Weekly Unlock Digest: Nov 17–23,2025

This week’s report comes as crypto markets extended last week’s weakness. Bitcoin slipped below $94k, its lowest level since May, while heavy liquidations across majors added to the weakness. On the token side, we track $ZRO, this week’s largest unlock by dollar value, along with $YZY seeing outsized changes to circulating supply.

Weekly Unlocks Recap

BTC declined 12.3% over the past seven days, moving below the $94k level for the first time since May. Roughly $1.63B in liquidations followed across major pairs, with the move extending into ETH and other large-cap assets.

This week’s macro focus shifts to the FOMC minutes, updated U.S. housing data, and the release of the delayed September jobs report.

Narrative Watch: Buy-back programs remain in focus — projects such as UNI (Uniswap) and LDO (Lido) have fresh announcements.

WCT, SCR, OMNI, GRASS and MBG all posted strong 30-day supply growth. WCT saw the biggest jump, with circulating supply up 66% over the month. GRASS, SCR, OMNI and MBG each added 30–53% new supply, with prices generally weaker where issuance was highest.

Until overall market momentum recovers, these high-emission tokens may continue to trail the broader market.

Upcoming Events

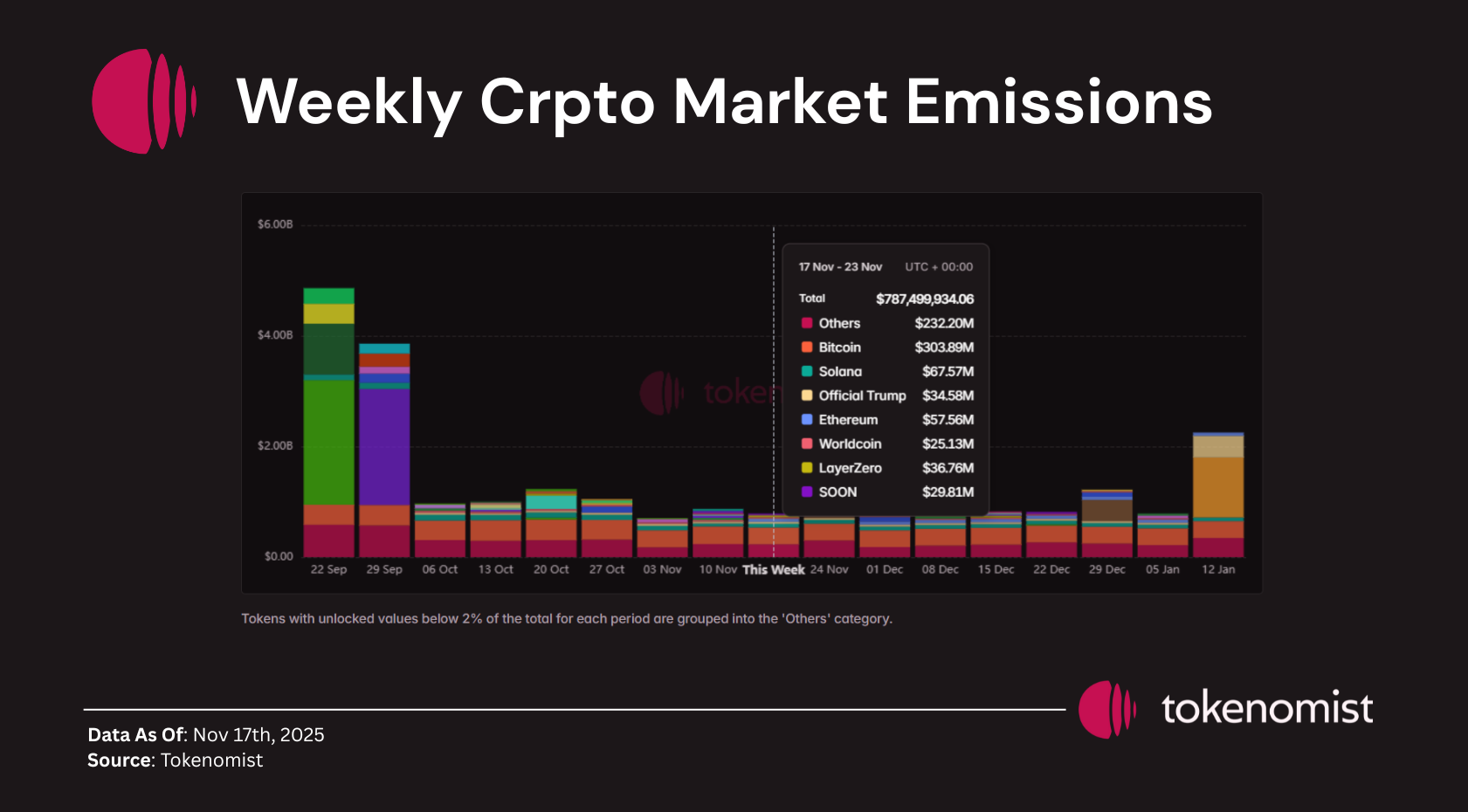

Next week’s scheduled token releases total ~$787M, with notable unlocks across BTC, SOL, ETH, Official Trump, ZRO, and SOON. These assets account for most of the week’s unlock value, though actual price impact will vary depending on float size and liquidity depth.

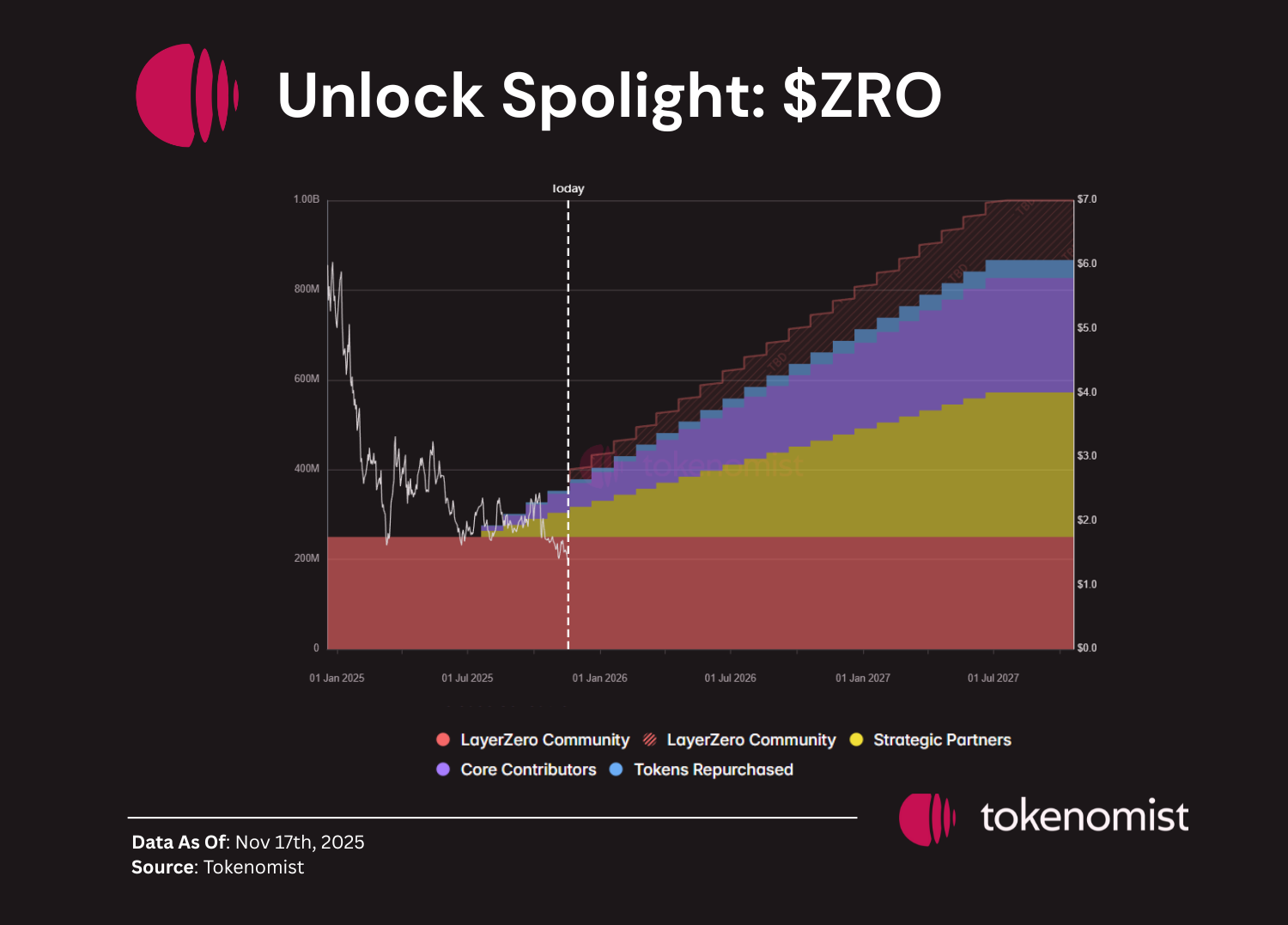

Unlocks Spotlight: $ZRO

- Unlock Date: Nov 20, 2025

- Amount: $35.7M

- Unlock as % of Circ. Supply: 7.3%

- Vested Allocations: Founders & Investors

$ZRO leads the week by unlock value. Most tokens are directed toward internal allocations, with founders and investors receiving the majority of released supply.

A large portion of $ZRO’s supply remains locked under a multi-year vesting schedule, with founder and investor allocations releasing gradually through 2027. This week’s unlock increases circulating supply by 7.3%, but the broader schedule follows a tapered emission curve

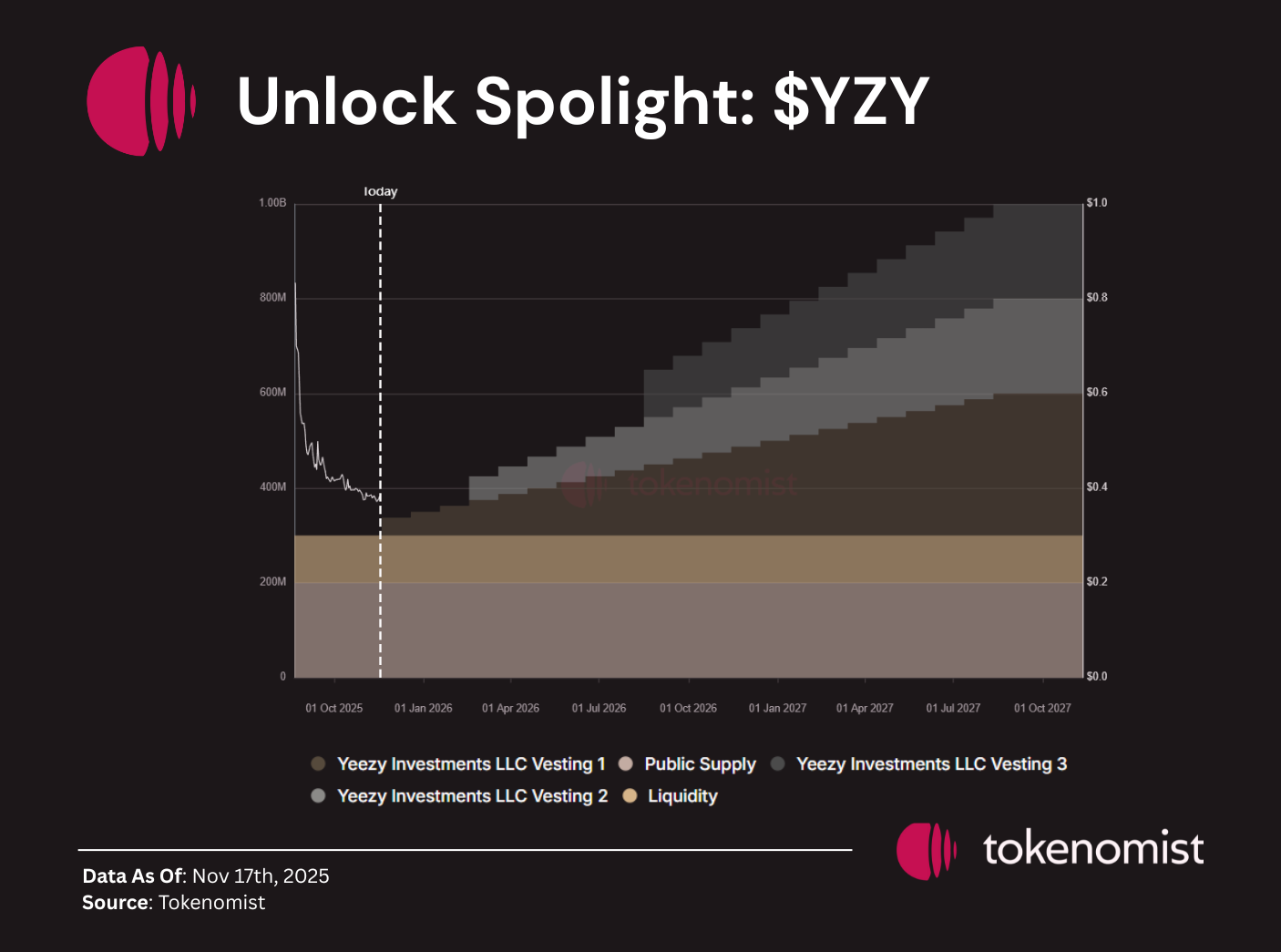

Unlocks Spotlight: $YZY

- Unlock Date: Nov 19, 2025

- Amount: $15M

- Unlock as % of Circ. Supply: 12.5%

- Allocations: Yeezy Investments (Investors)

$YZY records the largest insider unlock share this week, with the entire release allocated to investors. The unlock also represents the highest float expansion relative to current supply among tracked tokens.

This marks the first cliff unlock for investor allocations. While over 70% of supply remains locked, additional investor-side tokens are scheduled to release through monthly unlocks in the coming months.

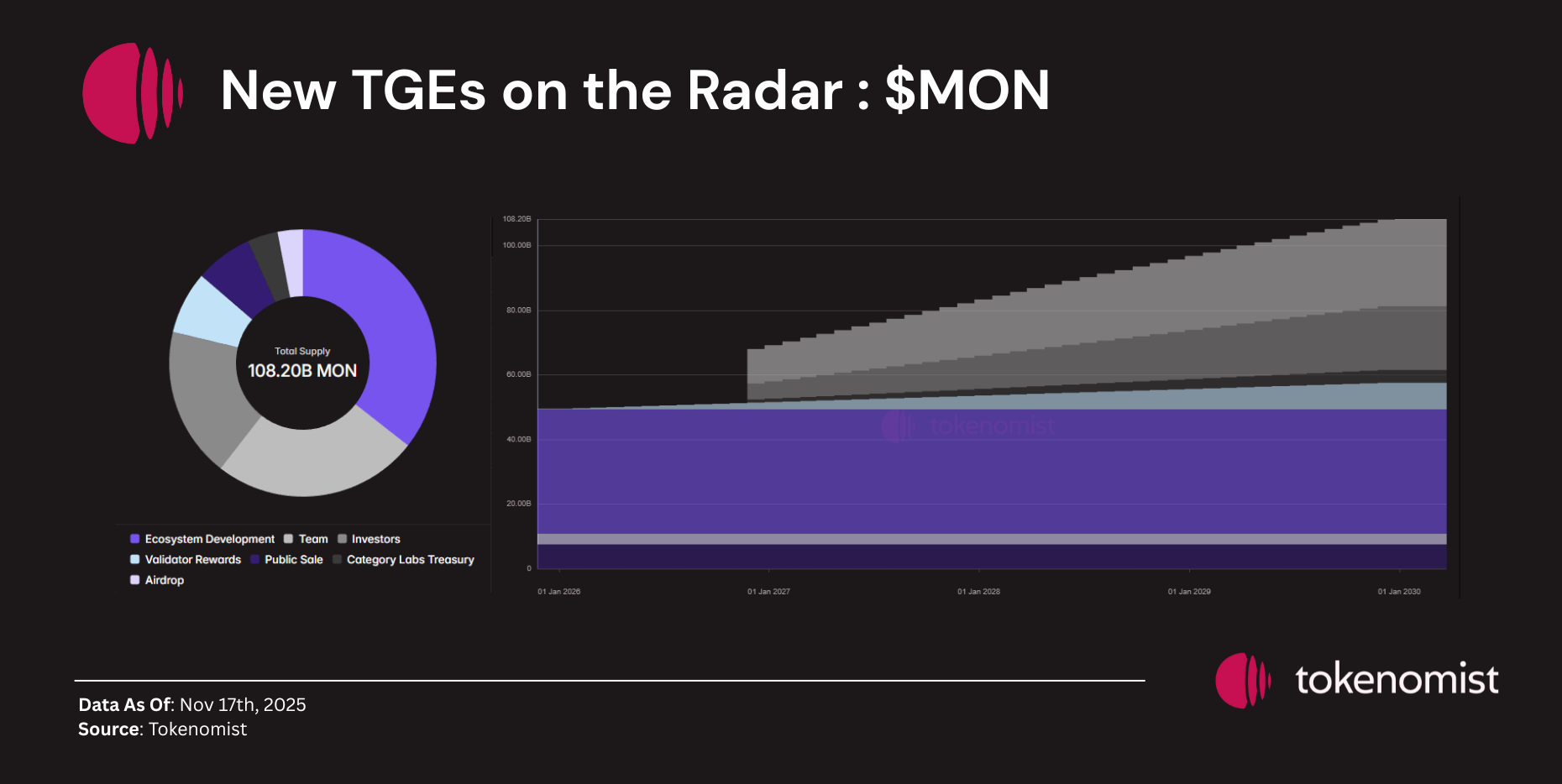

New TGEs on the Radar

This week’s notable TGE is $MON, the native token of Monad — a high performance Layer 1 focused on EVM compatibility and parallel execution. Monad aims to scale Ethereum-style applications with higher throughput and faster finality using its pipelined execution design.

Coinbase opened the public sale for Monad (MON), running from Nov 17–22. The sale offers 7.5B MON (7.5% of the 100B initial supply) at a fixed price of $0.025.

Key points:

- Fixed price with a clear FDV — no auction mechanics.

- Allocation model favors smaller orders to reduce whale dominance.

- Sale closes on Nov 22, with TGE + mainnet on Nov 24, creating a tight transition.

Monad is built by Category Labs and has raised ~$225M from major investors including Paradigm, Dragonfly, Electric Capital, and Castle Island, signaling strong institutional backing.

Tokenomics: $MON

Ecosystem: 35.6% (100% unlocked at TGE)

Public Sale: 6.9% (100% unlocked at TGE)

Airdrop: 3% (100% unlocked at TGE)

Team: 25%

Investors: 18.2%

Validator Rewards: 7.6%

Category Labs Treasury: 3.7%

Notable Crypto News

- Harvard endowment takes a rare step into Bitcoin with a ~$443M allocation via BlackRock’s IBIT. (https://www.coindesk.com/markets/2025/11/15/harvard-endowment-takes-rare-leap-into-bitcoin-with-usd443m-bet-on-blackrock-s-ibit)

- Alibaba to use JPMorgan’s blockchain for tokenised USD and EUR transfers.

- Strategy adds another 8,178 BTC (~$835.6M), bringing holdings to ~649,870 BTC. ( https://cointelegraph.com/news/strategy-bitcoin-buy-purchase-november)

- a16z highlights arcade tokens as a key building block in crypto’s next evolution. ( https://a16zcrypto.com/posts/article/arcade-tokens/)

- Tether explores a €1B funding deal with AI robotics startup Neura. (https://x.com/fttechnews/status/1989397237919539521)

Multicoin Capital invested in $ENA ( https://multicoin.capital/2025/11/13/ethena-synthetic-dollars-challenge-stablecoins-duopoly/)