Understanding Pendle Finance: Yield Management and Optimization

What’s Pendle Finance (briefly!)

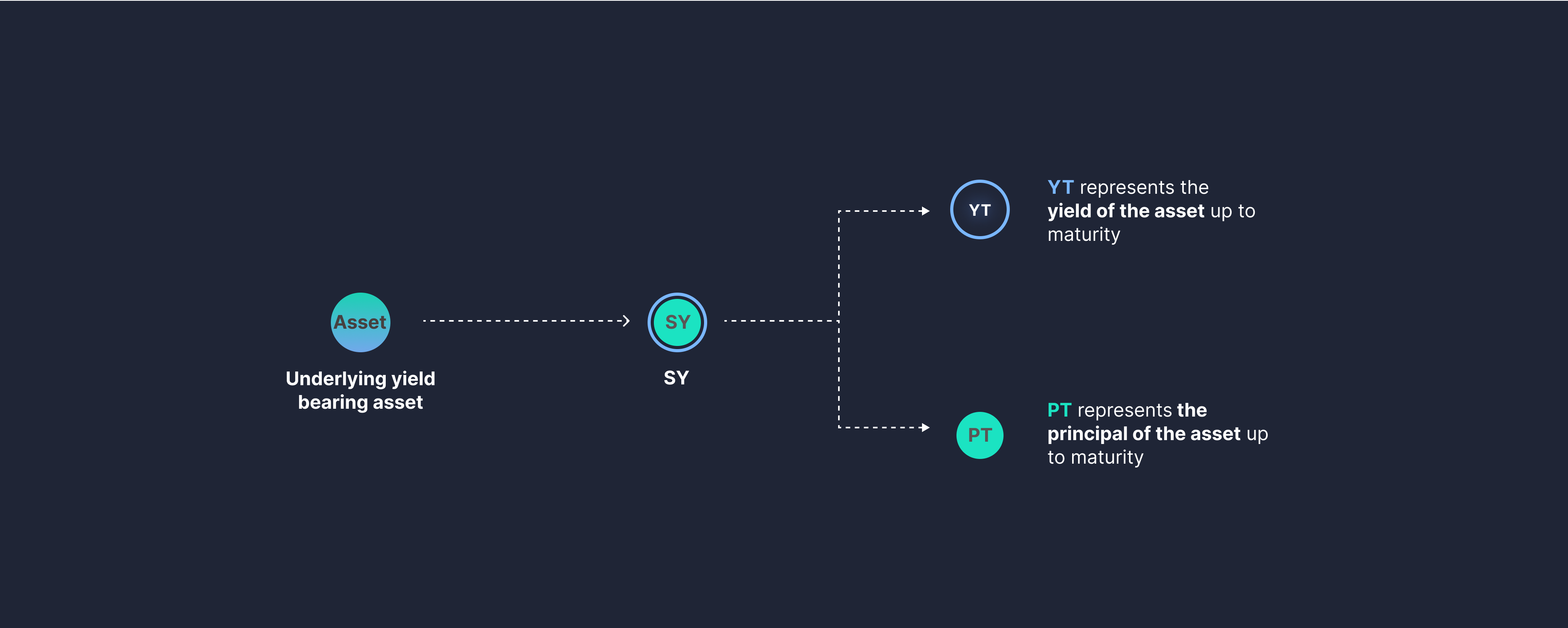

Pendle is a decentralized protocol focused on yield management and optimization. It tokenizes yield-bearing assets into standardized yield tokens (SY), which split into principal tokens (PT) and yield tokens (YT). These tokens are tradable on Pendle's AMM, allowing for various yield strategies, such as fixed yield, leveraged yield, and risk-free liquidity provision.

Pendle Mechanism

The fundamental equation of Pendle's platform is SY = YT + PT. Yield Tokens (YT) depreciate over time, eventually becoming worthless at maturity. This depreciation causes the price of Principal Tokens (PT) to appreciate over time, assuming the value of the Standardized Yield Token (SY) remains constant.

When the price of Yield Tokens (YT) is discounted (lower than the standard price), the price of Principal Tokens (PT) will be at a premium. Conversely, when the price of YT is higher, the price of PT will be lower.