Weekly Unlock Digest - Week 1, June 2025

Bitcoin continues to hover near its all-time high, with signs of exhaustion keeping traders cautious. Altcoins remain flat, and relief selling may be limiting upside. Meanwhile, token unlocks showed mixed price impacts over the past month. This week’s highlights include major releases from $ENA and $TAIKO, rising mindshare for $ZBCN, and the debut of $SOPH.

Weekly Unlocks Recap

After breaking its all-time high, Bitcoin has been hovering around the same level, struggling to push decisively higher. Many technical indicators are signaling overbought conditions, making market participants more cautious. At the same time, altcoins remain mostly flat, with little momentum across the board. One factor potentially holding the market back is the presence of relief sellers — investors who previously held unrealized losses are now exiting at breakeven as prices return to their original entry points.

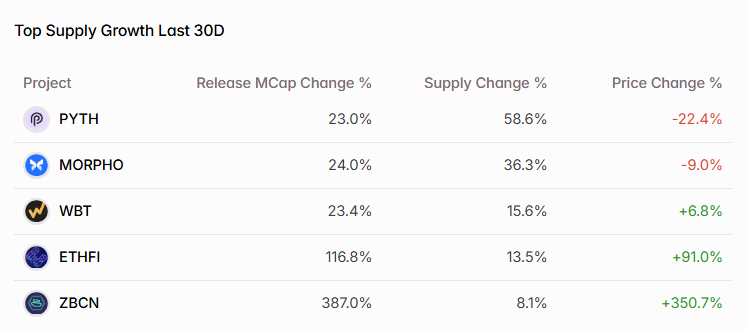

Over the past month, the impact of token unlocks on price performance has been mixed. Some tokens managed to hold or even gain value despite emissions, driven by strong demand or renewed narrative momentum. Others, however, struggled under selling pressure. The most notable example is $PYTH, which saw the steepest price decline following substantial unlocks — we covered this in detail last week (read the full breakdown here).

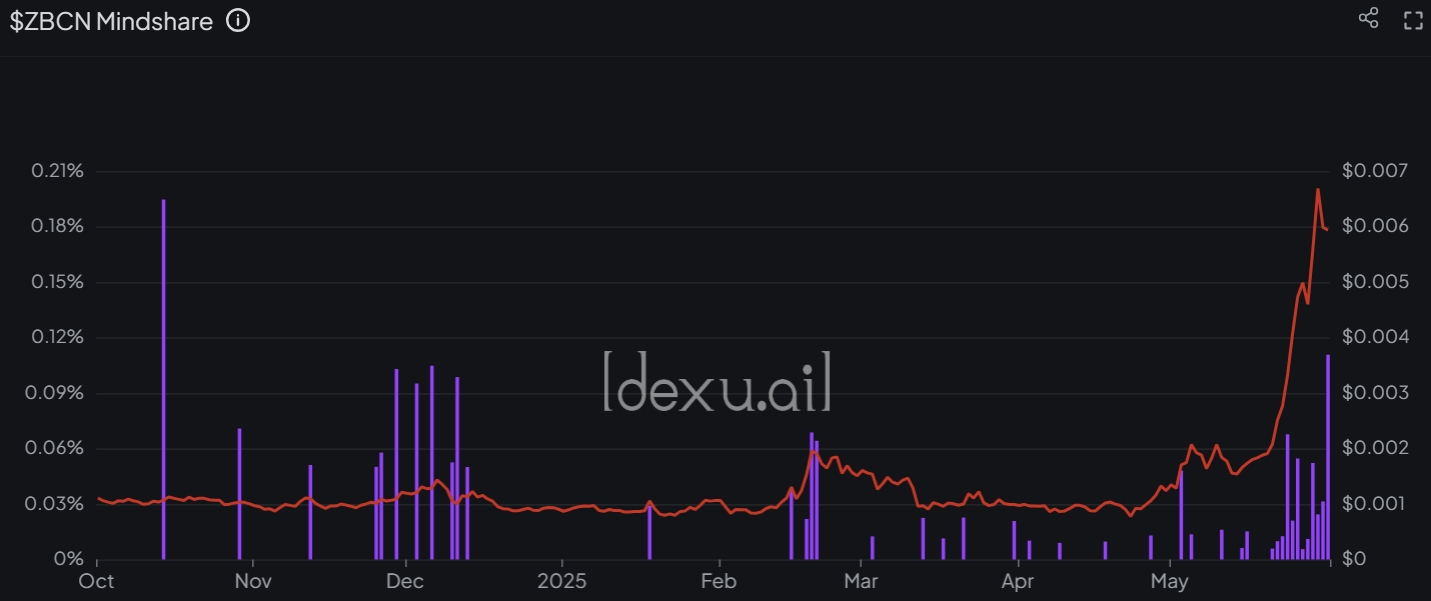

$ZBCN, the native token of Zebec Network, has been gaining significant traction in recent weeks. Zebec offers real-time payroll solutions and serves as an on-chain payment infrastructure, a niche that places it in a similar category to well-known projects like $XRP.

The token has also been heavily promoted on TikTok, where it's often hyped as the “next $XRP.” As community interest grows, $ZBCN is increasingly viewed as undervalued — not just in comparison to $XRP, but also relative to its revenue fundamentals and early private funding valuations. This has prompted some investors, including former $XRP holders, to rotate into $ZBCN in search of higher potential upside.

However, it's worth noting that $ZBCN has already rallied over 6x from its bottom, which could make near-term entries riskier. Additionally, only 30% of the total supply is currently circulating, meaning further unlocks are expected and could introduce selling pressure moving forward.

Upcoming Events

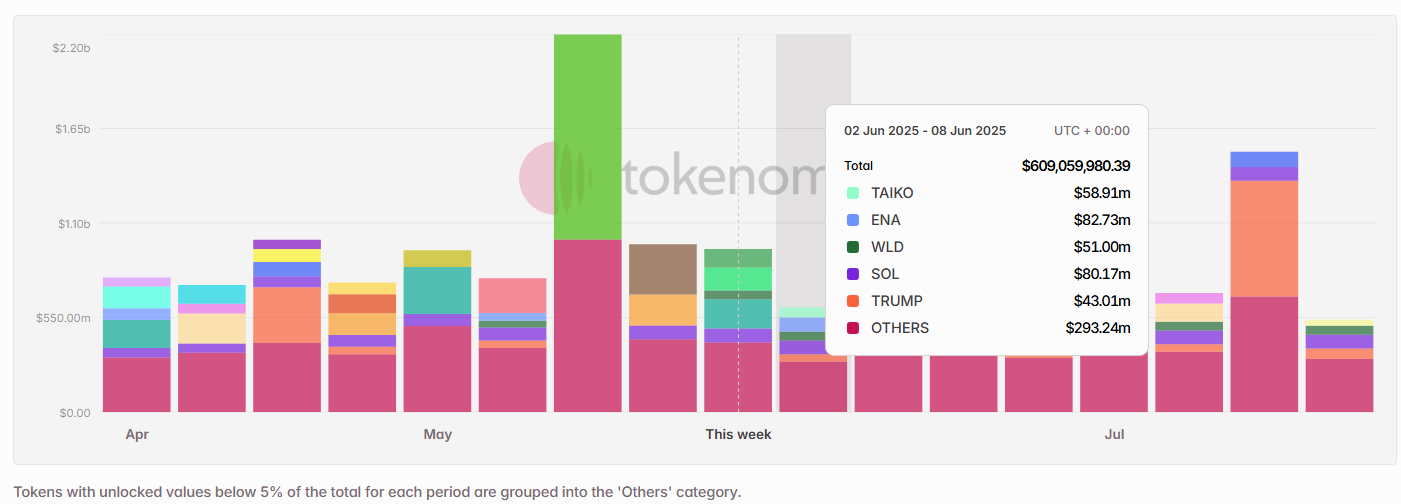

Next week’s scheduled token unlocks are set to surpass $600 Million in total value. Of this, approximately 23% is classified as insider unlocks under Tokenomist’s framework — referring to allocations designated for founders, core teams, or early investors. Notable tokens facing sizable releases by dollar value include $ENA, $SOL, $TAIKO, $WLD, and $TRUMP.

Unlocks Spotlight: $ENA

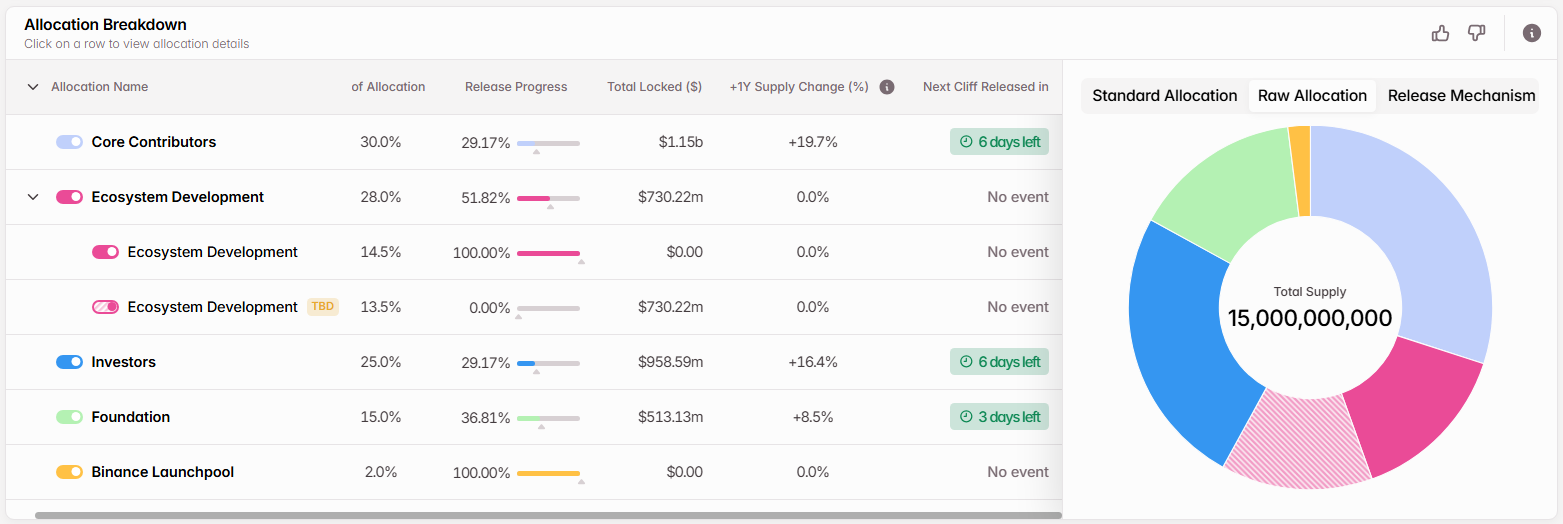

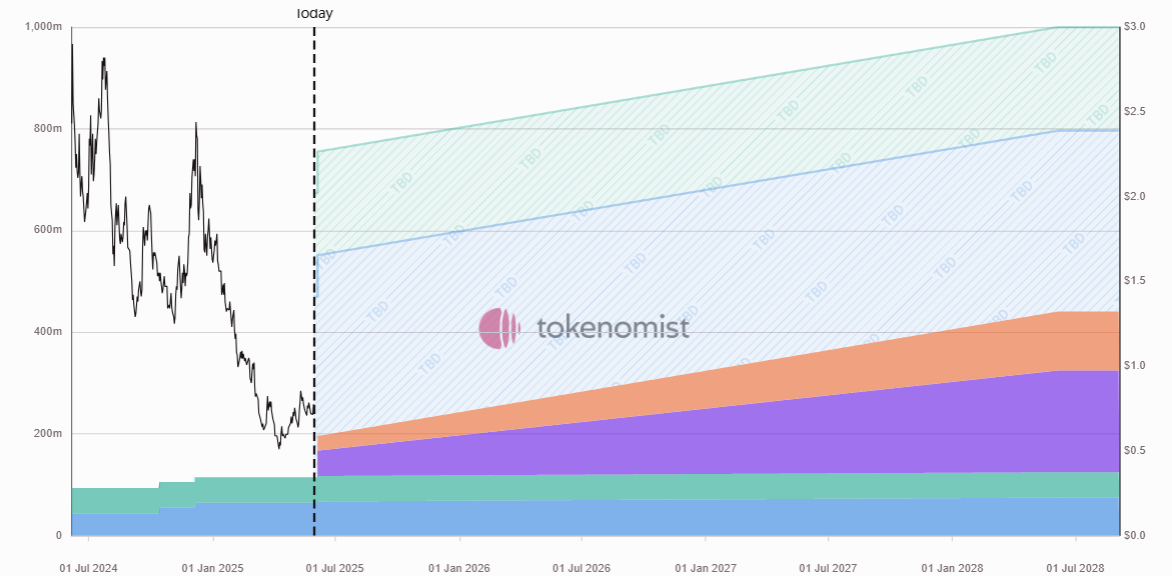

- Unlock Date: June 2 & June 5, 2025

- Unlock as % of Circulating Supply: 3.65%

- Current Unlock Progress: 38% unlocked

- Vested Allocations: Core Contributors, Investors, and Foundation

$ENA leads this week in terms of dollar value unlocked, but the release represents only a small percentage of its circulating supply. These unlocks are part of the ongoing vesting schedule for insider cohorts, including core contributors and early investors. With 29% of insider allocations already released, the market may have priced in some of this supply, reducing the immediate impact.

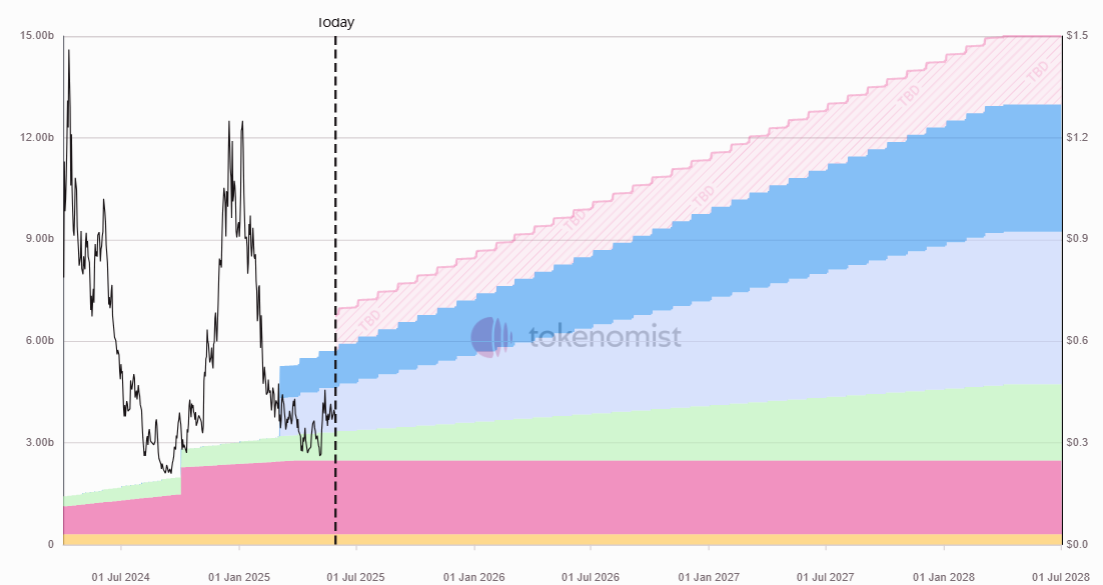

Unlocks Spotlight: $TAIKO

- Unlock Date: June 5, 2025

- Unlock as % of Circulating Supply: 69.60%

- Current Unlock Progress: 11% unlocked

- Vested Allocations: Taiko Labs (Core Team), Investors, and Protocol Guild Airdrop

This week, $TAIKO stands out with the largest percentage unlock relative to its circulating supply. The release marks the project’s first cliff unlock for insider allocations. Following this initial cliff, tokens will continue to vest gradually through linear emissions. The market’s reaction may offer an early glimpse into how participants view $TAIKO’s long-term fundamentals and unlock schedule.

New TGEs on the Radar

This week saw two new tokens enter the market: $HUMA (Huma Finance) and $SOPH (Sophon).

$SOPH (Sophon) is a modular rollup built on the zkStack, designed specifically for gaming and entertainment applications. Its launch was backed by strong exchange support, debuting on major platforms like Binance, OKX, and Bybit.

However, $SOPH's price has dropped over 50% since launch, raising concerns that it may have entered the market at an overly aggressive valuation — a common risk when hype outpaces fundamentals.

$SOPH → hype meets gravity 📊

— iMithrandir 🪄 (@iMithrandir_) May 30, 2025

Launched at $0.095

Now trading near $0.051

Down ~50% in 48 hours.

What happened?

• Early unlocks hit fast

• No bid on the way down

• $0.058 support gave out

• Volume thinning, no base (yet)

Harsh? Sure. Surprising? Not really.

Most serious… pic.twitter.com/1Bjewb1Usd

Tokenomics-wise, 37% of $SOPH’s total supply is allocated to the community, with more than half of that released at TGE — aligning with a strategy to build early user engagement. The launch featured an initial low float, with just 20% of the total supply unlocked at listing. Insider allocations are on a delayed schedule, with the first major unlock set to begin around one year from now, followed by a gradual vesting curve. This structure is designed to minimize immediate sell pressure from early backers while incentivizing long-term participation.

Notable Crypto News

Institutional

- BlackRock eyes 10% stake in Circle's IPO — Bloomberg Report (CoinTelegraph)

- SharpLink Gaming To Raise $425M Through PIPE For Ethereum Treasury Strategy With Consensys (Nasdaq)

Regulation

- SEC says proof-of-stake staking activities do not constitute securities transactions (The Block)

- SEC Files to Dismiss Long-Running Lawsuit Against Binance (CoinDesk)

- Senate Stablecoin Bill Passes Key Vote as GENIUS Act Regains Momentum (Decrypt)

Tokenomics

- OpenSea says SEA token launch depends on key feature releases, promises new rewards for users as OS2 exits beta (The Block)

- BIO Community Approves Delay of Core Team's 1-Year Cliff Unlock (Bio)

General

- Tether-backed Bitcoin treasury firm Twenty One raises total financing to $685 million after second note sale (The Block)

- Stablecoin Giant Circle Files for IPO on NYSE (CoinDesk)

- Conduit raises $36M for stablecoin, fiat cross-border payment network (CoinTelegraph)