Weekly Unlock Digest: Sep 22-28, 2025

The crypto market stayed largely flat last week as the Fed delivered a widely expected 25 bps rate cut and signaled two additional cuts by year-end. This week’s report covers the upcoming $PARTI cliff unlock, the largest by both dollar value and % of circulating supply. We also spotlight two major TGEs: $AVNT, a leverage trading platform token that’s doubled since launch, and $ASTER, a perp DEX token backed by YZi Labs and endorsed by CZ.

Weekly Unlocks Recap

The Fed delivered a 25 bps rate cut last week, fully in line with market expectations, and signaled two more cuts before year-end as unemployment is projected to rise to 4.5%. Since rate cuts were already priced in, Bitcoin and Ethereum traded mostly flat, showing little immediate reaction.

Despite muted price action, the dovish guidance supports a more risk-on environment heading into the latter part of the year, potentially setting the stage for stronger crypto momentum.

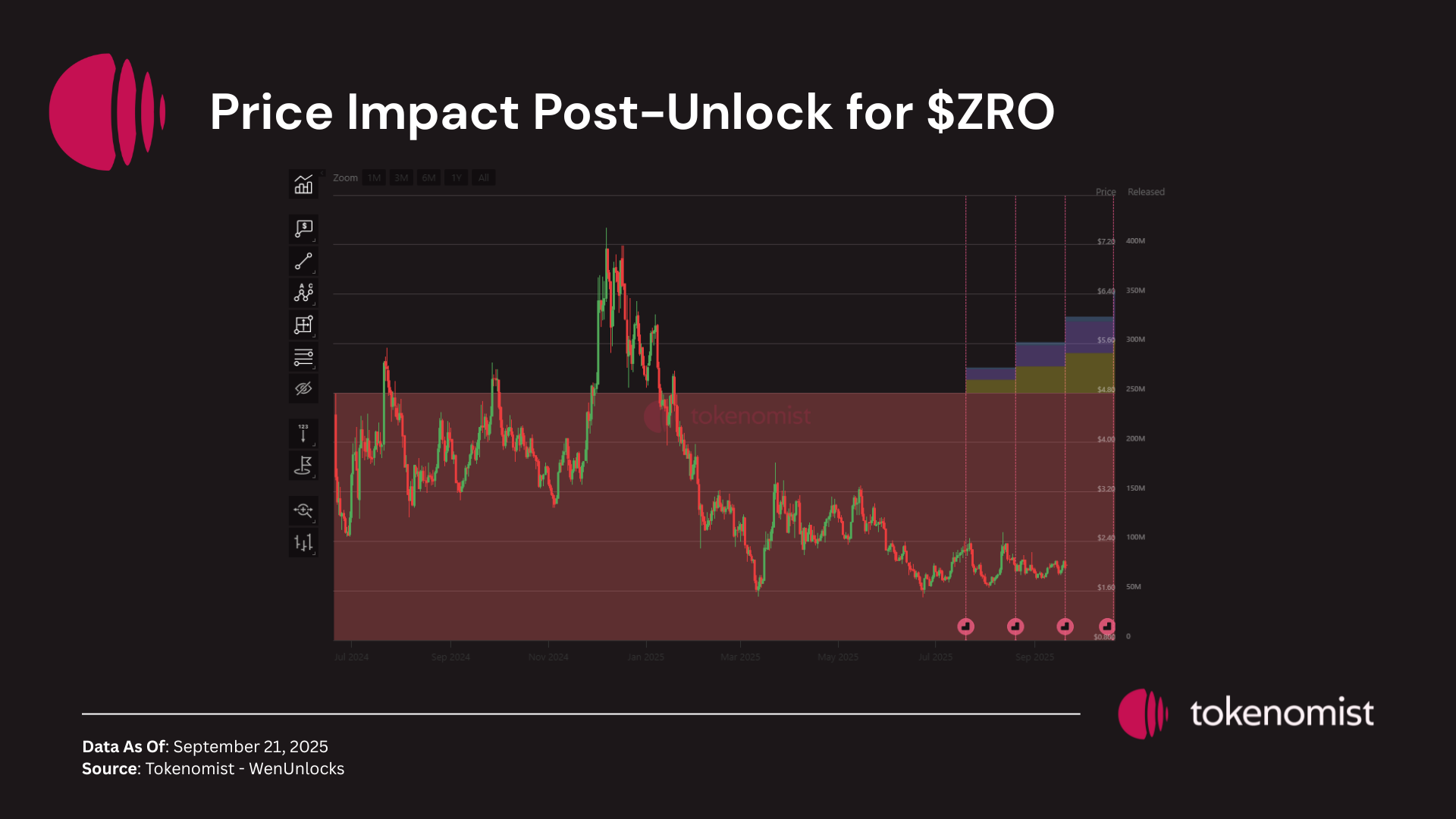

Last week’s largest unlock came from $ZRO, with most tokens released to insider allocations, including strategic partners and core contributors. The token continues to face headwinds as supply overhang weighs on price, leaving it near all-time lows despite improving macro sentiment.

Upcoming Events

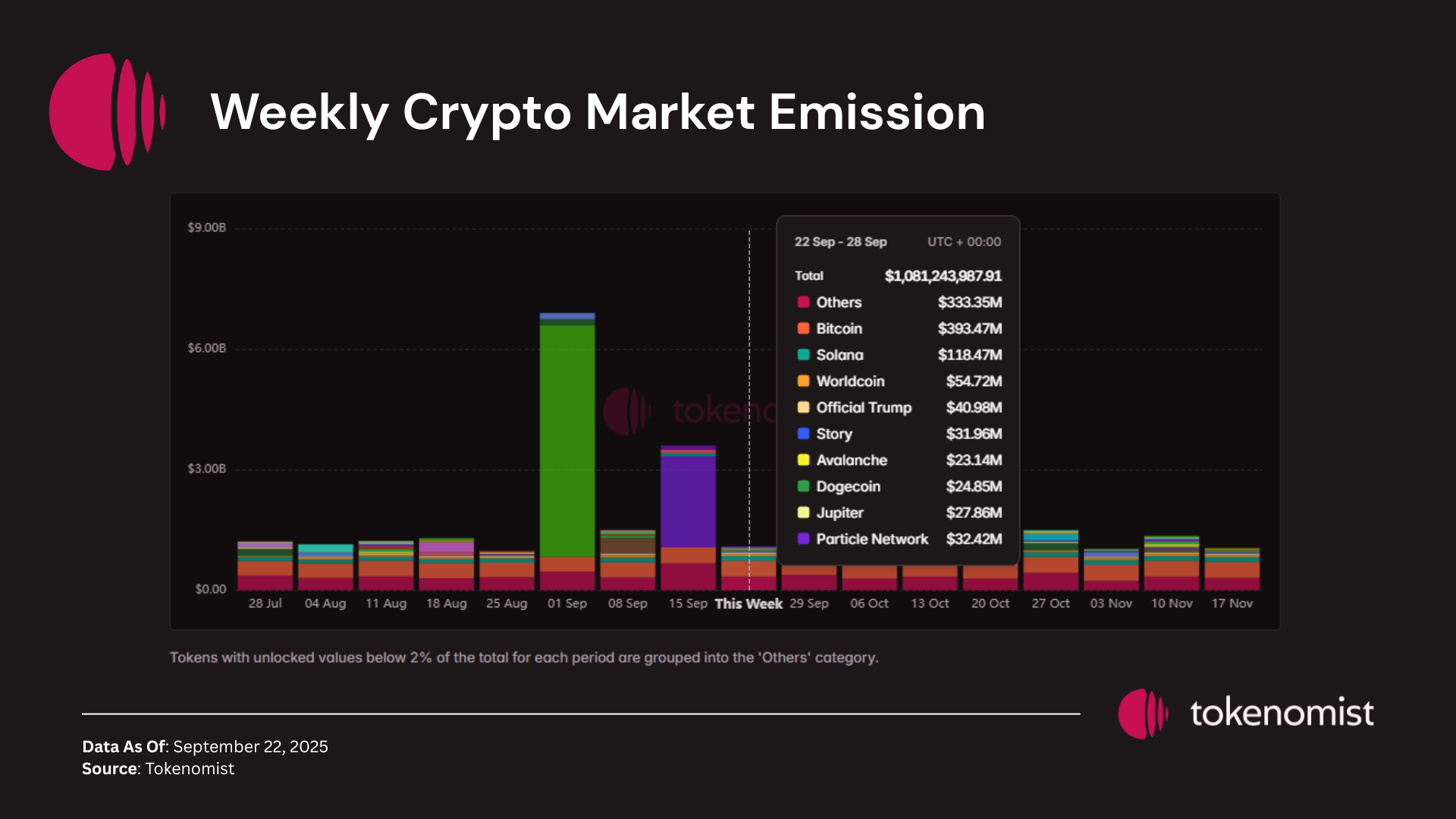

Next week’s scheduled token releases are set to exceed $1 Billion in total value. Notable tokens facing sizable releases by dollar value include $BTC, $SOL, $WLD, $TRUMP, and $PARTI.

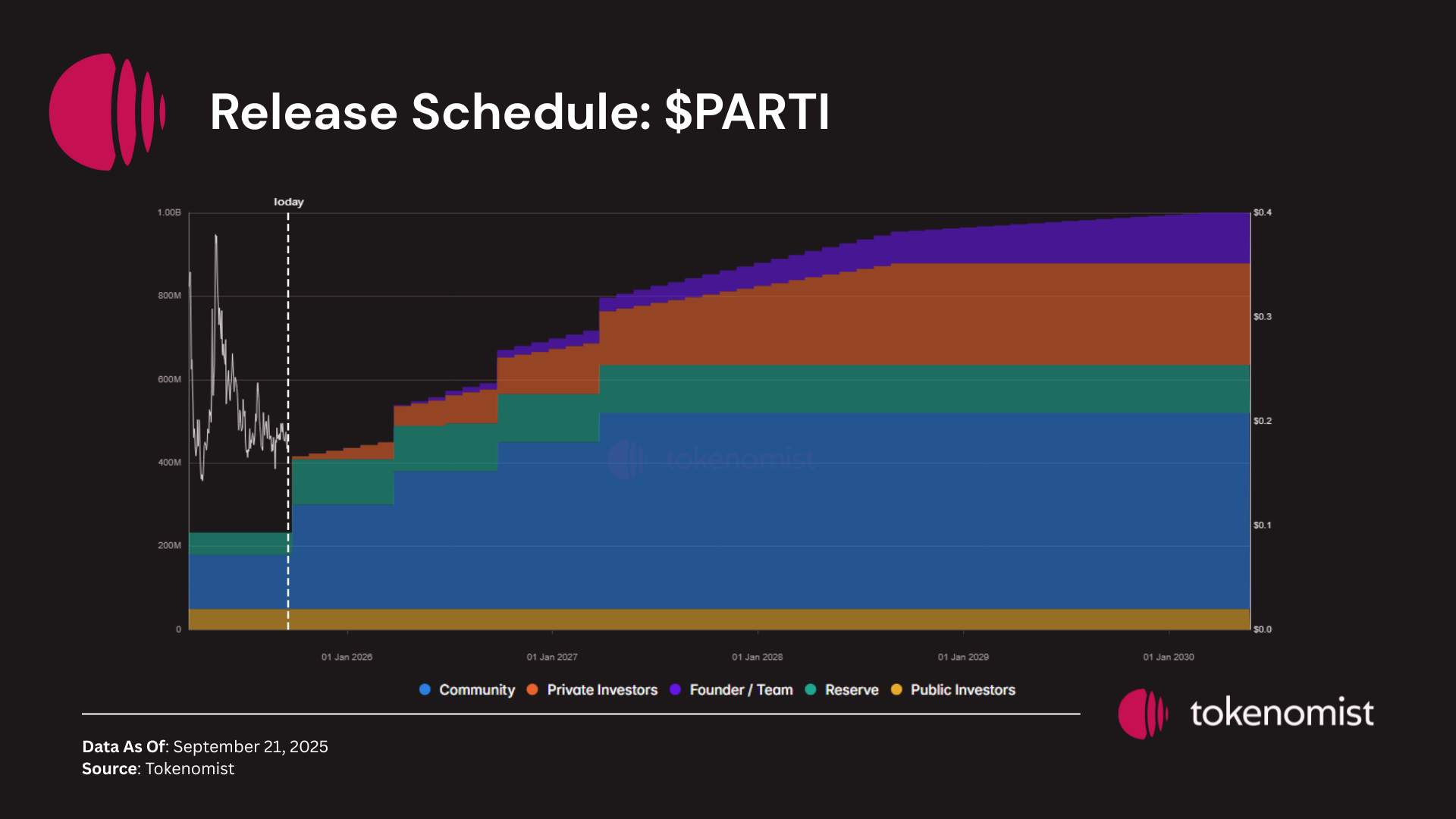

Unlocks Spotlight: $PARTI

- Unlock Date: September 25, 2025

- Amount: $ 33.60M

- Unlock as % of Circulating Supply: 78.44%

- Vested Allocations: Community Growth, Reserve, Binance HODLer airdrops, Private Sales, and KOL rounds

$PARTI leads next week with both the largest unlock by dollar value and the highest percentage of circulating supply. This event marks the token’s first major cliff unlock since TGE, including the initial release to private investors.

Despite stronger macro tailwinds boosting overall sentiment, $PARTI’s price action remains range-bound — suggesting that investors are still waiting to see how the market absorbs this substantial supply release.

New TGEs on the Radar

This week’s TGE highlights feature $AVNT and $ASTER, two projects making waves in their respective sectors.

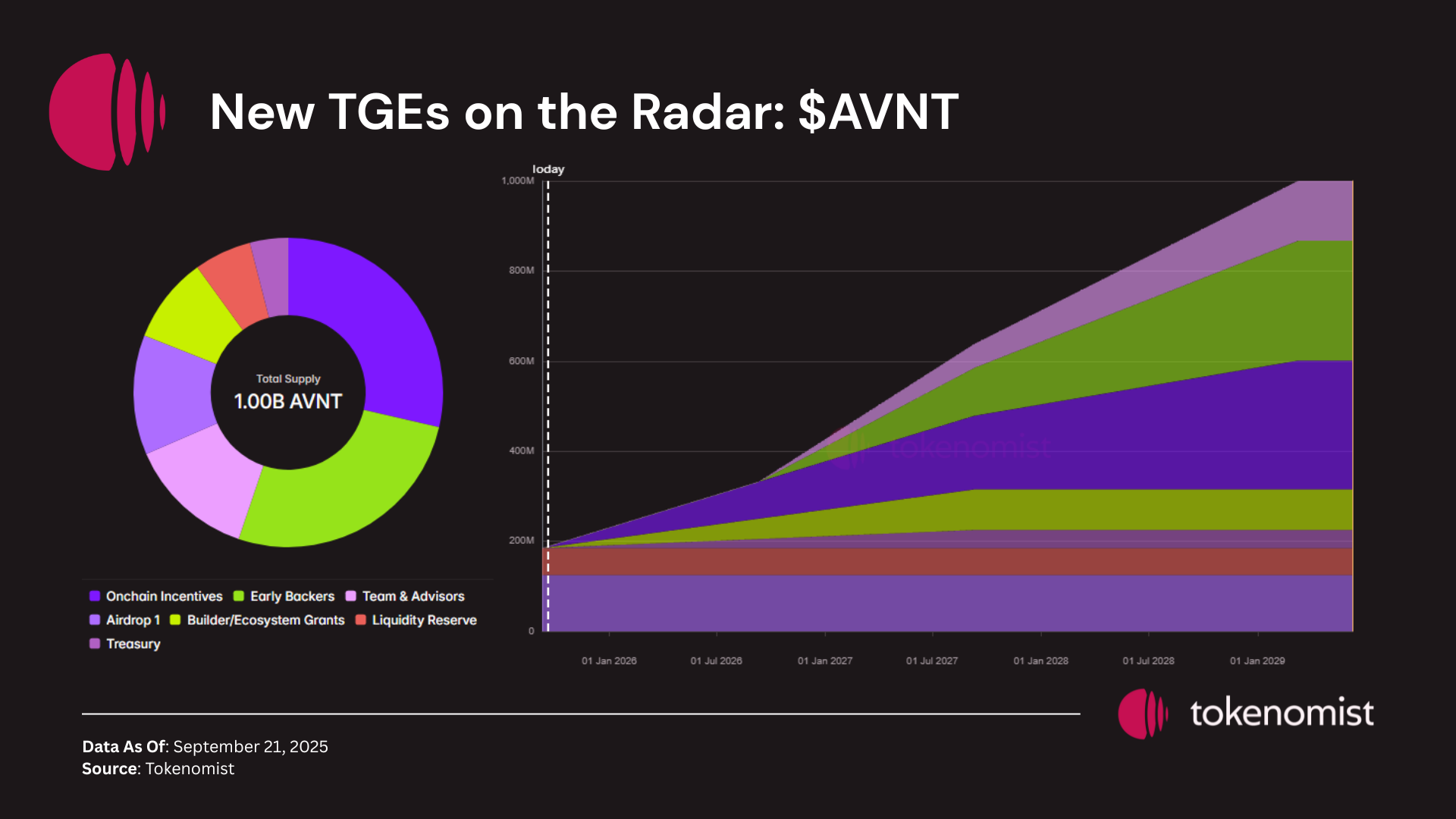

$AVNT (Avantis)

This week’s notable TGE was $AVNT, the native token for Avantis — a decentralized leverage trading platform supporting both crypto and forex. Avantis stands out by introducing dynamic risk management for liquidity providers through a tranche-based system.

The tokenomics follow a low-float, high-FDV model, with 1 billion total supply and 18.5% available at TGE. Private investor and team allocations remain locked until one year post-TGE, helping maintain short-term supply discipline.

Price action has been strong since launch, with $AVNT trading more than 2x above its TGE price thanks to favorable market sentiment. The token currently sits at roughly $300M market cap and $1.1B FDV, positioning it as one of the higher-profile leverage trading plays in the sector.

$ASTER (Aster)

Aster is a decentralized perpetual exchange offering perpetual trading, yield farming, and stablecoin minting. The project gained major traction last week after being endorsed by CZ (former Binance CEO) and funded by YZi Labs (ex-Binance Labs), fueling speculation that this is Binance’s answer to the rising dominance of Hyperliquid.

The token launch was explosive: market cap jumped from $116M to $1B within 24 hours.

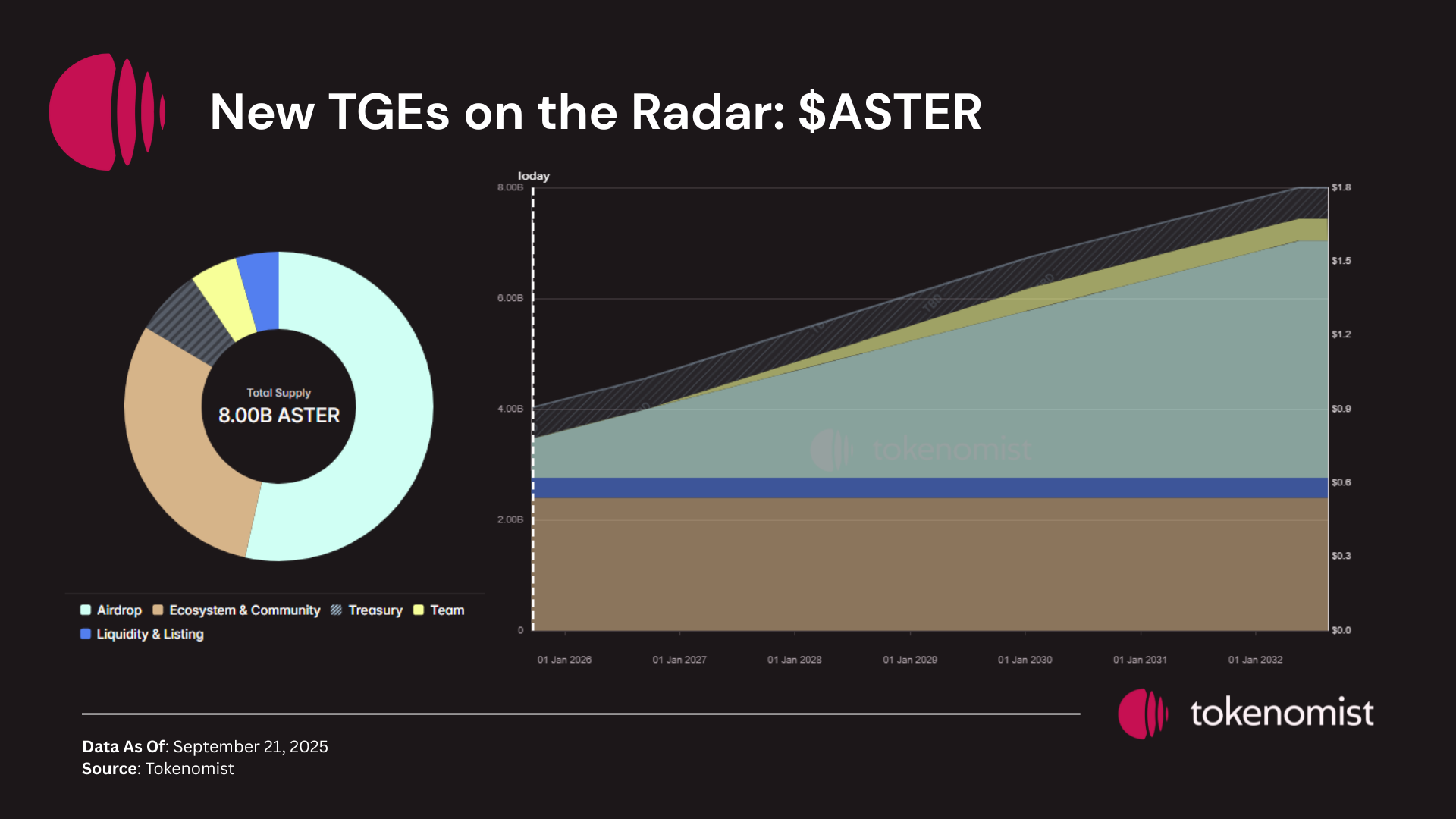

Aster launched with 43% of total supply unlocked at TGE, broken down as:

✅ Liquidity & Listing: 4.5% (fully unlocked)

✅ Airdrop: 8% (15% of total airdrop allocation unlocked)

✅ Ecosystem: 30% (fully unlocked)

This places $ASTER’s initial circulating supply in the mid-range compared to competitors.

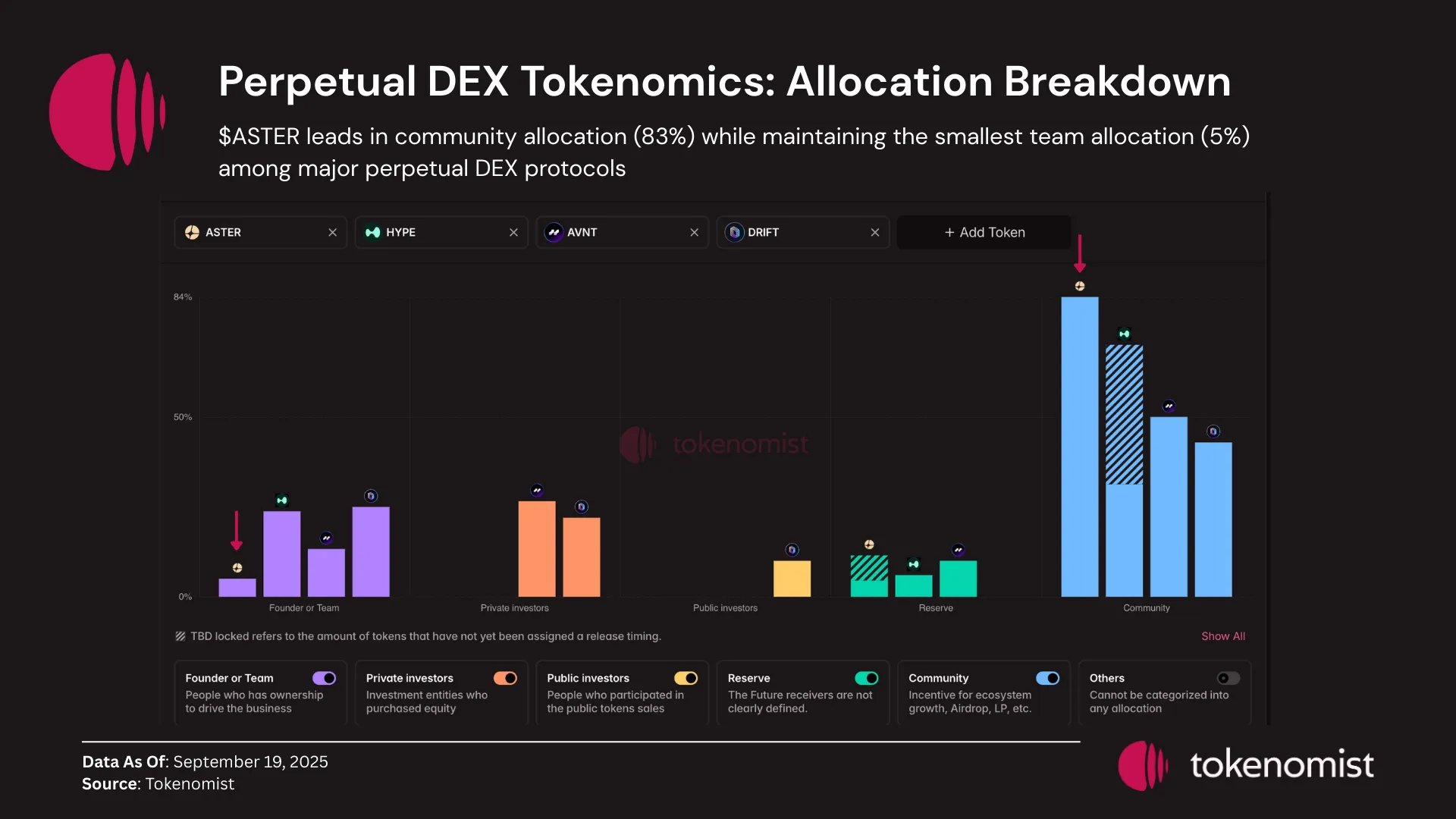

Notably, $ASTER boasts:

🔸 No investor allocation

🔸 Smallest team allocation among major perp DEXs (5%)

🔸 ~7% reserved for treasury

🔸 83% of total supply allocated to the community (Airdrop + Ecosystem & Community) — making it one of the most community-heavy perp DEX tokens in the market.

Notable Crypto News

Institutional

- Pantera-Backed Solana Treasury Firm Helius Raises $500M, Stock Soars Over 200% (CoinDesk)

- MoonPay buys crypto payments startup Meso to expand global reach (The Block)

Regulation

- SEC approves Grayscale's multi-crypto fund with XRP, SOL and ADA (The Block)

- SEC approves new exchange listing standards fast-tracking crypto ETF listings (The Block)

Tokenomics

- Coinbase-incubated Base network 'beginning to explore' native token, creator Jesse Pollak says (The Block)

General