Weekly Unlock Digest - Week 4, May 2025

Bitcoin hit a new all-time high this week, reinforcing strong institutional interest and pushing crypto market sentiment higher. While the overall trend remains positive, altcoin performance has become more selective — with some tokens holding up well despite unlocks, and others showing signs of weakness. This report highlights notable unlocks, including $SUI and $BIO, the ongoing $PYTH selloff, and new token launches like $HAEDAL and $SXT.

Weekly Unlocks Recap

The crypto market continued its upward momentum this week, with Bitcoin reaching a new all-time high above $110,000. This milestone highlights sustained institutional interest, as seen in Bitcoin dominance climbing to 64%. While the broader sentiment remains positive, altcoins have become increasingly selective, with only a few showing meaningful upside.

As the market becomes more selective in its altcoin exposure, some tokens have shown positive price action despite ongoing unlocks, reflecting strong demand or continued interest. However, others have underperformed, suggesting that investors are more cautious and discerning in the current environment.

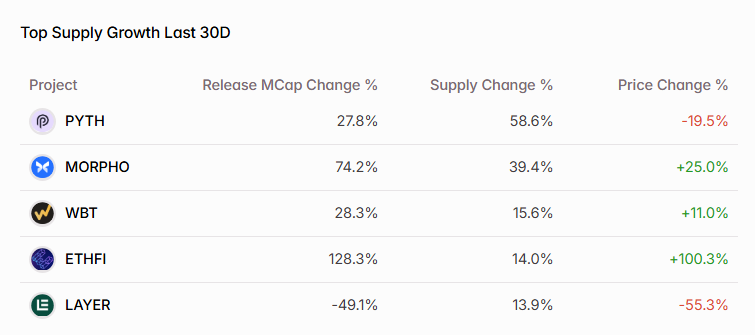

$PYTH stands out as notably underperforming over the last 30 days. More than 50% of its circulating supply has been released, contributing to a nearly 20% price decline during the period. While the majority of these tokens were directed toward the community, around 12% were allocated to insider group — a dynamic that may have added to selling pressure and raised concerns among investors.

Looking ahead, $PYTH has no scheduled unlocks until May 2026, offering a temporary reprieve from additional supply pressure. The next unlock is expected to match the size of the most recent one, giving the market several months to absorb the current circulating supply before facing another large release.

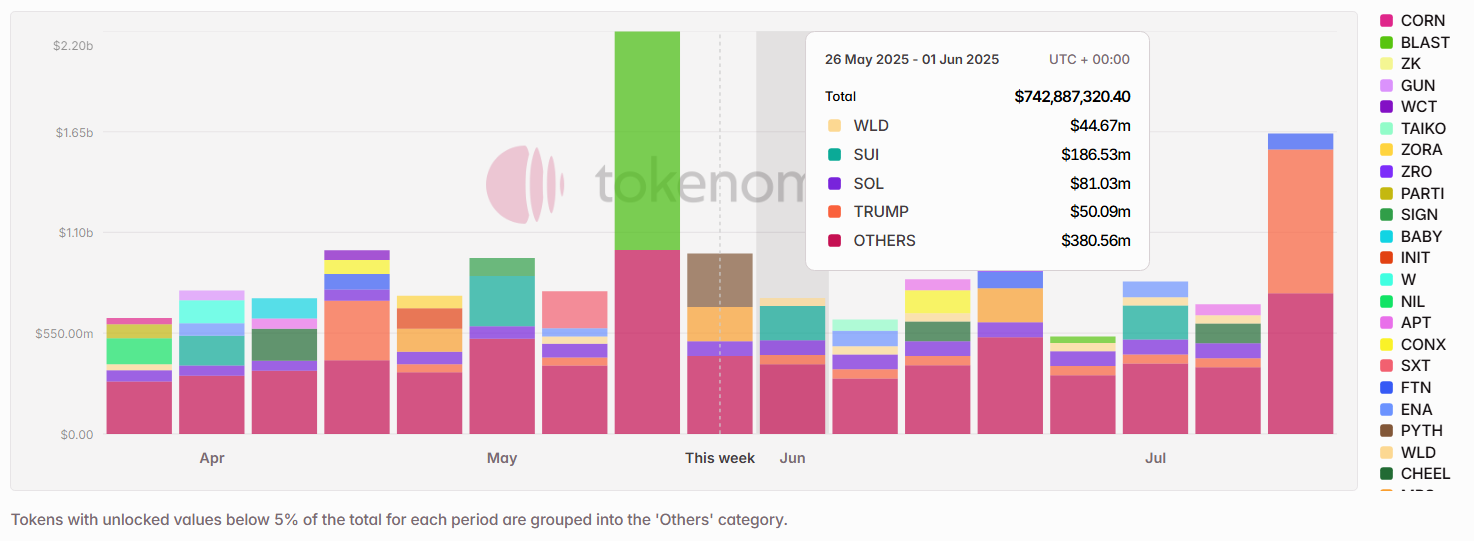

Upcoming Events

Next week’s scheduled token unlocks are set to surpass $740 Million in total value. Of this, approximately 26% is classified as insider unlocks under Tokenomist’s framework — referring to allocations designated for founders, core teams, or early investors. Notable tokens facing sizable releases by dollar value include $SUI, $SOL, $TRUMP, $WLD, and $BIO.

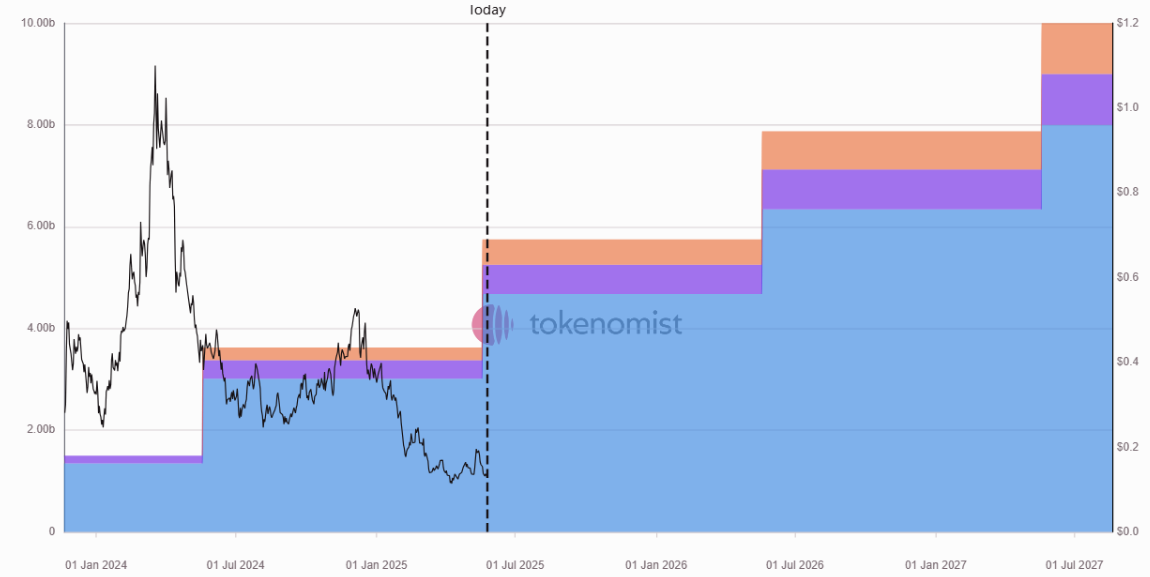

Unlocks Spotlight: $SUI

- Unlock Date: June 1 , 2025

- Unlock as % of Circulating Supply: 1.32%

- Current Unlock Progress: 33% unlocked

- Vested Allocations: Series B, Community Reserve, Early Contributors, and Mysten Labs Treasury

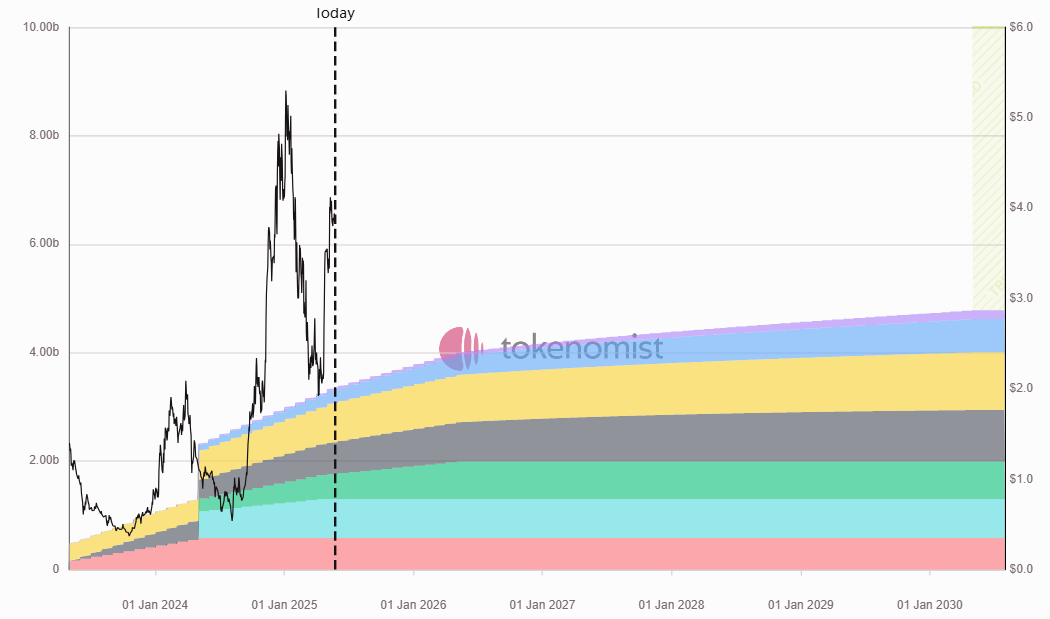

This week’s unlock spotlight is on $SUI, which has the largest unlock by dollar value. While only 33% of the total supply has been unlocked so far, more than half of the supply are not scheduled to be released until after 2030. This means there is less unlock pressure in the near future.

Unlocks Spotlight: $BIO

- Unlock Date: May 28, 2025

- Unlock as % of Circulating Supply: 20.22%

- Current Unlock Progress: 51% unlocked

- Vested Allocations: Investors, Core Contributors, Advisors, and Community Airdrop

$BIO stands out this week with the highest percentage unlock relative to its circulating supply. This marks the first major cliff since its TGE, with most of the newly released tokens allocated to insider cohorts such as the core contributors and investors. The market’s reaction may depend on how these stakeholders choose to handle the new liquidity.

New TGEs on the Radar

This week introduced two new tokens to the market: $HAEDAL (Haedal Protocol) and $SXT (Space and Time).

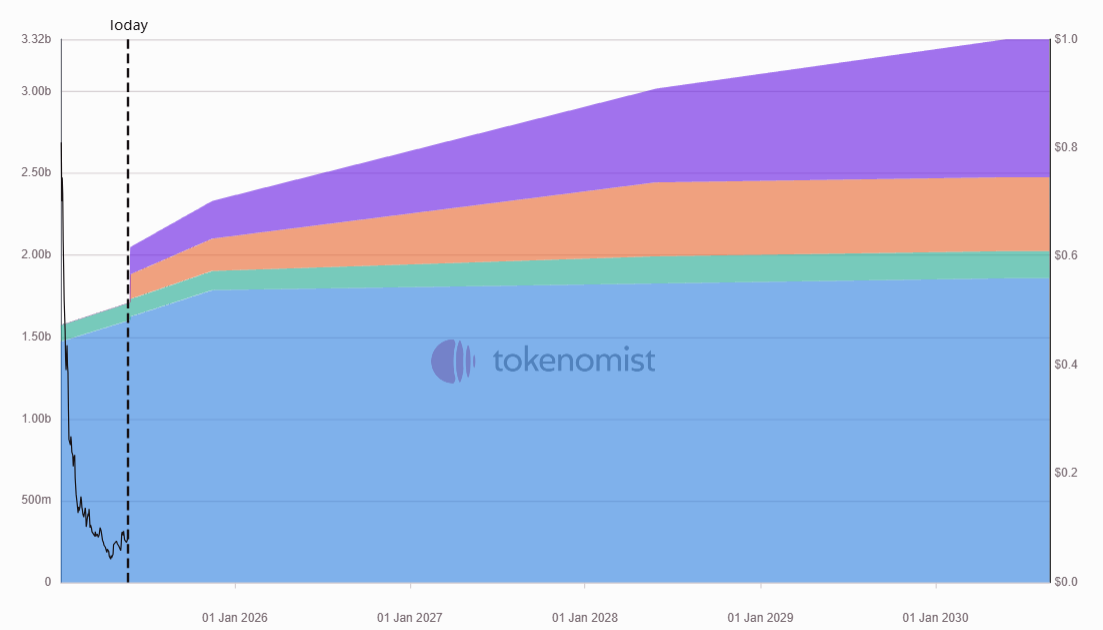

$SXT is a Layer 1 blockchain focused on ZK-proven data, aiming to bring scalable, verifiable data infrastructure to Web3. The project raised $50 million, led by M12, Microsoft’s venture fund. It currently trades at approximately $150M market cap and $500M fully diluted valuation (FDV).

We're grateful to build with the support of Microsoft's Venture Fund @M12vc since they led a strategic funding round for Space and Time in 2022 🤝 pic.twitter.com/UV2HC95QqH

— Space and Time (@SpaceandTimeDB) May 20, 2025

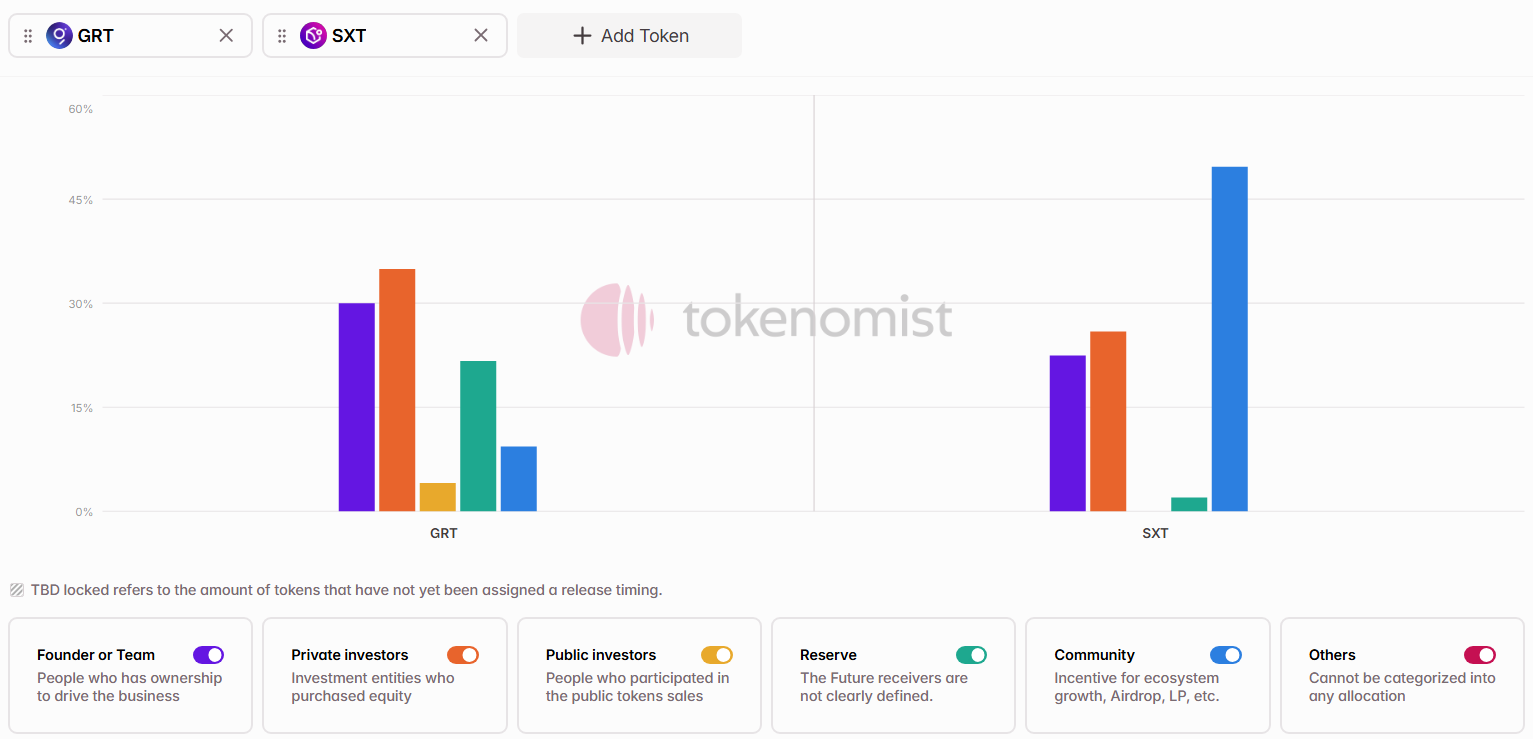

Compared to similar projects like The Graph ($GRT) — which is now trading at a $1 billion market cap — $SXT allocates a significantly larger share of its supply to the community, while reserving less for private investors and the team. This distribution approach may support broader user alignment early on, though long-term value capture will still depend on adoption and utility.

Notable Crypto News

Institutional

- JPMorgan Chase Begins Offering Clients Access to Bitcoin (CNBC)

Regulation

- U.S. Senate Advances GENIUS Act: Long Awaited Stablecoin Framework Edges Closer to Reality (Chainalysis)

- SEC Charges Unicoin, Executives Over Alleged $110 Million Crypto Fraud (Decrypt)

Tokenomics

- $MKR Holders Must Upgrade to $SKY to Keep Governance Rights (Sky)

- $CLOUD Unveils ASR Round 1: 15M sCLOUD Rewards for Active Stakers (Sanctum)

General

- Kraken introducing tokenized stock trading on Solana in collaboration with Backed Finance for non-US users (Kraken)

- Sui validators freeze majority of stolen funds in $220M Cetus hack (CoinTelegraph)