Weekly Unlock Digest: Sep 1-7, 2025

The crypto market stayed range-bound this week, with ETH and BTC giving back brief post-Jackson Hole gains. Altcoins showed little strength, and sentiment remains cautious. In this week’s report, we highlight $ENA’s insider-heavy unlock, $SPEC’s high-percentage release amid AI weakness, and and new token launch like $WLFI.

Weekly Unlocks Recap

The crypto market closed slightly down this week. Ethereum briefly hit a new all-time high after Jerome Powell’s dovish remarks at Jackson Hole, but both ETH and BTC have since retraced back to pre-meeting levels.

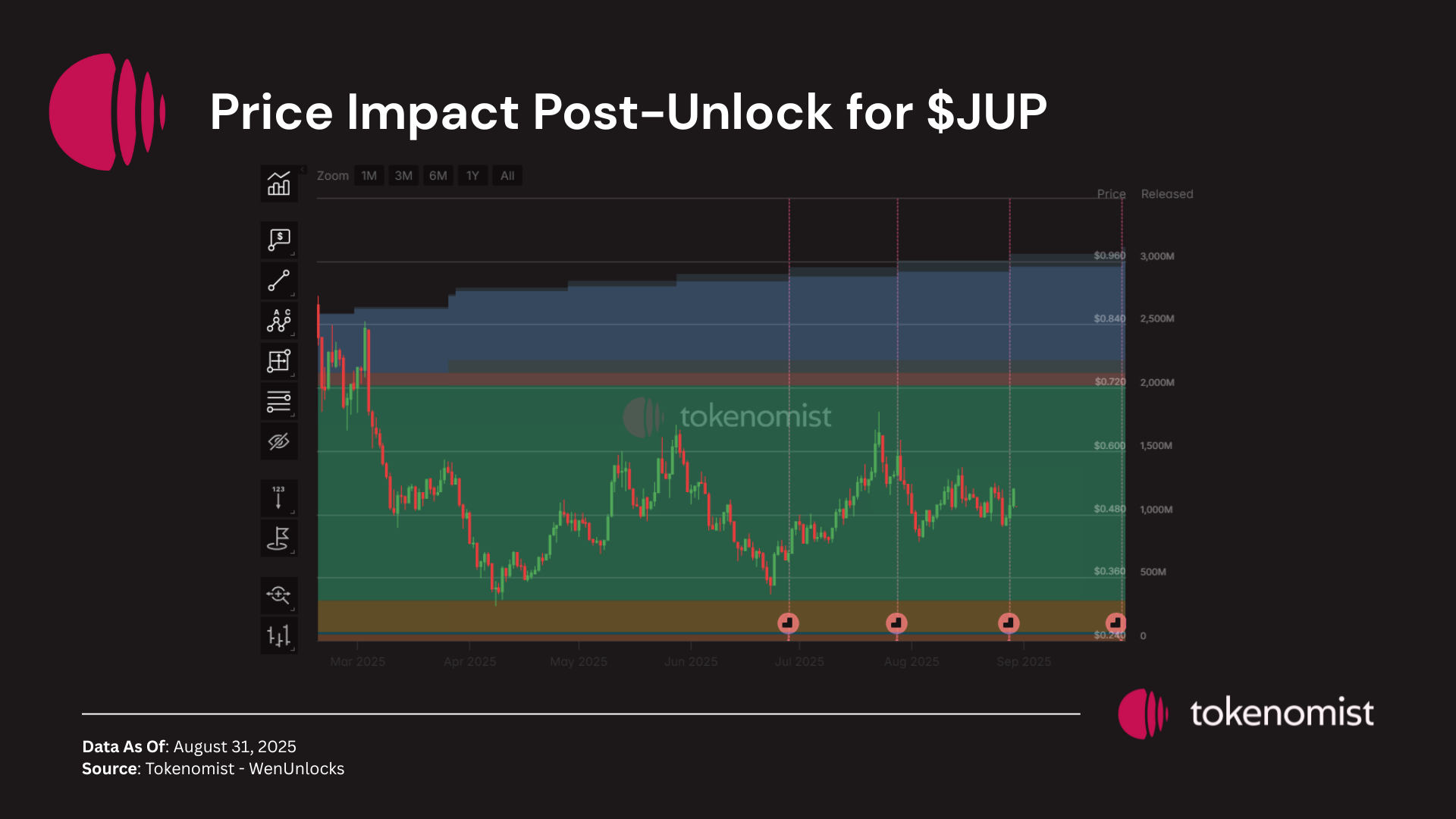

With the market still trading in a range-bound structure, altcoins show little sign of outperformance. $JUP, which saw the largest unlock last week, continues to move sideways without clear momentum.

Upcoming Events

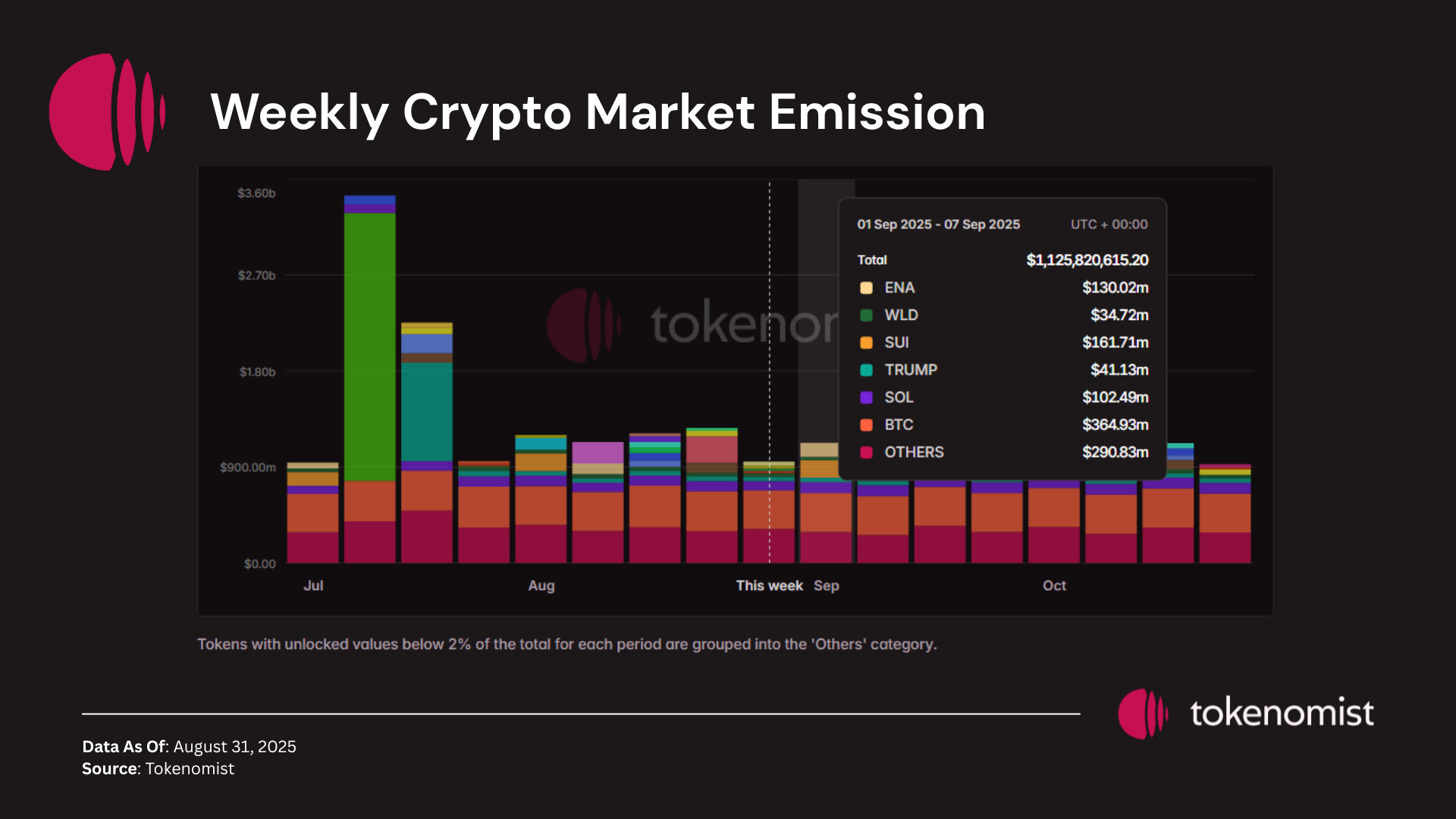

Next week’s scheduled token unlocks are set to exceed $ 1 Billion in total value. Of this, approximately 10% is classified as insider unlocks under Tokenomist’s framework — referring to allocations designated for founders, core teams, or early investors. Notable tokens facing sizable releases by dollar value include $ENA, $IOTA, $HONEY, $SPEC, and $STIK.

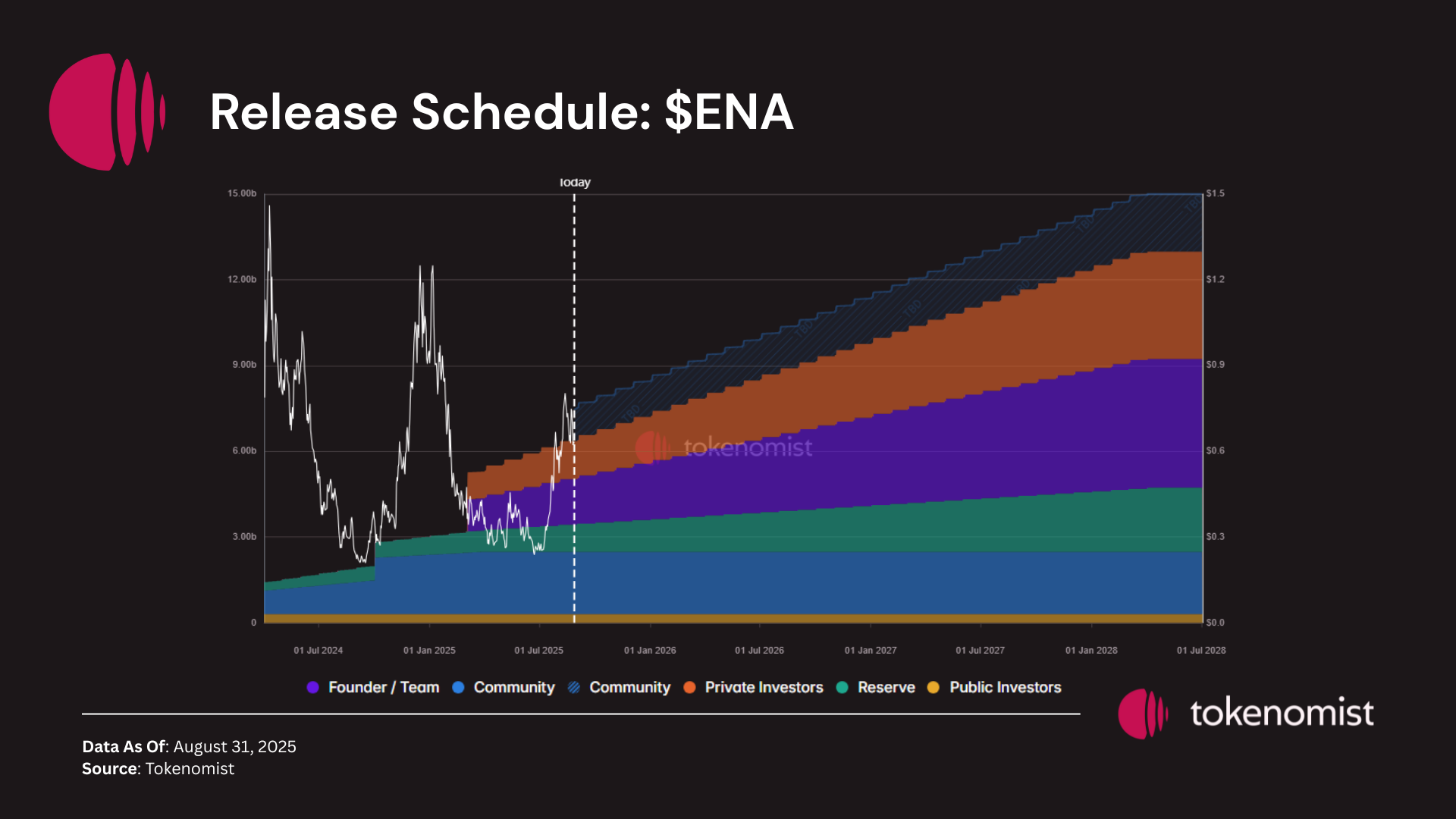

Unlocks Spotlight: $ENA

- Unlock Date: September 2 and 5, 2025

- Amount: $ 134.65M

- Unlock as % of Circulating Supply: 3.23%

- Vested Allocations: Core Contributors, Investors, and Foundation

$ENA leads this week’s unlocks with two major events — one for the foundation and another for insider allocations (team and private investors). With the largest supply release on the calendar, market focus is on how these unlocks may weigh on short-term sentiment despite broader ecosystem progress.

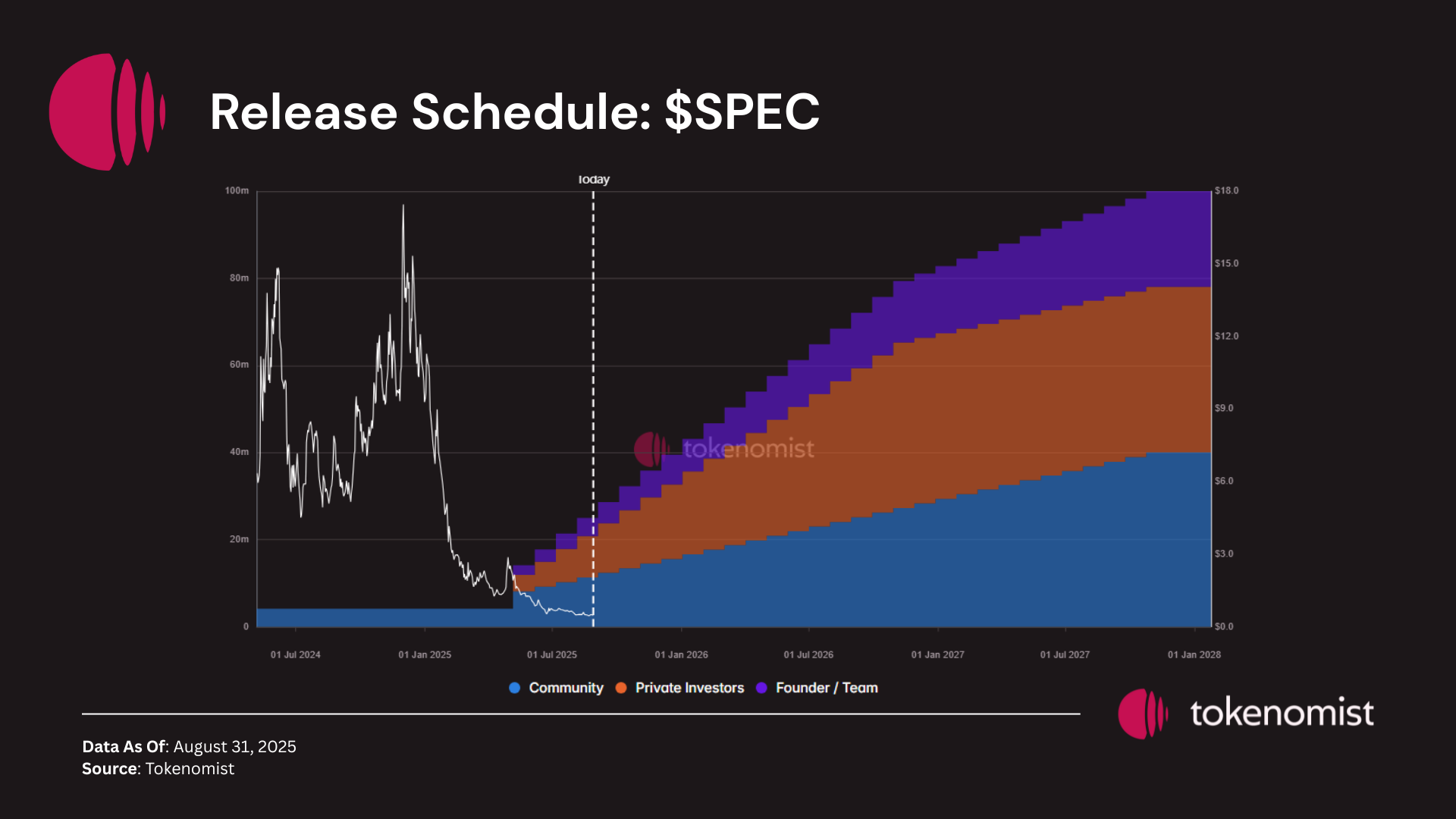

Unlocks Spotlight: $SPEC

- Unlock Date: September 4, 2025

- Amount: $ 1.72M

- Unlock as % of Circulating Supply: 14.50%

- Vested Allocations: Investors, Community, and Core Contributors

$SPEC records the highest unlock relative to circulating supply this week, with most tokens released to insider allocations. The token has struggled as the broader AI narrative loses momentum, with price sliding to new lows.

New TGEs on the Radar

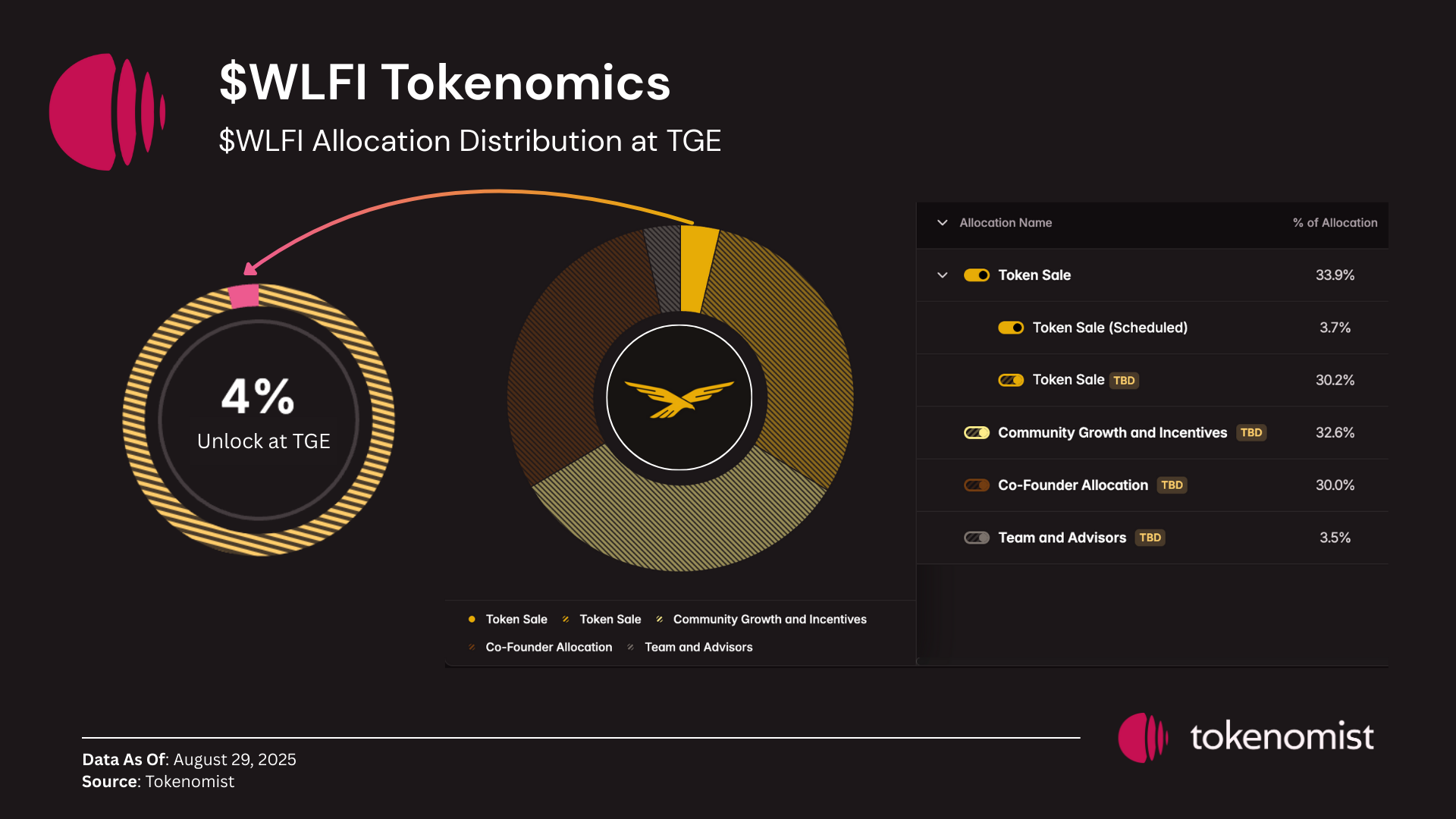

$WLFI is set to TGE on September 1, 2025. Early backers from the first tranche ($0.015) and second tranche ($0.05) are already sitting on massive gains compared to current pre-market levels.

The tokenomics feature a 100B total supply, with 20% of early investor tokens unlocked at TGE, while the remaining allocation will be decided through governance vote. This structure means only about 3.7% will be in circulation at launch, with most of the supply yet to be defined — a factor to watch closely as price discovery unfolds.

Notable Crypto News

Institutional

- Strategy investors drop class action alleging Bitcoin treasury company misled them (The Block)

- Ethereum ETFs on track for $4 billion in August inflows while Bitcoin funds face outflows (The Block)

Regulation

- Commerce Department Will Put Economic Data 'on the Blockchain': Howard Lutnick (Decrypt)

Tokenomics

- Resolv Foundation has launched a buyback program, with the first allocation set at 75% of core protocol fees (Resolv)

General

- Ethena’s USDe stablecoin surges to $12 billion supply, fueled by leveraged yield loops on Pendle and Aave (The Block)

- Hyperliquid to introduce new safeguards following crypto whale-driven XPL pre-market liquidations (The Block)

- Donald Trump Jr.'s VC firm bets on Polymarket (Axios)

- Trump Media, Crypto.com to Build $6.4B CRO Treasury Firm (CoinDesk)