Weekly Unlock Digest - Week 2, May 2025

Despite sizable token unlocks, many assets held firm or gained, reflecting stronger market absorption. This week’s report highlights standout performers like $ETHFI and $MORPHO, underperformers such as $LAYER, the largest upcoming unlock in $WBT, and a new TGE from MilkyWay.

Weekly Unlocks Recap

This week, Bitcoin delivered a strong bullish signal by breaking above the key resistance zone at $100,000 — a milestone that reignited market optimism. The upward surge was primarily driven by positive sentiment after the unveiling of a US-UK trade agreement, along with sustained heavy investments from institutions into US spot Bitcoin ETFs. Altcoins have also ridden this momentum, with many posting gains despite ongoing token unlocks. The sustained demand and improved sentiment suggest that unlock-driven supply pressure is being absorbed more effectively in the current risk-on environment.

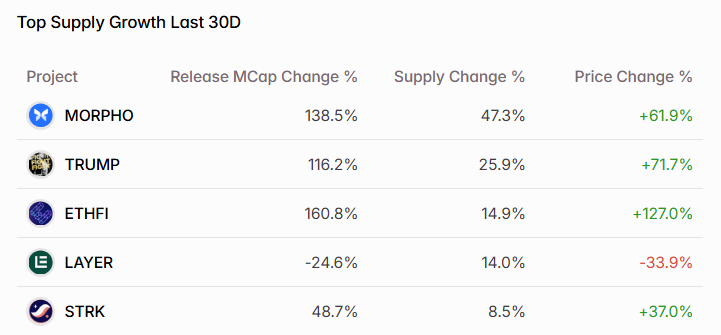

Among this week’s notable unlocks, $ETHFI and $MORPHO stood out for their impressive performance. $ETHFI saw a 14.9% supply increase, yet its price surged 127%, highlighting strong market conviction and demand for Ethereum staking narratives. Similarly, $MORPHO experienced a 47.3% supply increase, the largest among tracked projects, but still managed a +61.9% price gain. This suggests that in bullish conditions, investors are willing to absorb substantial token unlocks if fundamentals and sentiment align.

In contrast, $LAYER massively underperformed despite the overall market rebound. The token has now fallen over 60% from its peak, reversing what many suspected to be an artificially driven rally. Previously, $LAYER continued climbing even during market pullbacks—an unusual behavior that raised concerns of potential price manipulation. A closer look revealed that $LAYER held a higher market cap than $EIGEN, a project with 65 times more TVL, underscoring the disconnect between price and fundamentals. This collapse mirrors the earlier $OM crash, where valuation ran far ahead of on-chain reality.

$EIGEN vs. $LAYER $LAYER MC ($286m) > $EIGEN MC ($273m)

— Cryptophile (@Cryptophileee) March 25, 2025

Solayer TVL = $140m

Eigen TVL = $9b

Eigen TVL is 65 times bigger than Solayer's

What is going on?😱 pic.twitter.com/hbNBTIS1KD

Upcoming Events

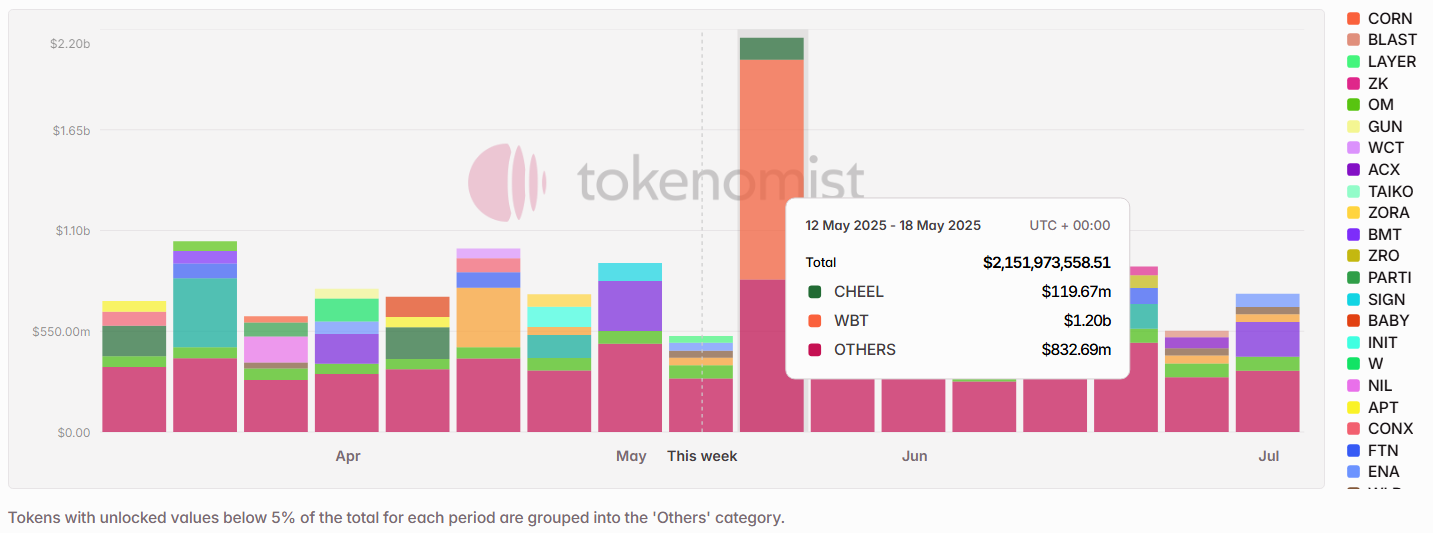

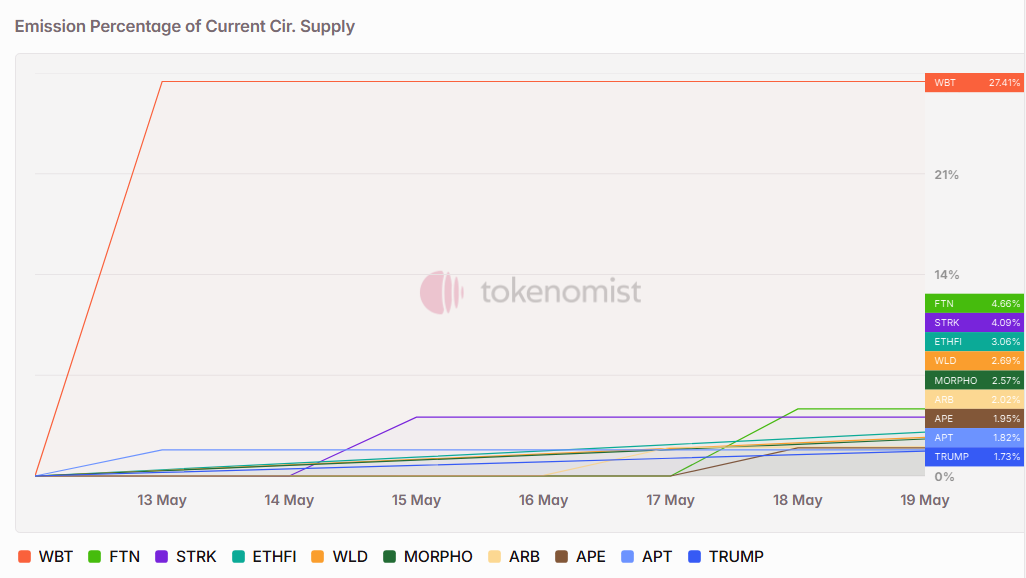

Next week’s scheduled token unlocks are set to surpass $2 Billion in total value. Of this, approximately 10% is classified as insider unlocks under Tokenomist’s framework — referring to allocations designated for founders, core teams, or early investors. Notable tokens facing sizable releases by dollar value include $WBT, $CHEEL, $FTN, $STRK, and $ETHFI.

This week features an unusually large unlock for one token, standing out in terms of size compared to recent weeks. However, with broader market sentiment turning positive—driven by renewed confidence and price momentum—the impact of these unlocks may vary by token. Strong demand or narrative support could help some tokens absorb the added supply more smoothly, while others may still face selling pressure.

Unlocks Spotlight: $WBT

- Unlock Date: May 13, 2025

- Unlock as % of Circulating Supply: 27.41%

- Current Unlock Progress: 63.50% unlocked

- Vested Allocations: Reserve

$WBT leads this week with the largest unlock by value, exceeding $1.2 billion. The newly vested tokens are allocated to the project’s reserve. Notably, previous cliff unlocks to this allocation have not disrupted the token’s performance—$WBT continues to trend strongly upward

New TGEs on the Radar

A recent notable token generation event (TGE) is $MILK by MilkyWay, a liquid staking protocol designed for the Celestia ecosystem. MilkyWay allows users to stake their $TIA tokens and receive milkTIA, a liquid derivative that represents their staked position while maintaining liquidity. This model not only enhances capital efficiency for users but also creates sustained buying pressure on $TIA, as it encourages staking participation. As a result, MilkyWay has contributed positively to both the demand for $TIA and the overall growth of the Celestia ecosystem. A remarkable detail of this TGE is that it was hosted by Binance Wallet via PancakeSwap, which drew massive demand from investors and helped fuel strong initial traction.

To analyze the design of $MILK tokenomics, we compared its allocation structure to a group of established liquid staking protocol tokens. A key takeaway from this comparison is that $MILK allocates a larger share of its token supply to the community, signaling a strong emphasis on long-term ecosystem growth.

In contrast, $MILK allocates a smaller portion of its supply to private investors compared to its peers. This suggests lower early-stage dilution and potentially less short-term sell pressure from seed and venture participants. Moreover, $MILK is the only project in the comparison set to allocate tokens to public investors through an IDO, reflecting a more inclusive approach to token distribution. This not only increases retail accessibility but also helps build a more engaged and distributed holder base from the outset — an important factor in driving long-term protocol alignment and reducing centralization risks.

Notable Crypto News

Institutional

- Stripe launches Stablecoin Financial Accounts, enabling users in 101 countries to hold stablecoin balances and transact using both fiat and crypto (Stripe)

- Coinbase acquires crypto derivatives exchange Deribit for $2.9 billion (CNBC)

Regulation

- US banks can handle customer crypto assets held in custody, regulator confirms (CoinTelegraph)

- SEC Delays May 5 Decision on Canary Capital’s Spot Litecoin ETF Amid New Commissioner Arrival (The Defiant)

Tokenomics

- Doodles announces the launch of $DOOD on Solana, with airdrops planned for eligible Doodles NFT holders (Doodles)

- Distributed validator technology provider Obol launches OBOL token (Blockworks)

General

- Ethereum Rolls Out Pectra, Its ‘Most Ambitious Upgrade Yet’ (Decrypt)

- Ethena Labs launches USDe on HyperliquidX exchange and HyperEVM, offering daily rewards for HyperCore users (Ethena Labs)