Weekly Unlock Digest - Week 2, June 2025

The crypto market saw mild consolidation this week, with BTC and ETH slightly down from recent highs. Attention now turns to macro data like CPI and PPI, which could steer short-term sentiment. Unlocks continue to show mixed effects — with $PYTH notably down 20% as demand fades. This week’s key highlights include large unlocks from $CONX and $BB, and a strong debut from $LA (Lagrange Protocol), which surged over 3x post-TGE.

Weekly Unlocks Recap

The crypto market saw mild consolidation over the past week, with both Bitcoin and Ethereum pulling back around 3–4% after recent highs. Looking ahead, market direction depend on upcoming macroeconomic data — particularly CPI and PPI figures — which could be influenced by the latest tariff developments.

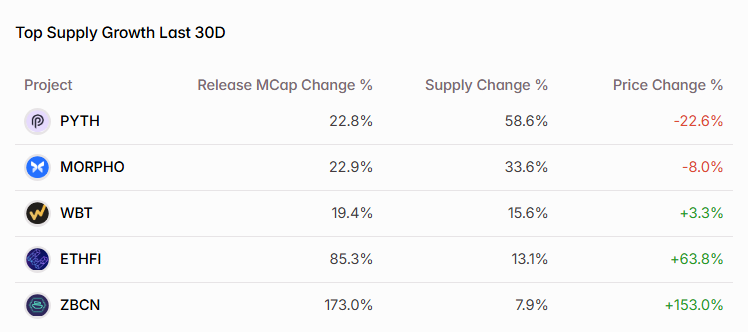

Since Bitcoin reached its new all-time high, the broader market has entered a more stagnant phase — and the price impact of token unlocks has varied widely. Some projects managed to absorb new supply without much disruption, while others struggled due to lack of fresh demand. One notable example is $PYTH, which has seen its price drop over 20% in the past 30 days, highlighting how persistent emissions can weigh heavily when market interest fades.

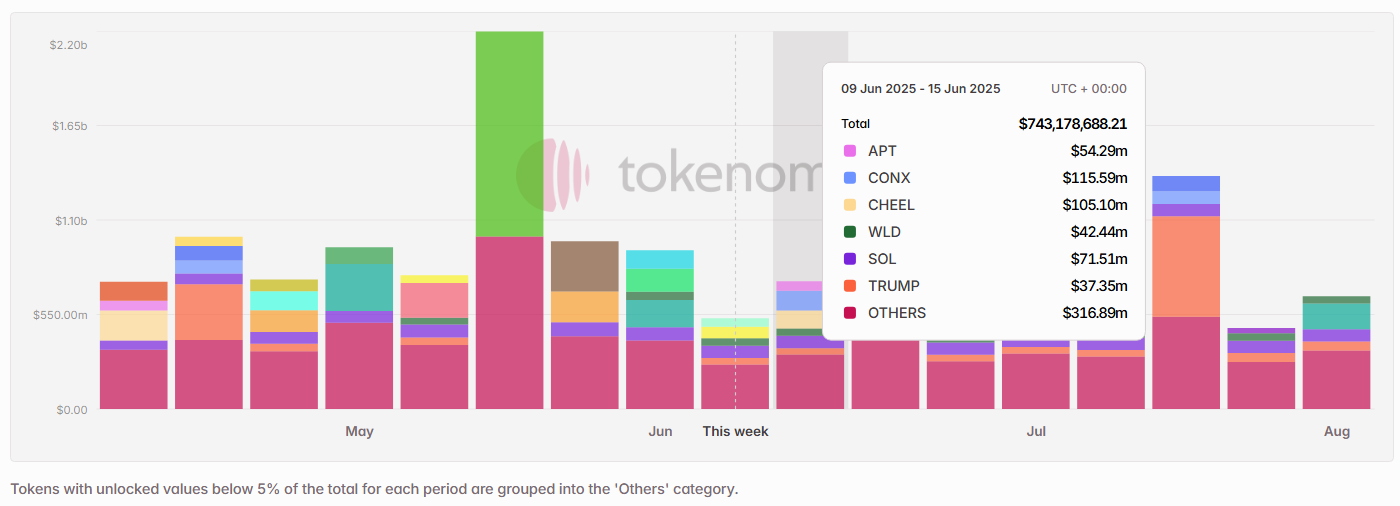

Upcoming Events

Next week’s scheduled token unlocks are set to surpass $740 Million in total value. Of this, approximately 12% is classified as insider unlocks under Tokenomist’s framework — referring to allocations designated for founders, core teams, or early investors. Notable tokens facing sizable releases by dollar value include $CONX, $CHEEL, $SOL, $APT, and $WLD.

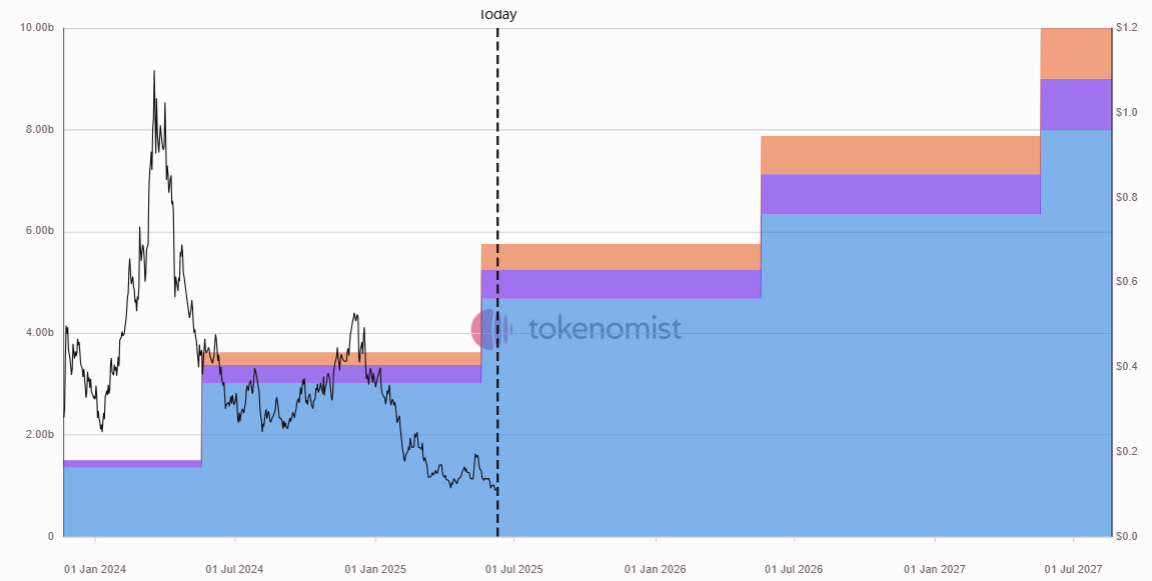

Unlocks Spotlight: $CONX

- Unlock Date: June 15, 2025

- Unlock as % of Circulating Supply: 5.4%

- Current Unlock Progress: 66.75% unlocked

- Vested Allocations: Foundation, Team, Ecosystem, Community Treasure, and Advisor & Partner

$CONX leads this week in terms of total dollar value unlocked. The release is split evenly between insider allocations and ecosystem incentives. While a large unlock can raise concerns, the balanced distribution between internal stakeholders and community growth initiatives may help reduce immediate sell pressure.

Unlocks Spotlight: $BB

- Unlock Date: June 12, 2025

- Unlock as % of Circulating Supply: 10.47%

- Current Unlock Progress: 25% unlocked

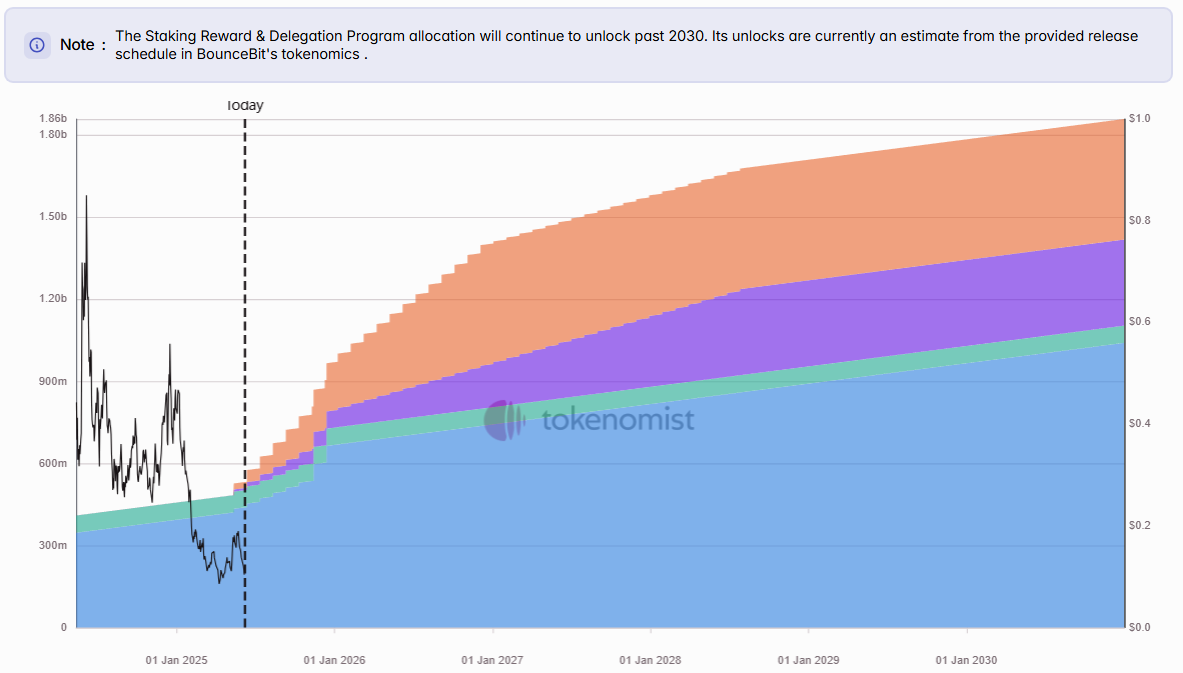

- Vested Allocations: Investors, BounceClub & Ecosystem Reserve, Team, and Advisors

$BB stands out this week with the largest unlock relative to its circulating supply. The majority of the tokens released are allocated to insider cohorts, including early investors and the core team. This event marks the start of ongoing insider vesting, which could introduce new supply-side pressure in the months ahead.

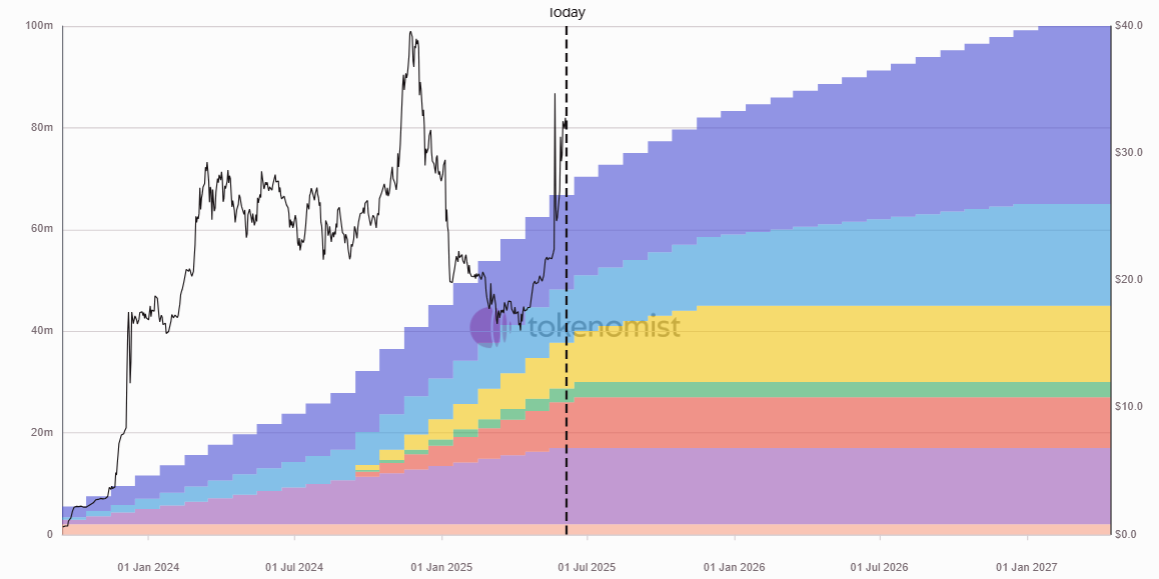

New TGEs on the Radar

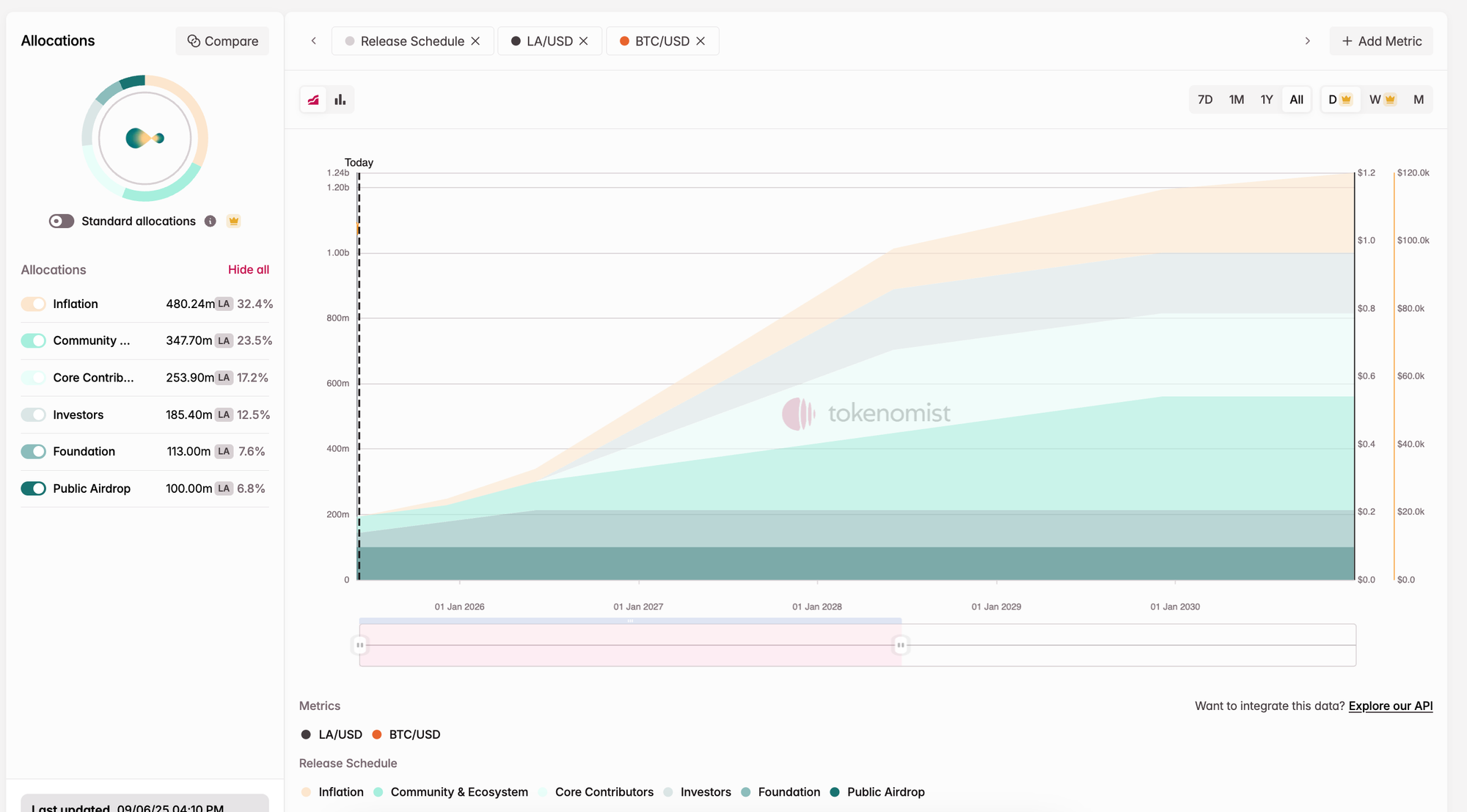

This week’s notable TGE is $LA (Lagrange Protocol), a cross-chain infrastructure enabling cryptographic, non-interactive state proofs across major blockchains without relying on trusted relayers. The project launched with broad EVM compatibility and plans to expand to non-EVM chains like Solana, Sui, Aptos, and Cosmos-based networks. Following its TGE, $LA has surged over 3x, reflecting strong initial market interest.

$LA has a total supply of 1 billion tokens, with a 4% annual emission rate. Roughly 45% is allocated to insider cohorts—including investors and contributors—who are subject to a 1-year lock followed by a 2-year linear vesting schedule. On the community side, 5% of the supply was unlocked at TGE, while the remaining allocation is locked for 6 months and will vest gradually after that.

Notable Crypto News

Institutional

- JPMorgan to offer crypto ETF financing, considers letting clients use crypto as loan collateral (The Block)

- Robinhood’s $200 million Bitstamp deal takes it beyond retail trading (CNBC)

Regulation

- Stablecoins Dominate Bitcoin 2025 as U.S. Officials Push Digital Dollar Legislation (CNBC)

- SEC Delays Approval of Ethereum and Solana Staking ETFs (The Block)

Tokenomics

- Kamino updated TBD allocation Community Grants with Airdrop Season 2 and Season 3 (Kamino)

General