Radiant Capital: The Omni-Chain Money Market Shining Bright in DeFi

Unlocking the Power of Consolidated Liquidity and Cross-Chain Borrowing

Key Takeaway: Radiant Capital seeks to revolutionize the DeFi landscape by consolidating fragmented liquidity and enabling seamless cross-chain borrowing and lending experiences for users.

Introduction: A DeFi Star Emerges with Radiant Capital

Radiant Capital, the first omni-chain money market, aims to unite fragmented liquidity across major chains, streamlining the DeFi experience and opening up new possibilities for managing capital. In this article, we will delve into the key facts, tokenomics, and the potential impact Radiant Capital could have on the DeFi ecosystem.

A New Horizon: Radiant Capital's Vision and Mechanism

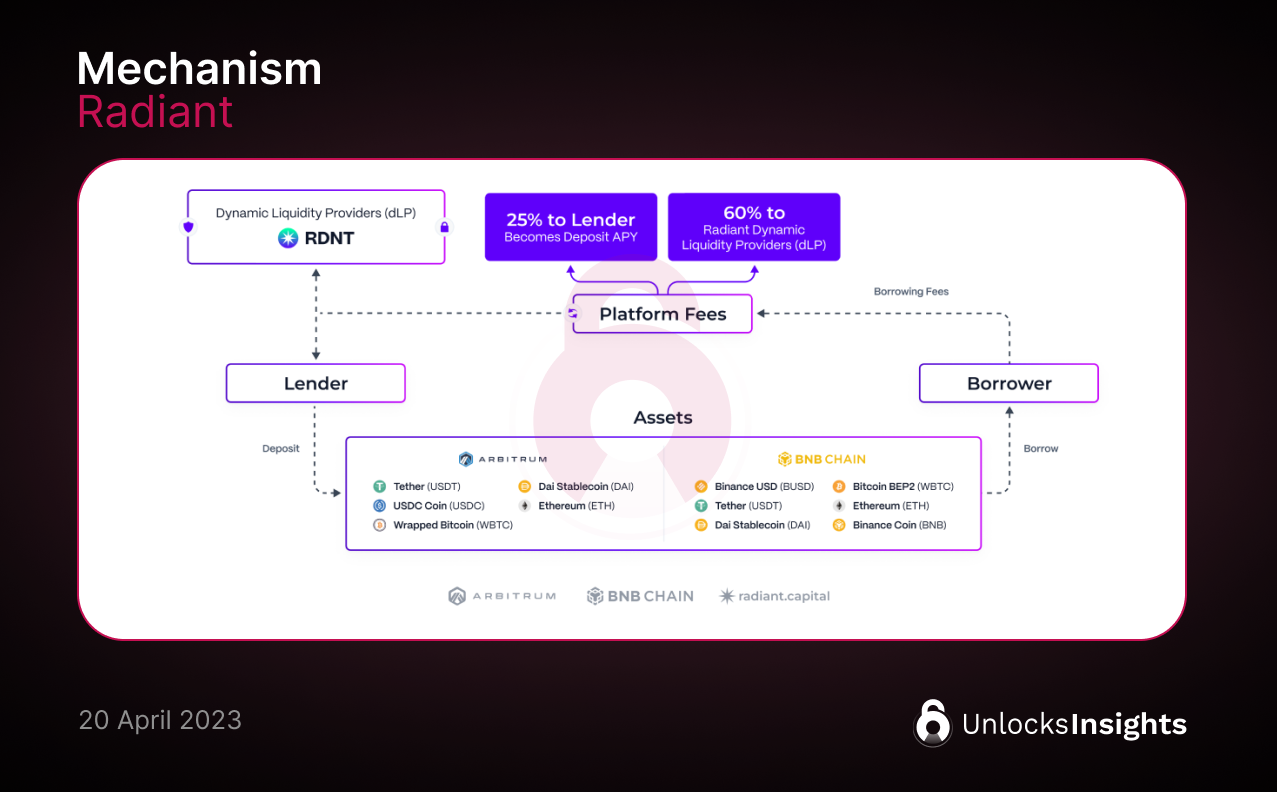

Radiant Capital's primary goal is to consolidate liquidity from top alternative layers, making DeFi more efficient and seamless for users. Lenders who provide liquidity to Radiant can capture added value from the community's engagement through the native token $RDNT. Meanwhile, borrowers can access liquidity without selling assets or closing positions by withdrawing against collateralized assets on the protocol.

Growth and Security: Radiant Capital's Development and Audits

Radiant Capital launched its V1 on Arbitrum, a secure alt L1 solution, to ensure the highest level of security and decentralization. The Radiant DAO has been developing Radiant V2, a new DeFi primitive, for over 1.5 years. The platform has invested over $2 million in security audits conducted by PeckShield, Solidity, Zokyo, and Blocksec.

Cross-Chain Interoperability with LayerZero Labs

Radiant Capital's cross-chain functionality operates atop layerzero.network. LayerZero enables users to seamlessly transfer assets and interact with various blockchains, regardless of their native chains. Built on a robust protocol, LayerZero ensures secure and efficient cross-chain transactions.

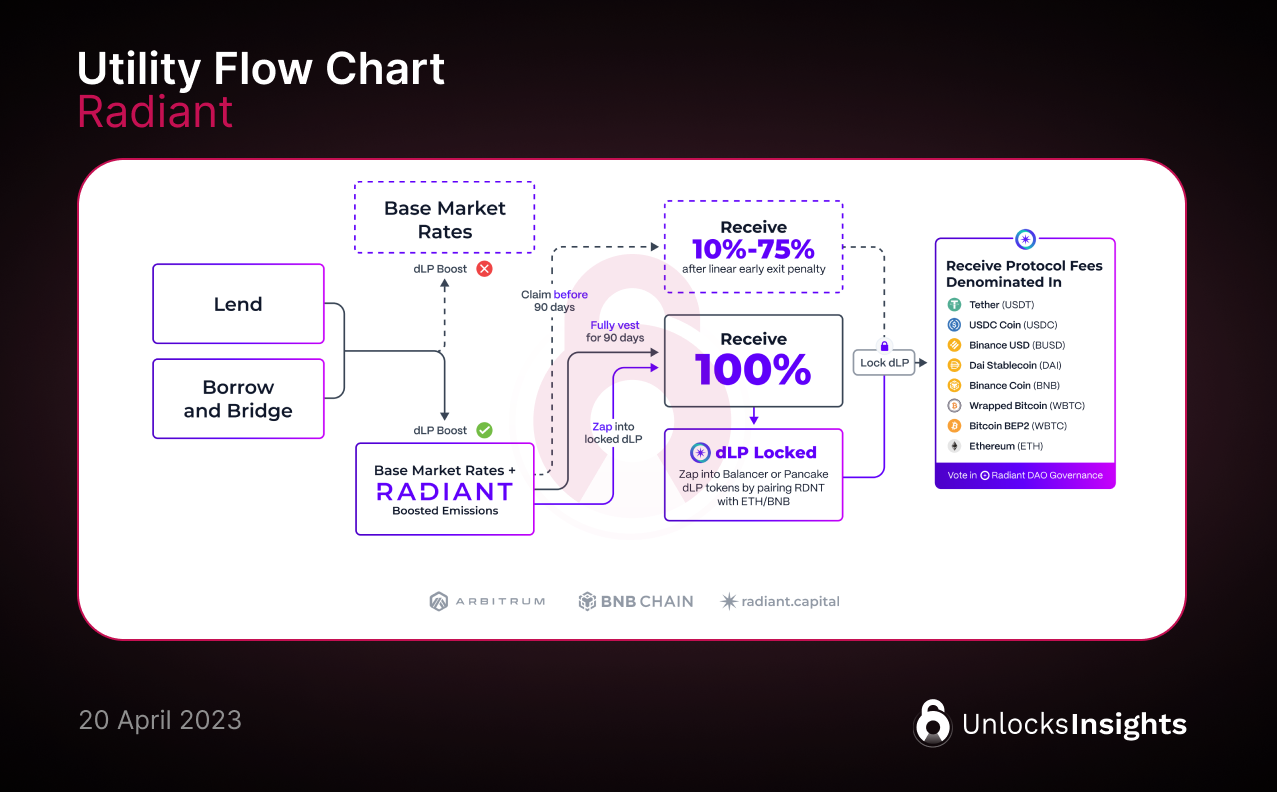

Dynamic Liquidity (dLP) Tokens: Incentives and Participation

Radiant Capital offers incentives to users who lock their Dynamic Liquidity (dLP) tokens in the Radiant DAO money market. By locking dLP tokens, users can activate RDNT emissions on deposits & borrows, share in platform fees, and obtain voting power. Users who deposit without locking dLP tokens will earn natural market rates but won't be eligible for RDNT emissions.

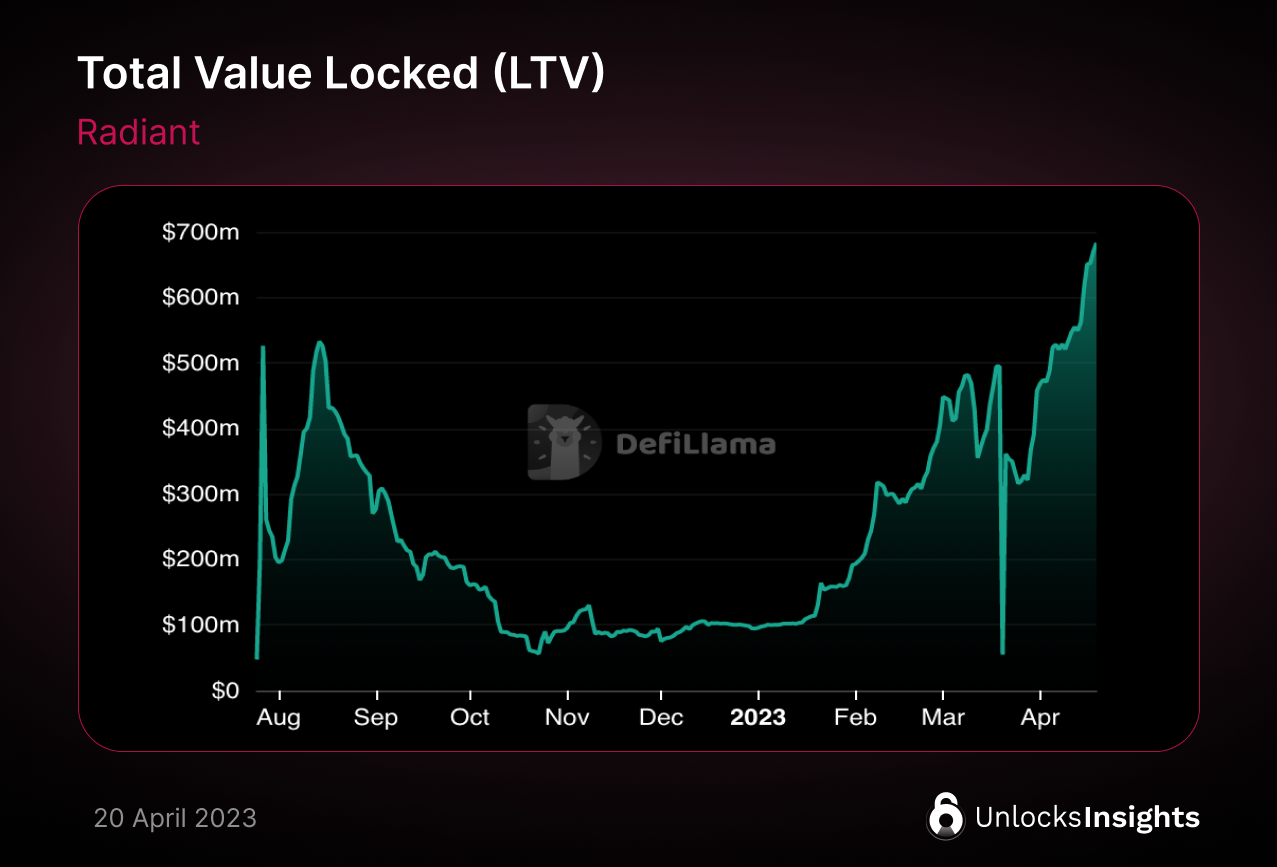

The Numbers: Total Value Locked (TVL) and Market Capitalization

Radiant Capital's TVL is estimated at $683 million, while the market capitalization of the circulating native tokens is approximately $125 million.

Tokenomics: The $RDNT Omni-Chain Utility Token

$RDNT is an omni-chain utility token powering the Radiant ecosystem. It enables native, cross-chain token transfers through Radiant's OFT-20 interoperability solution. The token's total supply is capped at 1 billion and is distributed to align stakeholder interests with the Radiant ecosystem's success.

Afterthought: The Future of DeFi with Radiant Capital

Radiant Capital aims to transform the DeFi landscape by allowing users to deposit assets on any major chain and borrow supported assets across multiple chains, improving the borrowing and lending experience.

Conclusion: A Bright Future for Radiant Capital and DeFi

By offering cross-chain borrowing and lending in a seamless manner, Radiant Capital is poised to revolutionize the DeFi landscape.

Disclaimer:

- Non-Financial Advice.

- Not Sponsored content.

References and Sources:

- docs.radiant.capital

- defillama.com