Weekly Unlock Digest: Sep 8-14, 2025

The market stayed flat last week as September’s rate cut is now seen as certain, with weak labor data hinting at more cuts ahead. Bitcoin and Ethereum showed little momentum shift. In this week’s report, we highlight $APT’s insider-heavy unlock, $BB’s high-percentage release amid BTCfi weakness, and and new token launch like $WLFI.

Weekly Unlocks Recap

Markets have fully priced in a September rate cut as certain, following continued signs of weakness in the labor market. This softness could also justify consecutive cuts later this year. Price action last week remained flat overall, with Bitcoin edging slightly higher while Ethereum slipped marginally, showing no major momentum shift. Meanwhile, the Digital Asset Treasuries (DATs) narrative saw a minor pullback, with several of them now trading at or below their mNAV.

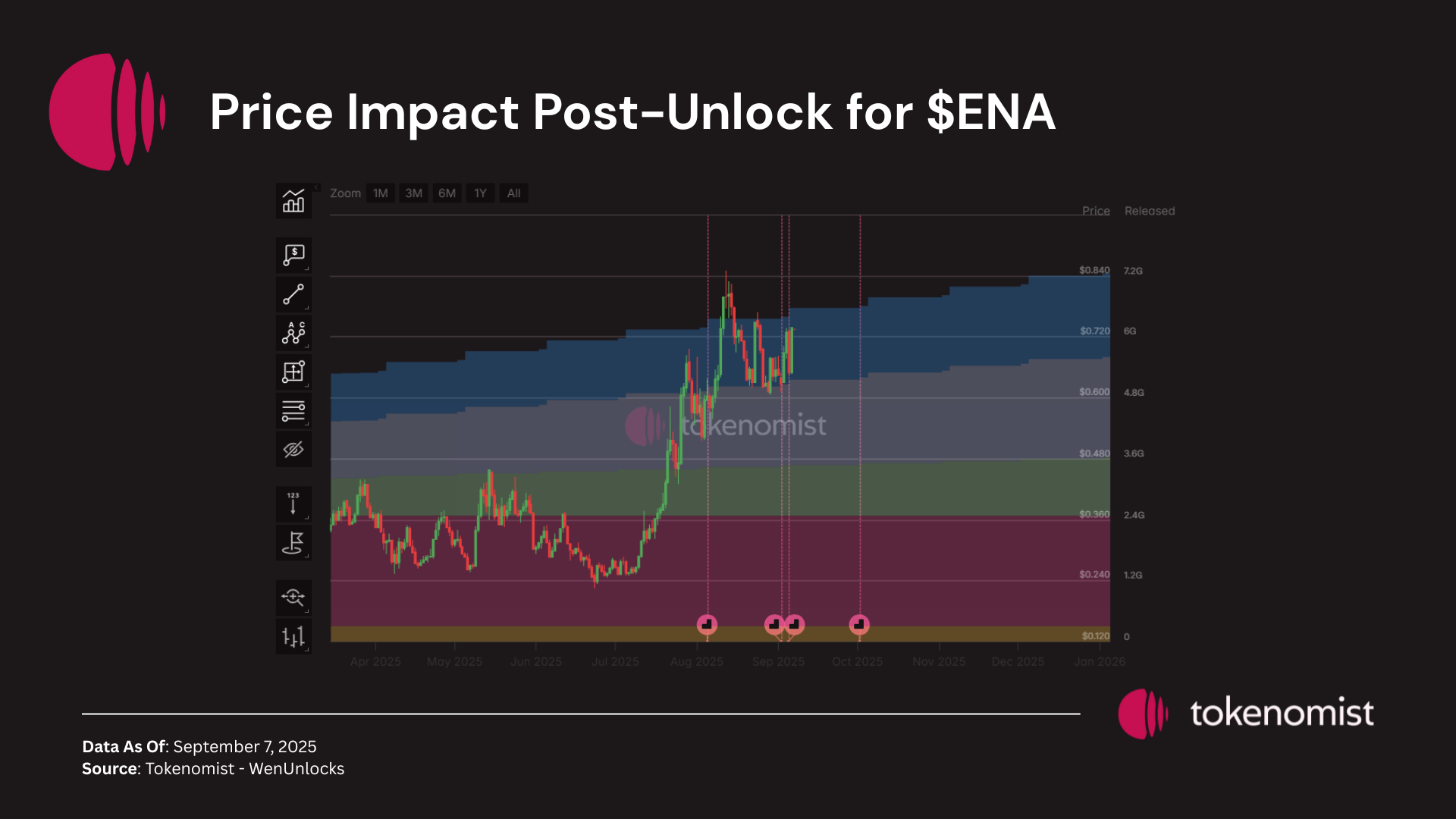

Despite holding the largest unlock value last week, with most of it allocated to insiders, $ENA defied expectations. While the broader market stayed flat, the token gained over 14% as investor interest remained strong. This shows that unlock events don’t always trigger sell pressure — the outcome depends heavily on whether allocation holders choose to realize profits or continue holding.

Upcoming Events

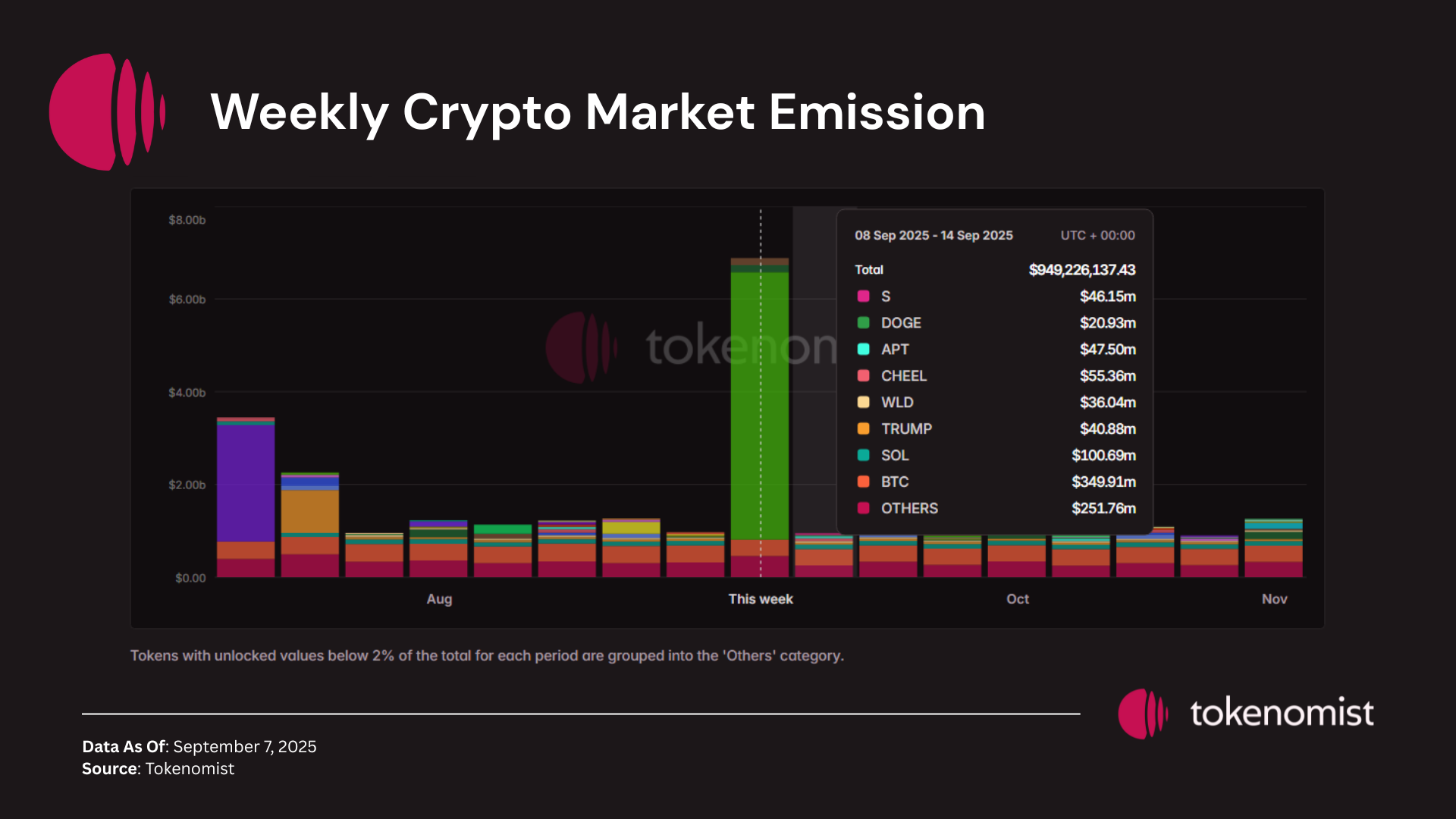

Next week’s scheduled token releases are set to exceed $ 945 Million in total value. Of this, approximately 4.7% is classified as insider unlocks under Tokenomist’s framework — referring to allocations designated for founders, core teams, or early investors. Notable tokens facing sizable releases by dollar value include $APT, $CHEEL, $IO, $MOVE, and $BB.

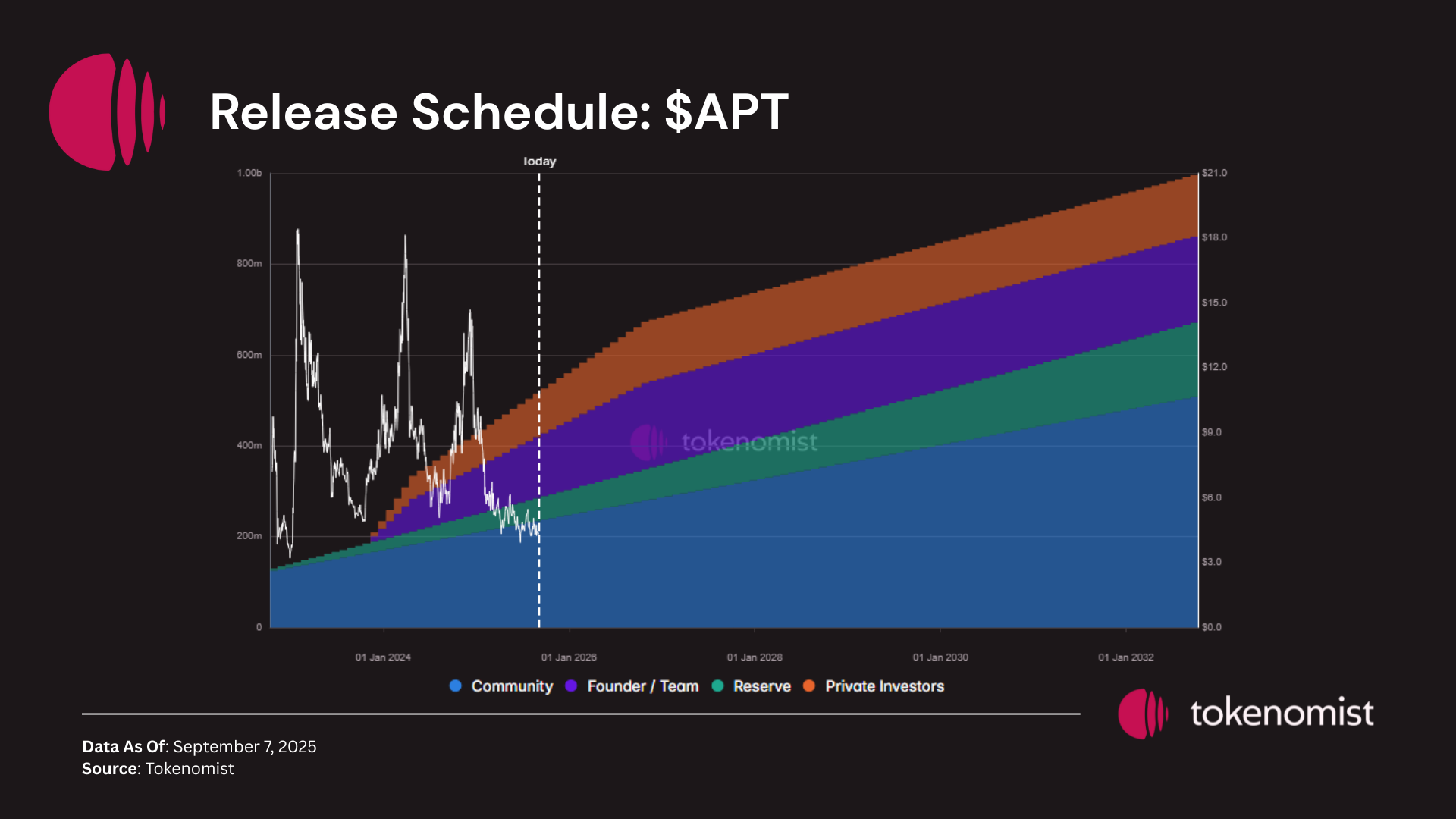

Unlocks Spotlight: $APT

- Unlock Date: September 11, 2025

- Amount: $ 48.52M

- Unlock as % of Circulating Supply: 2.20%

- Vested Allocations: Core Contributors, Community, Investors, and Foundation

$APT leads this week with the largest unlock by dollar value, with the majority of tokens released to insider allocations. Despite broader market resilience, APT’s price action remains underwater, reflecting persistent supply overhang and limited near-term demand to absorb the new emissions.

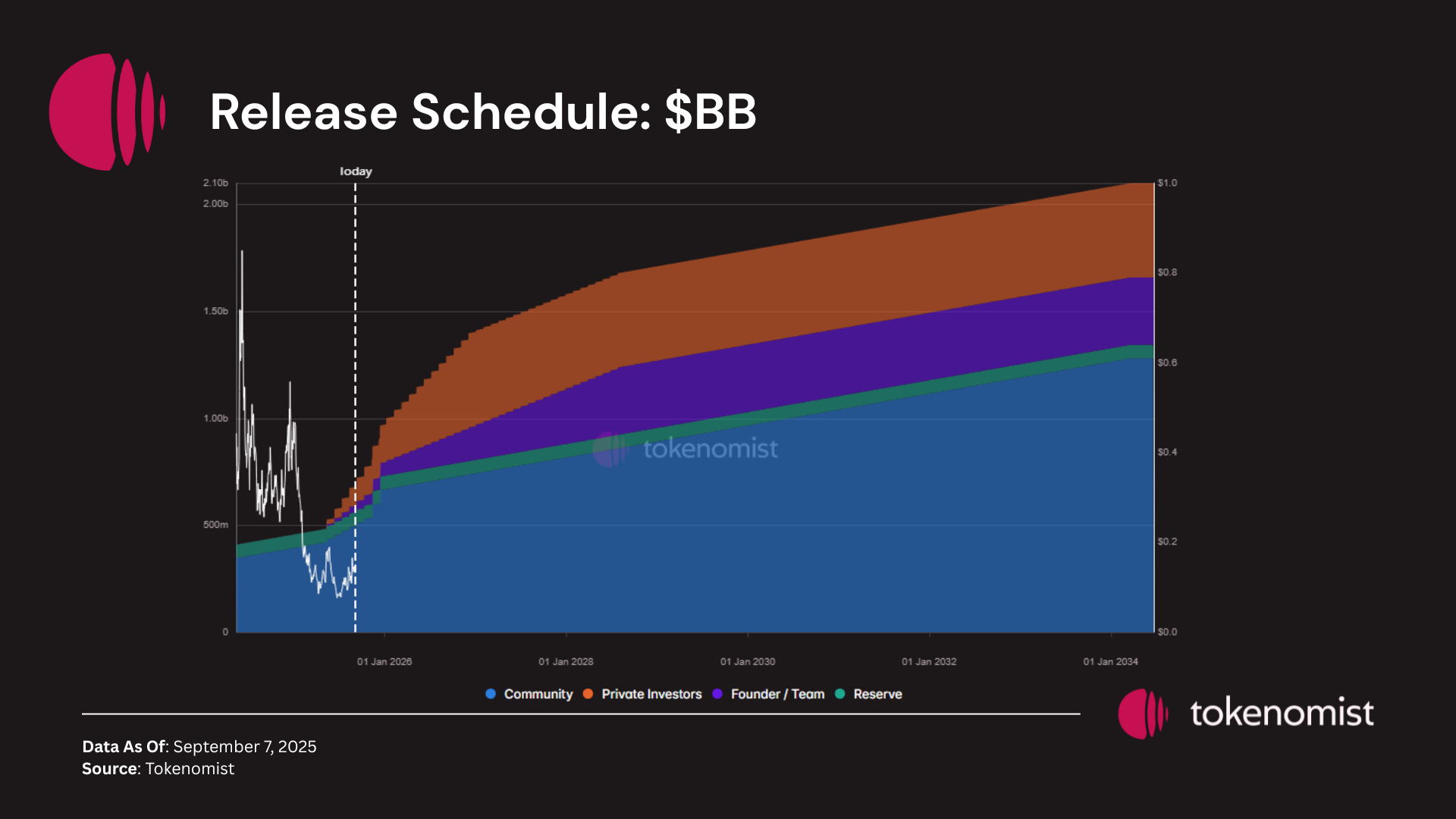

Unlocks Spotlight: $BB

- Unlock Date: September 10, 2025

- Amount: $ 5.68M

- Unlock as % of Circulating Supply: 6.31%

- Vested Allocations: Investors, BounceClub & Ecosystem Reserve, Team, and Advisors

$BB posted the week’s largest unlock relative to circulating supply, with allocations split between insiders and the community. However, with momentum in the BTCfi sector largely faded, BB’s price action has struggled to recover.

New TGEs on the Radar

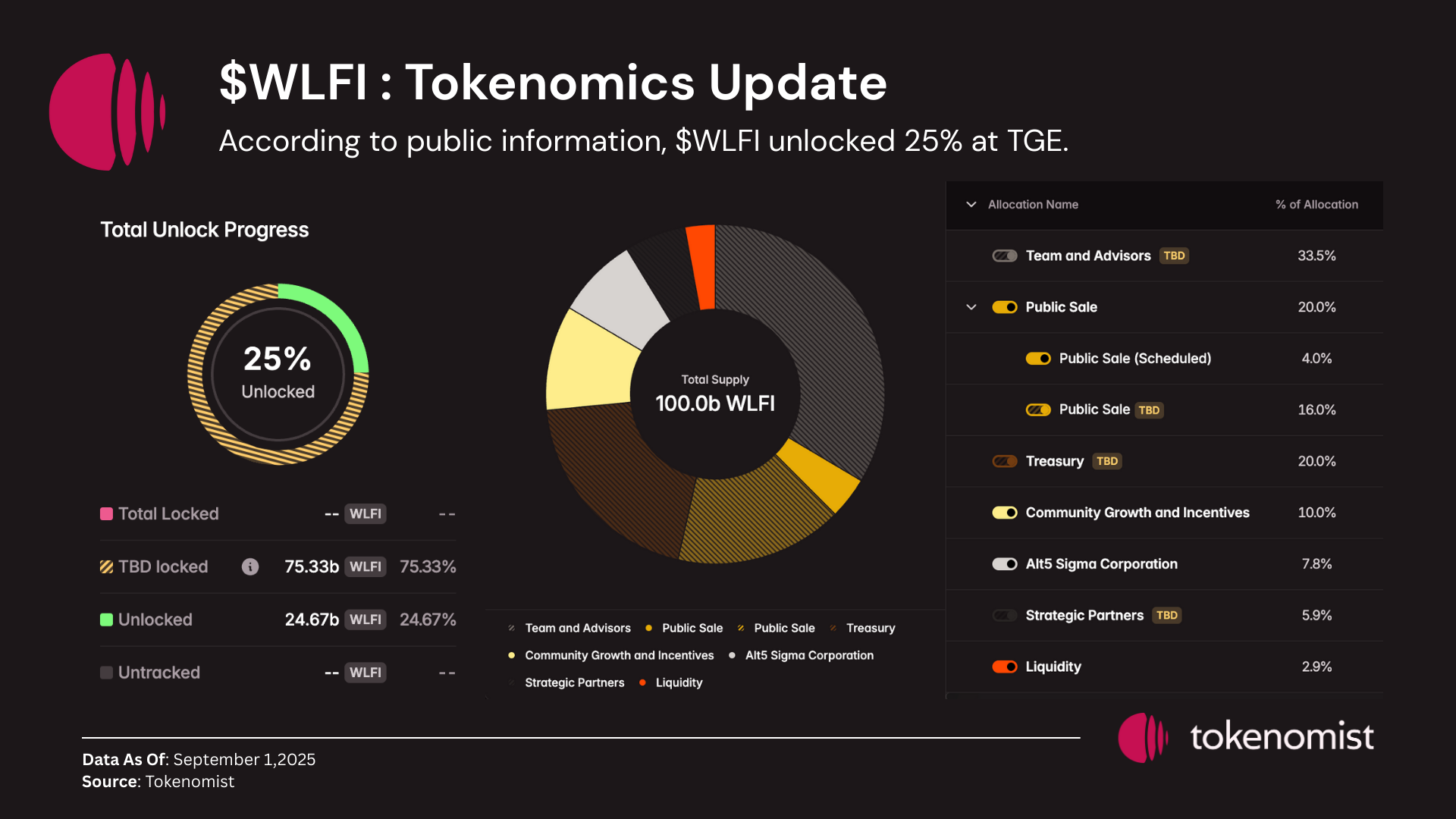

Last week saw the highly anticipated TGE of World Liberty Finance ($WLFI), which drew massive pre-market trading volumes and investor attention. However, confidence was quickly shaken after the team revealed through a Medium update that 25% of supply would be unlocked at launch — a sharp deviation from the previously projected 4–5%.

This sudden change fueled confusion among investors and triggered profit-taking by early backers, who had secured tokens at significantly lower entry prices. Even with only 20% of investor allocations unlocked, these holders realized substantial gains, adding to the selling pressure and weighing on short-term sentiment.

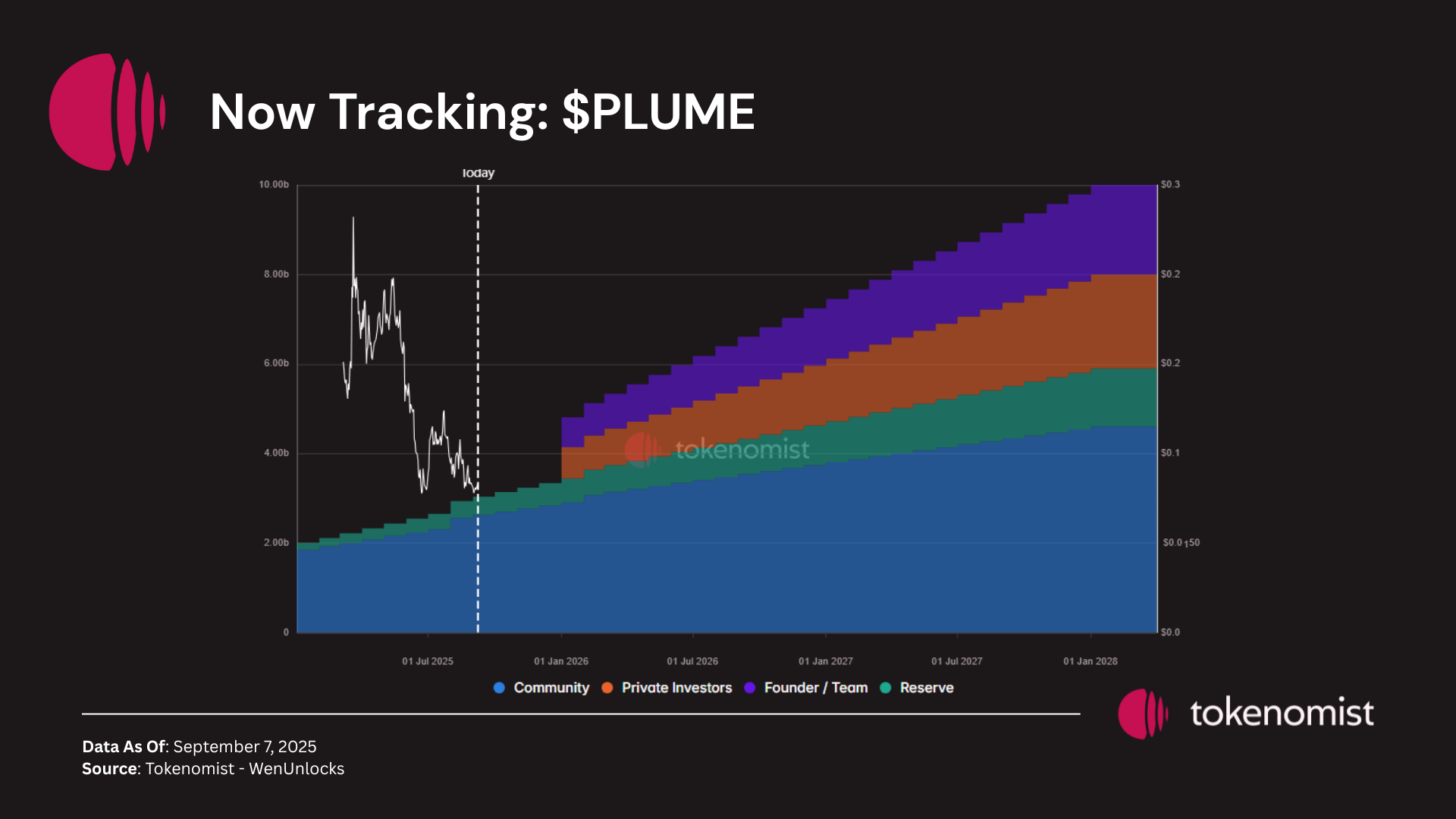

Alongside $WLFI, we’re now tracking $PLUME, a growing name in the RWA space. The key date to watch is January 2026, when its first major cliff unlock will release a large insider allocation compared to the current supply. All of $PLUME’s tokenomics data, including unlock schedules and sector comparisons, is now live on our platform. Track it here to stay ahead.

Notable Crypto News

Institutional

- BitMine Boosts Ethereum Stash Above $8 Billion, Now Holds 1.5% of ETH Supply (Decrypt)

- Metaplanet buys $112 million worth of bitcoin; total holdings reach 20,000 BTC (The Block)

- Stripe, Paradigm Unveil Tempo as Blockchain Race for High-Speed Stablecoin Payments Heats Up (CoinDesk)

Regulation

- Nasdaq tightens scrutiny of companies raising cash to buy crypto (The Block)

Tokenomics

- SUI Group treasury's holdings surpass $300 million after adding 20 million tokens (The Block)

General

- Polymarket can go live in the US following CFTC ruling, CEO says (The Block)

- Ondo debuts over 100 tokenized US stocks and ETFs on Ethereum, with BNB Chain and Solana support to follow (The Block)

- Ethena jumps 12% after treasury firm StablecoinX secures $530 million investment (The Block)

- Gemini Seeks $2.22 Billion Valuation in Nasdaq IPO (Unchained)