Weekly Unlocks Digest: Dec 22–29, 2025

This week’s report arrives as crypto markets stabilized after last week’s volatility. BTC gained ~0.5% over the past seven days, briefly rallying below 2% following the Bank of Japan’s rate hike to 0.75% — the highest level in 30 years. Despite the move, broader risk appetite remained cautious, with total liquidations reaching ~$2.08B across major pairs.

On the token side, focus turns to $H, which posts the largest unlock relative to circulating supply this week, alongside $HYPE, where all scheduled emissions flow directly to Team.

Weekly Unlocks Recap

Macro attention was driven by global central bank actions rather than crypto-native catalysts. The BoJ’s rate hike supported a short-term BTC price action, while markets continued to price in tighter liquidity conditions heading into year-end.

Macro attention now centers on :

• Coinbase roadmap adds $LIGHTER

• $UNI DAO voting on activating protocol fees to burn UNI

• $ASTER Stage 5 buyback program launches

On the token side, several protocol-specific catalysts stand out:

• $HYPE — Voting on Hyperliquid’s proposal to burn $1B worth of HYPE concludes on Dec 24

• $HYPE — Scheduled unlock on Dec 29 releases 2.59% of circulating supply (~$250M), fully sourced from team allocations

• $ASTER — Token emissions set to reduce starting Dec 22

• $DEGEN — Treasury temporarily matching user burn percentages for one week

• $APEX — ApeX Protocol deployed 375,000 USDT to repurchase 914,634 APEX, locked for 3 years

Top Supply Growth — Last 30 Days

Supply expansion over the past month remains concentrated among a small set of names:

• RAIN leads with double-digit supply growth alongside strong price performance

• EIGEN, ETHFI, ZRO, and KMNO post mid-to-high single-digit supply increases

• Price reactions remain mixed, highlighting dilution-driven moves rather than organic demand growth

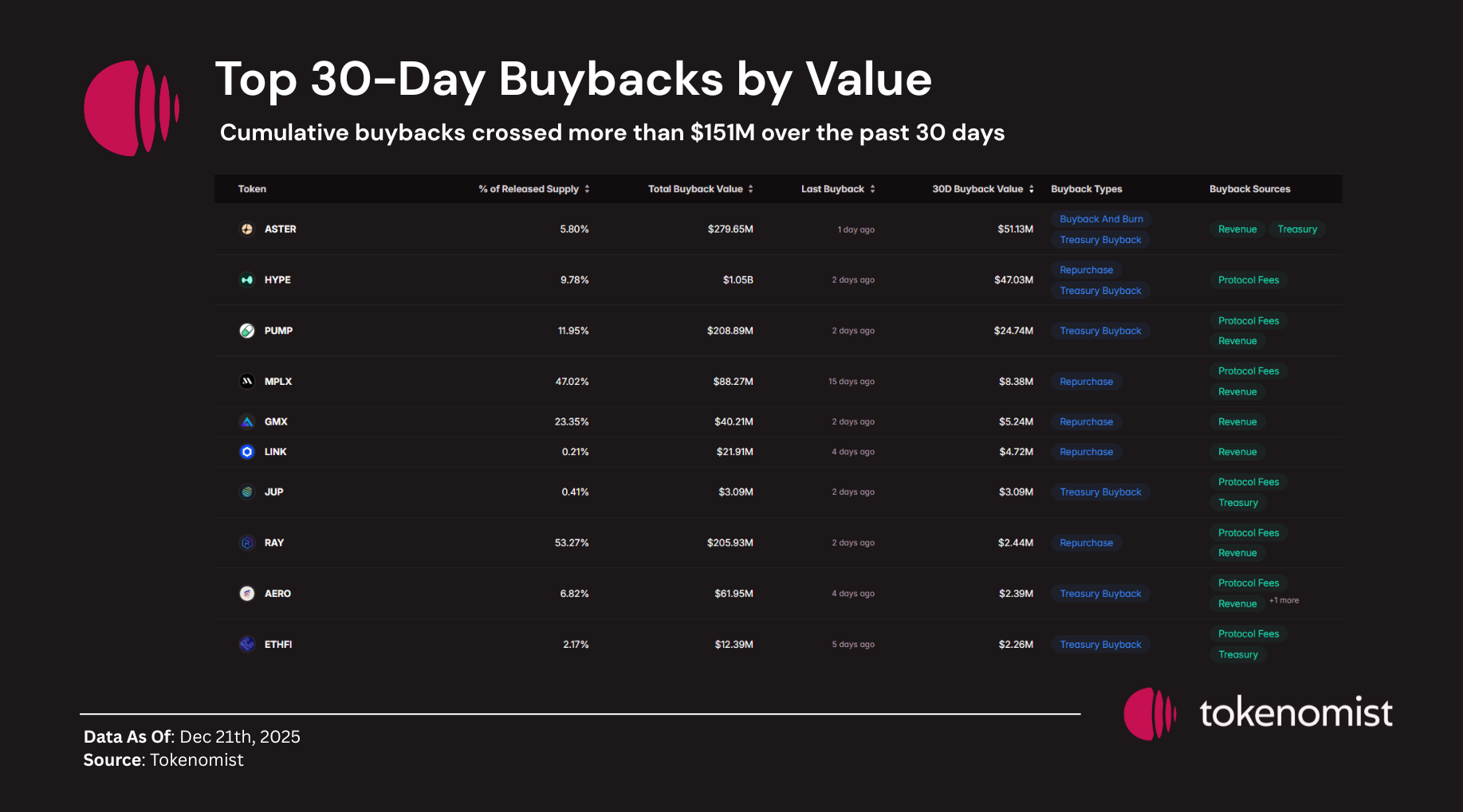

Top 30D Buybacks

Cumulative buyback activity remains dominated by fee-driven programs:

• ASTER leads 30D buybacks with over $51M, supported by revenue and treasury flows

• HYPE follows with ~$47M in 30D buybacks, primarily funded via protocol fees

• PUMP, MPLX, GMX, LINK, JUP, and RAY continue steady but smaller-scale repurchase activity

Full Dashboard : https://tokenomist.ai/buyback/screener

Cumulatively, 30-day buybacks across major protocols exceed $151M, reinforcing the divergence between revenue-generating platforms and inflation-heavy token models.

Upcoming Events

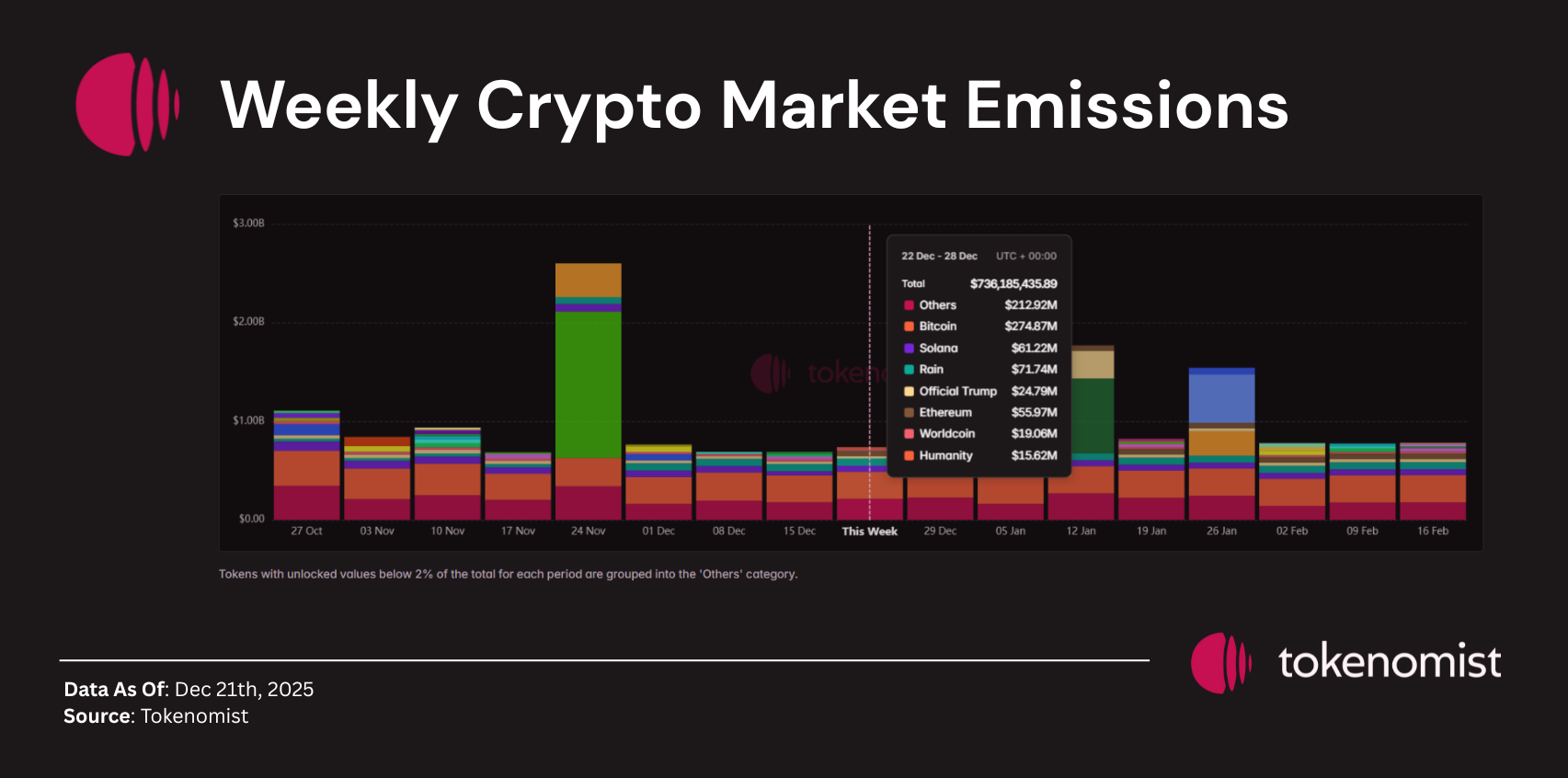

This week’s scheduled unlocks total ~$736M, largely flat versus last week. Emissions remain concentrated across BTC, RIVER, SOL & TRUMP

No single token dominates weekly supply, with emissions broadly distributed across majors and mid-caps.

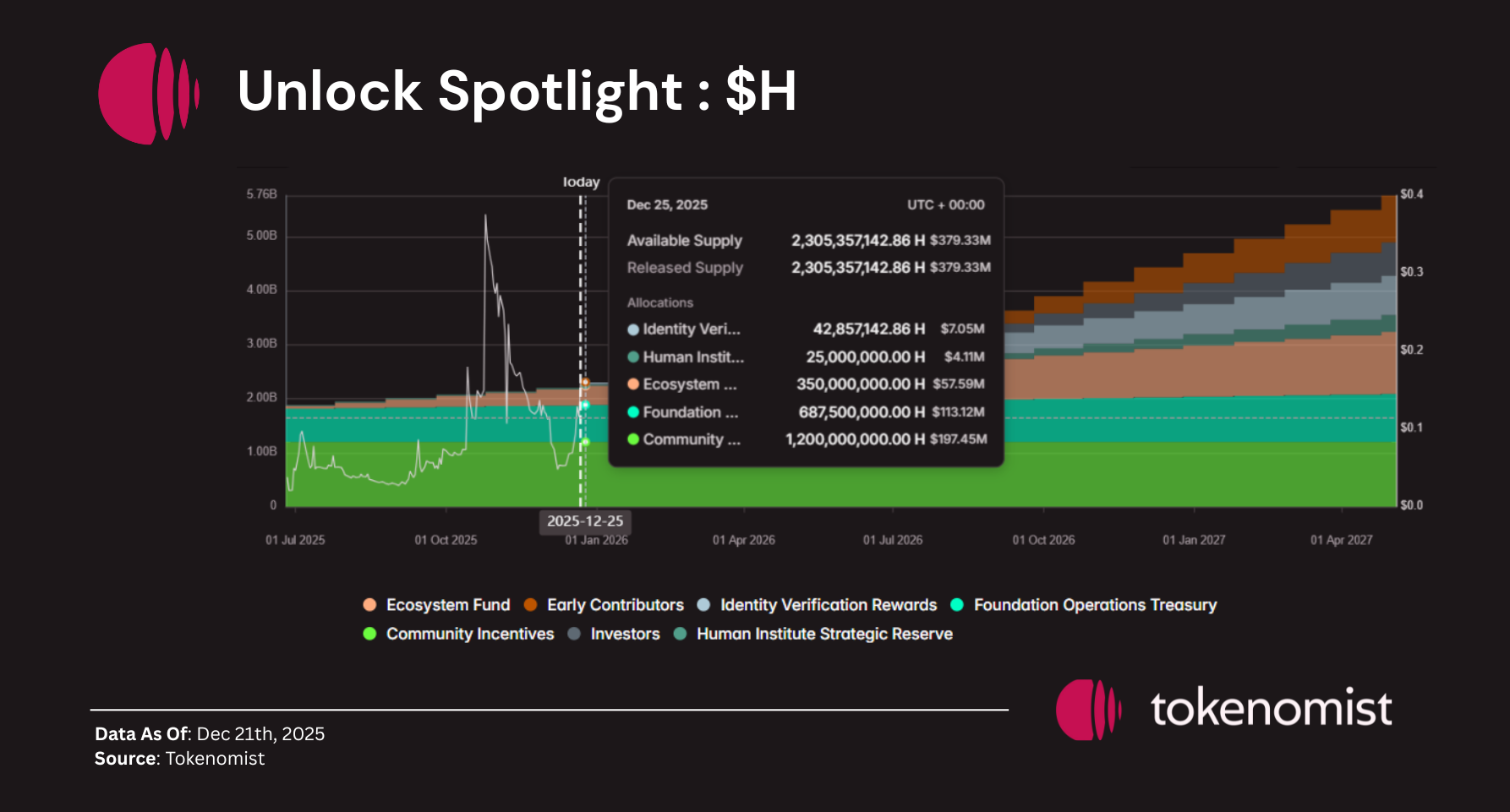

Unlock Spotlight: $H

Unlock Date: Dec 25, 2025

Amount: $16.36M

Unlock % of Circulating Supply: 4.79%

Allocations: Ecosystem, Foundation, Rewards

$H records the largest unlock relative to circulating supply this week, with all emissions tied to treasury-controlled allocations.

Full Unlock Schedule : https://tokenomist.ai/humanity

A significant portion of $H’s supply remains locked under a multi-year schedule. Currently, ~22% of total supply is unlocked, with only treasury allocations vesting. Insider unlocks are not scheduled to begin until Q2 2026.

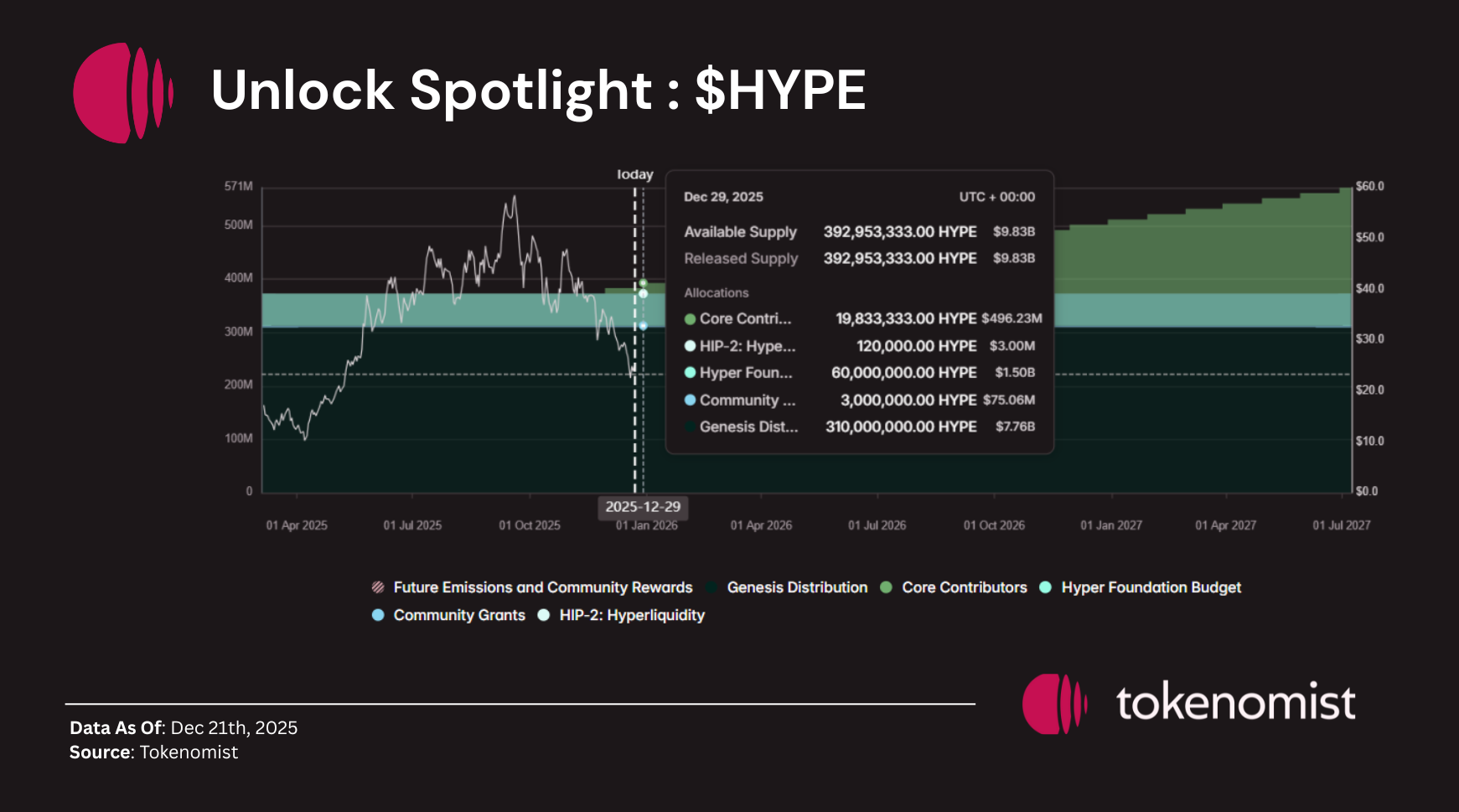

Unlock Spotlight: $HYPE

Unlock Date: Dec 29, 2025

Amount: $309M

Unlock % of Circulating Supply: 2.66%

Allocations: Core Contributors

$HYPE leads the week by unlock value, with the entire release directed toward core contributor allocations.

Full Unlock Schedule : https://tokenomist.ai/hyperliquid

While this week’s unlock adds 2.66% to circulating supply, the broader emission curve remains gradual, following a steady monthly release schedule with the majority of supply still locked long term.

Notable Crypto News

- Aave slides as community debates control over the brand ( https://www.coindesk.com/markets/2025/12/22/aave-slides-as-community-debates-over-who-controls-the-brand)

- DAWN raises $13M Series B led by Polychain Capital (https://bitcoinethereumnews.com/blockchain/dawn-raises-13m-series-b-led-by-polychain-to-scale-global-decentralized-wireless-broadband-network/)

- Lighter transfers 250M $LIT tokens ahead of TGE (https://bitcoinethereumnews.com/tech/lighter-shifts-25-of-lit-supply-as-traders-anticipate-possible/)

- Galaxy publishes 2026 crypto market outlook ( https://www.galaxy.com/insights/research/predictions-2026-crypto-bitcoin-defi)

- Coinbase Institutional releases 2026 market forecast ( https://www.coinbase.com/en-in/institutional/research-insights/research/market-intelligence/2026-crypto-market-outlook )

- Former Pump.fun developer sentenced to 6 years for $2M Solana fraud ( https://bitcoinethereumnews.com/finance/ex-pump-fun-dev-sentenced-to-6-years-for-2-million-solana-fraud/)