Weekly Unlock Digest: Dec 1 – 7, 2025

This week’s report lands as crypto markets continue to face renewed volatility. BTC slipped 1.2% over the past seven days, with total liquidations climbing to ~$2.83B as traders positioned ahead of December’s macro catalysts. On the token side, we track $ENA, this week’s largest unlock by value, and $SPEC, which posted the highest jump in circulating supply.

Weekly Unlocks Recap

BTC dipped 1.2% this week as markets braced for the Fed Interest Rate Decision, FOMC projections, and FOMC minutes, with rate-cut odds for December now sitting near ~71%. Volatility remained elevated, contributing to roughly $2.83B in liquidations across major pairs.

On the token side, two key events stand out:

• $ENA leads this week by unlock value with its Dec 2 release.

• $SPEC prints the largest relative increase in circulating supply at 10.1%, driven by team, investor, and community allocations.

Narrative Watch: ASTER S4 buybacks begin Dec 10, and MegaETH mainnet is expected to go live in early December.

• WCT, OMNI, USUAL, RIVER, and STBL lead 30D supply growth, each posting 20–65% increases, largely driven by vesting rollouts rather than organic activity.

• Price performance across these names remains deeply negative, reflecting unlock-led dilution rather than demand growth.

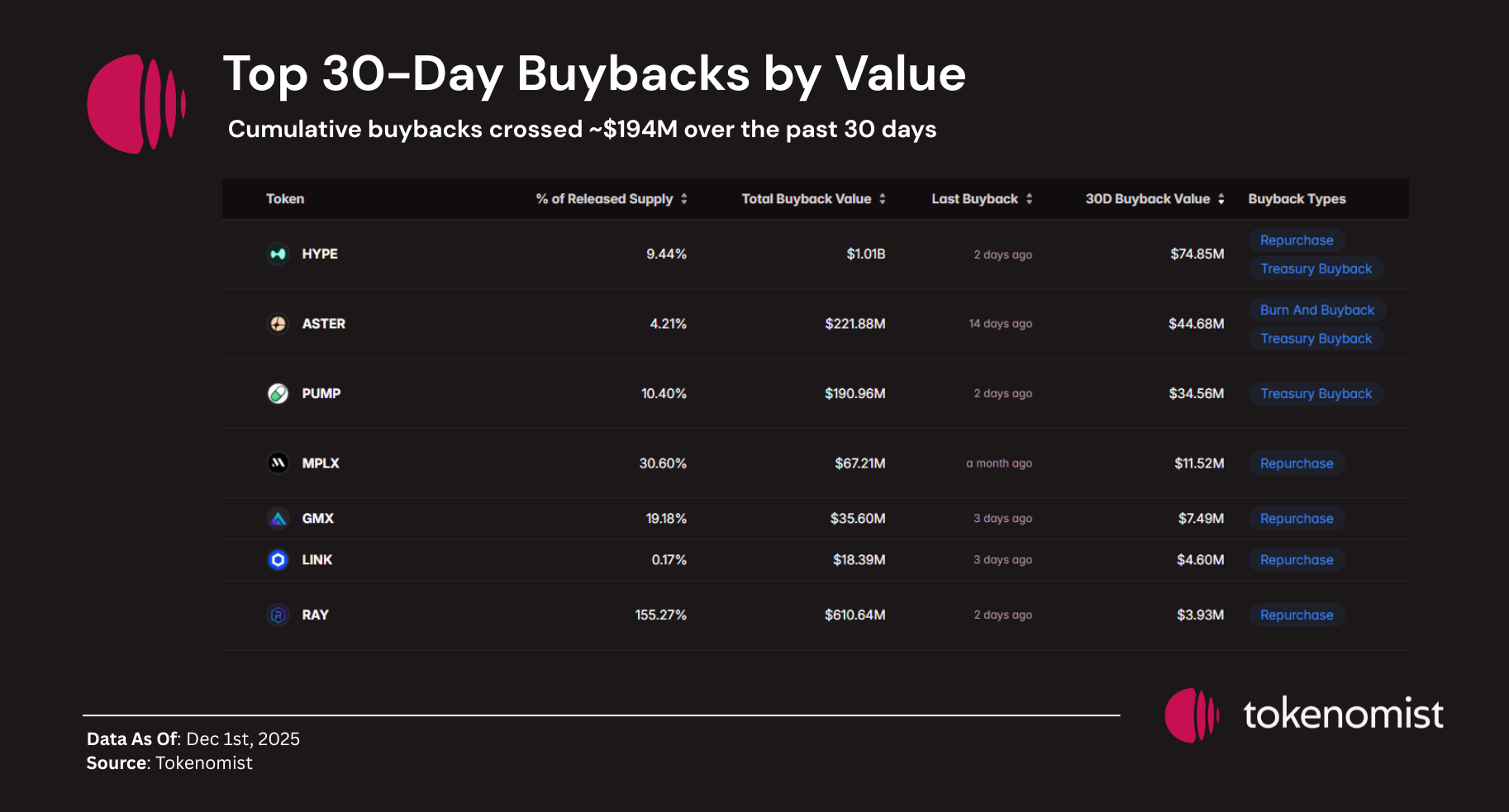

Top 30D Buybacks

Cumulative 30D buyback activity surpassed $194M across major tokens.

• HYPE, PUMP, and ASTER dominate 30-day repurchases, with cumulative activity driven by protocol revenue and treasury-funded programs.

• HYPE alone accounts for $74.85M in 30D buybacks — the highest among all tracked assets.

• MPLX, GMX, LINK, and RAY continue steady repurchase patterns, though at smaller scales.

Upcoming Events

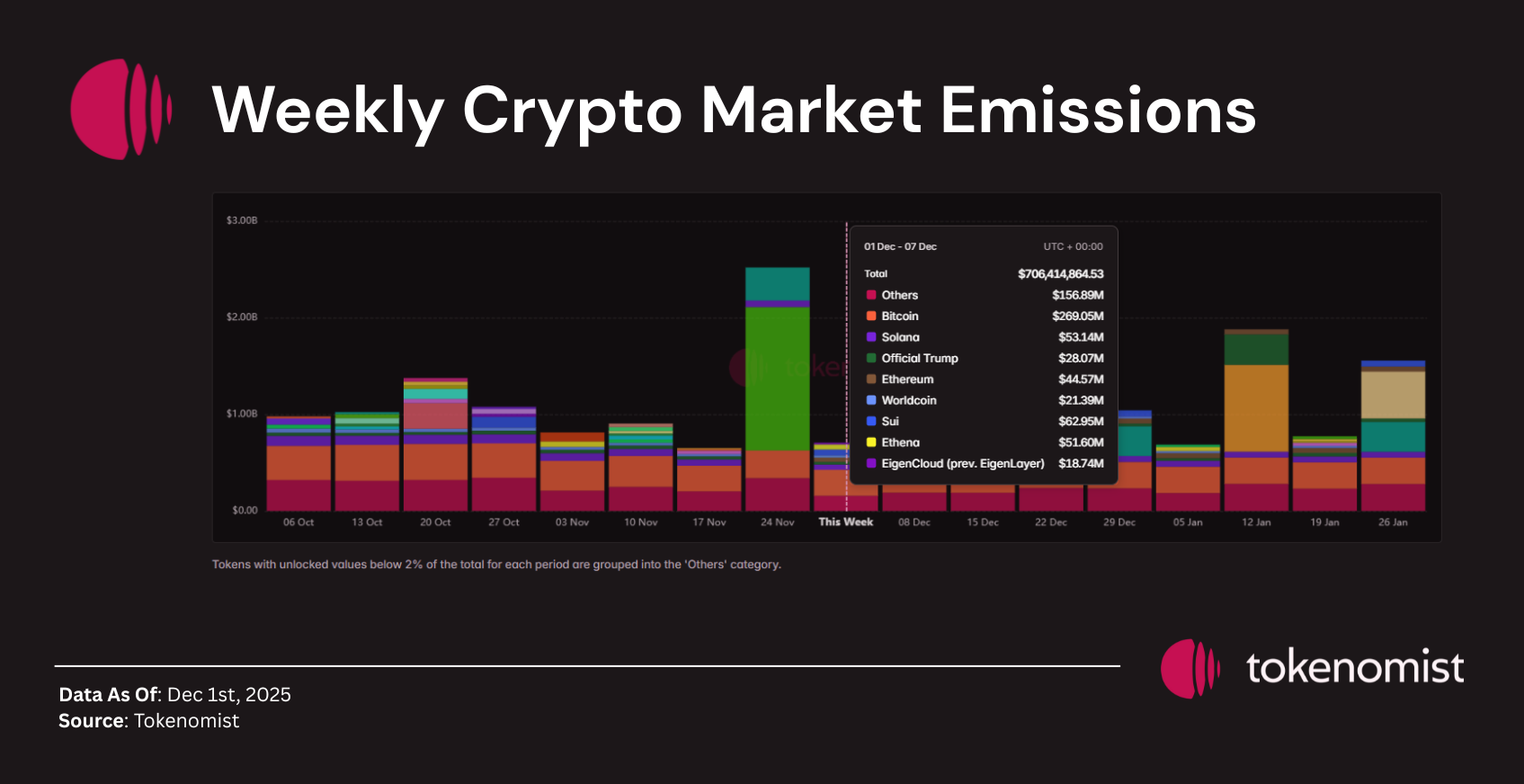

This week’s scheduled unlocks total ~$706M, sharply lower than last week’s $2.5B — marking one of the steepest week-over-week declines in Q4 2025.

Unlock contributions are distributed across majors like BTC, SOL, ETH, and SUI, with no outsized single-week catalysts. Most activity remains fragmented across mid-caps.

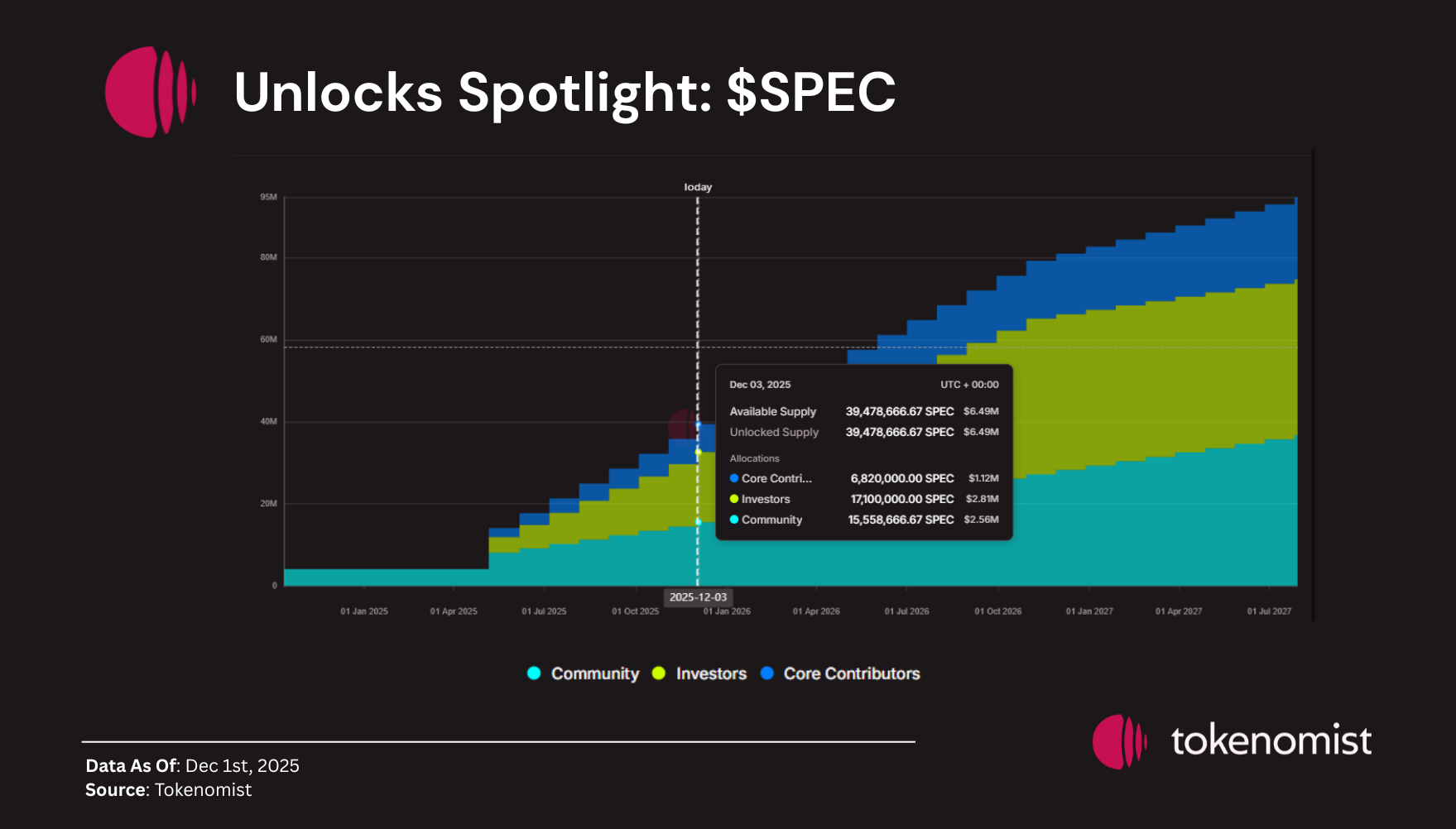

Unlocks Spotlight: $SPEC

- Unlock Date: Dec 3, 2025

- Amount: $593K

- Unlock % of Circulating Supply: 10.10%

- Allocations: Core Contributors, Investors, Community

$SPEC records the largest unlock relative to circulating supply this week, with a meaningful portion tied to team and investor allocations, increasing short-term dilution risk.

Full Dashboard : https://tokenomist.ai/spectral

A sizable portion of $SPEC’s supply remains locked under a multi-year schedule, with team and investor allocations set to vest gradually over time. This week’s 10.10% unlock marks a sharp step-up in circulating supply, though the broader emission curve remains controlled.

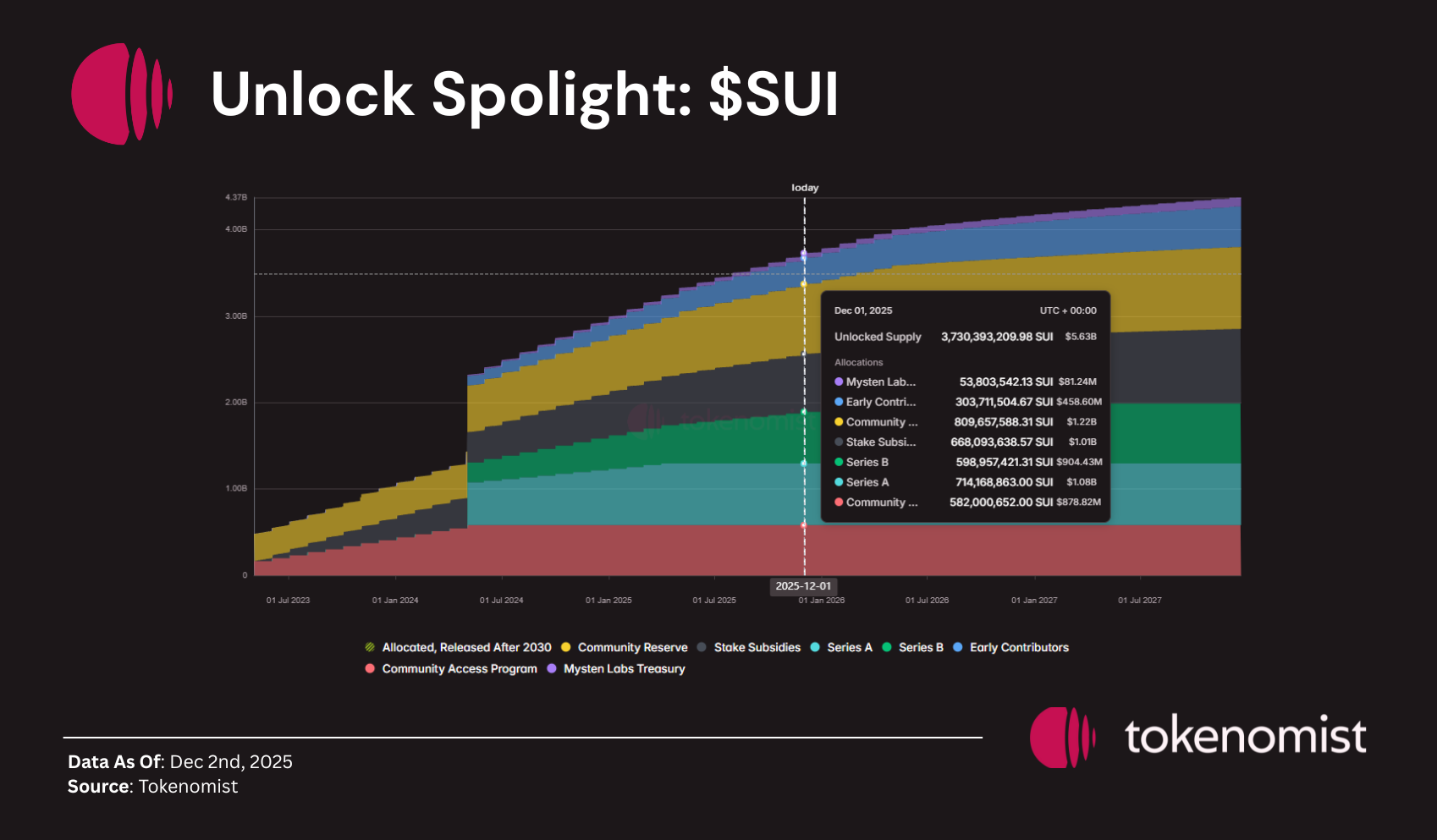

Unlocks Spotlight: $SUI

- Unlock Date: Dec 1, 2025

- Amount: $66M

- Unlock % of Circulating Supply: 1.2%

- Allocations: Investors, Team & Reserves

$SUI leads the week by unlock value. Most tokens are directed toward internal foundation & Investor allocations.

Full Dashboard : https://tokenomist.ai/sui

Over 63% of $SUI supply remains locked across a multi-year roadmap. This week’s release adds only 1.2% to circulating supply, fitting within its steady, low-dilution pattern

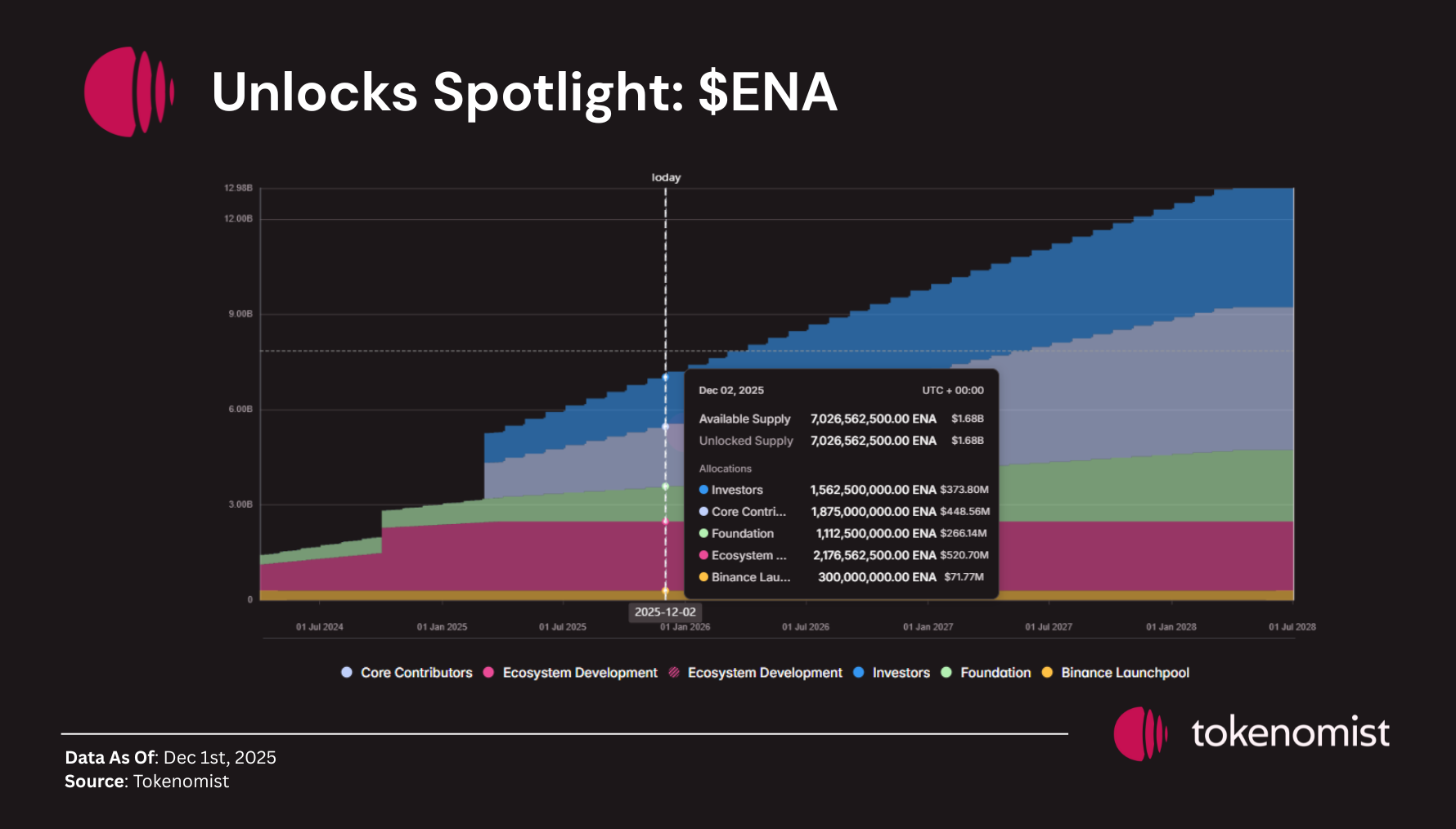

Unlocks Spotlight: $ENA

- Unlock Date: Dec 2, 2025

- Amount: $9.7M

- Unlock % of Circulating Supply: 0.58%

- Allocations: Foundation

$ENA leads the week by unlock value. Most tokens are directed toward internal foundation allocations, with contributors receiving the majority of released supply.

Full Dashboard : https://tokenomist.ai/ethena

$ENA’s supply remains locked across a multi-year roadmap, with foundation-controlled tokens unlocking progressively. This week’s release adds only 0.58% to circulating supply, fitting within its steady, low-dilution pattern.

Notable Crypto News

- Strategy Establishes $1.44B Cash Reserve, Slashes 2025 Profit ( https://www.coindesk.com/markets/2025/12/01/strategy-establishes-usd1-44b-cash-reserve-slashes-2025-profit-btc-yield-targets)

- Ethereum Developers Prep for Fusaka, Second Upgrade of 2025 ( https://www.coindesk.com/tech/2025/11/26/ethereum-developers-prep-for-fusaka-second-upgrade-of-2025 )

- Japan to Cut Crypto Tax Burden to 20% Uniform Rate in Boost for Local Bitcoin Traders ( https://www.coindesk.com/markets/2025/12/01/japan-to-cut-crypto-tax-burden-to-20-uniform-rate-in-boost-for-local-bitcoin-traders )