Sudoswap: A Game Changer for NFT and DeFi Trading?

Discover the On-chain NFT/AMM Protocol Aiming to Unlock the True Worth of NFTs

Key Takeaway: Sudoswap, an on-chain NFT/AMM protocol, offers a novel approach to trading NFTs and other assets, blending the worlds of DeFi and NFTs, and potentially transforming the way users engage with these markets.

Introduction: The Need for a Breakthrough Solution

Sudoswap is an innovative on-chain NFT/AMM protocol designed to make trading NFTs and other assets, such as ETH and ERC20 tokens, simple and efficient. This article will provide an overview of the protocol, its reasoning, underlying technologies, and tokenomics.

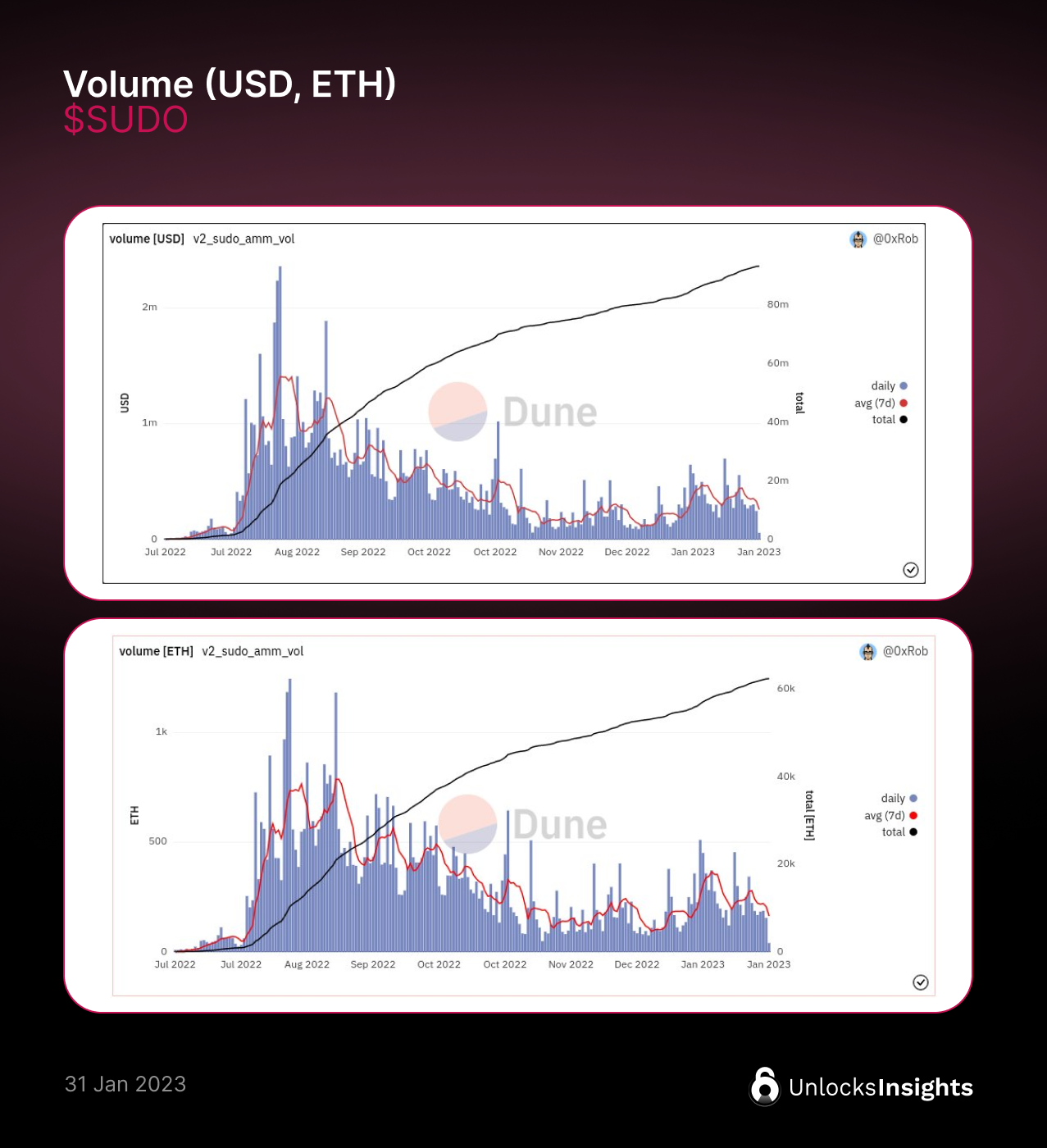

Since July 2022, the total volume mounted to be nearly 94M USD and 63K ETH. And as of now, the 7d average volume is about 330K USD and 200 ETH.

Sudoswap: Bridging the Gap Between NFTs and DeFi

Sudoswap was developed in response to the challenges faced by users trading NFTs using fractionalization, which can be complicated, costly, and not capital efficient. Sudoswap offers a platform where users can easily swap NFTs without requiring a counterparty, and where liquidity providers can earn trading fees by contributing assets to trade pools.

A New Approach: LSSVM

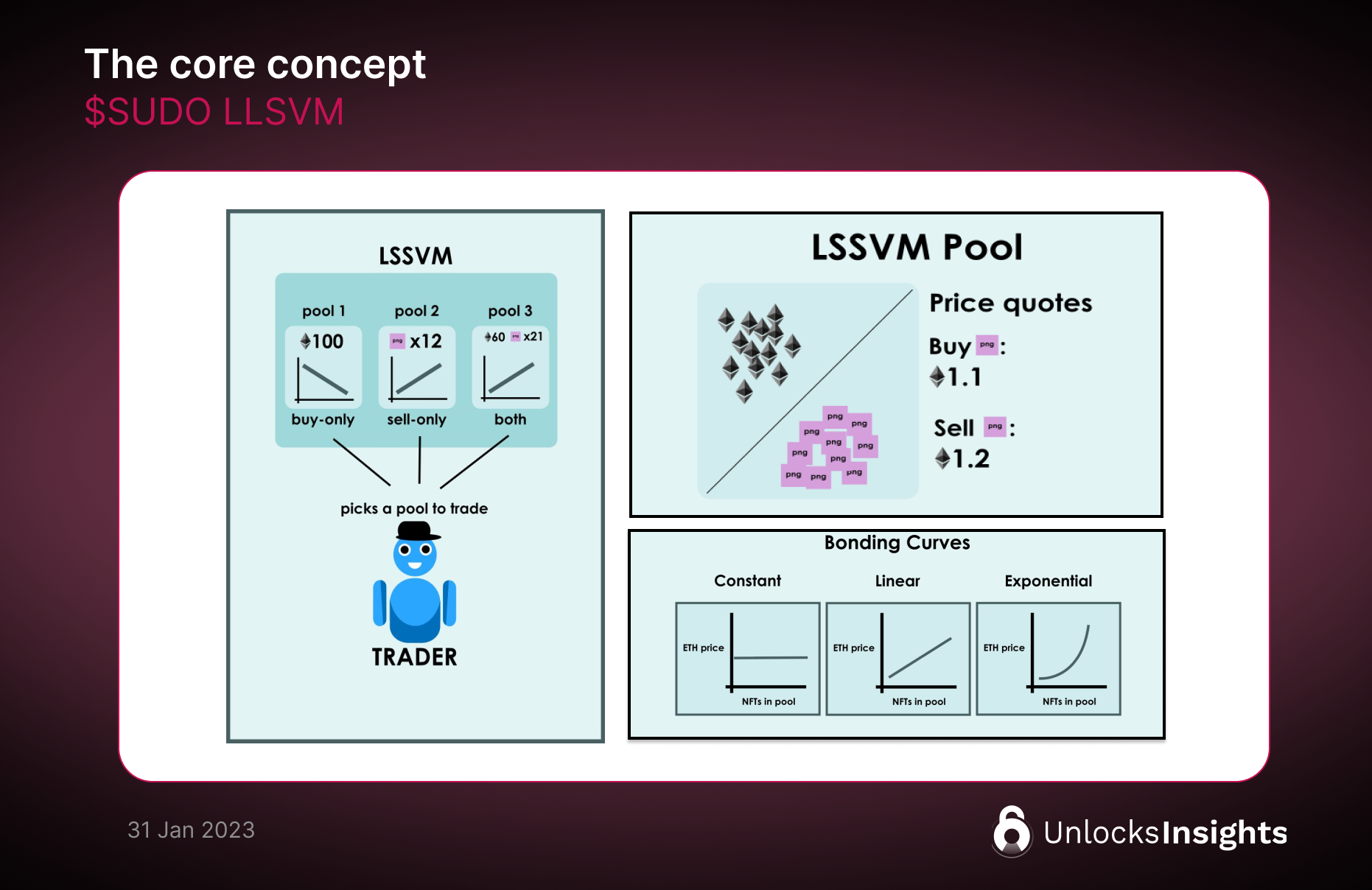

The core concept behind Sudoswap is LSSVM, a new NFT Automated Market Maker (AMM) developed by 0xmons. LSSVM enables immediate NFT trading quotes, with single-sided pools managed by liquidity providers and parameterized by a custom bonding curve, determining the quote given.

How Sudoswap Works

- Liquidity providers deposit NFTs, ETH, or ERC20 tokens into pools, set buy/sell prices, and bonding curve parameters.

- Users buy or sell NFTs from or into pools, with prices changing based on the bonding curve.

- Liquidity providers can change parameters or withdraw assets at any time.

Introducing $SUDO: The Governance Token

$SUDO is the governance token for the Sudoswap protocol. $SUDO holders can vote on crucial changes using on-chain proposals, such as adjusting the fee switch, adding new routers, pool whitelisting external contracts, and adding new bonding curves.

Tokenomics

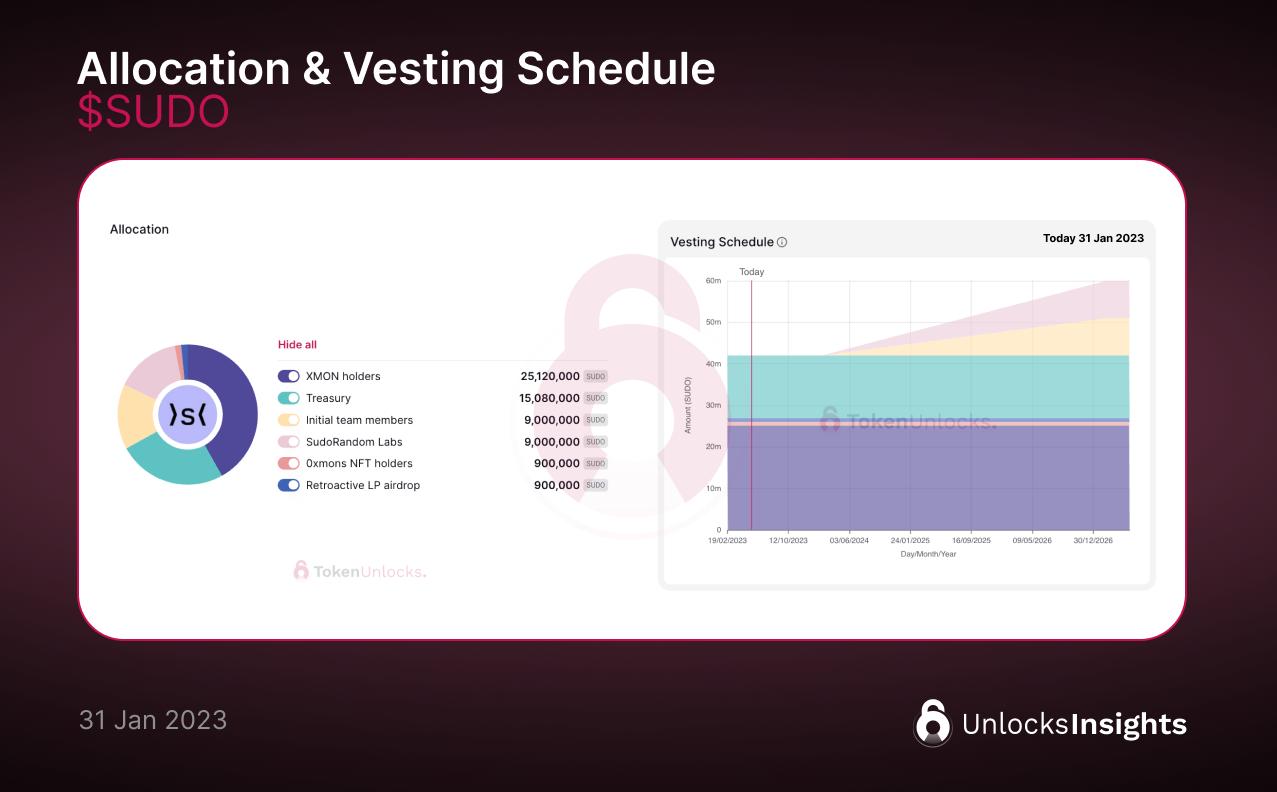

The initial supply of $SUDO is set at 60 million, with the majority distributed to XMON holders. Initially, $SUDO tokens will be non-transferable to ensure sufficient participation in governance. A proposal for transferability will be addressed at a later time. From 2024, 30% of the initial supply will undergo a linear unlocking process, allocated to initial team members and SudoRandom Labs.

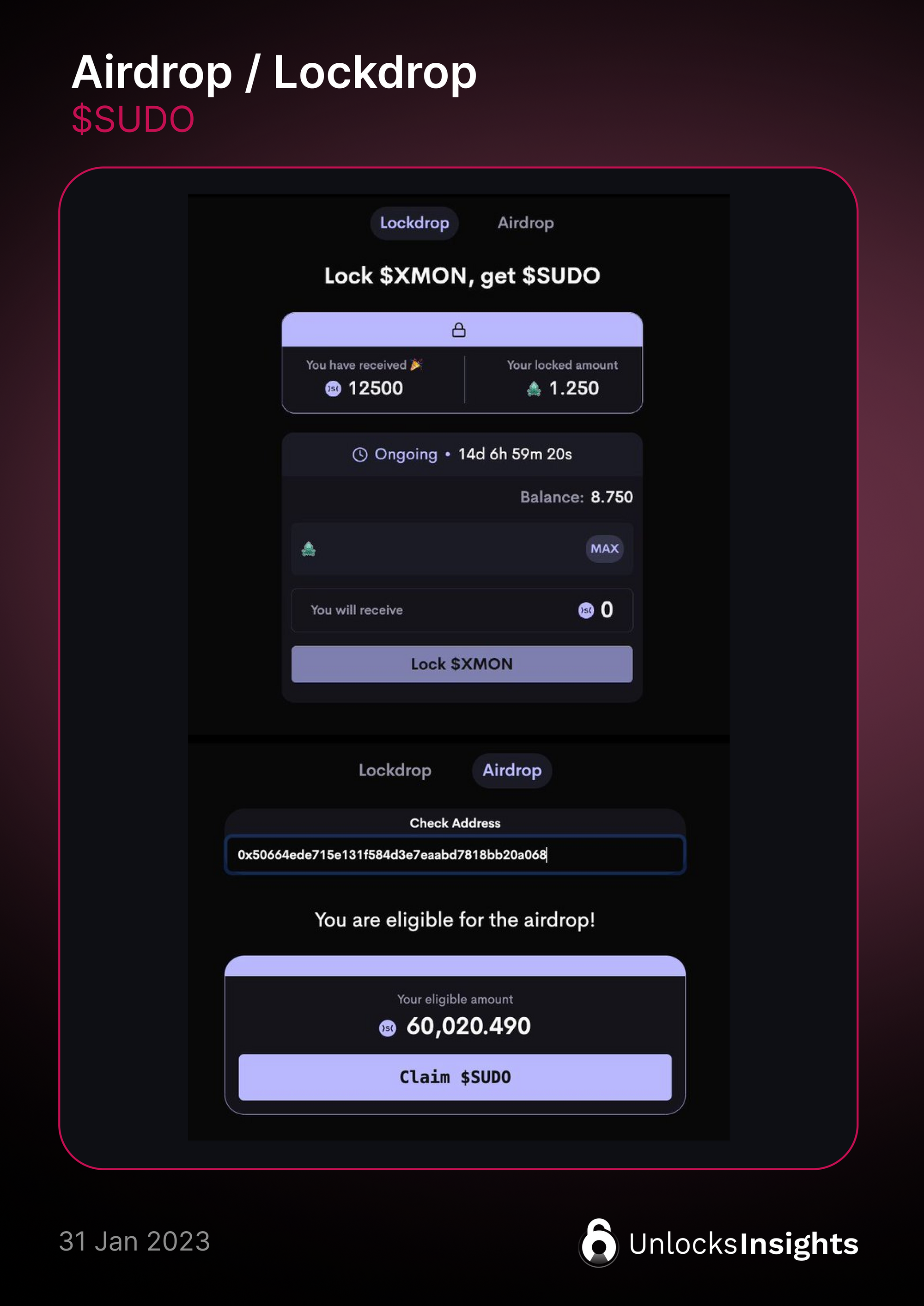

How to Participate in the $SUDO Airdrop/Lockdrop?

$XMON holders can lock their tokens for one month from the deployment of contracts. Early trade pool sudoAMM LPs and 0xmons NFT holders are also eligible for a $SUDO airdrop.

Conclusion: A Different User Experience with Sudoswap

Sudoswap combines DeFi and NFTs to offer a unique user experience, aiming to be a key player in both the DeFi space and NFT world. The innovative platform holds potential benefits for both experienced and new users looking to trade NFTs and other assets.

Disclaimer:

- Non-Financial Advice.

- Not Sponsored content.

References and Sources: