AAVE and $GHO Stable coin: Impact & Mechanics

Delve into Aave's Ecosystem, from its Core Protocols to the Emergence of the Stablecoin $GHO, and Its Potential Competition with Stablecoin Giants

Key Takeaway: Discover the ins and outs of Aave, one of the leading platforms in decentralized finance (DeFi), exploring its lending and borrowing mechanisms, staking opportunities, credibility, and tokenomics. Additionally, learn about Aave's latest venture, the stablecoin $GHO, which aims to challenge established stablecoins like $USDT and $DAI with its unique features and the support of the Aave community.

Introduction: Venturing into the Realm of Aave

Aave has emerged as a powerful player in the decentralized finance (DeFi) landscape, offering intriguing opportunities for users. In this article, we will dive into the Aave ecosystem, exploring its history, lending/borrowing mechanics, credibility, tokenomics, and the potential impact it has on the ever-evolving world of decentralized finance. Additionally, we will discuss Aave's newly introduced stablecoin, $GHO, and its aim to make a mark in the DeFi ecosystem, potentially challenging the dominance of other stablecoins like $USDT and $DAI.

The Origins of Aave:

From ETHLend to a DeFi Powerhouse: Aave's story began in 2017 when Stani Kulechov established ETHLend, which was later rebranded as Aave in 2018. Today, Aave is a registered legal entity in Switzerland and the UK, with a growing presence in the world of DeFi.

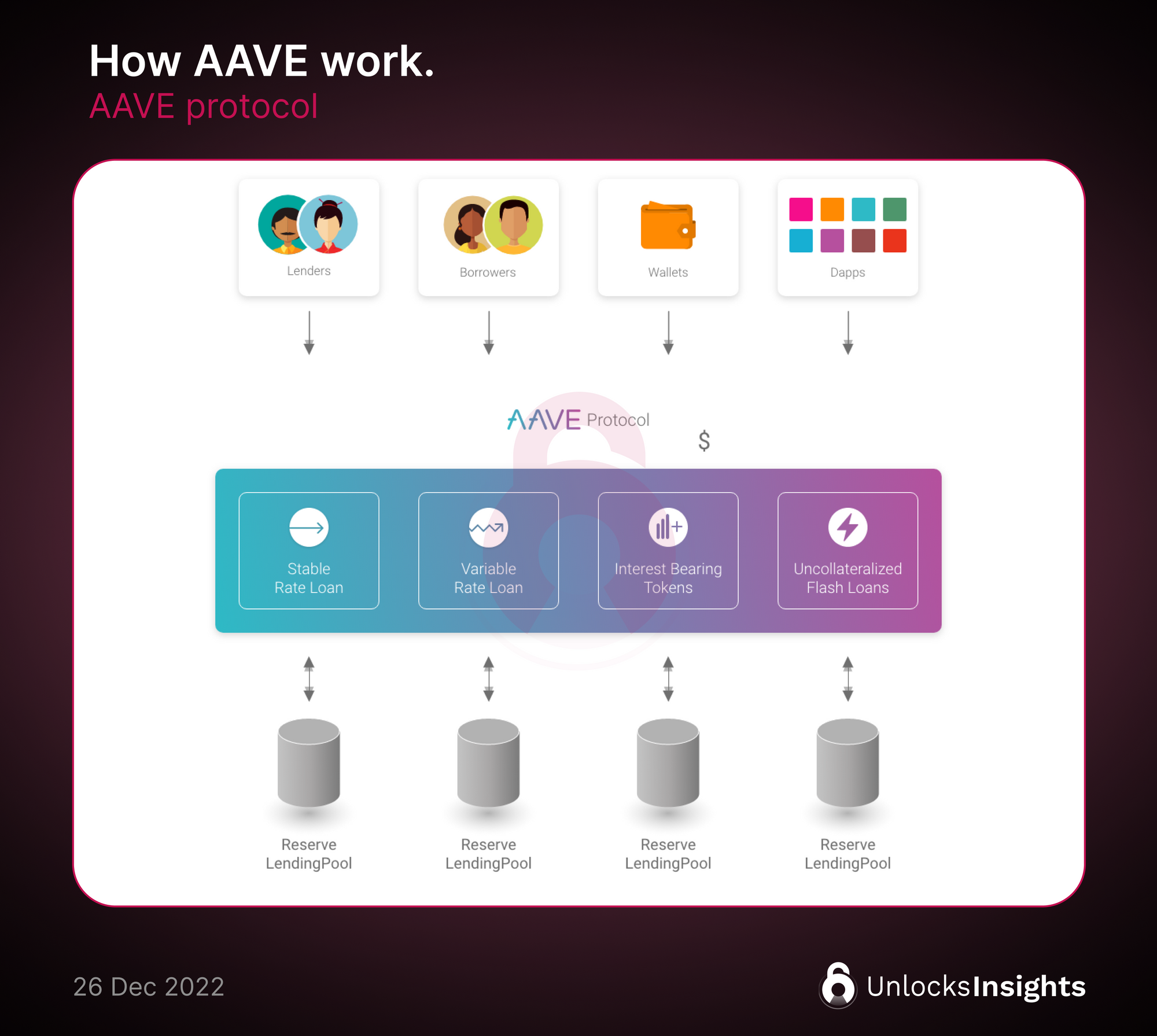

Aave's Core:

The Lending and Borrowing Mechanism: Originally known as ETHLend, Aave's smart contract was based on a traditional financial principle – the lending/borrowing mechanism. Acting as a trustee, the Aave protocol provides liquidity to the market and incentivizes lenders. Users can participate as lenders or borrowers, and the protocol is compatible with various networks, including Ethereum, Polygon, Avalanche, Arbitrum, Fantom, Harmony, and Optimism.

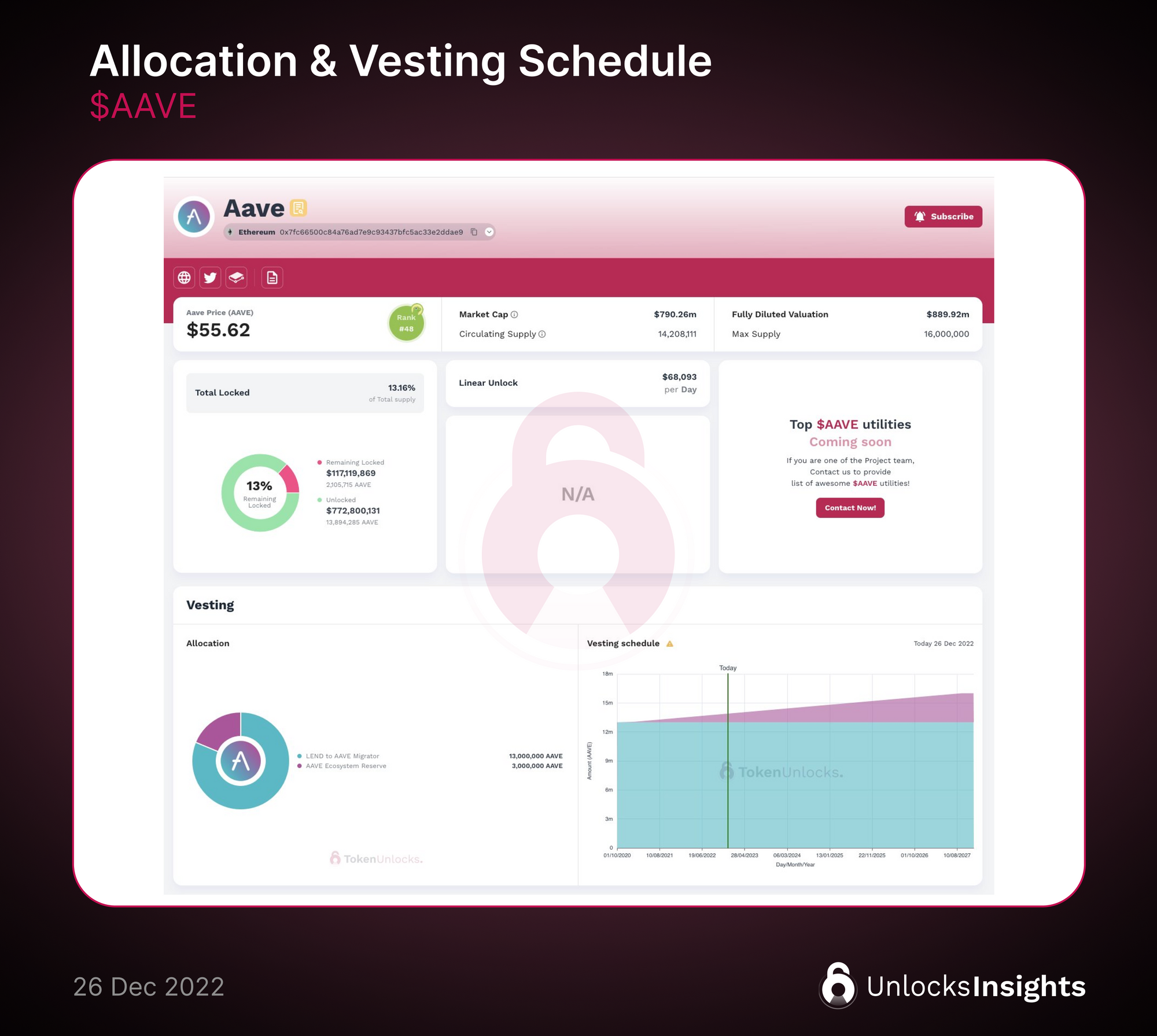

Aavenomics:

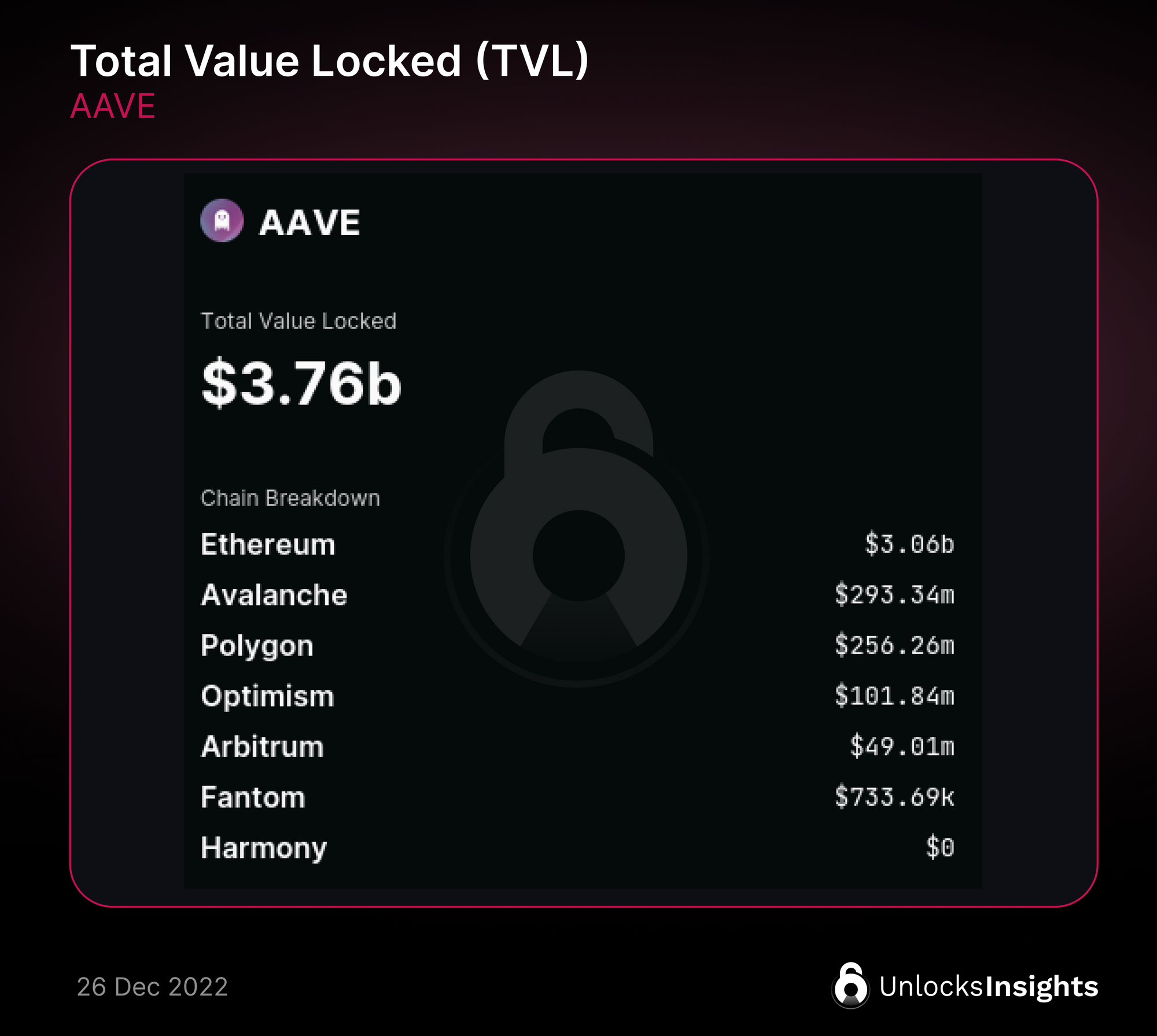

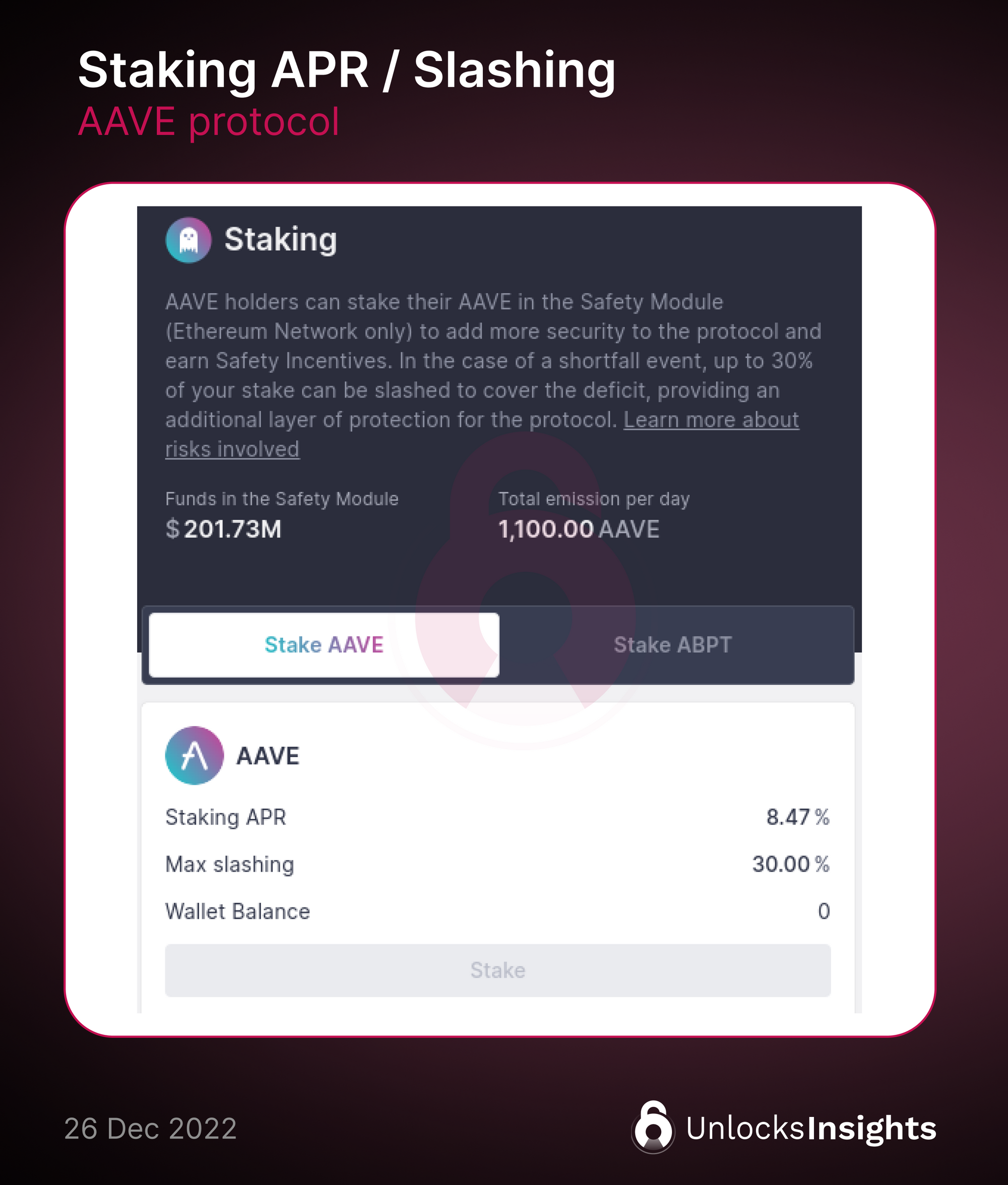

Understanding Tokenomics and Staking: Aave has a maximum supply of 16 million tokens, with all $AAVE set to be unlocked by September 2027. Currently, approximately 87% of the total supply is in circulation. The platform's total value locked (TVL) is estimated to be around $3.75 billion, with roughly 81% of it on the Ethereum network. $AAVE holders can stake their tokens in the Safety Module and receive stkAAVE as proof of staking, with an expected staking APR of 8.47%. It's important to note that staked $AAVE can be slashed in the event of a shortfall, providing additional protection to the protocol.

The Foundation of $GHO:

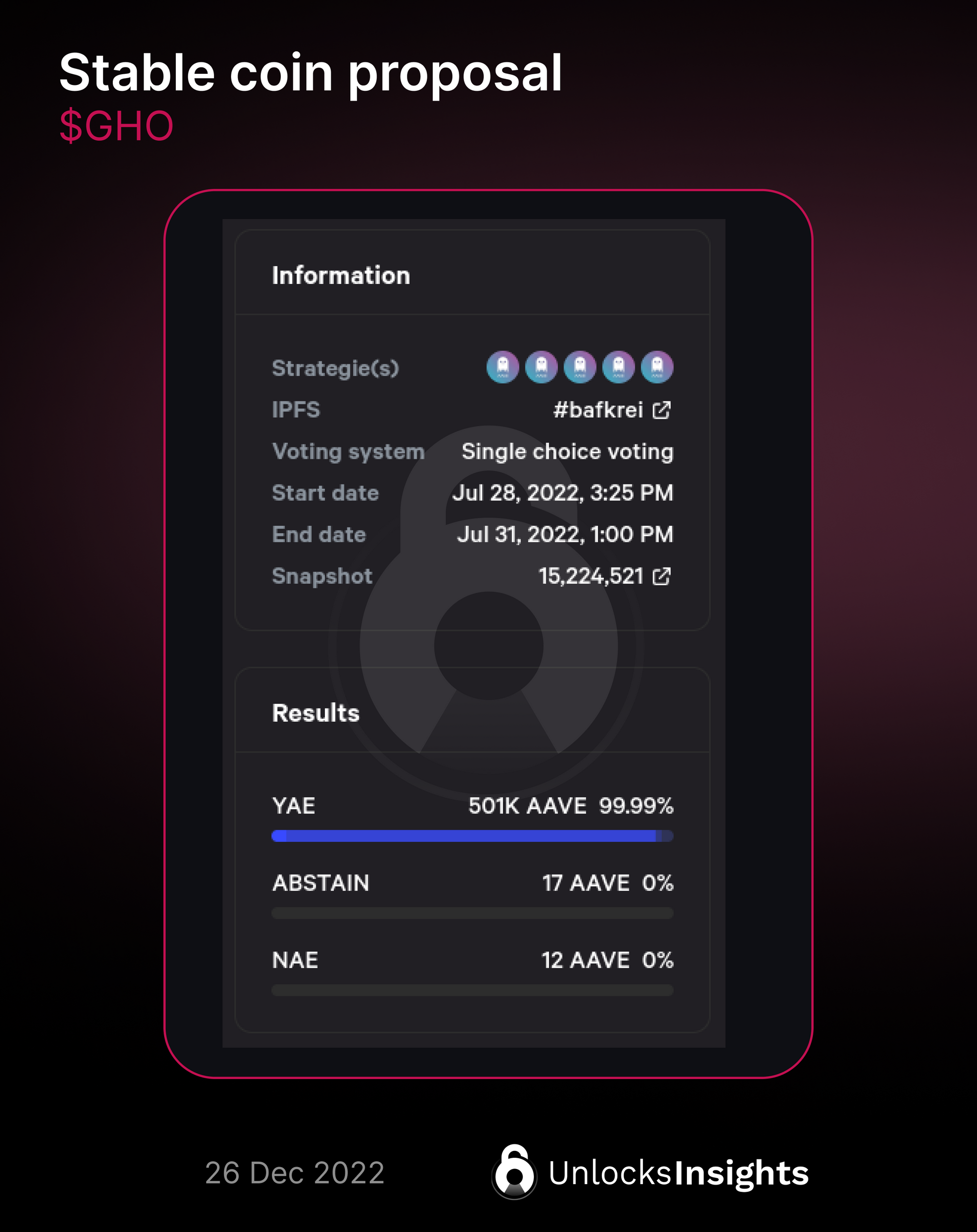

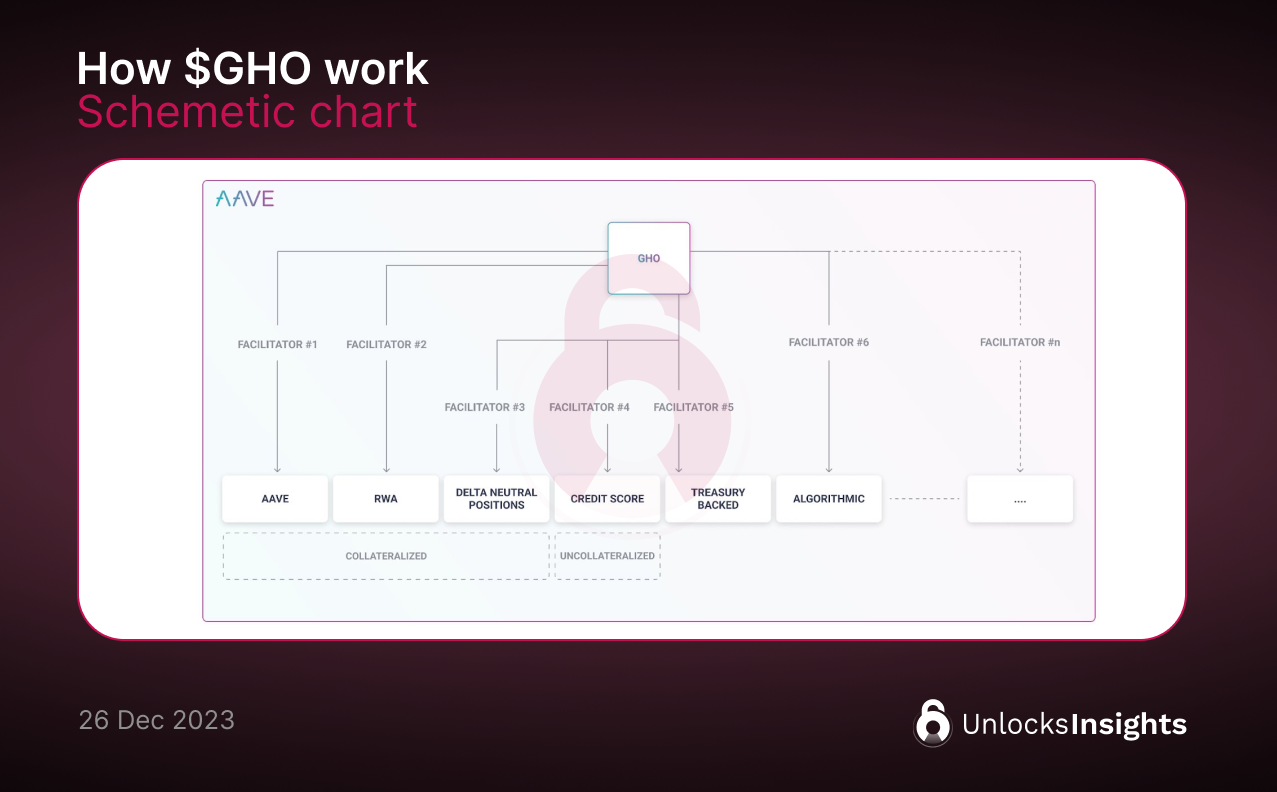

Exploring the Facilitators: $GHO, Aave's newly introduced stablecoin, was proposed by the Aave Companies and received overwhelming support from the community. Facilitators, elected by Aave Governance, play a crucial role in minting and burning $GHO. While the first facilitator is currently being worked on, it's essential to note that the technical paper lacks detailed information about other facilitators, including protective algorithms or responsive intermediaries.

Credibility:

Audits and Security Measures: Aave's protocols have undergone rigorous audits by reputable entities like Open Zeppelin and Trail of Bits. These audits have helped identify and rectify potential vulnerabilities, ensuring the platform's security and credibility.

Benefits for the Aave Community:

The Aave community stands to benefit from the introduction of $GHO. 100% of the interest payments on the stablecoin will be sent to the AaveDAO's treasury, incentivizing community participation and support. Additionally, $AAVE stakers will receive discounted rates when minting $GHO, further rewarding them for their contribution and potentially leading to increased demand for $AAVE.

Competing with Centralized and Decentralized Stablecoins:

$GHO will face competition from both centralized stablecoins (CeSC) like $USDT and decentralized stablecoins (DeSC) such as $DAI. To establish itself in the market, $GHO will need to find a place among the top 10 stablecoins in terms of market capitalization and utility.

Aave's Future: Growth, Expansion, and the Web3 Ecosystem:

The Aave community actively seeks solutions to expand the platform's market dominance. With ongoing development and upgrades, the protocol has the potential to attract more users and contribute significantly to the web3 ecosystem. In line with this vision, The Aave Companies is currently working on a stablecoin similar to $DAI.

Conclusion:

Aave's lending, borrowing, and staking mechanics offer intriguing opportunities for users in the DeFi landscape. With its active community, expanding market presence, and ongoing development, Aave presents itself as an exciting contender in the world of decentralized finance. Furthermore, the introduction of $GHO has the potential to make waves in the DeFi ecosystem, challenging the dominance of other stablecoins and solidifying Aave's position as a key player in the industry. As $GHO continues to develop, it will be interesting to see how it affects the DeFi landscape and competes with other leading stablecoins.

Disclaimer:

- Non-Financial Advice.

- Not Sponsored content.

References and Sources: