Weekly Unlock Digest: Sep 29-Oct 5, 2025

This week’s report dives into a market navigating stronger-than-expected economic data. Crypto markets saw a broad pullback as Ethereum and altcoins faced heavy liquidations. On the token front, we’re tracking $SUI, this week’s largest unlock by dollar value. We also spotlight $XPL, the native token of Plasma, a stablecoin-focused L1 backed by Tether.

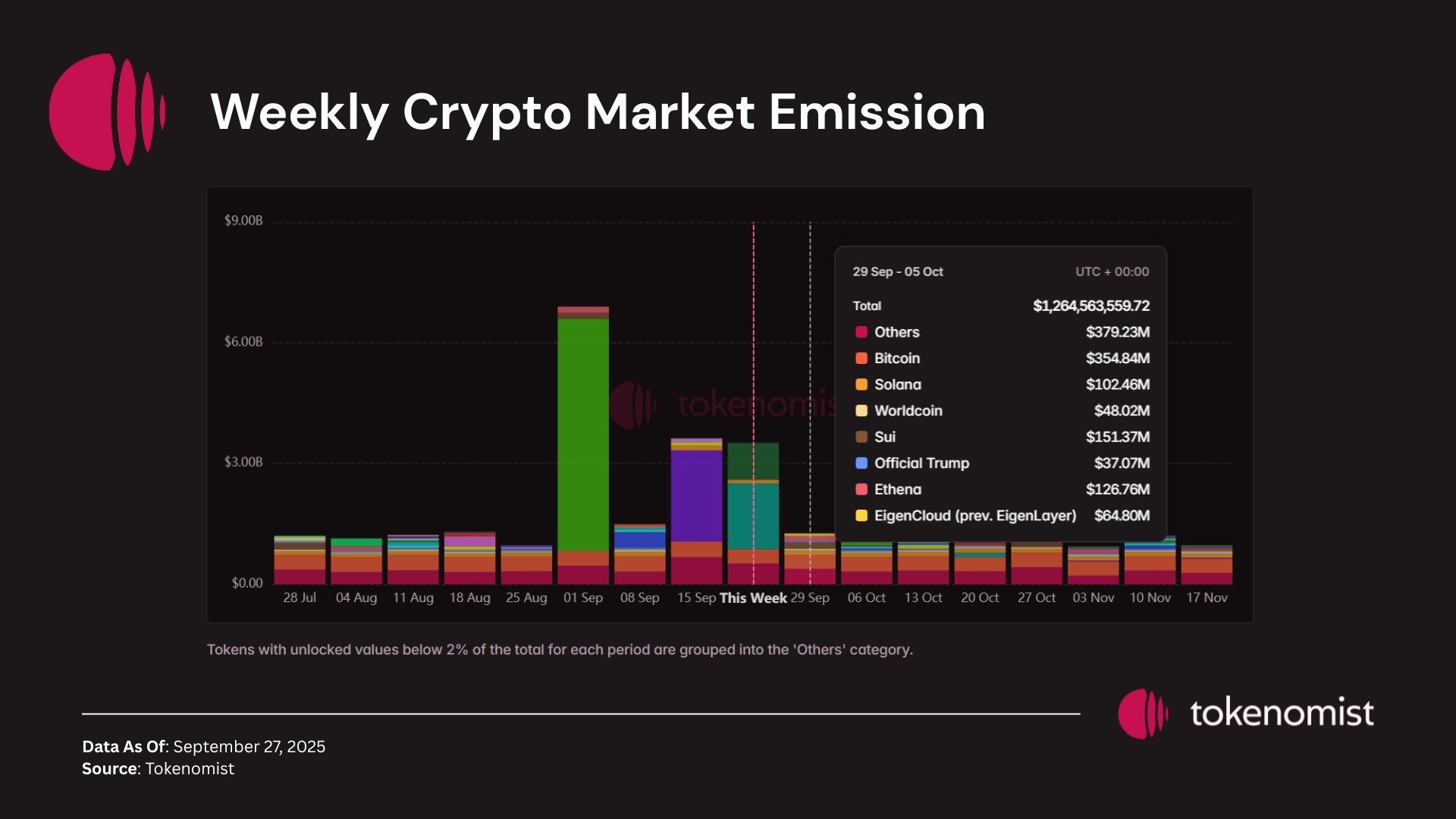

Weekly Unlocks Recap

Weekly jobless claims came in lower, and Q2 GDP forecasts were revised higher — signaling a stronger-than-expected economy. This data reduced the likelihood of rapid Fed easing, especially with inflation still running sticky.

Crypto markets pulled back as major liquidations hit Ethereum and several altcoins, leading to a broad risk-off move across the sector.

In an environment where risk appetite is fading, tokens with large unlock schedules may struggle to find sufficient demand. Until broader momentum improves, these tokens may face continued underperformance relative to the market.

Upcoming Events

Next week’s scheduled token releases are set to exceed $1.3 Billion in total value. Notable tokens facing sizable releases by dollar value include $BTC, $SUI, $ENA, $SOL, and $EIGEN.

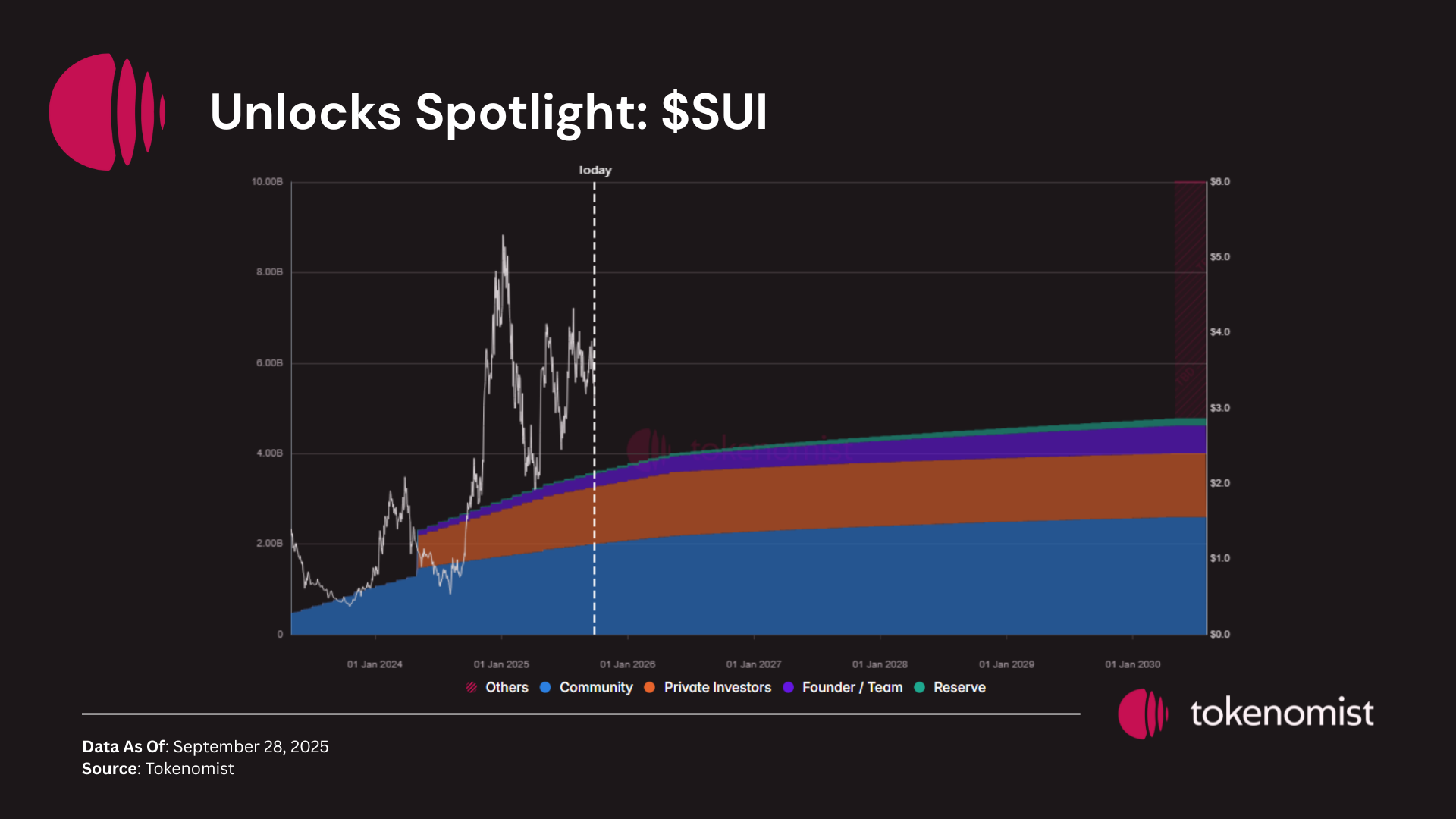

Unlocks Spotlight: $SUI

- Unlock Date: October 1 , 2025

- Amount: $ 140.78M

- Unlock as % of Circulating Supply: 1.23%

- Vested Allocations: Series B, Community Reserve, Early Contributors, and Mysten Labs Treasury

$SUI leads this week’s unlocks by dollar value, with most tokens going to insider allocations such as Series B investors and the core team.

Despite the size of this release, its impact may be muted: a significant portion of $SUI’s total supply is still locked under a long vesting schedule, with some allocations not set to release until after 2030. This creates a slow-drip emission profile, giving the market time to absorb new supply without aggressive sell pressure.

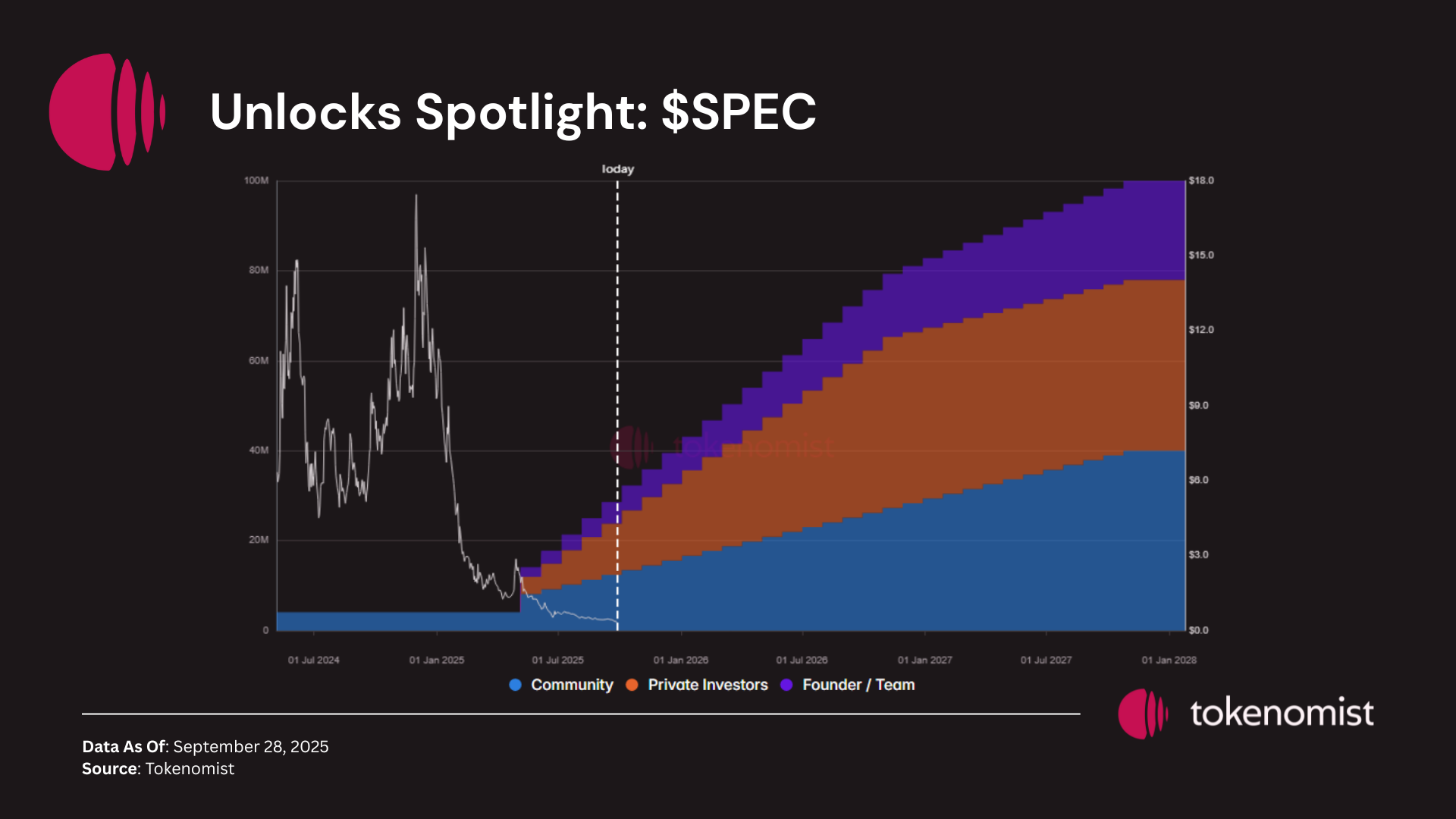

Unlocks Spotlight: $SPEC

- Unlock Date: October 4, 2025

- Amount: $ 1.25M

- Unlock as % of Circulating Supply: 12.66%

- Vested Allocations: Investors, Community, and Core Contributors

$SPEC records the largest unlock relative to circulating supply this week, with a mix of insider and community-focused allocations coming in circulation.

However, $SPEC continues to drift toward new all-time lows as momentum in the AI narrative fades. This unlock could test market appetite further, as investors watch to see whether community allocations support renewed activity or simply add to the existing sell pressure.

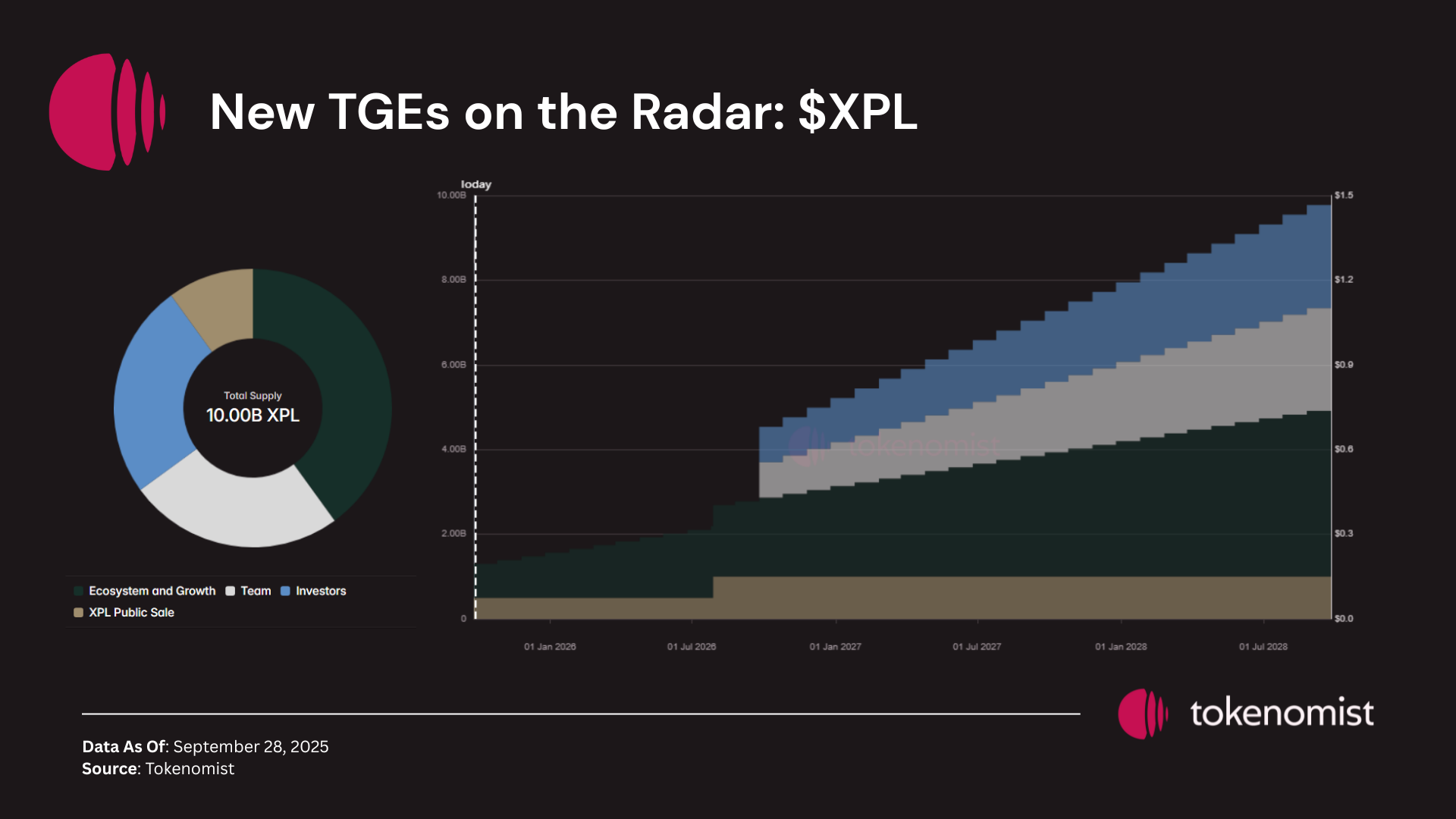

New TGEs on the Radar

This week’s notable TGE is $XPL, the native token of Plasma — a stablecoin-focused layer 1 supported by Tether. Plasma introduces zero-fee USDT transfers via its PlasmaBFT consensus, positioning itself as a high-throughput chain purpose-built for stablecoin settlement.

$XPL launched with an opening market cap of $1.7B, making it one of the more significant L1 launches this year.

Tokenomics:

- Public Sale Investors: 10% of total supply (subject to 12-month lockup for U.S. persons, fully unlocked July 28, 2026)

- Team: 25%

- Private Investors: 25%

- Ecosystem: 40% (8% unlocked at TGE, remaining released monthly over 3 years)

Notable Crypto News

Institutional

- Tether CEO confirms major capital raise at a reported $500 billion valuation (CNBC)

- Metaplanet Hits 85% of Bitcoin Yearly Target, Becomes Fifth-Largest Corporate Holder (Decrypt)

- Cloudflare plans to launch stablecoin called NET Dollar as market is poised to expand (The Block)

Regulation

- CFTC launches tokenized initiative allowing derivatives traders to post stablecoins as collateral (The Block)

Tokenomics

- Stablecoin-focused Layer 1 Plasma goes live introducing XPL token and DeFi integrations (The Block)

General