Price Impact of Unlock by Project Types

Eager to understand the potential impact of upcoming unlocked events on token prices? Wondering which project types might wield a more significant influence on token prices? Gain insights into these questions with our analysis.

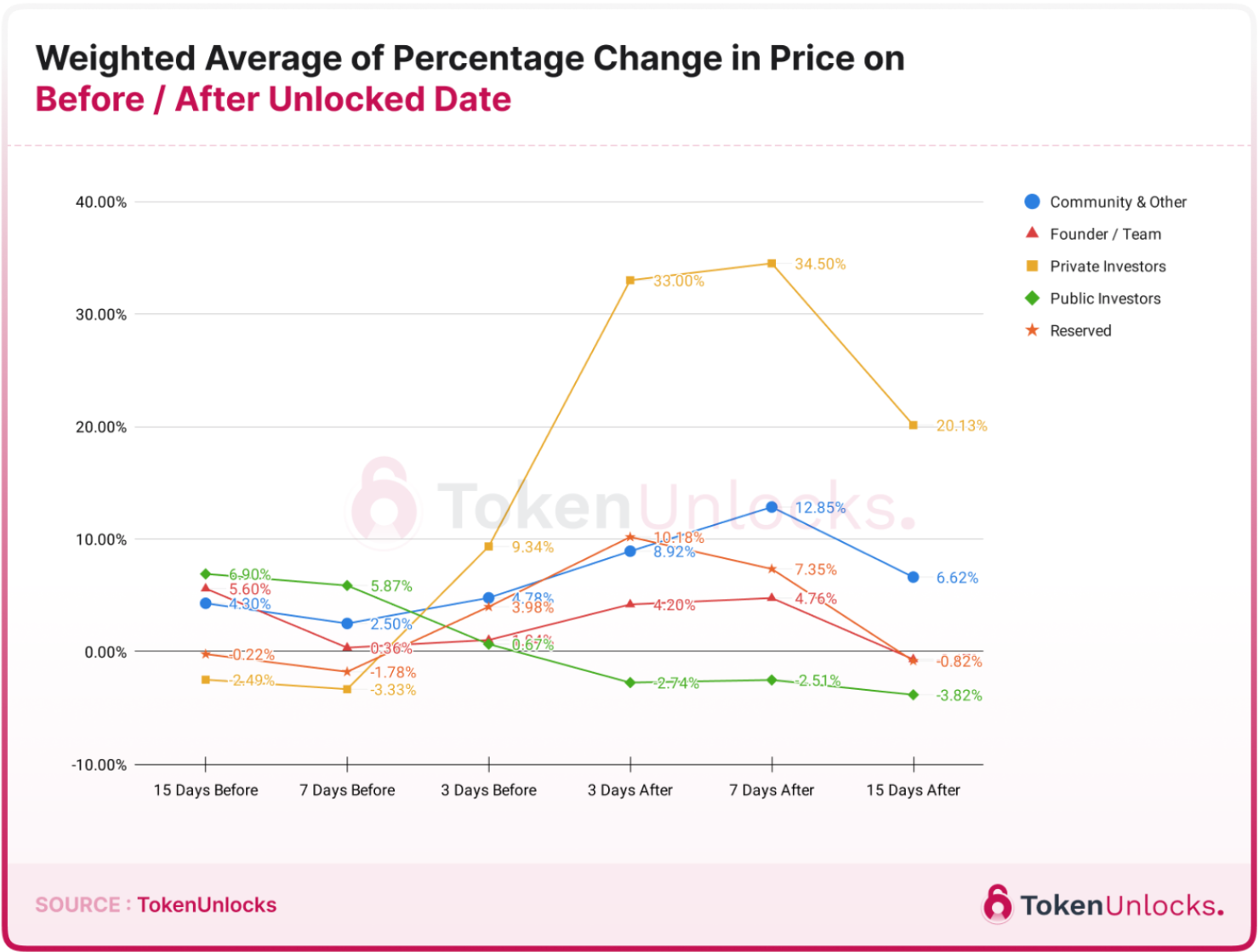

Price action on each token allocation

In our 2023 annual report, we've compiled data from nearly 600 cliff unlocks to assess the price impact on various token allocation types, categorized according to our standard allocation criteria.

Explore the derivation of Token Unlocks' standard allocation

Highlight from what we found

There is a common belief that the majority of cliff unlocks for private investors, such as VCs or angel investors, will lead to a price dump. However, our collected data reveals a different pattern, indicating that prices generally surged within the first 3 days after the cliff unlock. The upward trend persisted even after 7 days post-unlock before experiencing a slight decline to a positive change of around +20% after 15 days post-unlock.

Interesting to see more on what we found. Let’s have a look at our annual report.

Price action on each type of project

In addition to examining the price action of each token allocation, this analysis delves further into the price behavior of different types of projects. Utilizing data from the Token Unlocks database spanning from 2019 to early 2024, these projects are classified into six types: