strong fundamentals.

💡 The Solution: Make tokenomics behave more like traditional finance. Instead of confusing "TBD" allocations that inflate FDV, mint tokens only when needed. Remove supply caps so burning mechanisms actually improve valuation metrics.

🏦 Bottom Line: Whether adopted or not, this proposal forces the industry to confront fundamental questions about how we value crypto assets. The protocols that solve these measurement problems first will likely capture institutional capital more effectively.

Introduction

A viral proposal by Jon Charbonneau (co‑founder of DBA Asset Management) and Hasu suggests that Hyperliquid should reduce more than 45% of the HYPE token supply. The idea has sparked a heated debate across crypto Twitter: would such a drastic move actually improve scarcity and align incentives, or could it create new problems?

— Jon Charbonneau 🇺🇸 (@jon_charb) September 22, 2025

The proposal comes at a critical time when the crypto industry is grappling with fundamental questions about token valuation. As institutional adoption accelerates, the lack of standardized metrics becomes increasingly problematic for professional investors trying to apply traditional valuation frameworks to crypto assets.

In this article, we will cover:

- Breaking Down the Proposal Mechanics

- The Core Problem: Why Current Metrics Mislead Investors

- Detailed Analysis of Each Proposed Change

- Market Implications and Precedent Analysis

- What This Means for the Broader DeFi Ecosystem

Breaking Down the Proposal Mechanics

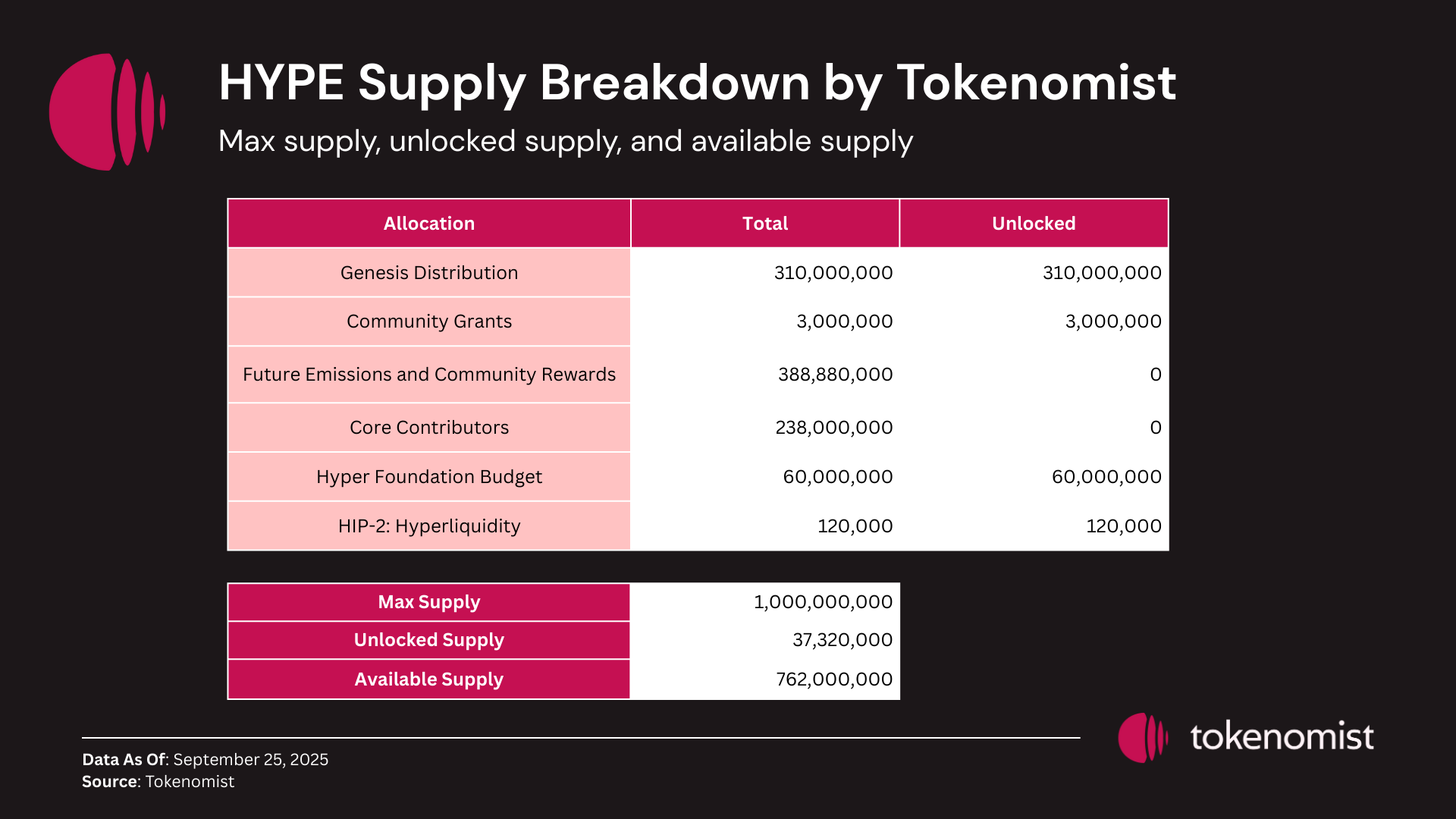

Based on the proposal, there are 3 key changes presented:

1. Future Emissions & Community Rewards (FECR)

- Action: Revoke authorization for all unminted HYPE currently allocated to FECR.

- Impact: Eliminates 421 million tokens from future circulation

- Rationale: TBD allocations with unknown release schedules artificially inflate FDV calculations

2. Assistance Fund (AF)

- Action: Burn all HYPE currently held in the AF (31 million tokens) and those acquired by the AF on an ongoing basis.

- Impact: Immediate supply reduction plus ongoing deflationary pressure

- Rationale: Treasury buybacks currently don't affect supply metrics, burning makes the impact measurable

3. Max Supply Cap Removal

- Action: Remove the max supply cap of 1bn HYPE. Ongoing token issuance (e.g., for staking emissions or community rewards) would now increase the total supply.

- Impact: Makes future burning mechanisms actually effective at reducing FDV

- Rationale: With a hard cap, burns don't improve valuation metrics → removing the cap allows organic supply adjustment

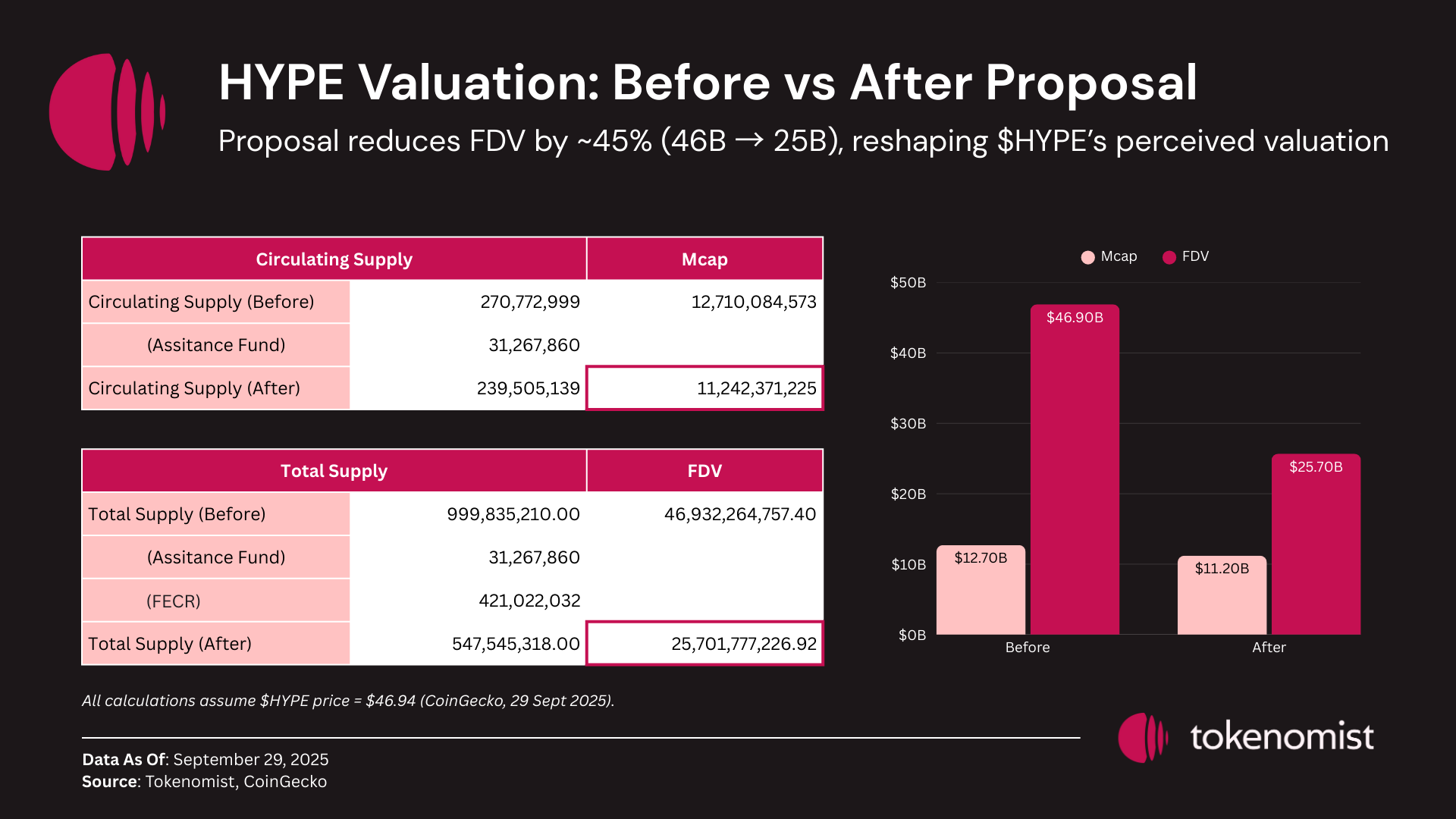

The result is an immediate >45% reduction in HYPE's total supply, from 1 billion to approximately 550 million tokens.

The Core Problem: Why Current Metrics Mislead Investors

The proposal addresses a fundamental issue that has plagued the crypto industry throughout 2025: current valuation metrics are systematically misleading investors and distorting capital allocation decisions.

The Traditional Finance Benchmark

In traditional equity markets, investors rely on "outstanding shares"—a clear, standardized metric representing actual investable supply. This creates consistent valuation frameworks across all publicly traded companies.

Crypto lacks this standardization, leading to two problematic extremes:

Market Cap Issues:

- Too conservative, excluding team and investor tokens with known unlock schedules

- Creates artificial scarcity perception

- Misleads retail investors about true dilution risks

FDV Issues:

- Too aggressive, including tokens that may never enter circulation

- Penalizes protocols with conservative treasury management

- Makes genuinely scarce assets appear overvalued

Professional investors looking at the $59B FDV might dismiss HYPE as overvalued compared to competitors, despite the protocol's strong fundamentals. Meanwhile, retail investors focusing on market cap might not understand their dilution exposure.

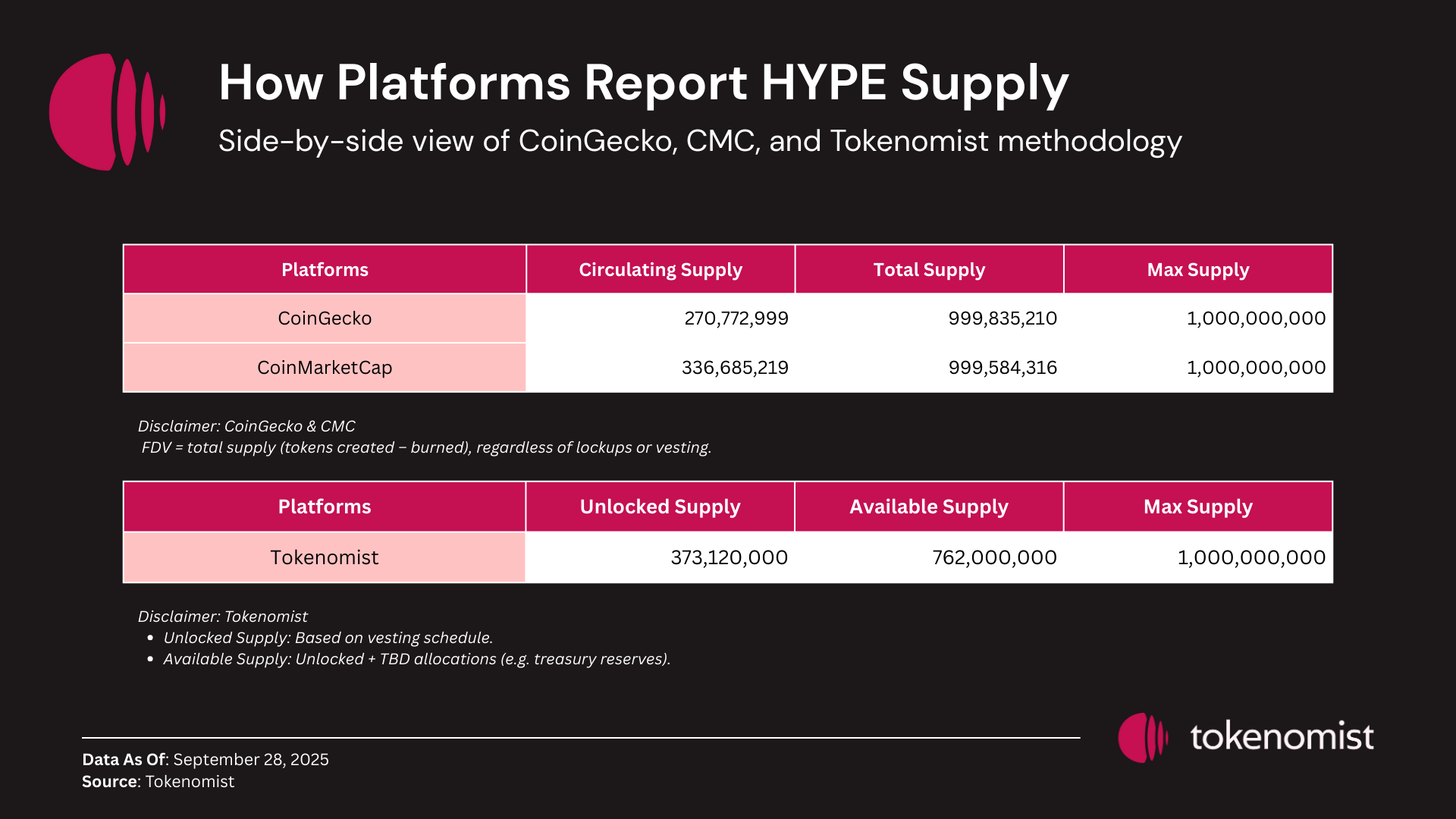

Platform Inconsistencies Create More Confusion

Why These Differences Matter:

Each platform's methodology leads to different investment conclusions. A high variance in valuation metrics would be unthinkable in traditional finance—yet it's common in crypto.

See full allocations and released schedule : https://tokenomist.ai/hyperliquid

Detailed Analysis of Each Proposed Change

Change 1: Revoking Future Emissions (FECR)

Proposal: Instead of maintaining a massive "TBD" allocation that inflates FDV, the proposal suggests minting tokens only when actually needed for specific programs.

Tokenomist Insight: This approach aligns with our "Unlocked Supply" metric, which only counts tokens with confirmed distribution plans.

Change 2: Treasury Burning Mechanism

The Problem with Current Buybacks: When protocols buy back tokens and hold them in treasury, it creates a valuation paradox:

- The protocol spends money to acquire tokens

- Supply metrics don't change → No measurable impact on scarcity or valuation

Solution: Immediate burns create measurable supply reduction and demonstrate commitment to tokenomics optimization.

Risk Assessment:

- Upside: Clear deflationary signal, improved metrics alignment

- Downside: Reduced treasury flexibility, potential community backlash from "wasted" tokens

- Mitigation: Gradual implementation with community approval thresholds

Change 3: Removing the Supply Cap

This is perhaps the most controversial aspect, increasing maximum supply to improve tokenomics seems backwards to many crypto investors.

With a hard cap of 1 billion tokens:

- Burning 100 million tokens still shows 1 billion max supply in FDV calculations

- All burns are essentially meaningless for valuation purposes

- Deflationary mechanisms can't improve investment metrics

Without a hard cap:

- Burning directly reduces the supply used in FDV calculations

- Deflationary pressure becomes measurable and investable

- Market can price in actual scarcity rather than theoretical maximums

Bitcoin's 21 million cap works because there's no burning mechanism and a clear, predictable issuance schedule. Protocols with active burning might need different approaches.

Market Implications and Broader Industry Impact

Immediate Effects on HYPE

If Implemented Successfully:

- FDV drops from ~$59B to ~$32B (45% reduction)

- Improved institutional attractiveness due to clearer metrics

- Potential premium pricing due to demonstrated tokenomics sophistication

Implementation Risks:

- Community backlash from complex changes

- Potential sell pressure if market interprets changes as desperation

Conclusion

The HYPE proposal, regardless of its ultimate adoption, represents a crucial inflection point for the crypto industry. It forces uncomfortable but necessary conversations about the adequacy of current valuation methodologies.

For Investors: This proposal demonstrates the importance of understanding tokenomics beyond surface-level metrics. The protocols that solve these measurement problems first will likely capture institutional capital more effectively.

For Protocols: The success or failure of this proposal will provide valuable data about market appetite for complex but potentially superior tokenomics structures.

For the Industry: We're witnessing the evolution from "DeFi Summer" experimentation to "DeFi Maturation" with institutional-grade standards. The protocols that adapt will thrive; those that don't may find themselves increasingly marginalized.