Weekly Unlock Digest - Week 5, July 2025

Crypto markets held steady this week as Bitcoin consolidated and Ethereum outperformed with over 7% gains, flipping BTC in trading volume on Coinbase. Risk-on sentiment remains strong, lifting even high-emission tokens. In this report, we cover $SUI’s $180M unlock, key macro catalysts ahead, and total scheduled unlocks exceeding $833M.

Weekly Unlocks Recap

After a strong rally in previous weeks, Bitcoin traded sideways and remained range-bound over the past seven days. In contrast, Ethereum continued to outperform, posting a weekly gain of over 7%. This momentum was reflected in trading activity, with Ethereum’s volume surpassing Bitcoin’s on Coinbase — a signal of rising risk appetite and increased retail engagement.

Looking ahead, markets face a macro-heavy week. Key events include the U.S. Federal Reserve’s rate decision at the upcoming FOMC meeting, Q2 earnings from major tech firms, and the postponed deadline for reciprocal tariffs, now set for August 1. These developments could inject fresh volatility into both crypto and traditional markets.

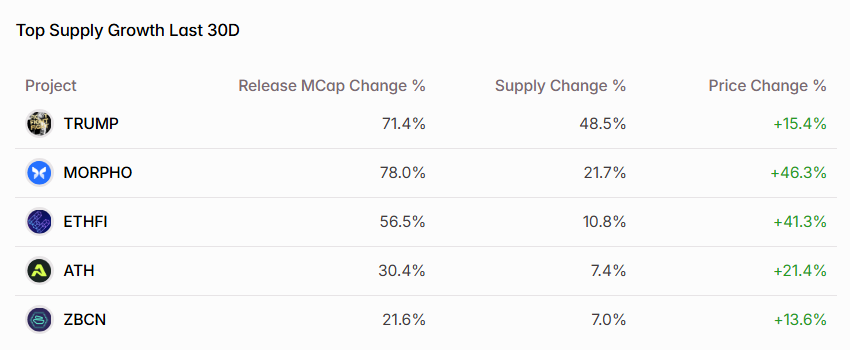

The bullish market sentiment has lifted even tokens with high emission rates, many of which posted notable gains despite large unlocks in recent weeks. This suggests that in the current risk-on environment, investor appetite is strong enough to absorb selling pressure — especially when broader macro factors and ETH-led optimism dominate the narrative. However, this could also mean short-term overextension, particularly for tokens with weak fundamentals or upcoming cliffs.

Upcoming Events

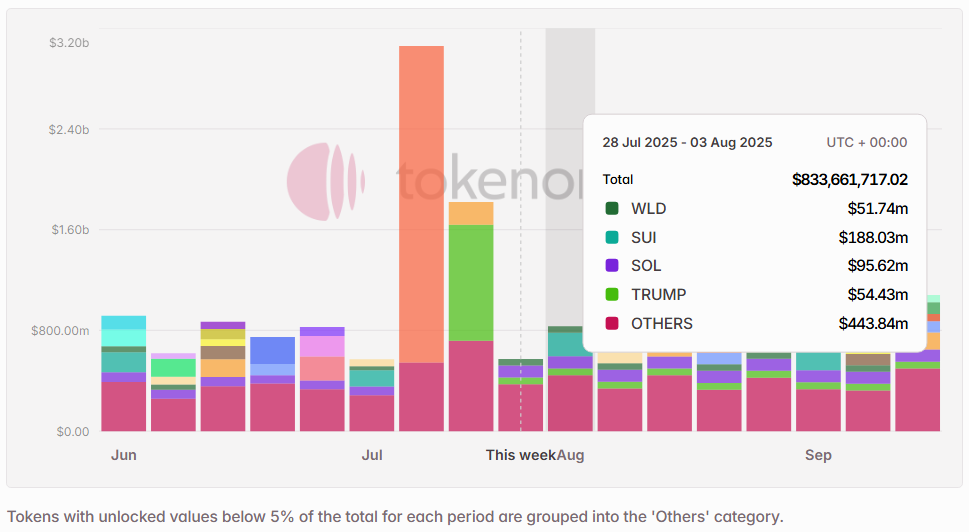

Next week’s scheduled token unlocks are set to exceed $833 Million in total value. Of this, approximately 21% is classified as insider unlocks under Tokenomist’s framework — referring to allocations designated for founders, core teams, or early investors. Notable tokens facing sizable releases by dollar value include $SUI, $SOL, $TRUMP, $WLD, and $JUP.

Unlocks Spotlight: $SUI

- Unlock Date: August 1, 2025

- Amount: $ 189.62M

- Unlock as % of Circulating Supply: 1.27%

- Vested Allocations: Series B, Community Reserve, Early Contributors, and Mysten Labs Treasury

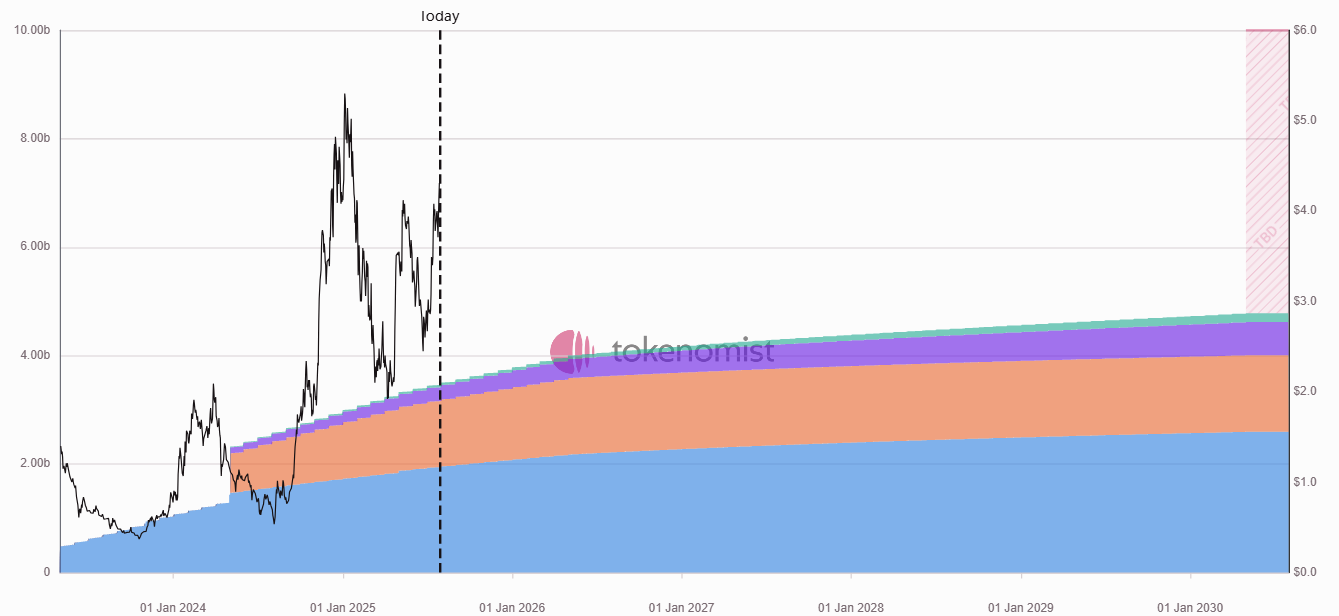

$SUI leads this week’s unlock schedule in terms of dollar value, with over $180 million worth of tokens set to be released. The vested allocations are split between insider stakeholders and community-related initiatives.

Despite its size in dollar terms, the immediate market impact is expected to be limited. The unlocked amount represents only a small fraction of the circulating supply, and the vast majority of $SUI’s token supply remains locked until May 2030. This delayed unlock structure helps ease short-term supply pressure and allows more predictable emission planning for the ecosystem.

Unlocks Spotlight: $GPS

- Unlock Date: August 1, 2025

- Amount: $ 11.64M

- Unlock as % of Circulating Supply: 20.42%

- Vested Allocations: Marketing, Community, and Ecosystem

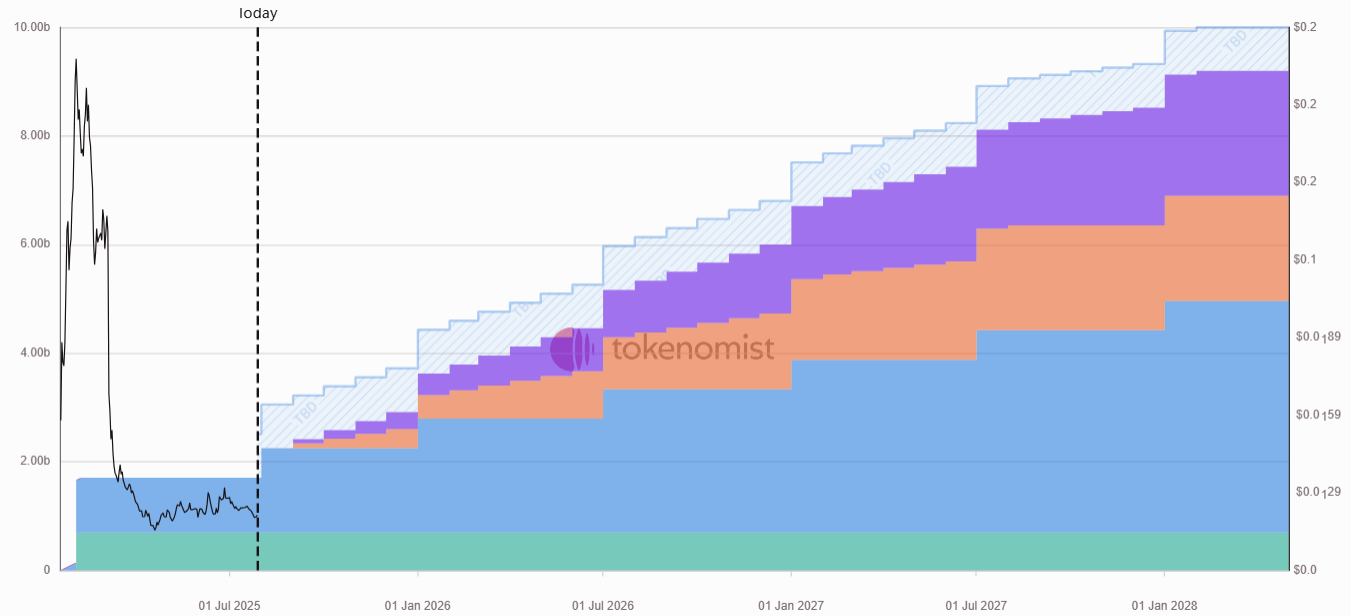

This week, $GPS stands out as the leader in percentage unlocked relative to circulating supply. All unlocked tokens are allocated to community-related initiatives — including Marketing, Community, and Ecosystem.

While this suggests the release is aimed at growing network activity rather than rewarding early investors, the sharp increase in float could still introduce meaningful supply-side pressure if recipients decide to sell.

Notable Crypto News

Institutional

- Strategy Reveals Another Stock Offering to Boost $71 Billion Bitcoin Stash (Decrypt)

- Ethereum Treasury SharpLink's Holdings Reach $1.3 Billion With Latest ETH Purchase (Decrypt)

Regulation

- Bitcoin and Ethereum ETF issuers file amendments for in-kind redemptions. (The Block)

- Coinbase launches CFTC-regulated perpetual futures for US traders amid growing crypto regulatory clarity. (The Block)

Tokenomics

- StablecoinX to go public via SPAC merger, raising $360M for ENA treasury (CoinTelegraph)

- Sonic Labs Launches Airdrop Season 1: 25% Claimable Now, 75% Vested Over Time (Sonic Labs)

- The Celestia Foundation has collaborated with Polychain Capital to reassign Polychain's TIA holdings to new investors (Celestia)

- RESOLV Activates Fee Switch, Begins Profit Sharing with Stakers (Resolv)

General

- Telegram has launched a new self-custodial crypto wallet in the U.S. through a partnership with MoonPay. (The Block)

- Ethereum validator queues swell on both entry and exit sides following price jump (The Block)

- Anchorage Digital partners with Ethena Labs for GENIUS compliant stablecoin (Ledger Insights)