Standard Allocation: Trends and Industry in 2023 of TokenUnlocks

👋🏼 Hey TokenUnlocks Alpha !!

If you're a crypto project founder or an investor making informed decisions, you're in the right place. In the fast-paced world of cryptocurrency, it is essential to understand token allocation to gain an edge. Every allocation choice, from public sales to private investments and reserves, significantly impacts a project's trajectory.

In this exploration, we will examine trends in token allocation for 2023 and how they affect founders and investors. A balanced token allocation can satisfy all stakeholders. In our 2022 annual report, we conducted a similar analysis with 40 tokens, but for 2023, we have listed 38 more tokens on our website. We will also highlight differences in strategies between large and small market cap projects.

If you are ready to delve deep and navigate the crypto universe, join us as we investigate how crypto founders determine optimal token allocations and vesting schedules.

Unfamiliar with unlocks and vestings? Read "What is token unlock?" TokenUnlocks FAQ or check out this awesome Coin Bureau's review of our annual report.

🤔 Why Token Allocation and Vesting Schedules Matters ?

Token allocation and vesting schedules form the backbone of a cryptocurrency project's long-term viability. But why do they matter so much?

Firstly, while chart analysis and technical indicators can provide insights into market trends and short-term price movements, they don't tell the whole story. To truly understand a project's potential, one needs to delve deeper into its fundamentals, and that's where token allocation and vesting schedules come into play.

So, let's deep into token allocation. In simple terms, token allocation is the percentage of tokens that are distributed among different stakeholder groups within a crypto project. Token allocation reveals a lot about a project's priorities and strategy. Different parties in a project—founders or the team, venture capitalists (VCs), and the community—each have distinct roles and incentives. Therefore, how a project allocates its tokens among these groups can tell us much about its long-term strategy and stability.

- The team or the founders, for instance, are usually the ones who put in the most effort in building the product. Their token allocation often reflects their dedication to the project and aligns with the project's long-term success. However, while they might not invest as much money as VCs, they're investing something equally, if not more, valuable—their time and talent.

- Private Investors or VCs, on the other hand, often take the most significant financial risk, especially during the early stages of a project. They put in a lot of the money needed for the project to grow by being part of private funding rounds like the Seed round, Series A, and Series B. This means they often get to buy in at a lower cost compared to public funding rounds. When the lock-up period is over, VCs often have a big impact on the market price because of the bigger allocation size and cheaper cost of their token.

- Lastly, the community plays a unique role. Unlike other groups, they're typically rewarded tokens for their participation in the project, such as through airdrops or staking rewards. They could be end-users of the project's service or supporters who contribute to the project's growth. The portion of tokens allocated to the community can reflect a project's commitment to decentralization and user engagement.

Vesting schedules serve as mechanisms to align the incentives of all involved stakeholders, thereby guaranteeing the effective delivery of projects by the team, ensuring VCs attain the milestones projected by the project team, and motivating the community to actively participate in the network. These schedules also help in mitigating the risk associated with token dumping and fostering a long-term commitment from all parties. By releasing tokens over a period of time, they ensure that all of the parties remain invested in the project's success over the long term.

Therefore, understanding token allocation and vesting schedules can provide a clear picture of a project's fundamental strengths, helping traders make more informed decisions beyond what technical analysis alone can offer.

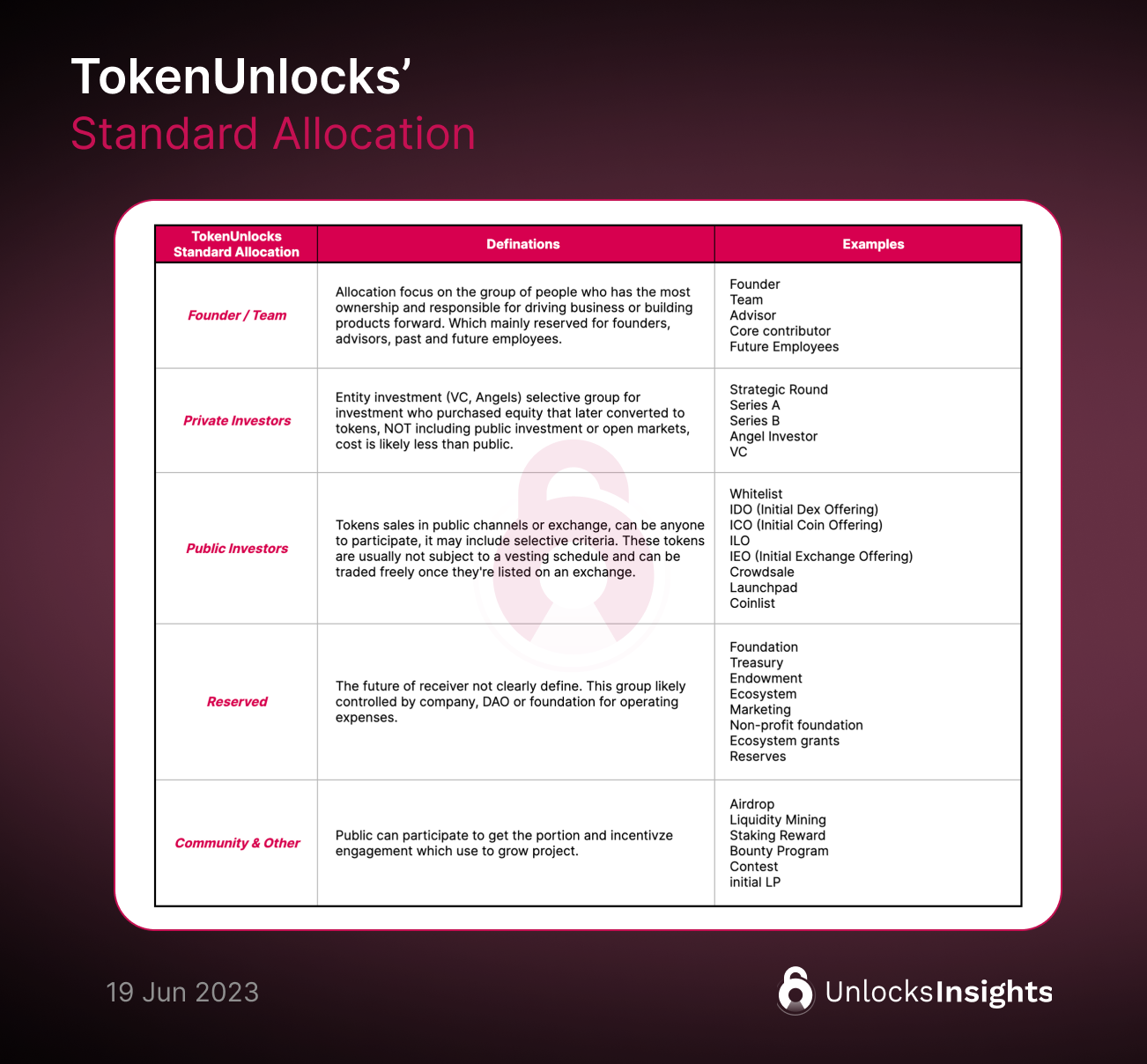

🎯 TokenUnlocks' Proposed Framework: Standardizing Token Allocation Groups

Defining token allocations isn't as straightforward as it may seem. Different projects may categorize token allocations differently. Some might include 'Liquidity Mining Programs' under community allocations, while others might consider them part of the foundation as they're often used for operating expenses. Some projects might lump teams, partners, and advisors into a single 'Core Contributors' category, while others distinguish between these groups.

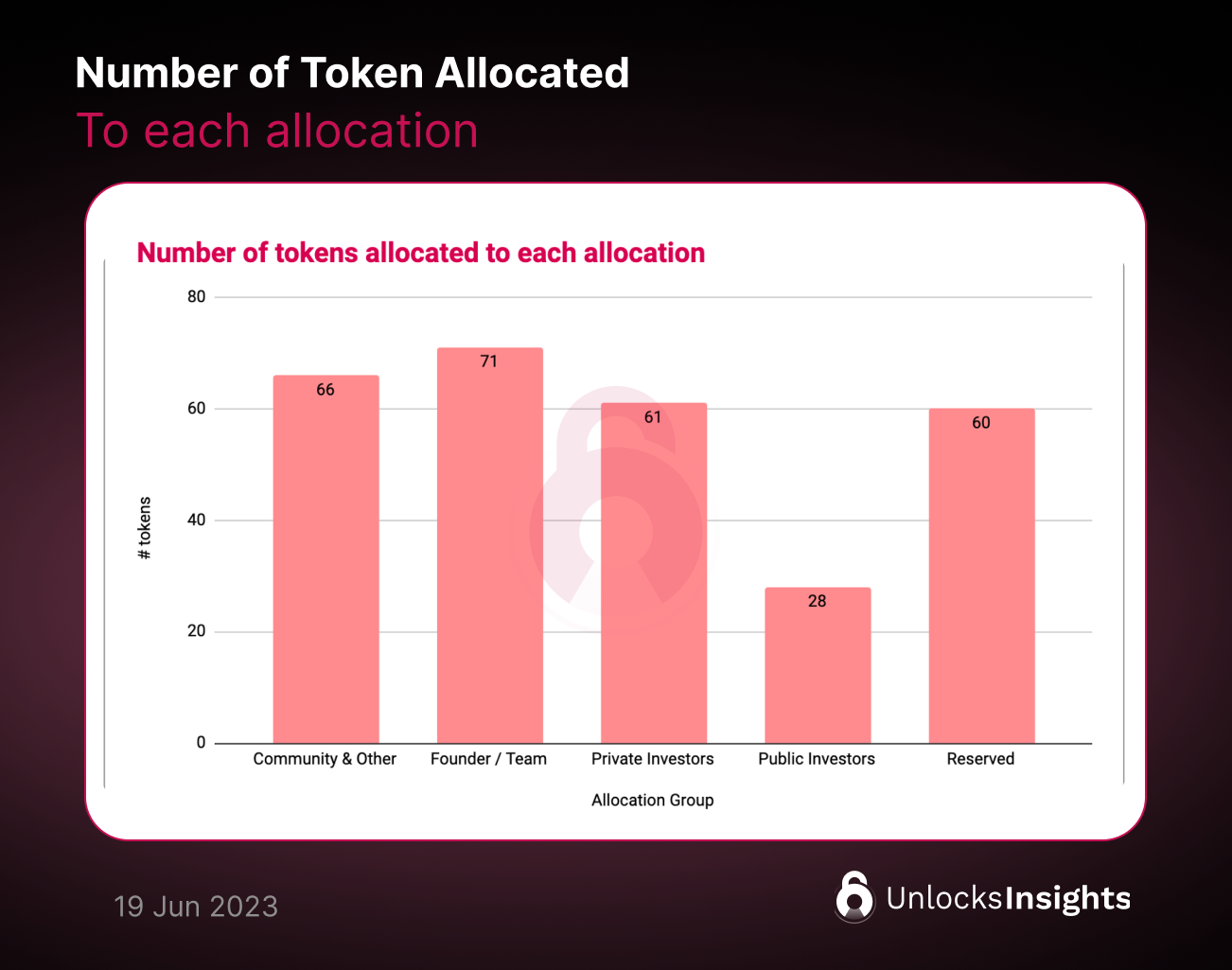

Through our extensive research, we have identified consistent patterns and benefits in token allocation behavior, despite some inconsistencies. Our research involved 72 limited supply tokens and we curated all of the data from both the whitepaper and onchain sources. TokenUnlocks confidently introduces a robust framework to help you understand the role of each stakeholder group.

Greater transparency and standardization in token allocation can significantly benefit the broader crypto community. It allows community members to hold teams accountable, ensuring that they publish their tokenomics and implement incentive structures that promote the project's long-term success.

These stakeholders typically fall into the following categories:

- Founder and Team

- Private Investors

- Public Investors

- Reserved and Treasury

- Community & Other

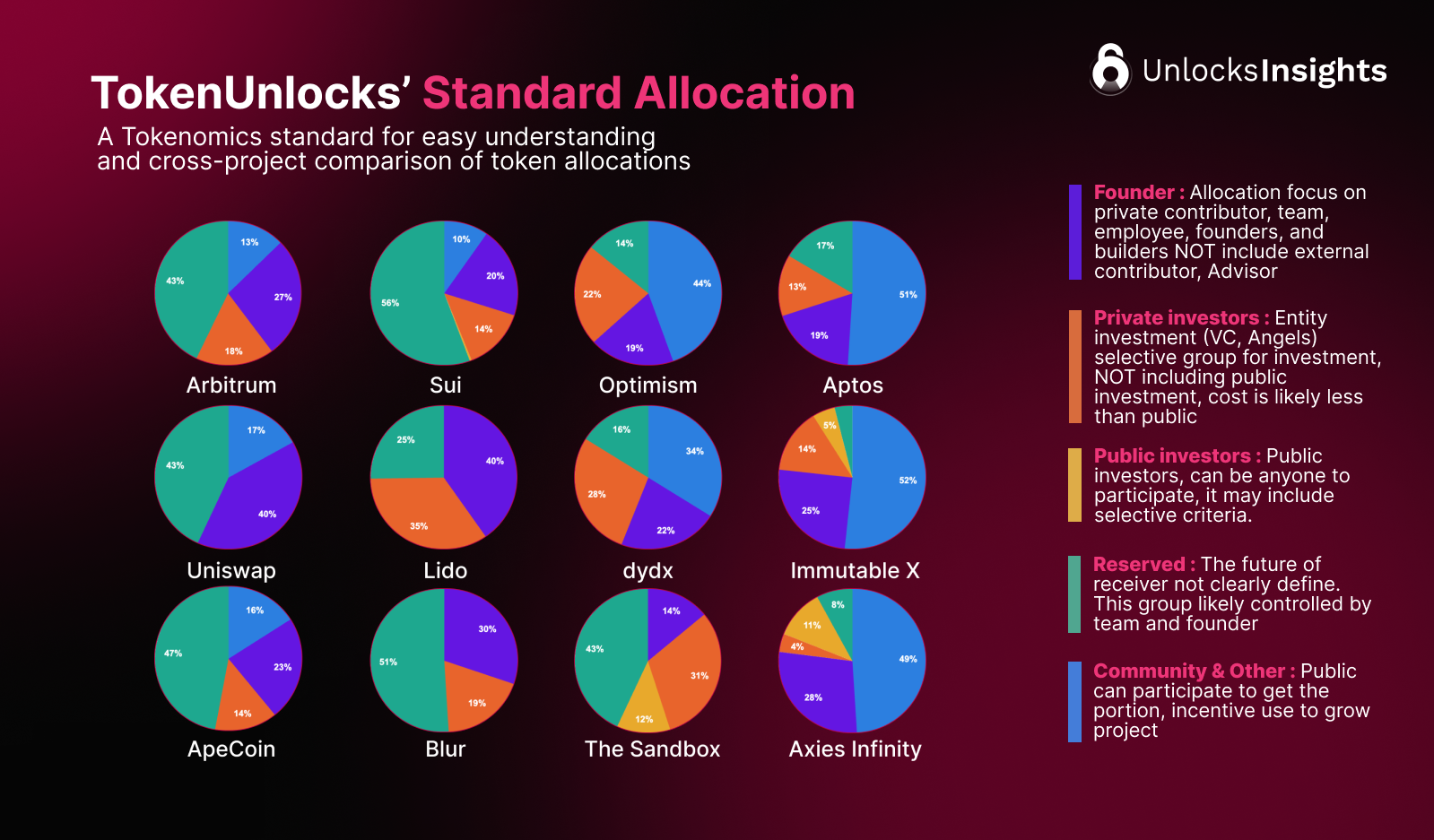

Please see more definition and example how we grouping them in attached image

Understanding these categories and their typical token allocations can provide valuable insights into a project's strategy, commitment, and long-term prospects. In the following sections, we'll dive deeper into these categories, examining the latest trends and strategies in 2023.

🔍 Cracking the Code: Understanding Recent Token allocation trends

Key findings :

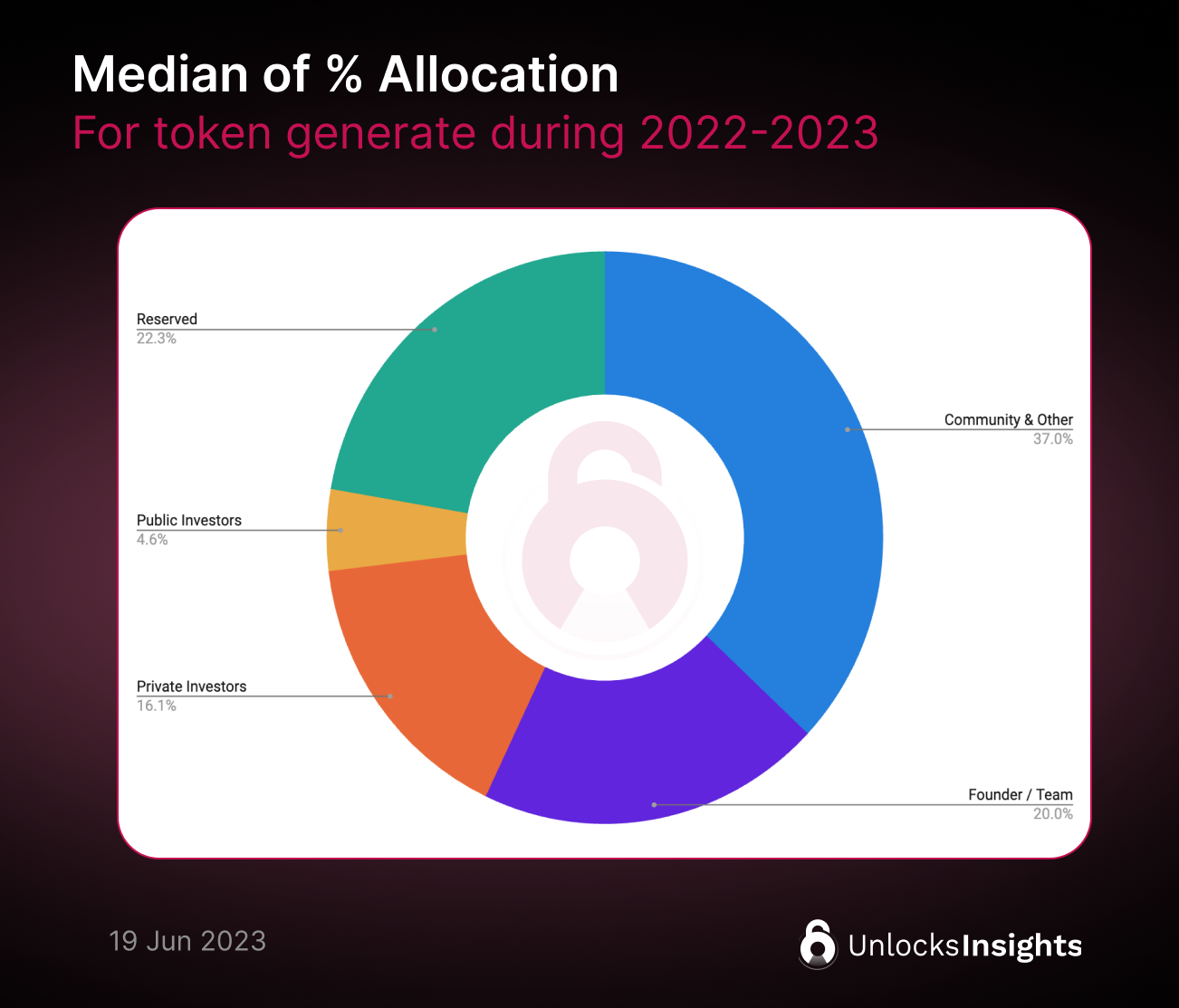

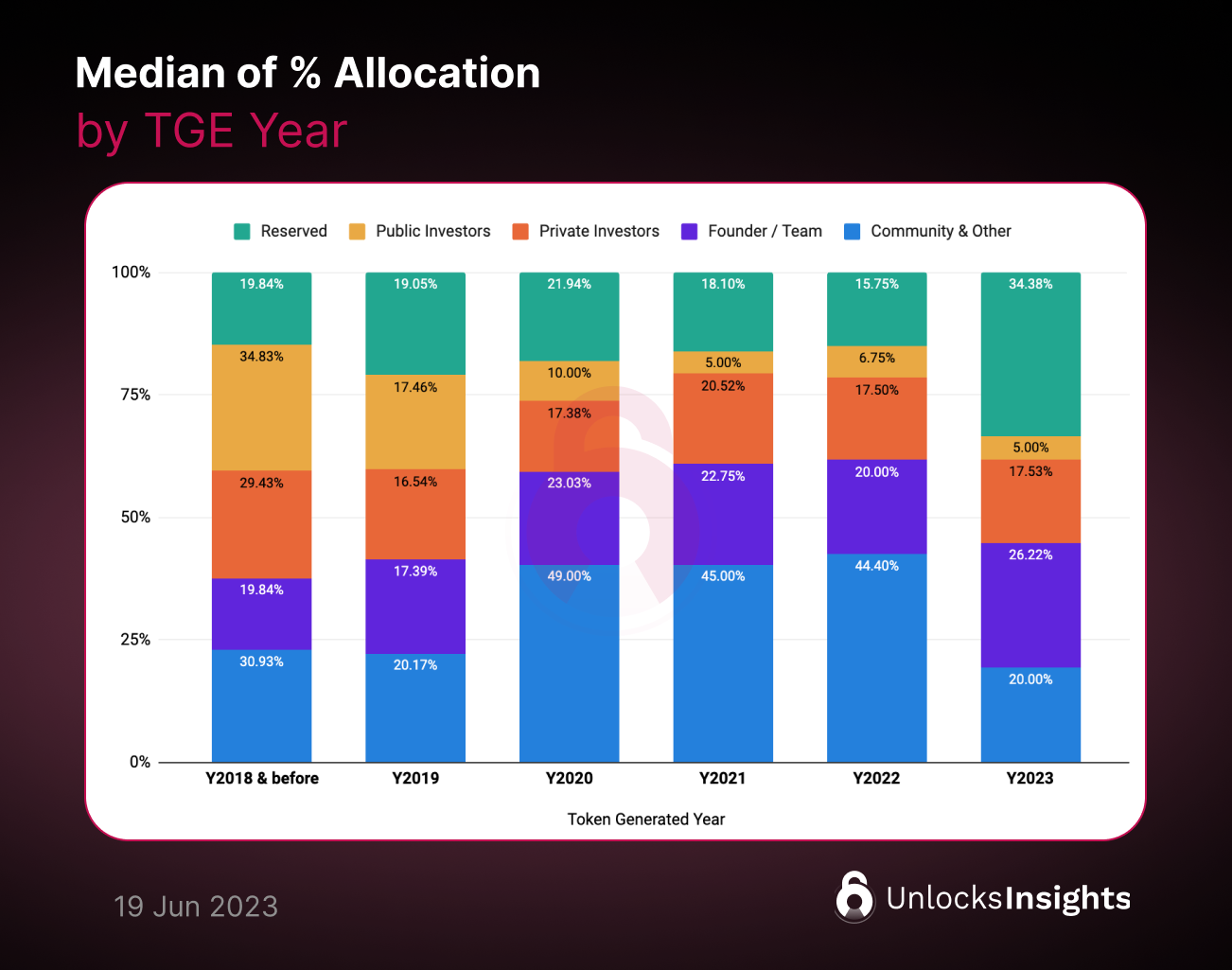

Overall since 2022, the most portion of allocation goes to community (37%) as distributing token to wide base of community members helps to distribute power and influence, reducing the risk of centralization, which match the main purpose of decentralization. Moreover, allocating tokens to the community can incentivize active participation and engagement. Whether it's through staking, liquidity provision, or participating in governance decisions, tokens can act as a powerful catalyst for attracting and retaining users, thereby generating strong network effects.

For reserved and treasury (27%) used to fund future initiatives, like new features or partnerships opportunity. Crypto founders need to ensure that they have enough fund for ongoing projects or could allocate to any other parties in the future for instance founder / team or private investors. That why this is the 2nd largest allocation.

Approximately 20% of the tokens are allocated to the founder/core team, while 16% are assigned to private investors. In most cases, projects attempt to distribute these two portions equally, or allocate slightly more to the team than to the investors. Private investors, often venture capitalists (VCs), typically seek substantial returns within a defined time frame. Allocating more tokens to the team helps alleviate pressure for short-term gains, allowing for a greater focus on long-term commitment and sustainable growth.

Lastly, public investors account for approximately 4.6% of the token allocation. Tokens sold in public sales generally do not have long vesting periods. Our research indicates that 75% of public sale vesting periods end before 8.8 months. This means that buyers can sell the tokens immediately after purchase, which causing price impact a lot.

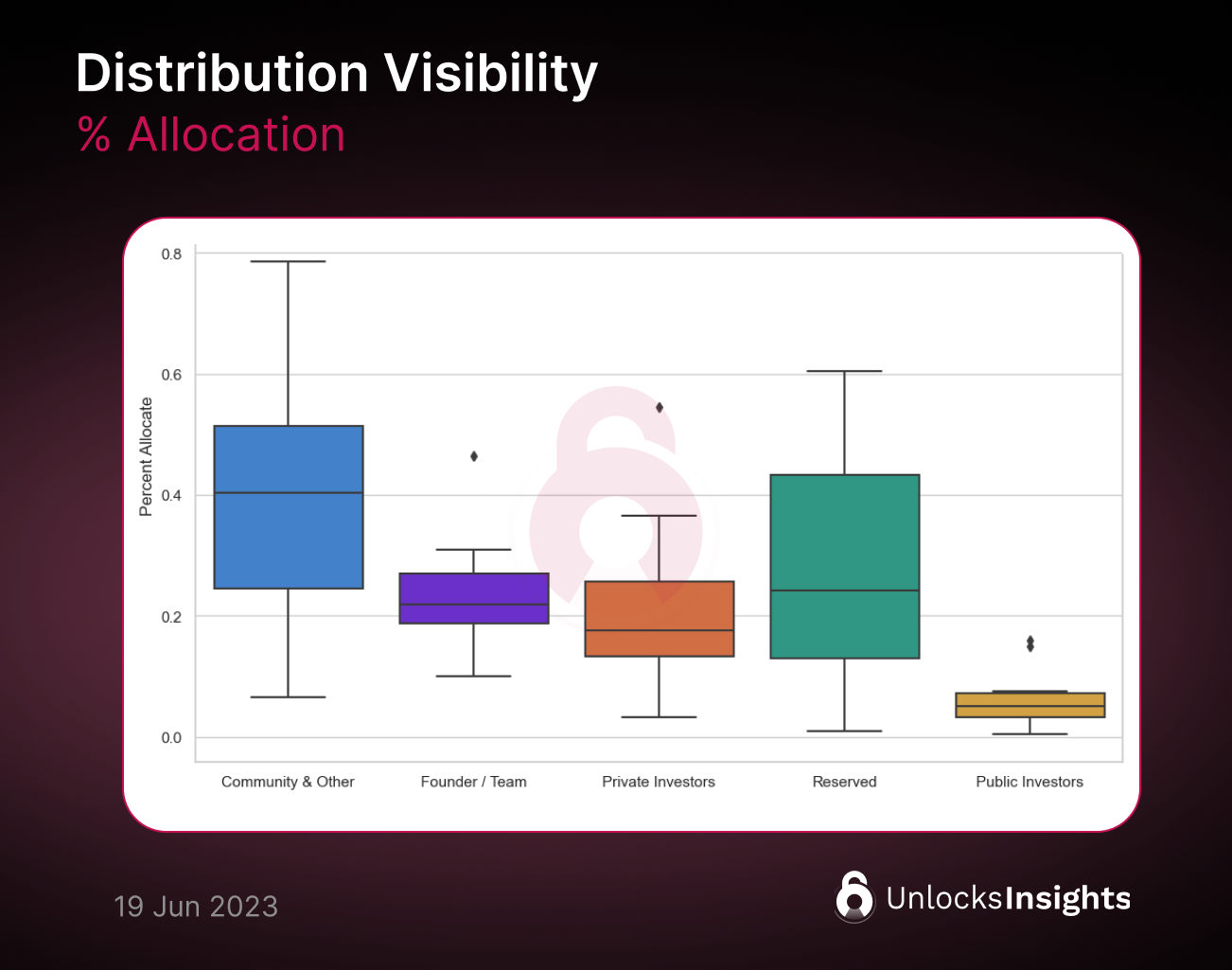

Extra box plot chart for data enthusiast, here you go for distribution visibility.

Next, let’s see what is the main change between past and present allocation trends.

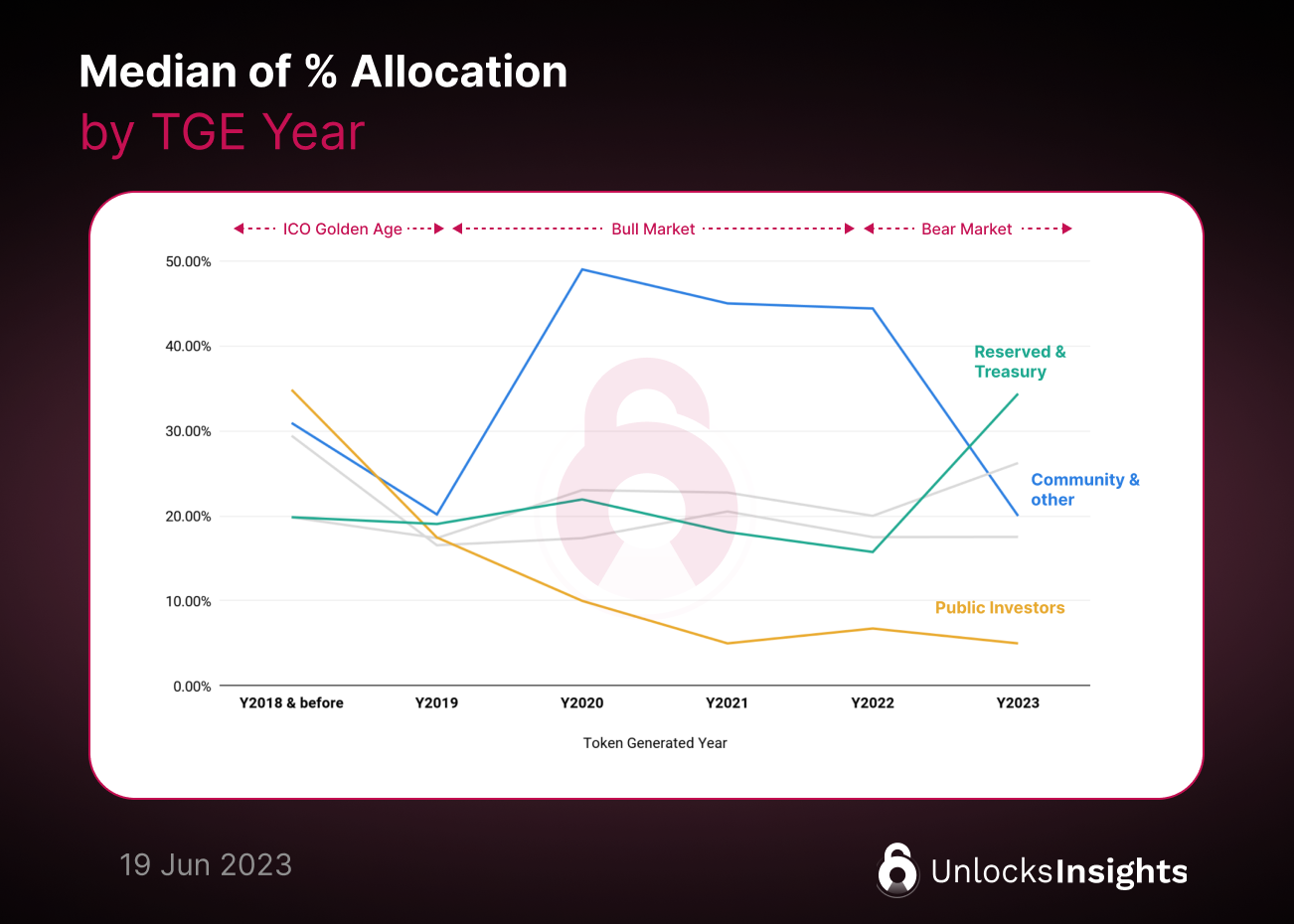

The allocation initially flowed from Public Sales and Reserved into Community from 2018-2021, subsequently making its way back to Reserved in 2023.

This can happended by these following reasons

✨ The gold era of ICO (2018 & before)

- ICOs, or Initial Coin Offerings, grew in popularity leading up to 2018, offering an alternative to traditional Initial Public Offerings with less regulation.

- From Binance Tokenomics Deep Dive, before 2018 many high market-cap tokens offered over 40% of their total supply to public sales during their ICOs. Well-known cryptocurrencies, such as Ethereum and Binance, allocated large proportions of their tokens to public sales (83.5% and 50% respectively).

- However, the ICO landscape was tainted by a high number of scams, with an estimated 80% of ICOs falling into this category according to a study by Statis Group. The crash of the cryptocurrency market also played a part in the decline of ICOs.

- In response to these challenges, Security Token Offerings (STOs) emerged. These hybrids between IPOs and ICOs have more stringent requirements and regulations for instance KYC process. This makes ICOs a more challenging and costly option for fundraising.

- Research by Benedetti and Kostovetsky (2018) and Howell et al. (2018) indicates that on average, 54% to 60% of total token supply was dumped during an ICO.

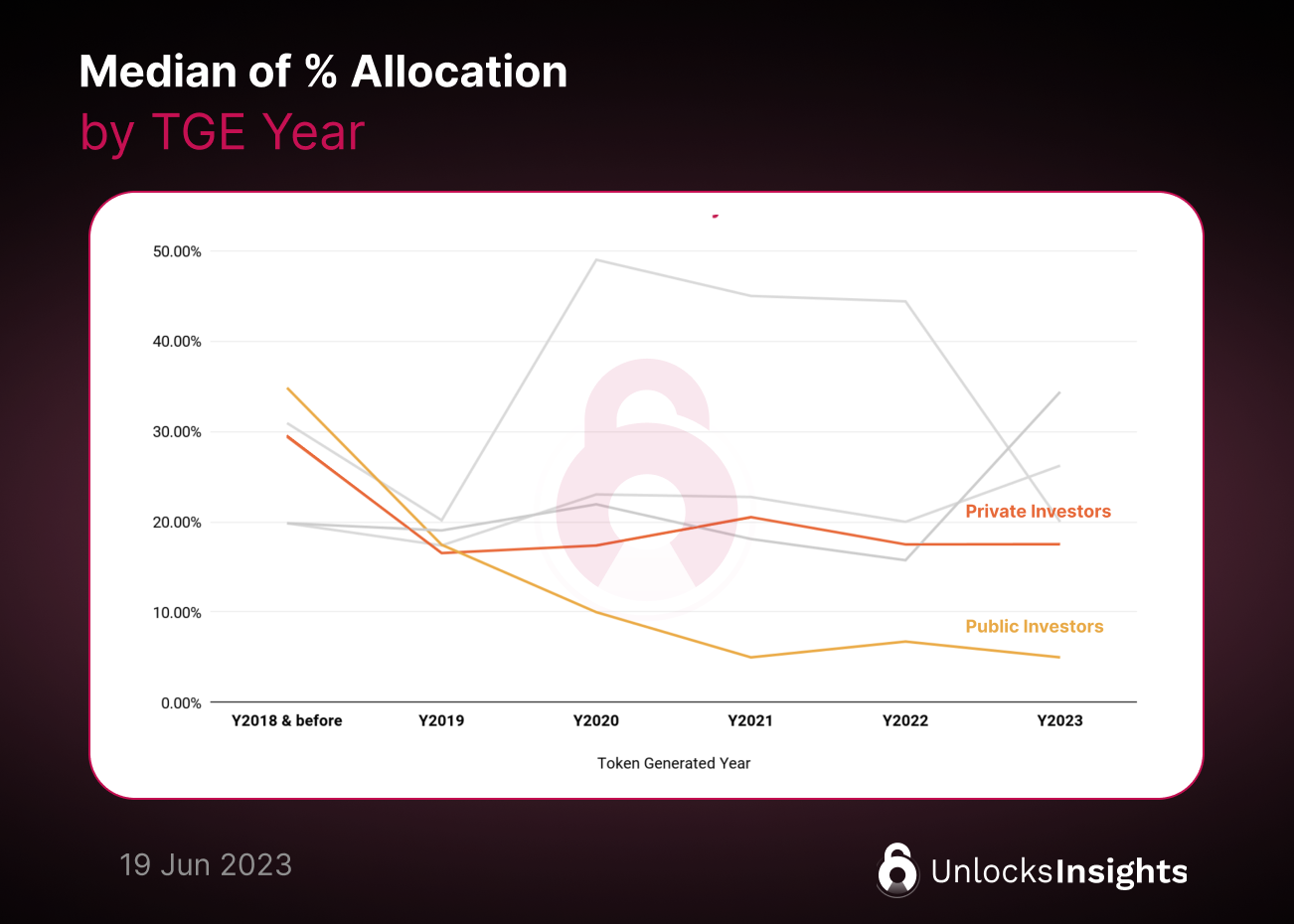

- From these several reasons, ICOs did not bring much value. Therefore, crypto founders decided to gradually reduce the allocation of public sales from 35% in 2018 to 5% in 2023, while private investor start increasing. It makes more sense for the team and VC to allocate more funds as they can sustain a longer-term value.

📈 Bull Market and Community Building (2019 - 2021):

- The community token allocation increased to 45-49% during 2020-2022

- During the bull market cycle, projects often focus more on building strong community and user engagement. This is achieved through allocating more tokens for mechanisms like staking, liquidity provision, and airdrops, thereby stimulating user participation and growing the project's ecosystem.

- By distributing tokens for free, projects can generate significant interest, engagement, and loyalty among users, all of which are highly valuable in the long run.

📉 Bear Market and Future Planning (2022 - 2023):

However, when the market becomes bearish or less predictable, projects may revert to a more conservative allocation strategy. They increase the reserved allocation to ensure long-term sustainability, cater to operational costs, and prepare for future developments or initiatives.

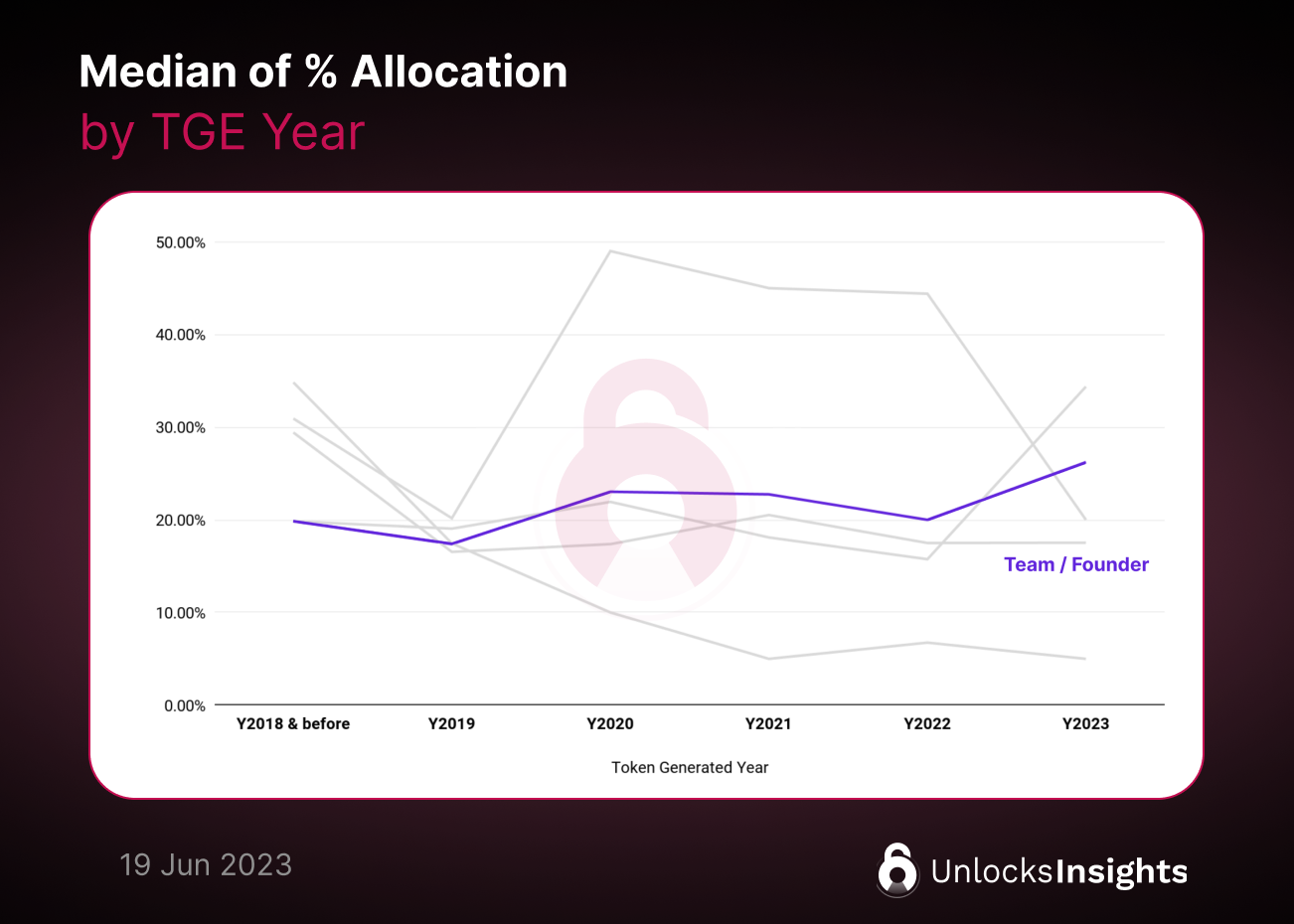

🧑🤝🧑 Founder / Core Team : The steady climber

- The percentage allocation for the Founder/Team category has increased steadily from 18% in 2017 to 27% in 2023.

- This increase shows that more projects are aligning vested interests with long-term project success, reflecting the team's equity ownership in the company issuing the token.

👀 2023 Notable Vesting Duration Trends

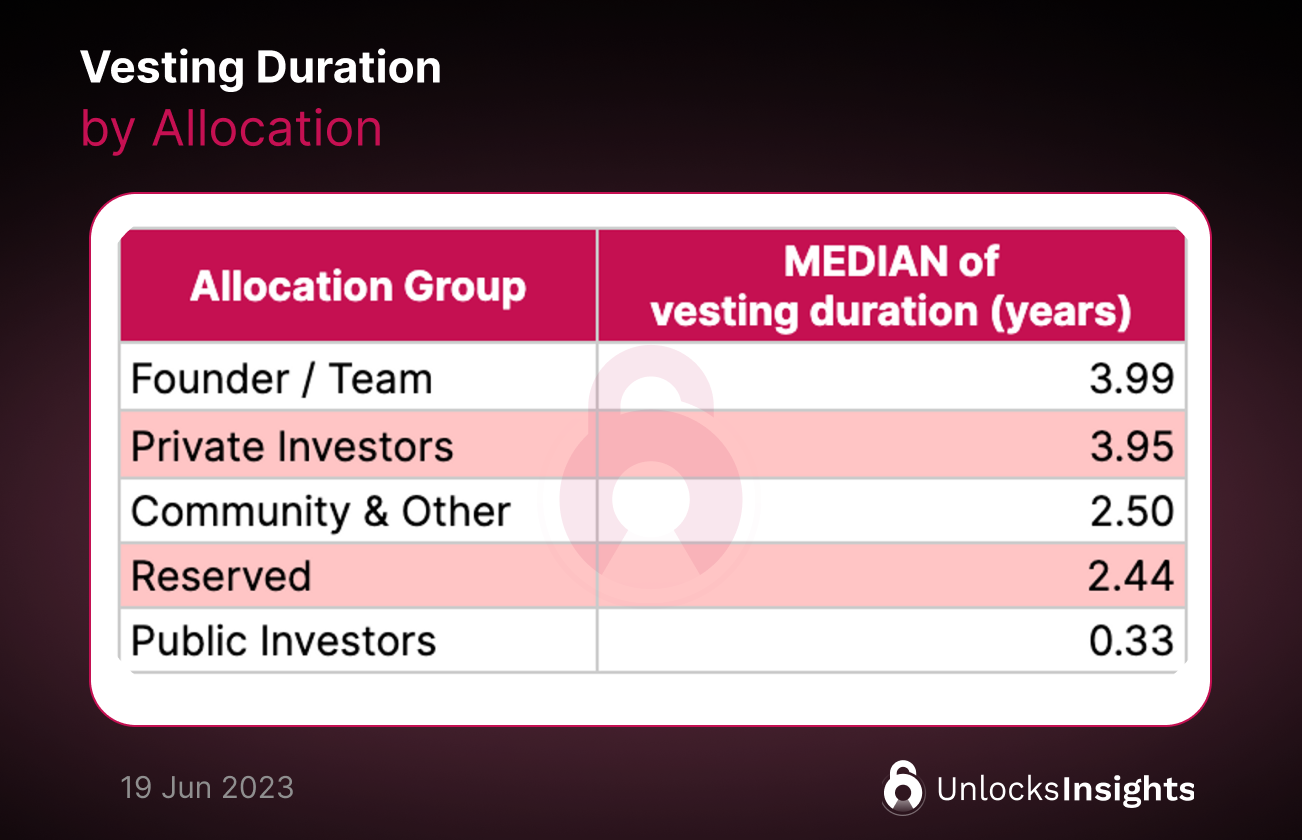

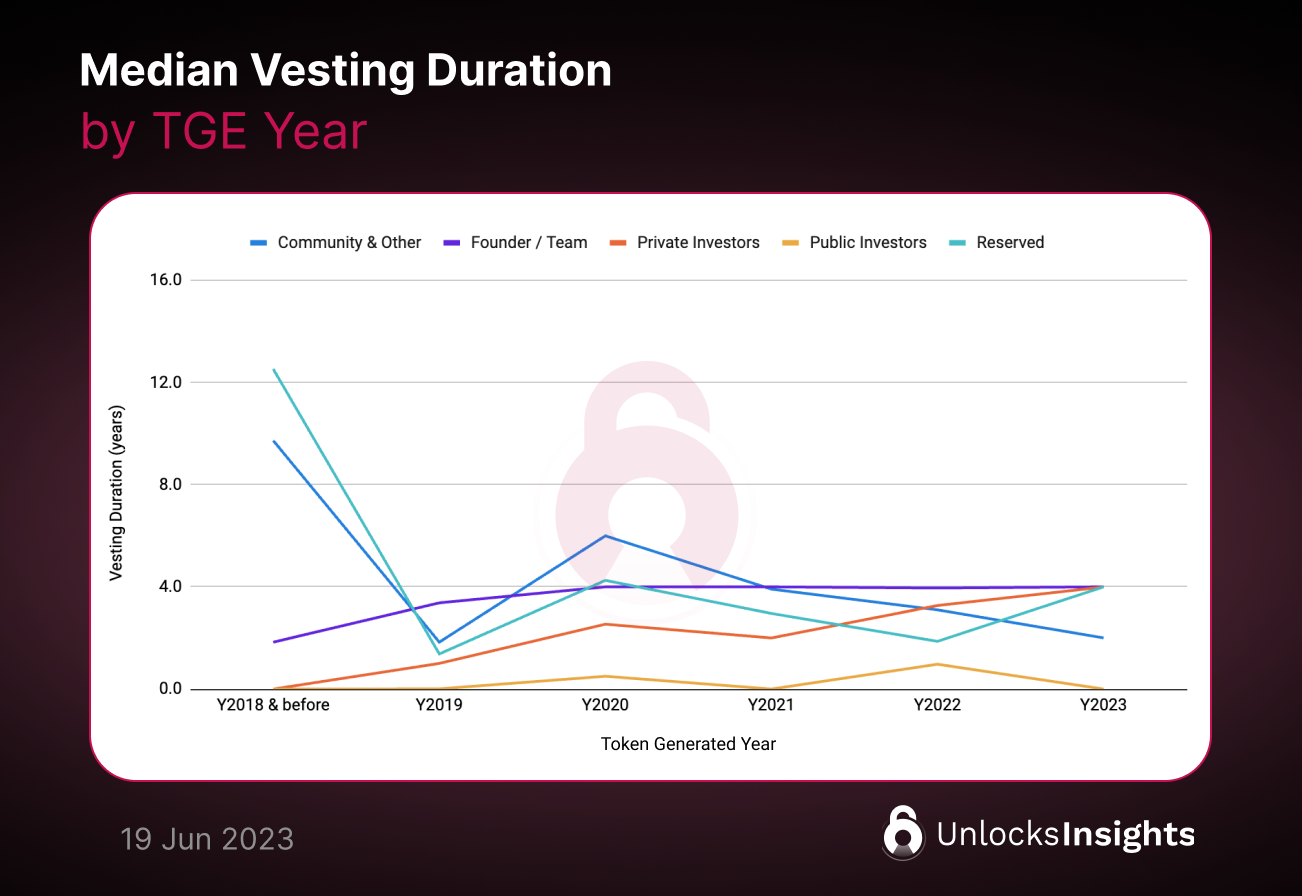

- Founder / Team and Private Investors took 4 years to vest, which following the industry standard similar to tech industry and companies outside of crypto/web3.

- Community and Reserved Treasury allocation took only 2.5 years to complete due to anticipation of rapid development and quicker achievement of milestones. Shorter vesting period allows early access to tokens, providing necessary funding for operations and development and incentivizing community engagement.

- Unsurprisingly, most of the public investors unlocks immediately after TGE (Token Generation Event) for raise fund from early adopter for sell token in the cheaper price.

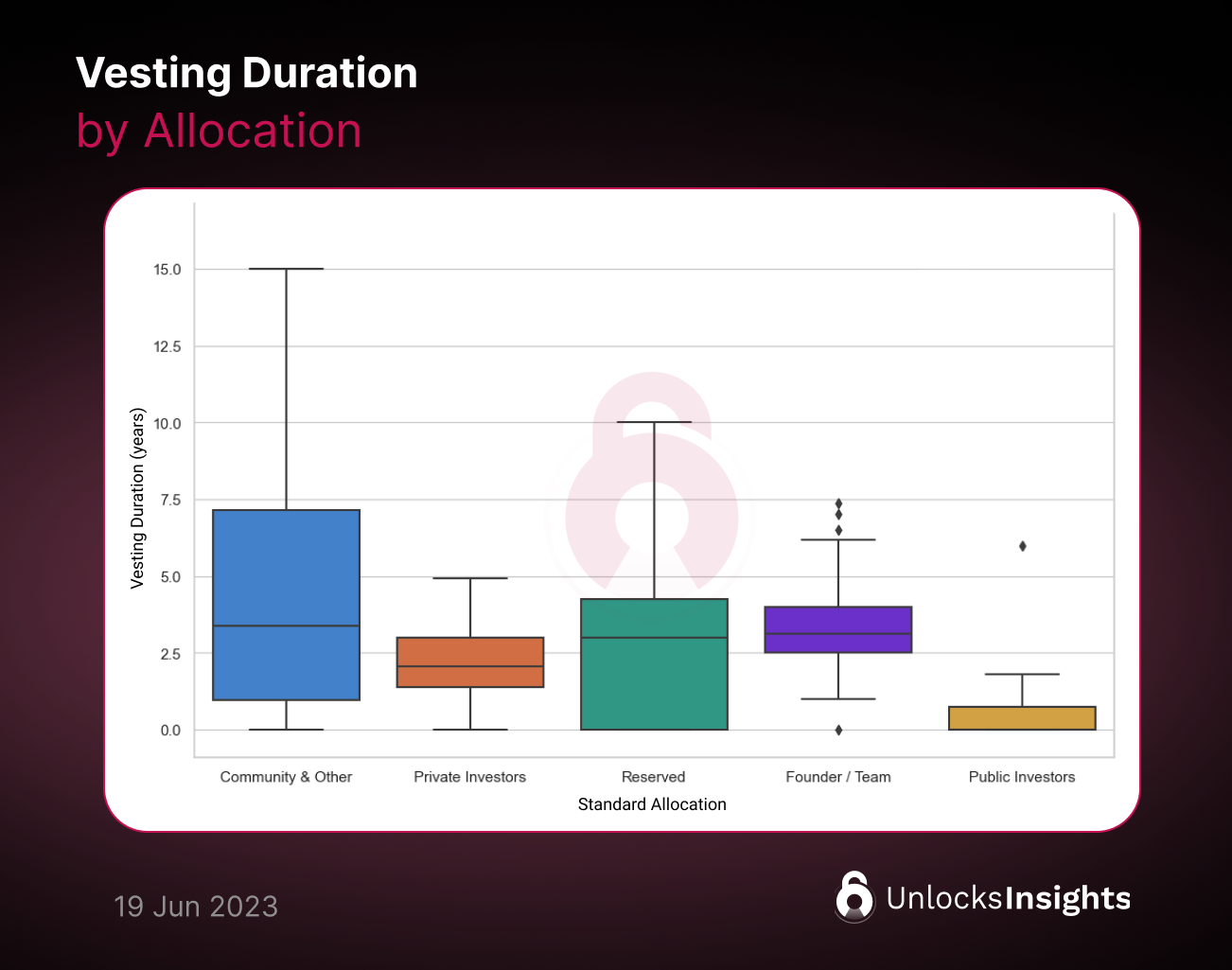

Here's an extra box plot chart for all you data enthusiasts out there, so you can see the distribution better.

How do each allocation vesting ?

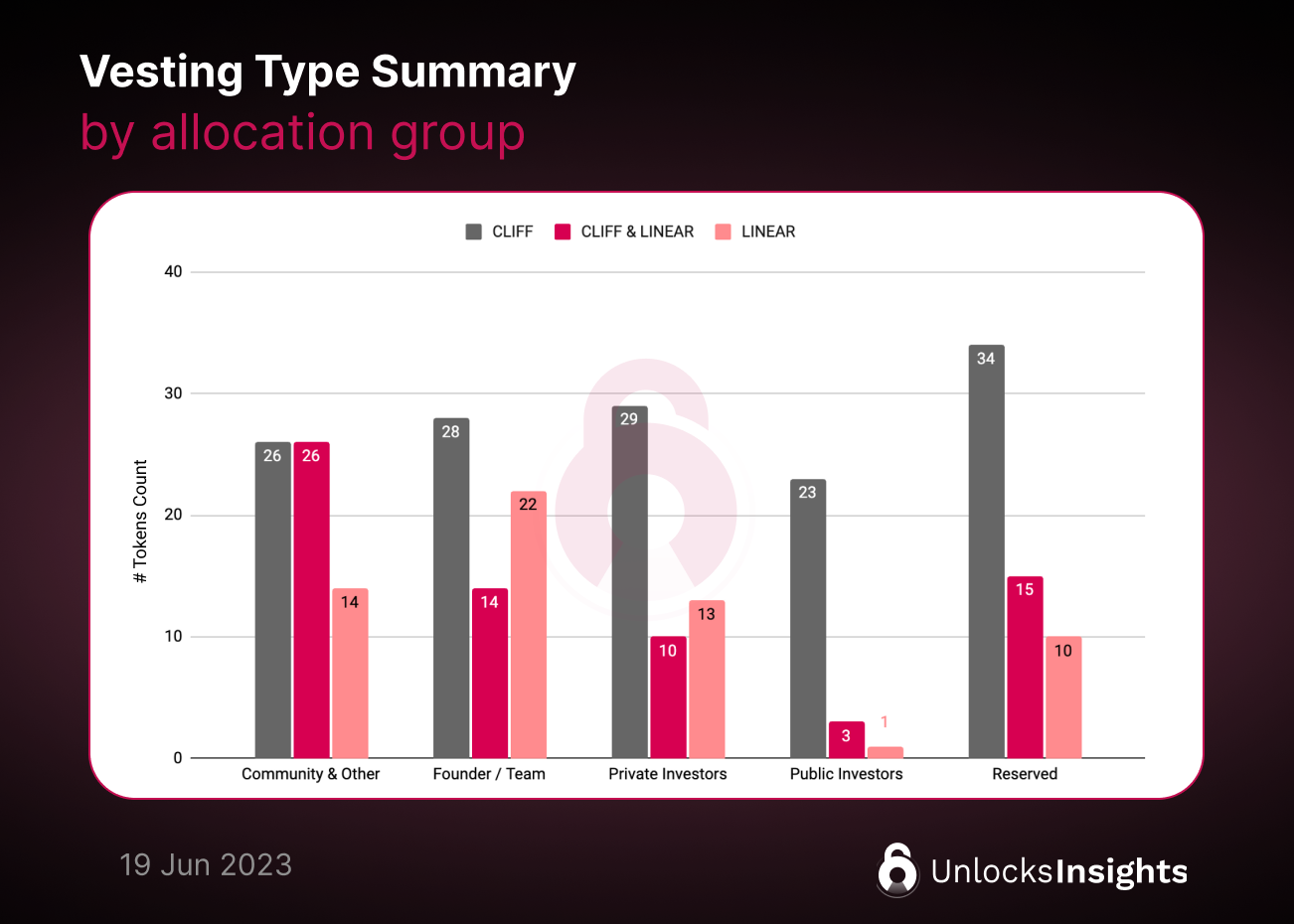

Founders and private investors often use linear vesting to mitigate selling pressure and recognize its advantages for long-term stability. Public investors, on the other hand, frequently prefer cliff vesting due to their shorter investment periods, catering to a more immediate return strategy.

The community's preference is somewhat a combination of cliff and hybrid (cliff + linear) vesting due to some projects combining many mechanics, such as airdrop, DAO, or staking.

The public investor get the least vesting duration (not more than 1 year). This can imply that the public investors is the for short term investors.

Contradict with the vesting duration of private investors which tends to increase over year since 2019 from 1 year to 4 years as this long term investors need to stay with the projects in order to indirectly increase the project’s activity as they might not satisfy if the token price is going down which same as the Founder/Team and Reserved part that need to stick with the projects.

Worth noting that the vesting duration for community part tends to decrease over year since 2020.

📊 Token Allocation - Large vs. Small Market Cap Token

The CoinMarketCap rank is a widely used way of ranking cryptocurrency projects based on their market capitalization. This is calculated by Token Price * Circulating Supply. The highest valued projects are ranked at the top. This method is popular because it allows for quick and easy comparison of different projects' size and popularity, and helps investors identify up-and-coming projects with high potential returns.

In this section, we will separate the cryptocurrencies with a large market cap, identified as the top 200 on CoinMarketCap ranking, from those with rank below 200, which we will refer to as small market cap tokens.

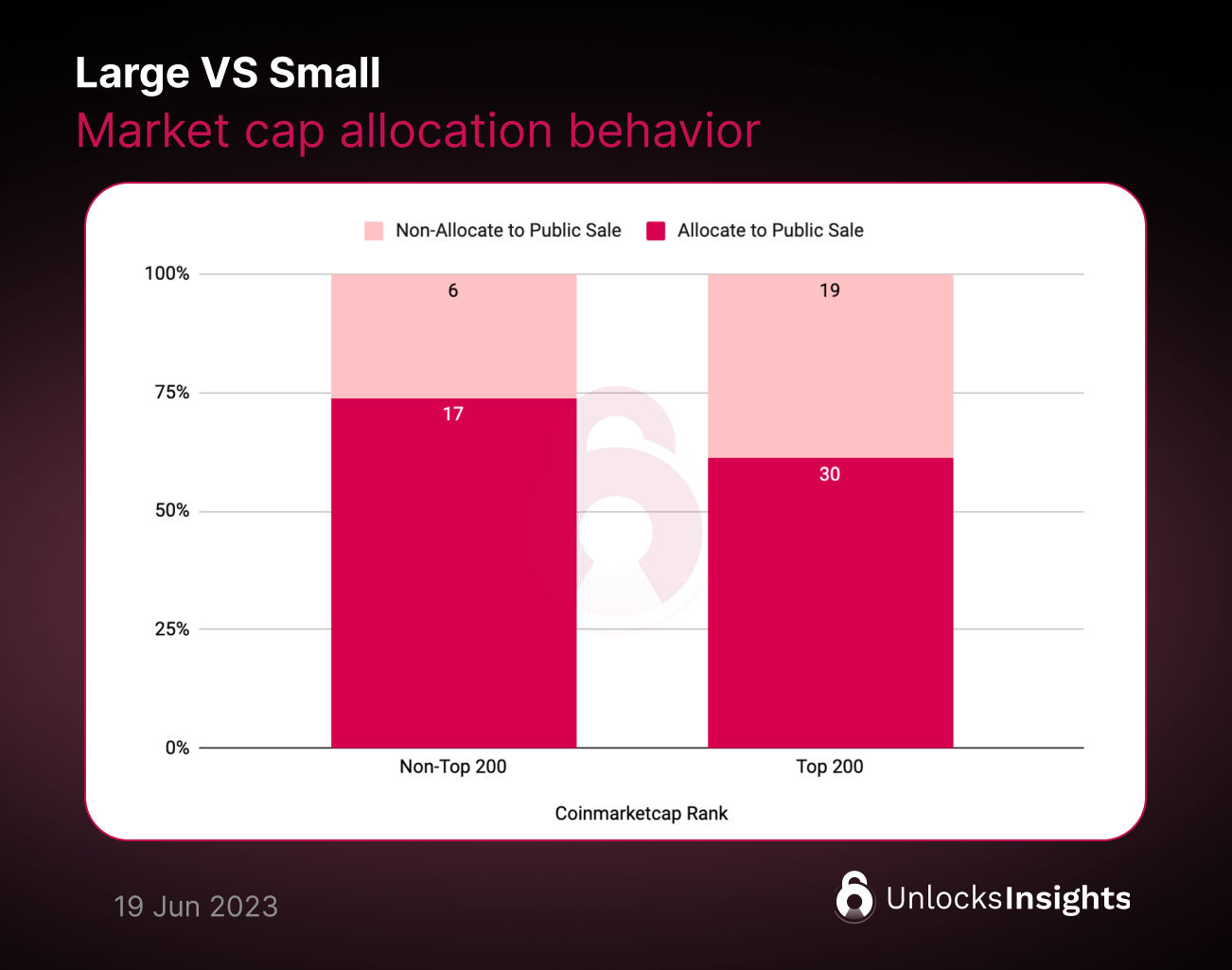

Only 28 out of 72 tokens are allocated to Public Investors lets deep down what’s going on.

Approximately 74% of small market caps tokens allocate to Public Investors, whereas only 61% of large market caps tokens allocate to Public Investors.

We speculate this could be due to large market cap projects often have established funding channels (institutional investors, venture capitalists, etc.), reducing reliance on public sales. Additionally, when a project becomes more mature, it may rely less on public funding. This can help keep the price stable since public sales may cause price changes from mass sell-offs after an initial coin offering (ICO). A more controlled distribution of tokens among fewer holders, accomplished through private sales, is often the preferred method.

Moreover, many of the tokens with huge market caps focus on building strong communities and robust ecosystems in their early phases. Examples include Uniswap, Optimism, and Arbitrum. Airdrops have proven to be effective for sustained success, as shown by Uniswap's $UNI distribution of 15% of the maximum supply for an early airdrop. In Uniswap's case, they airdropped tokens to 250k addresses of early platform users, sparking global interest and growth. This generated significant attention and media exposure, bringing more people to their platform. At the time of the airdrop, Uniswap had already supported over $20B in traded volume, and the airdrop further spurred this growth.

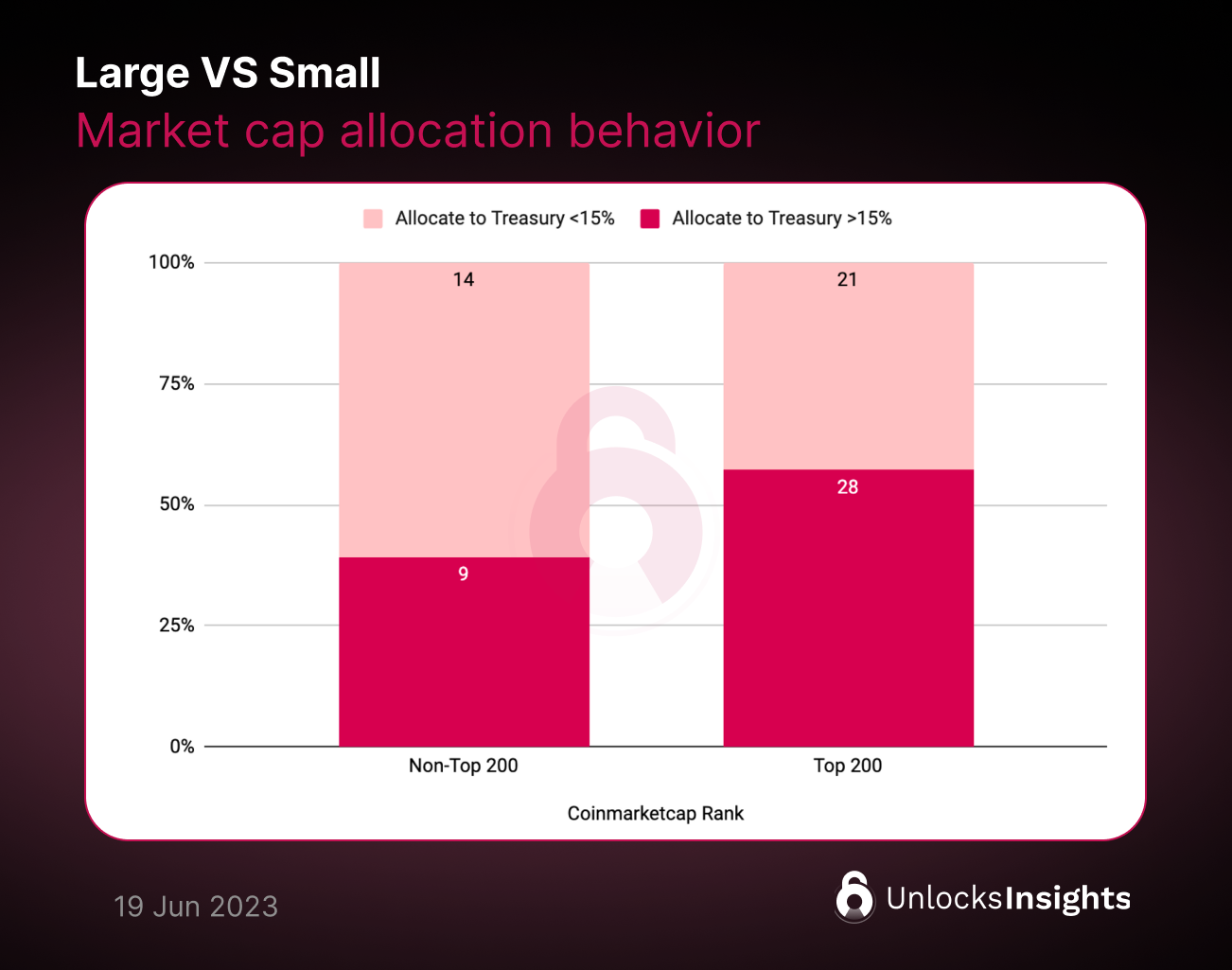

When we look at tokens with small and large market caps and set a 15% threshold for Reserves allocation, we see that 39% of smaller tokens put more than 15% of their token into Reserves or Treasury, while 57% of larger tokens do the same.

Large market cap tokens often allocate more tokens to their foundation or treasury to support sustainable development and ensure long-term viability. Meanwhile, smaller projects may allocate more tokens to public sales to attract initial investors, or allocate tokens to the community to gain more users. These smaller market caps may not yet have the same scale of long-term plans as large projects.

Conclusion: Harmonizing Tokenomics through the TokenUnlocks' Standard Allocation

Understanding token allocation can be difficult due to the lack of consistent documentation, standard terminology, and transparent data. These issues make it hard to gain deeper insights and make meaningful comparisons. Additionally, some projects, like CRV, have combined allocations for VC and the team, making it unclear what percentage is being distributed to each.

It is also complicated by the fact that different projects categorize token allocation differently. What one project considers a 'contributor' might be a salaried position with full ownership, while another may view them as volunteers.

To address these challenges, we have created the TokenUnlocks' Standard Allocation framework. Our goal is to bring consistency and standardization to the industry, which is often fragmented in terms of data, documentation, and methodologies. By adopting the TokenUnlocks Standard Allocation, we can collectively build a transparent and comparable foundation in token economics. This not only facilitates insightful analysis but also cultivates a best practice approach to token allocation, effectively paving the way for a more synchronized crypto industry.

TLDR;

- Token Allocation shows the longer term stability, its act as incentive alignment for different stakeholder of the projects.

- In 2022-2023, most of the tokens (37%) are given to the community. After that, they are saved in the treasury (27%), given to the founder/core team (20%), to private investors (16%), and to public investors (4.6%).

- During 2020 - 2022 amount allocated to the community went up to 45-49%.

- In 2023, shows public investors allocation decrease to 5% from 35% in 2018.

- Big market cap tokens allocate token fewer tokens to public sales (61%) compared to small market cap tokens (74%).

- Big market cap tokens get funding through means other than public sales, and save more tokens in their foundation or treasury to ensure their longevity. Smaller projects may allocate more tokens to public sales to attract investors, or distribute tokens to the community to increase their user base.

- TokenUnlocks has developed the Standard Allocation framework to address the problem of inconsistency. This framework promotes consistency and standardization in the industry and encourages best practices for token allocation.

If you love TokenUnlocks be sure to check out this blog and be the first to Unlocks new product alpha 👇

Standard allocations are exclusively available to TokenUnlocks Pro users.

Be a pro before anyone else!

>> Subscribe to TokenUnlocks Pro now <<

Reference:

- Token Allocation and Unlocks data from TokenUnlocks team

- Marketcap rank data by https://coinmarketcap.com/

- Optimizing Your Token Distribution : https://lstephanian.mirror.xyz/kB9Jz_5joqbY0ePO8rU1NNDKhiqvzU6OWyYsbSA-Kcc

- Token Vesting and Allocations Industry Benchmarks : https://www.liquifi.finance/post/token-vesting-and-allocation-benchmarks

- Why 90% of ICO token failed : https://enterpriseriskmag.com/2019/02/why-90-of-initial-coin-offerings-icos-security-token-offerings-stos-fail-and-much-of-the-rest-may-follow/

- A short history from token airdrops : https://blog.weatherxm.com/a-short-history-of-token-airdrops-8e58c0af9a9c#:~:text=The first airdrop in crypto,amount doubled to 636 coins