Weekly Unlock Digest: Sep 15-21, 2025

Markets remain focused on the upcoming September 17 FOMC meeting, with a 25 bps rate cut now fully priced in as labor market weakness persists. In this week’s report, we highlight $FTN’s insider-heavy unlock, $ZRO’s high-percentage release, and and new token launch like $LINEA.

Weekly Unlocks Recap

Markets are pricing in a 25 bps rate cut on September 17, driven by continued weakness in labor market data. However, August CPI came in slightly above expectations, keeping inflation concerns alive.

Bitcoin and Ethereum both posted gains over the past week, helping the broader crypto market rebound. Several altcoins, including $PUMP, $WLD, and $AVAX, also recorded notable upside moves.

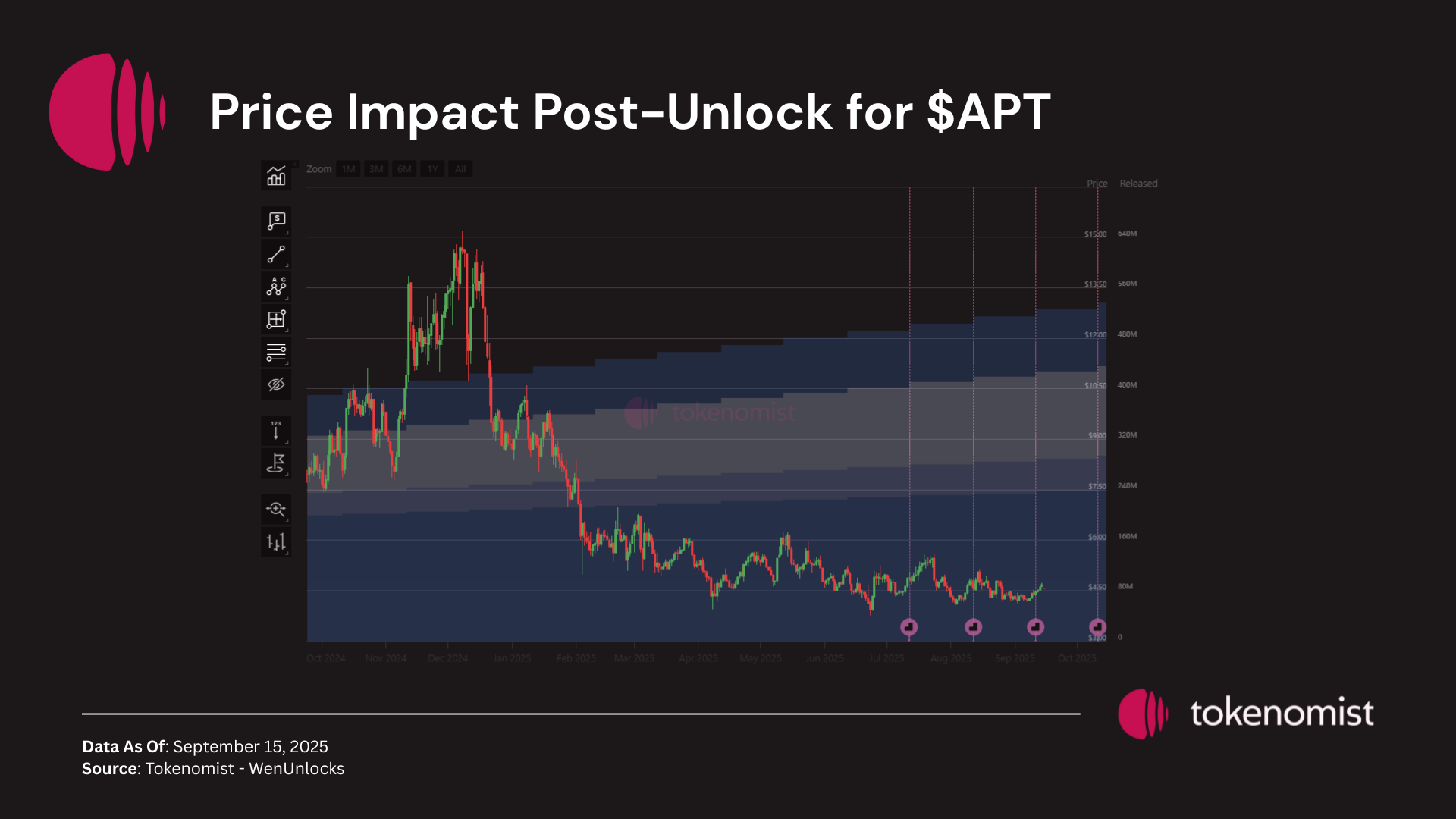

$APT, which had the largest unlock last week, saw a slight rebound from its previous lows. This improving market sentiment eased the immediate impact of the supply release, but the token is still trading near its all-time low and remains range-bound.

Upcoming Events

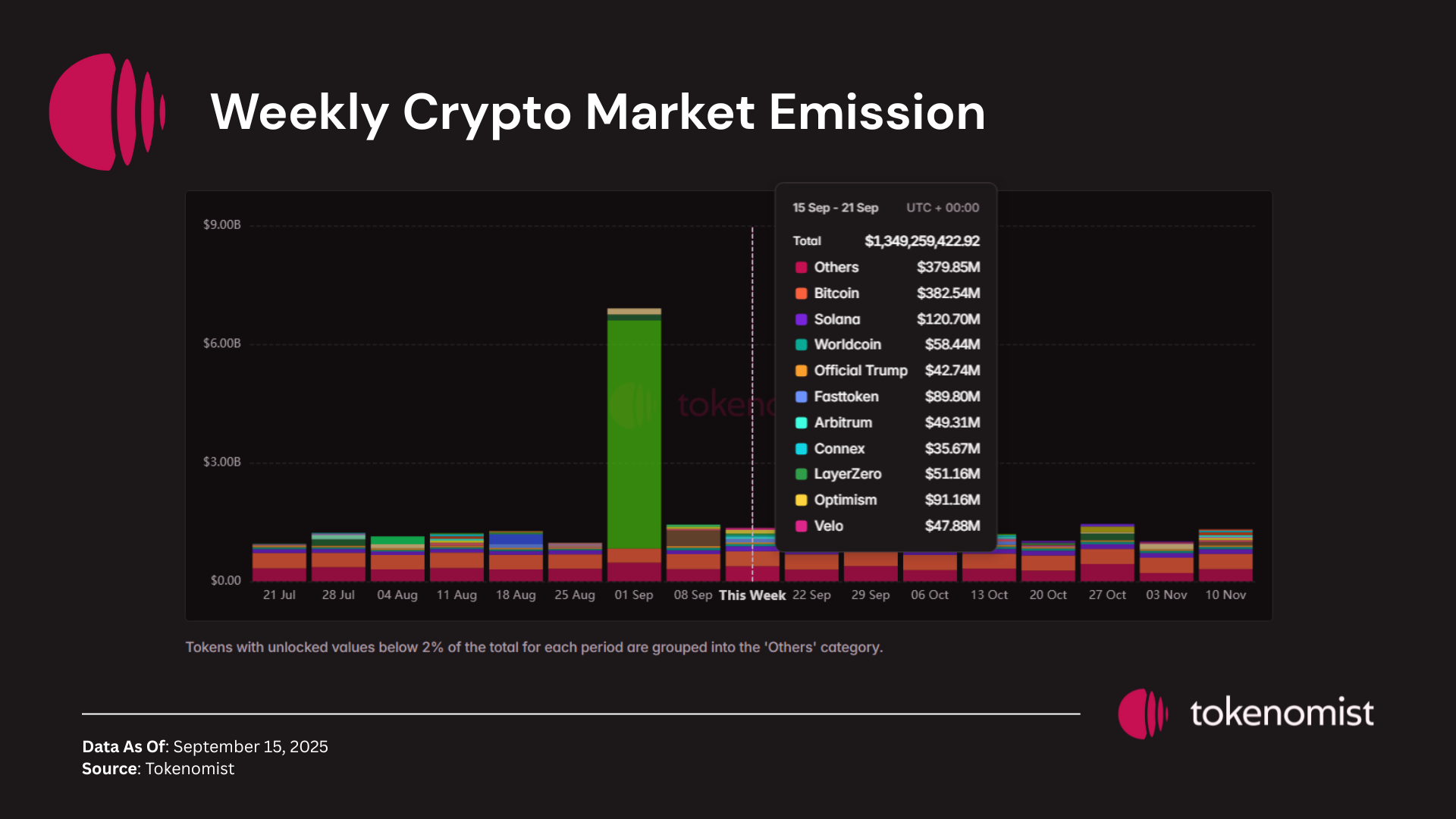

Next week’s scheduled token releases are set to exceed $1.3 Billion in total value. Notable tokens facing sizable releases by dollar value include $BTC, $SOL, $OP, $FTN, and $WLD.

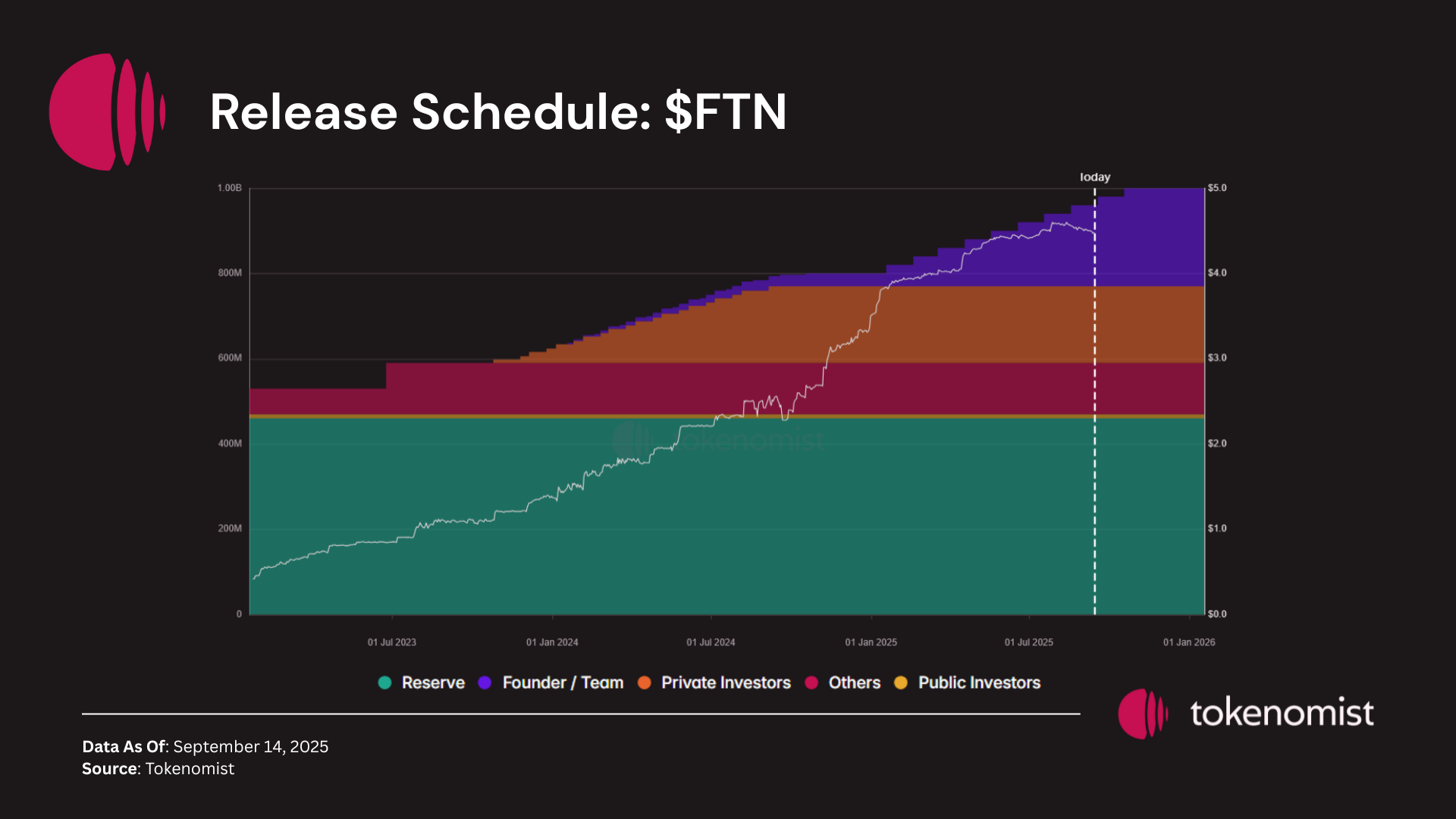

Unlocks Spotlight: $FTN

- Unlock Date: September 18, 2025

- Amount: $ 89.60M

- Unlock as % of Circulating Supply: 2.08%

- Vested Allocations: Founders

$FTN leads this week with the largest unlock by dollar value, with all tokens allocated to founders. This marks a late-stage unlock, as 96% of the token supply is already circulating.

Interestingly, $FTN’s price action has remained strongly upward despite the new supply. This could reflect limited available liquidity or concentrated holdings rather than broad market selling.

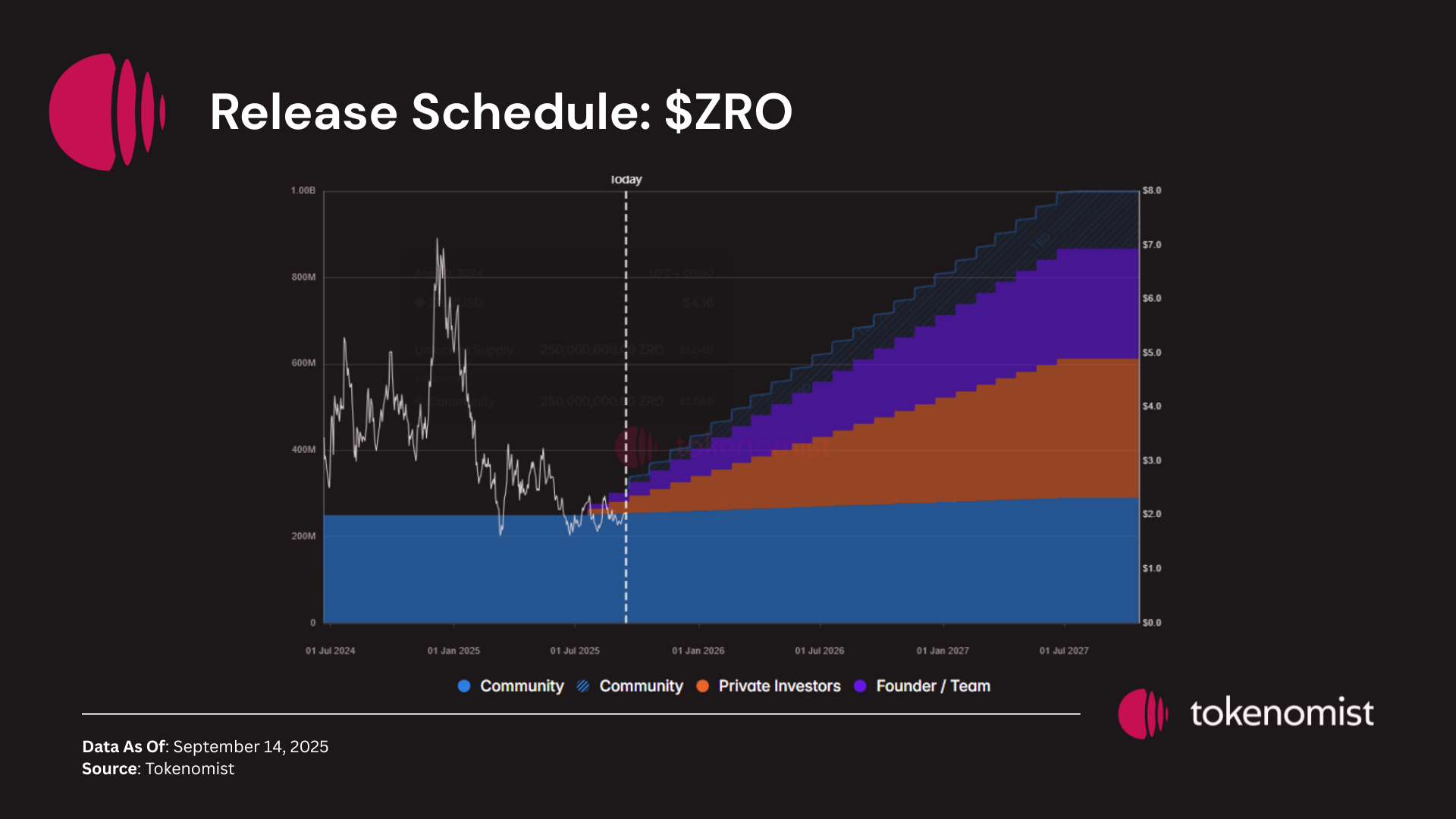

Unlocks Spotlight: $ZRO

- Unlock Date: September 20, 2025

- Amount: $ 50.39M

- Unlock as % of Circulating Supply: 8.53%

- Vested Allocations: Strategic Partners, Core Contributors, and Token Repurchased

$ZRO records the highest unlock relative to circulating supply this week, with most of the tokens allocated to core contributors and strategic partners.

The token continues to trade near all-time lows, reflecting persistent supply overhang and muted demand absorption. Market participants will be watching closely to see if this unlock adds additional pressure or if selling has already been largely priced in.

New TGEs on the Radar

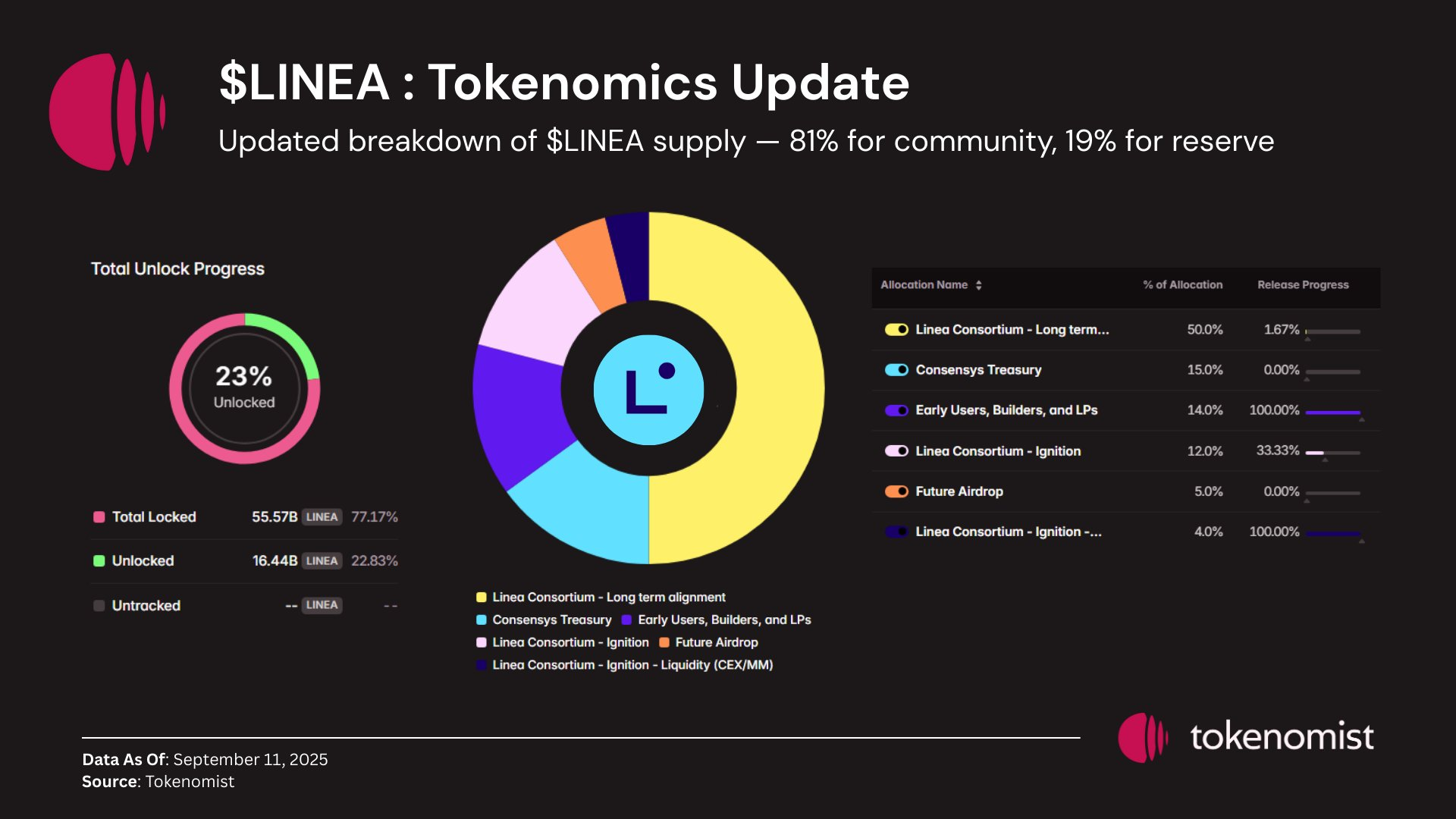

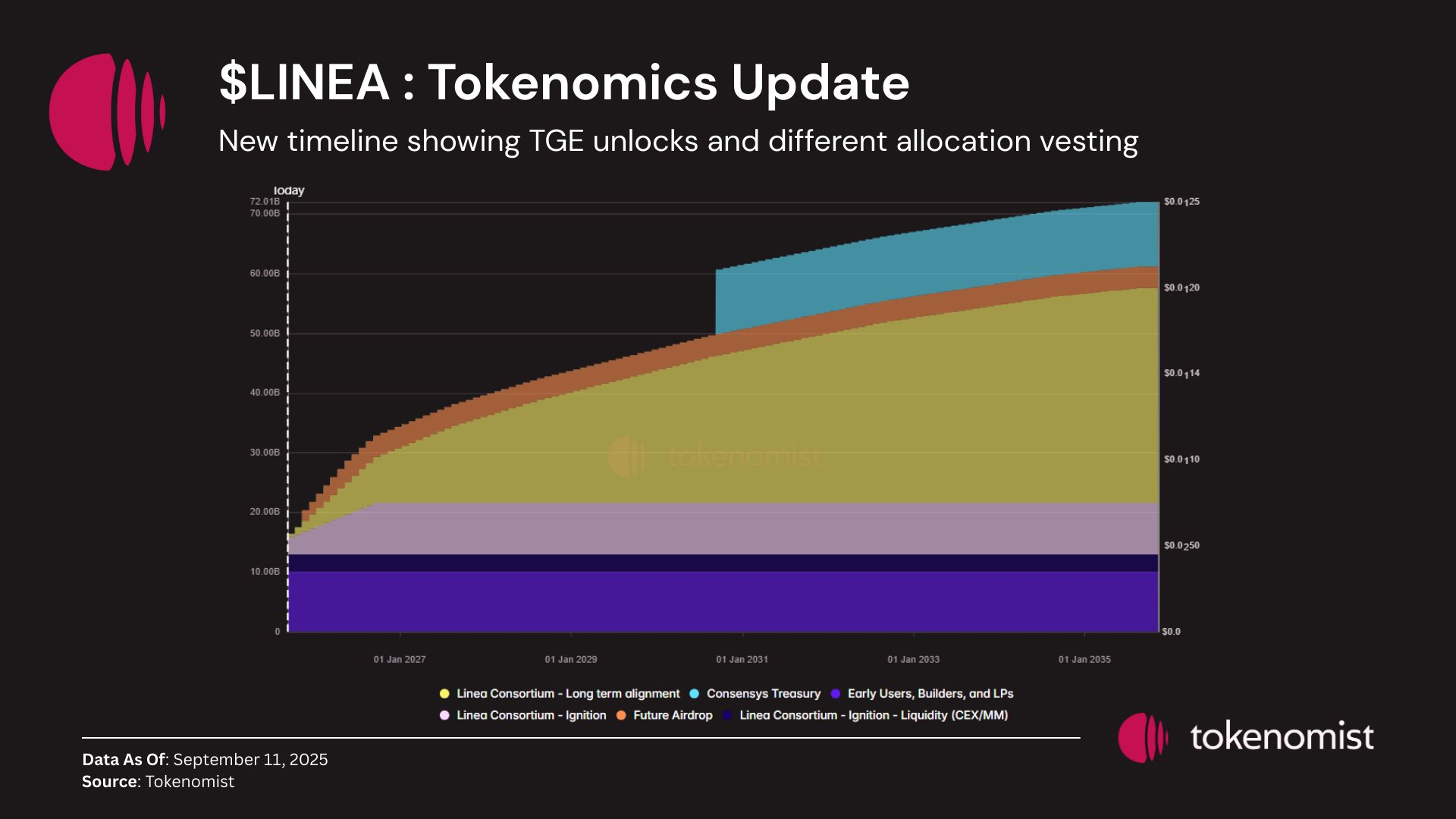

Last week’s standout TGE was $LINEA, a layer-2 zkEVM that mirrors the Ethereum environment, enabling developers to build just like on mainnet. The token allocation is heavily community-focused, with 81% going to community participants and 19% reserved. This mirrors Ethereum’s launch model, aiming for a decentralized and user-driven ecosystem.

Linea’s treasury allocation will remain locked for five years, and the project introduces a dual-burn mechanism: 20% of net fees will be used to buy back and burn ETH, while 80% will burn LINEA tokens.

For a full deep dive into $LINEA’s tokenomics, read here.

1/📢 Deep Dive: $LINEA Tokenomics Analysis@LineaBuild is taking a different path from most tokens, inspired by Ethereum’s genesis design.

— Tokenomist (@Tokenomist_ai) September 10, 2025

🚫 No insider allocations.

🚫 No token-based governance.

✅ Ecosystem-first

Let’s break it down 🧵 pic.twitter.com/jvVAR68AaQ

Notable Crypto News

Institutional

- StablecoinX Secures $530M Investment to Back Ethena-Linked Treasury (CoinDesk)

- Strategy buys another 1,955 bitcoin for $217 million amid S&P 500 snub as holdings reach 638,460 BTC (The Block)

- Forward Industries Closes $1.65B Deal to Build Solana Treasury (CoinDesk)

- Binance Teams With $1.6 Trillion Asset Manager Franklin Templeton for Crypto Product Push (Decrypt)

Regulation

- VanEck plans to file for Hyperliquid staking ETF, European ETP (Blockworks)

Tokenomics

- Linea Token Launches at $500 Million Market Capitalization (The Defiant)

- WLFI proposes to burn tokens, using 100% of WLFI Treasury Liquidity Fees (World Liberty Financial)

General

- Polygon rolls out hard fork to address finality bug causing transaction delays (The Block)