Weekly Unlock Digest: Jan 19 - 25, 2026

This week’s report breaks down how improving macro sentiment is colliding with some of the largest token unlocks on the calendar. We cover $ZRO’s ongoing team unlock overhang, major upcoming cliff unlocks for $PLUME, and what their price action is signaling so far. We also dive into a bigger question: do buybacks actually offset aggressive emissions, or just delay the sell pressure?

Weekly Unlocks Recap

Markets moved higher over the week, with both BTC and ETH gaining around 5–6%. The rebound was driven by December Core CPI printing at 2.6% YoY, below market expectations. The softer inflation data was well received across both equities and crypto, reinforcing the view that the Fed is likely to keep policy rates steady in the near term.

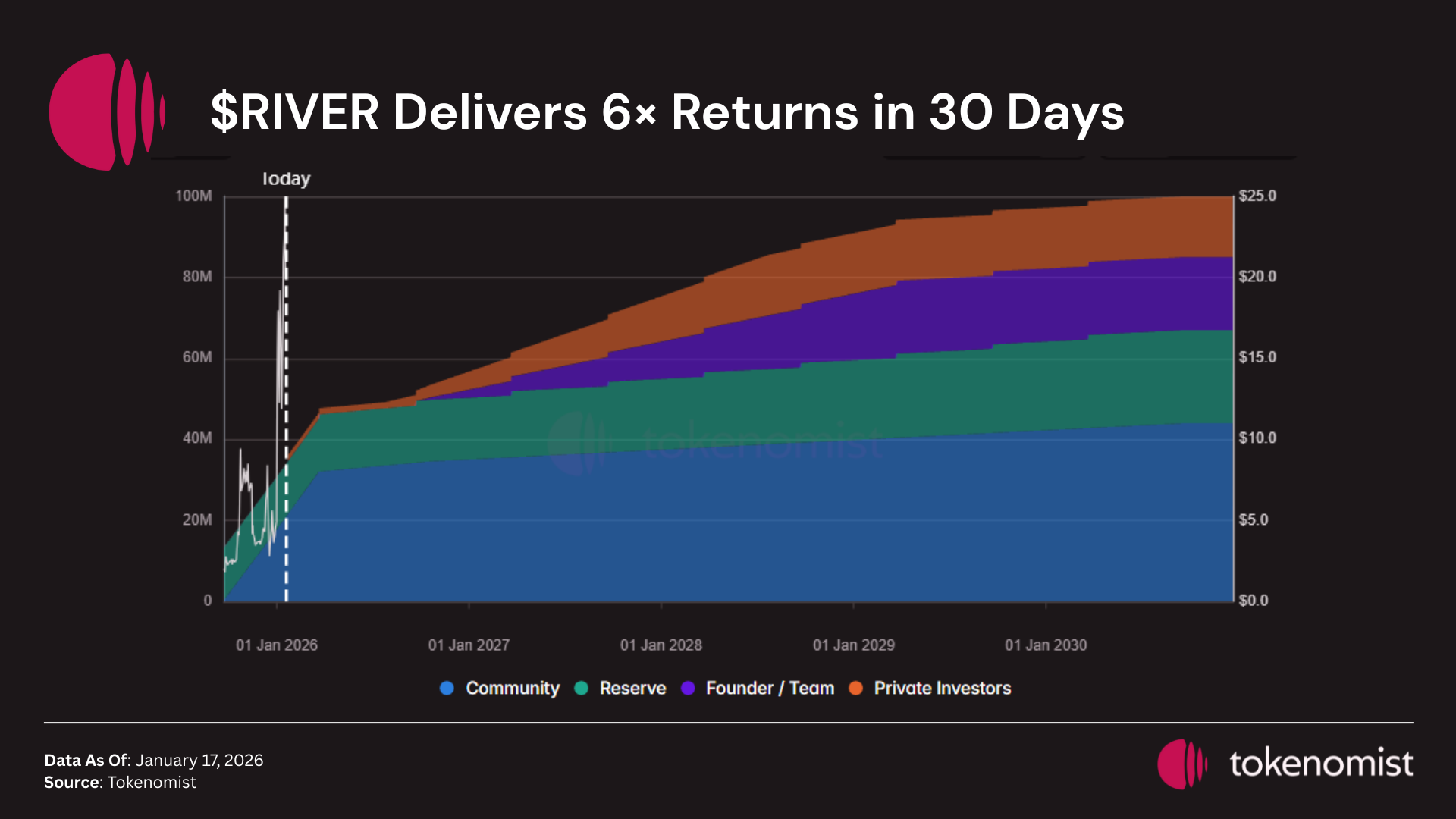

This improvement in risk sentiment significantly muted the impact of token unlocks. Tokens with the highest supply growth over the past 30 days still posted positive returns, with $RIVER standing out despite having the largest emission increase. However, on-chain data from Bubblemaps shows that the top five addresses control over 96% of total supply. Combined with its early-stage nature and low float, price action remains highly susceptible to manipulation — a risk traders should approach with caution.

Upcoming Events

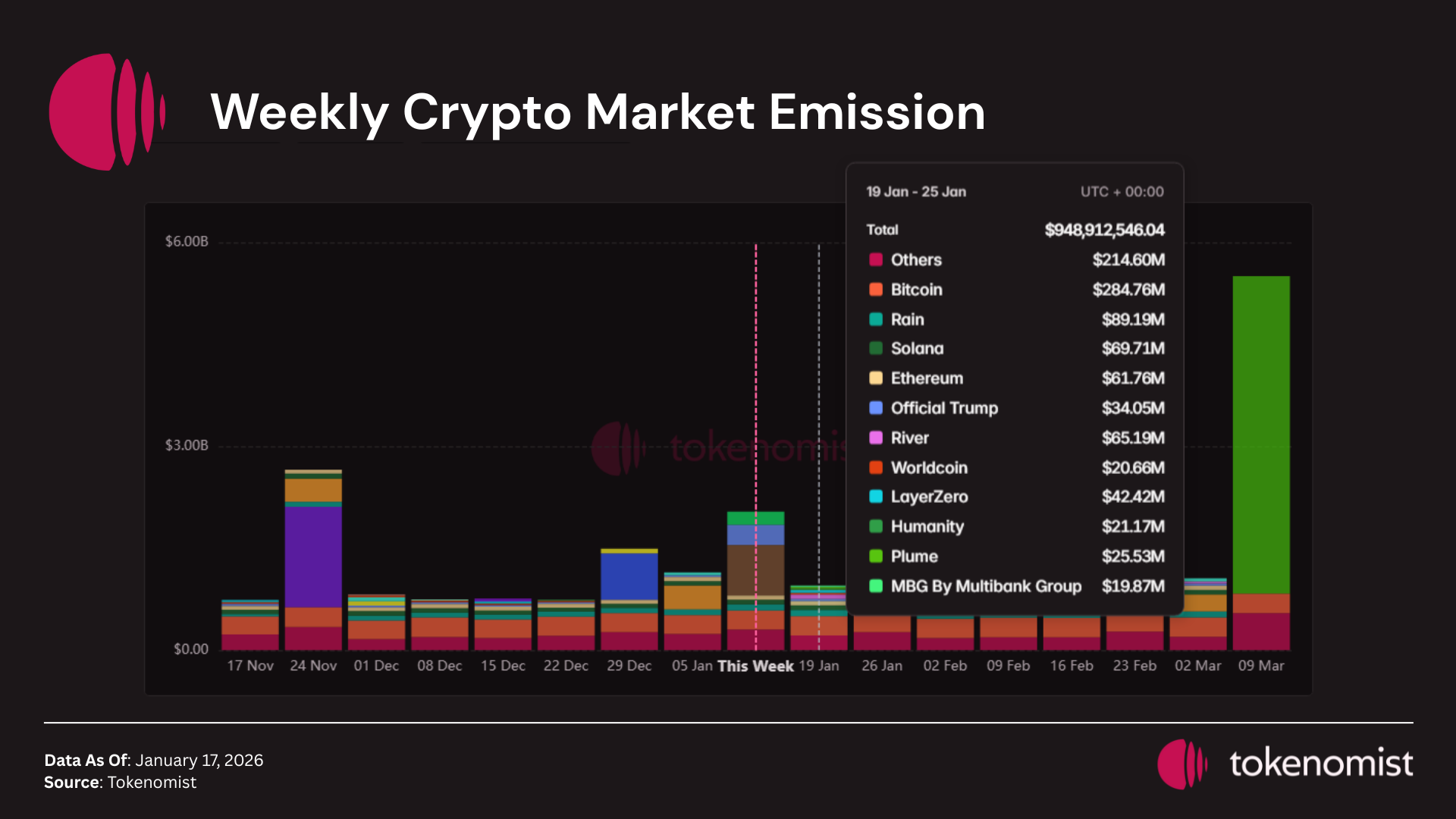

Next week’s scheduled token releases are set to exceed $940 Million in total value. Notable tokens facing sizable releases by dollar value include $BTC, $RAIN, $ETH, $RIVER, and $ZRO.

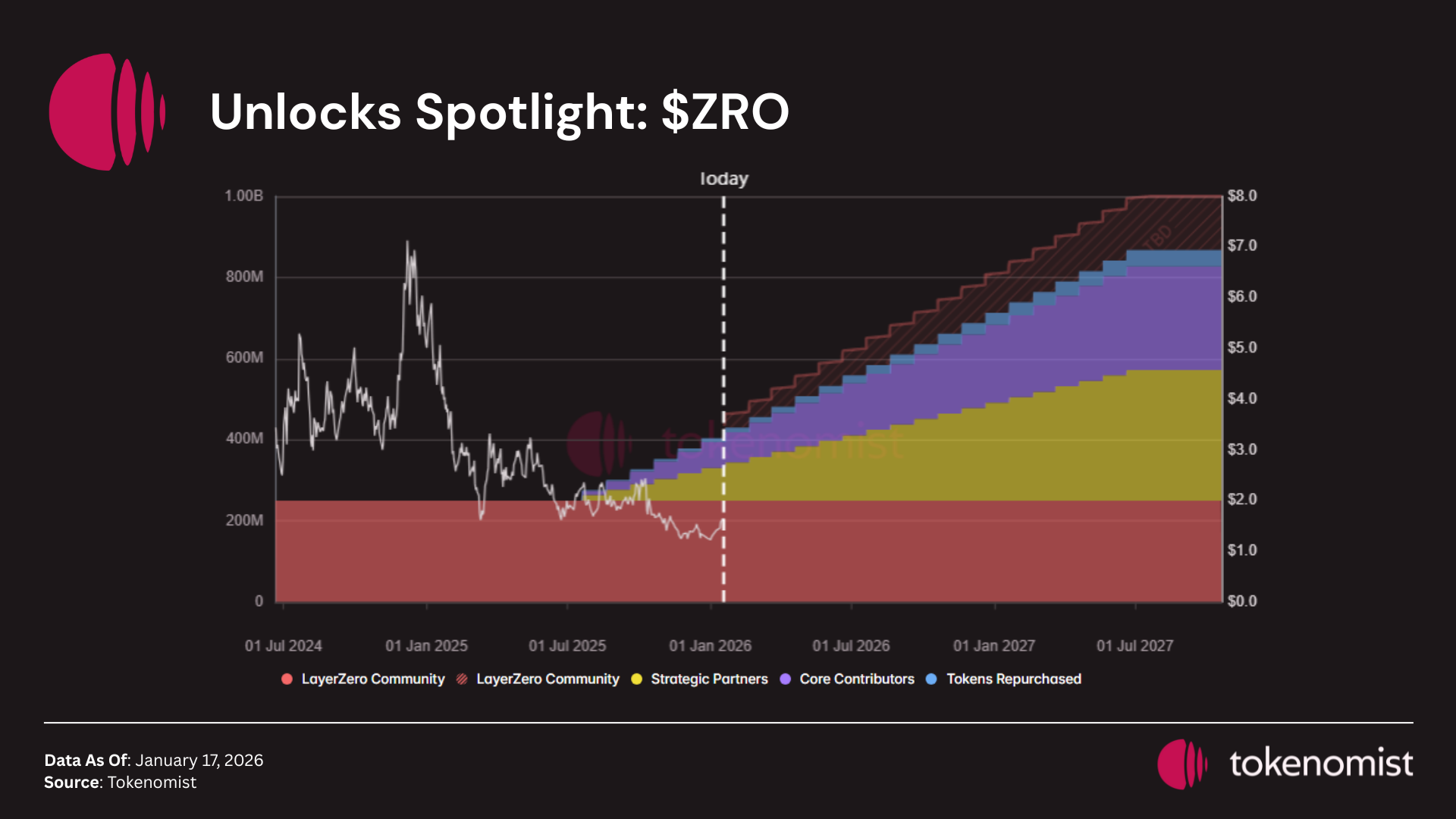

Unlocks Spotlight: $ZRO

- Unlock Date: January 20, 2026

- Amount: $ 42M

- Unlock as % of Circulating Supply: 6.36%

- Vested Allocations: Strategic Partners, Core Contributors, and Token Repurchased

$ZRO faces the largest unlock by dollar value next week, marking the start of a two-year continuous vesting cycle primarily allocated to insiders.

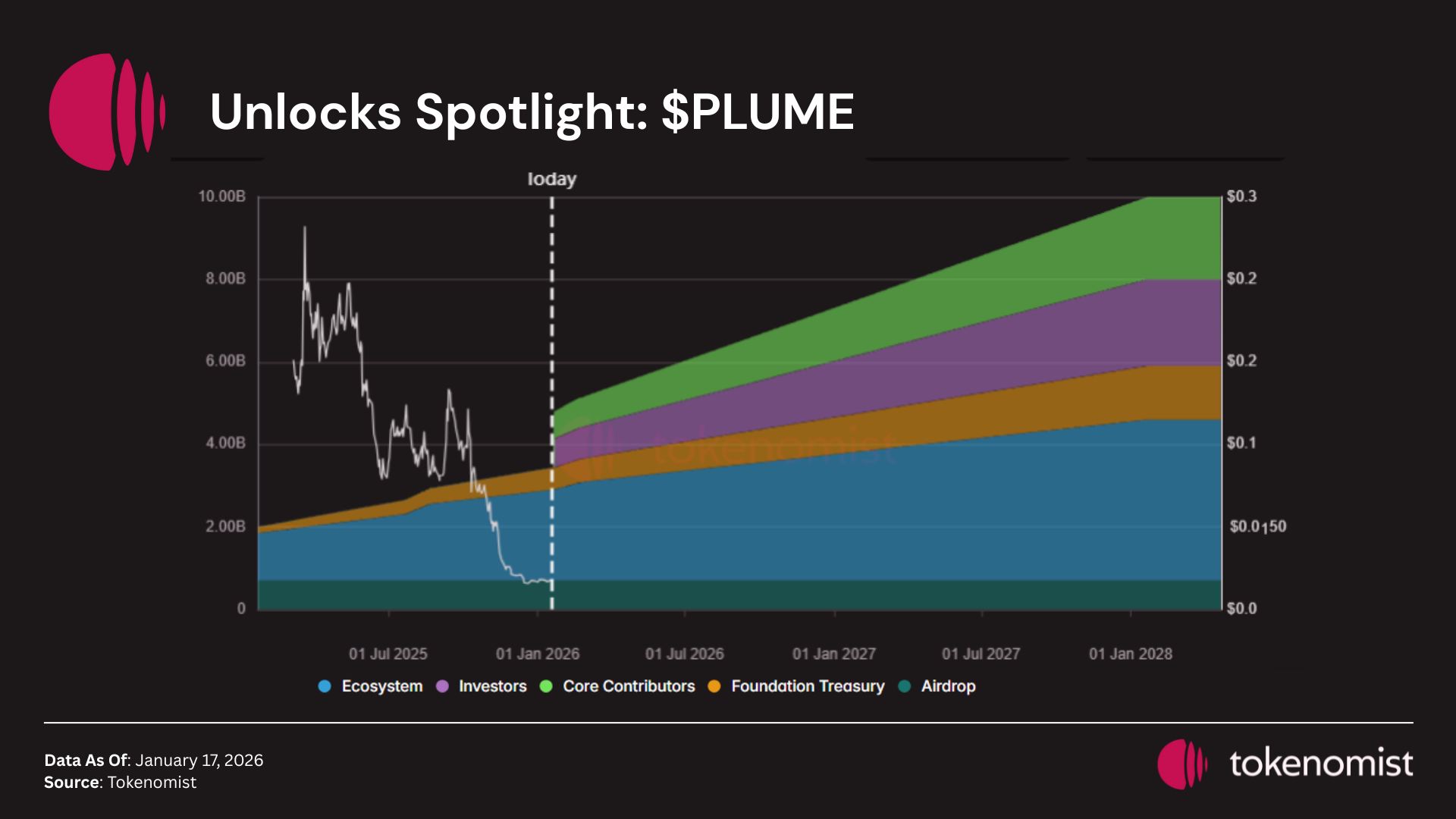

Unlocks Spotlight: $PLUME

- Unlock Date: January , 2026

- Amount: $ 24M

- Unlock as % of Circulating Supply: 39.75%

- Vested Allocations: Investors and Core Contributors

$PLUME records the highest unlock as a percentage of circulating supply, with all vested tokens going to insider cohorts.

Price action reflects the pressure. $ZRO is down −50.9%, while $PLUME has collapsed −88.5% since TGE, mirroring a broader altcoin trend where much of the upside was captured during private rounds at elevated valuations. Post-TGE, limited value accrues to retail as supply steadily unlocks.

Looking ahead, both tokens are set to release over 100% of their current circulating supply over the next year, with the majority of these emissions allocated to insider cohorts. This structure has become increasingly common among recent token launches, reinforcing why tokenomics design and unlock schedules remain some of the most critical risk factors for investors.

In response to growing concerns around dilution, a number of projects have recently introduced buyback and burn mechanisms. But the key question remains: Is buyback truly a holy grail for token price support?

Is Buyback a Holy Grail?

Research from Artemis suggests that buybacks are most effective only after a project has achieved clear product–market fit. In traditional markets, companies typically reinvest early revenues into growth and market expansion, with stock buybacks reserved for later stages once cash flows are stable and growth opportunities begin to normalize.

In contrast, many crypto projects deploy buyback mechanisms far earlier in their lifecycle, often before establishing sustainable user demand or recurring revenue. When the underlying narrative fades and users migrate elsewhere, revenues decline — leaving little capacity for continued buybacks.

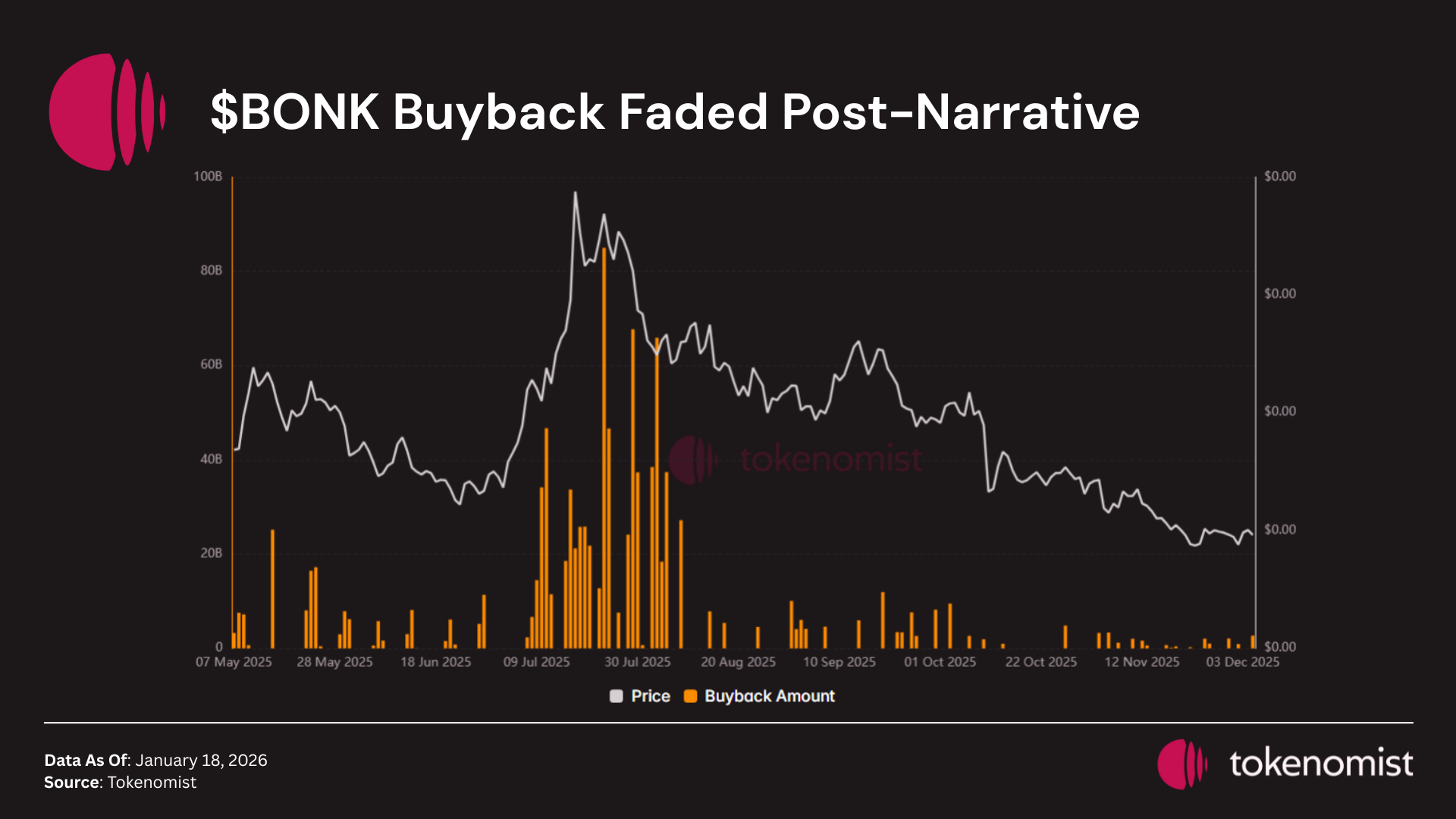

This dynamic can be illustrated through $BONK. The project implemented token buybacks and burns using protocol revenue during the peak adoption of LetsBonk.fun. This temporarily boosted demand, driving the token price up over 90% in July 2025 as buybacks intensified. However, once activity and narrative momentum cooled, revenue rapidly declined and the price followed shortly after.

The key weakness of buyback mechanisms in crypto is that they are flow-dependent, not structural. Buybacks rely on ongoing revenue generation, while token emissions are often fixed and non-negotiable.

When buybacks are smaller than scheduled emission, they fail to meaningfully alter the net supply trajectory. In these cases, buybacks function more as short-term demand injections rather than long-term supply reduction mechanisms.

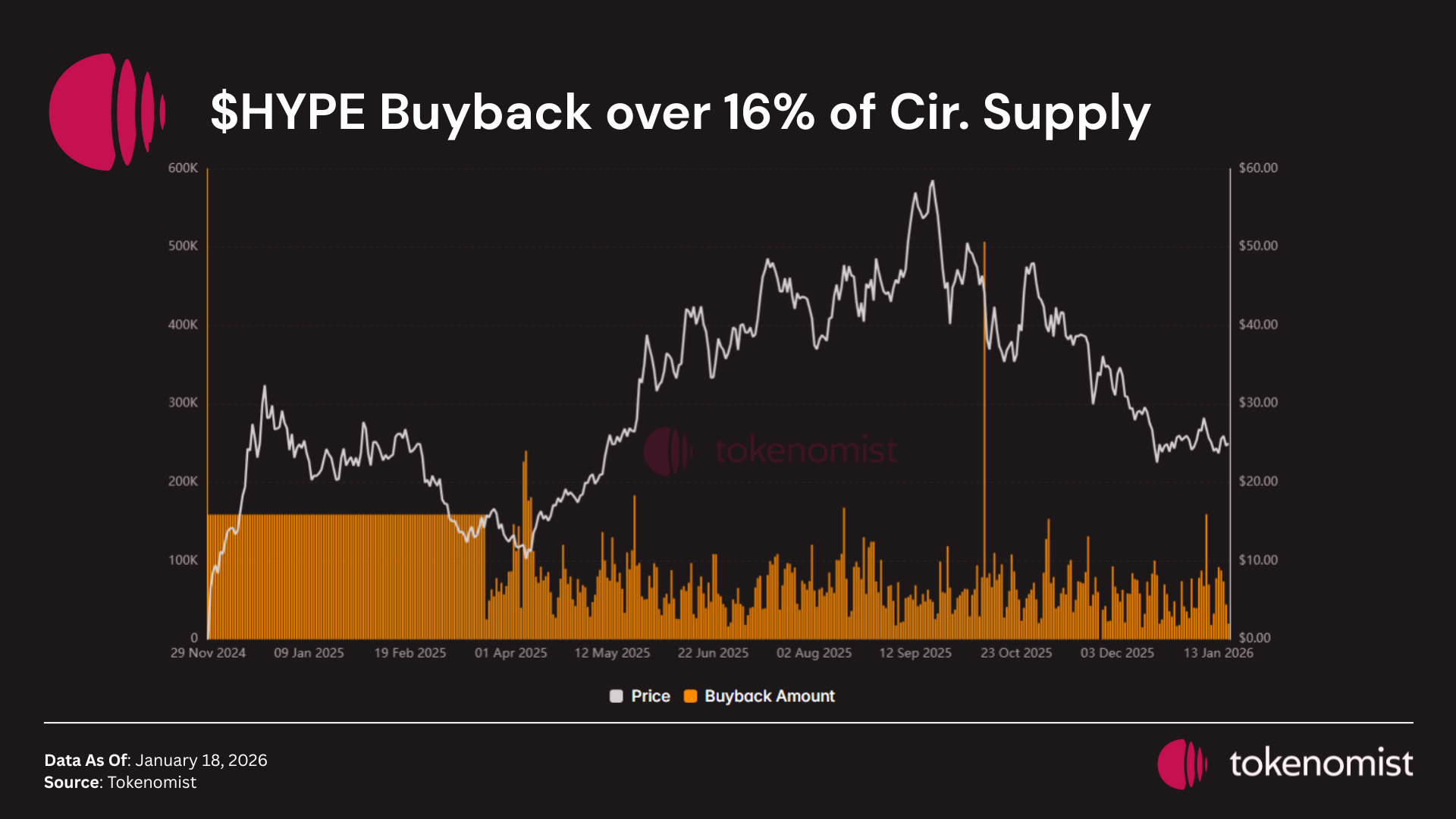

One of the clearest examples of buybacks being applied correctly is $HYPE. The protocol has already achieved strong product–market fit and continues to capture market share from centralized exchanges. More importantly, its revenue base is sustainable enough for buybacks to meaningfully offset emissions, rather than serving as a short-term price support mechanism.

Ultimately, buyback and burn mechanisms are not inherently ineffective, but they are often misapplied in crypto. Without sustainable cash flows and disciplined emission schedules, buybacks alone are unlikely to counteract dilution-driven downside — reinforcing why unlock analysis remains indispensable for investors navigating this cycle.