Weekly Unlocks Digest - Week 1, May 2025

Despite substantial token unlocks, market sentiment has flipped bullish — with prices rising across several high-emission tokens. The shift appears driven by macro relief and Bitcoin’s push above $93K, signaling renewed risk appetite. This week report covers the market’s surprising resilience, standout performers and laggards like $STRK, major upcoming unlocks, and a new TGE in Sign Protocol.

Weekly Unlocks Recap

One of the key takeaways this week is the market’s surprisingly resilient response to tokens with the highest circulating supply growth over the past 30 days. Despite substantial unlocks—typically seen as bearish catalysts—prices for several of these tokens have continued to climb. This indicates that current market demand is outpacing the newly introduced supply.

The shift in sentiment appears to be driven by broader macro relief, particularly easing concerns around tariffs and Bitcoin’s rebound above the $93,000 level— a key strategic threshold that aligns with the short-term holder cost basis. These positive developments have boosted risk appetite, flipping the usual tokenomics dynamic where increasing supply would normally exert downward pressure on price.

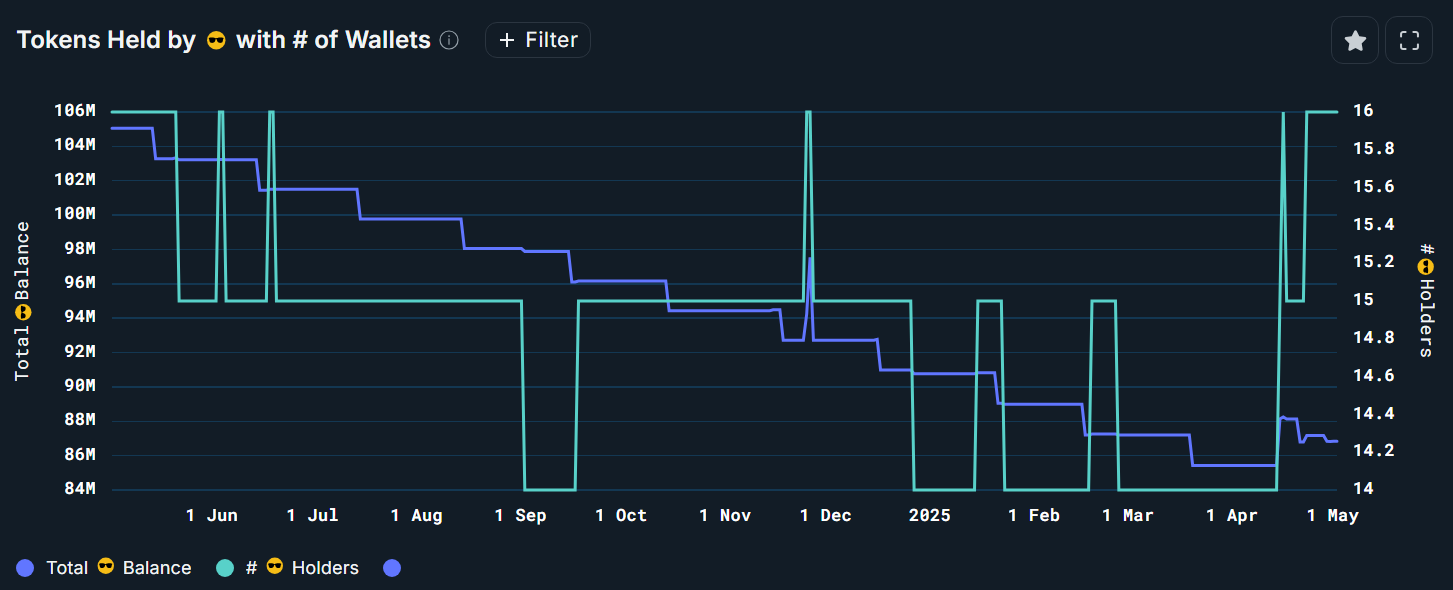

While many tokens have benefited from the recent shift in sentiment, $STRK stands out as a notable underperformer. Despite the broader bullish trend, $STRK has seen little to no significant demand, leading to continued weakness over the past month. This underperformance aligns with on-chain data from Nansen, which shows a gradual decline in $STRK holdings among smart money wallets — suggesting a lack of conviction from sophisticated market participants.

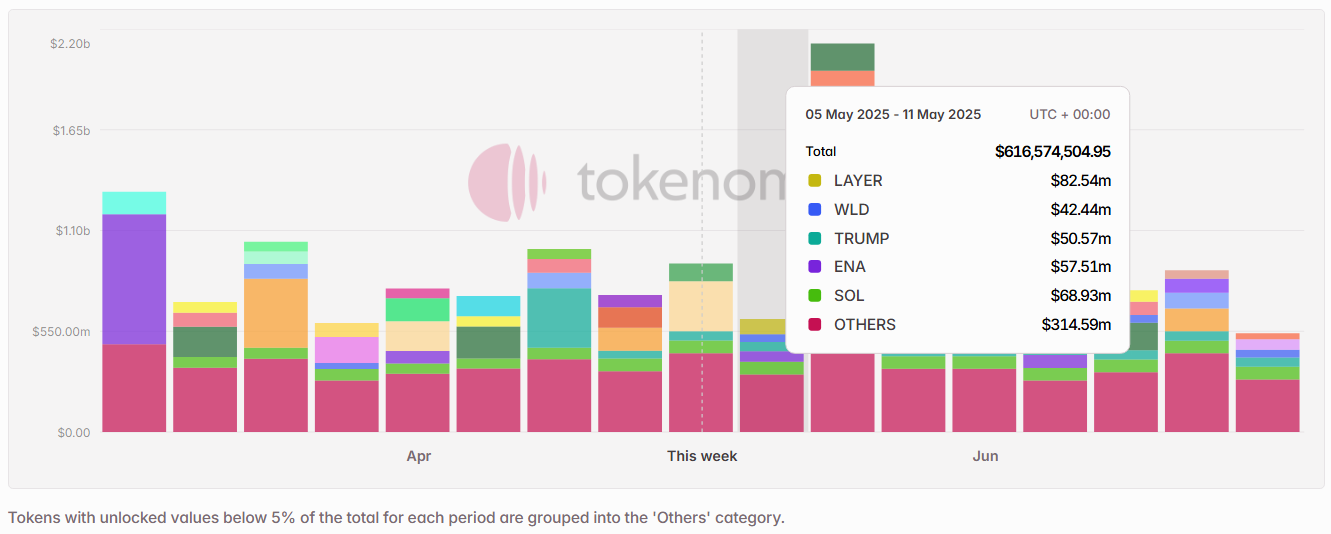

Upcoming Events

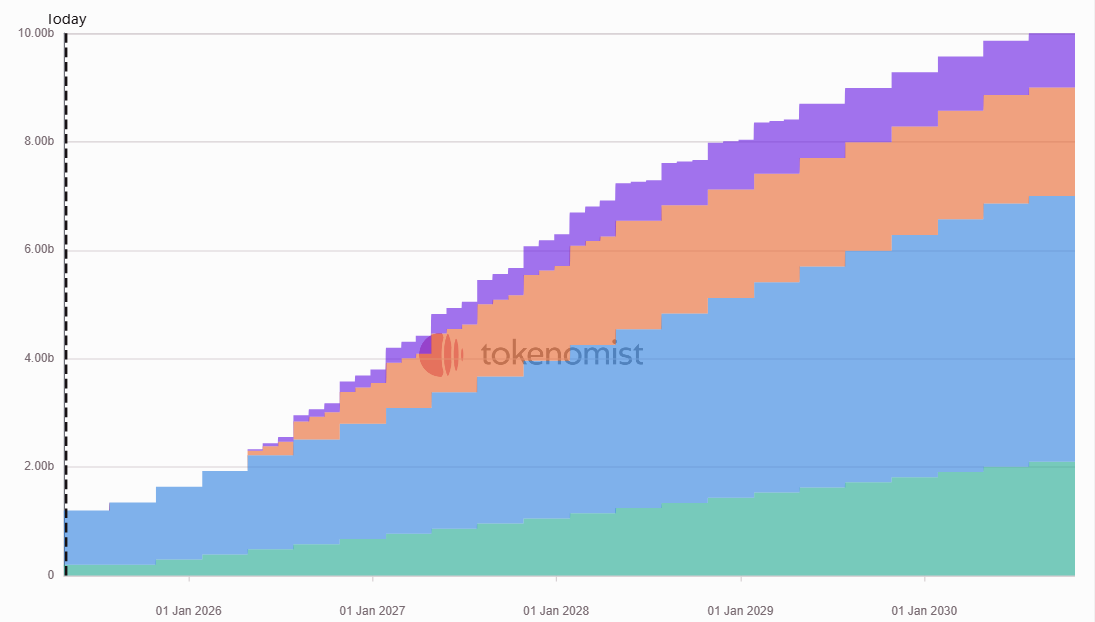

Next week’s scheduled token unlocks are set to surpass $600 million in total value. Of this, approximately 13% is classified as insider unlocks under Tokenomist’s framework — referring to allocations designated for founders, core teams, or early investors. Notable tokens facing sizable releases by dollar value include $LAYER, $SOL, $ENA, $TRUMP, and $WLD.

These unlocks may introduce fresh supply-side pressure, particularly for tokens with concentrated insider allocations or limited secondary market liquidity. Traders and analysts should closely monitor how these events unfold, as the market’s response could offer important signals about current demand resilience.

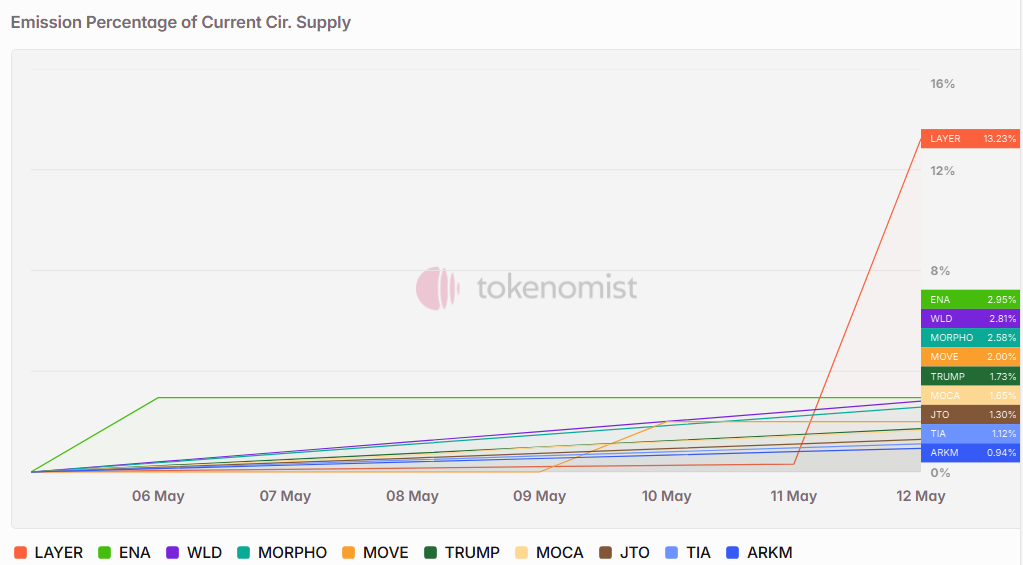

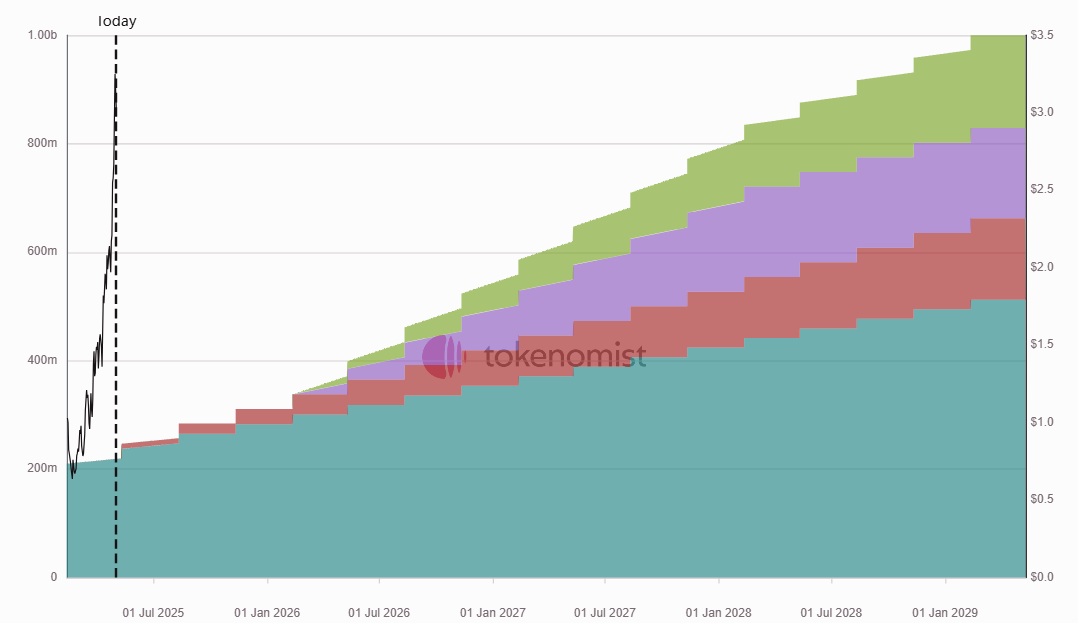

Unlocks Spotlight: $LAYER

- Unlock Date: May 11, 2025

- Unlock as % of Circulating Supply: 12.87%

- Current Unlock Progress: 22% unlocked

- Vested Allocations: Foundation, Community & Ecosystem

This event marks the beginning of a series of cliff unlocks, signaling a shift in the token's supply dynamics going forward. So far, $LAYER has shown strong price performance, but this substantial release will test the market's ability to absorb new supply without disrupting upward momentum.

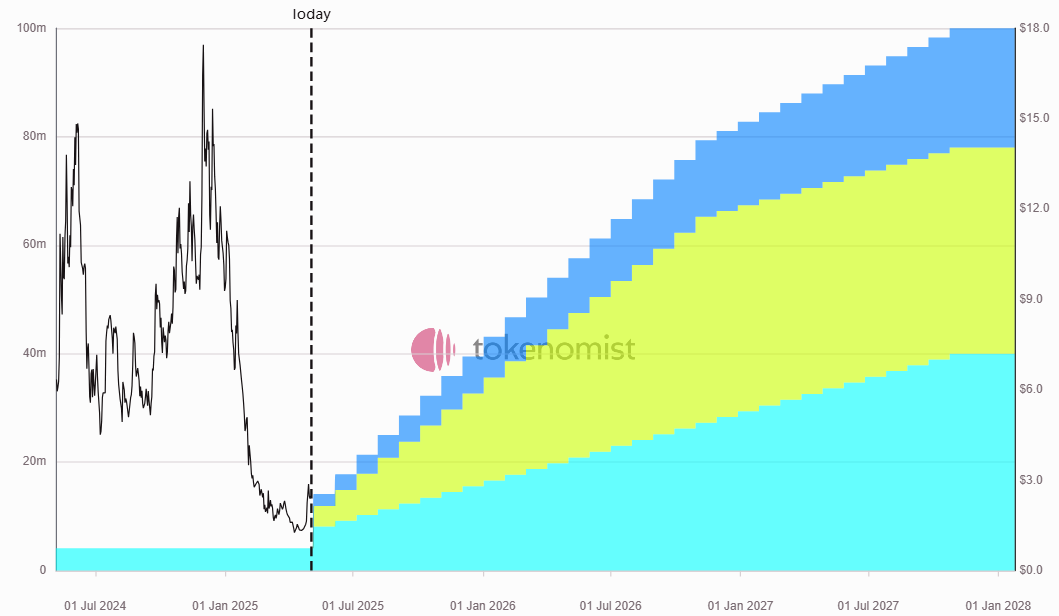

Unlocks Spotlight: $SPEC

- Unlock Date: May 6, 2025

- Unlock as % of Circulating Supply: 70.90%

- Current Unlock Progress: 4% unlocked

- Vested Allocations: Core contributors, Investors, Community

$SPEC stands out this week with an exceptionally large unlock relative to its circulating supply, with over 70% of the current supply set to be released. Given that the allocations are heavily insider-based, this event poses significant potential sell pressure if holders choose to realize gains. The token follows a low float, high FDV model, which means that upcoming unlocks could materially change its market dynamics.

New TGEs on the Radar

Sign Protocol is a newly launched attestation layer for Web3. It enables users and dApps to create, sign, and verify agreements or claims on-chain, supporting use cases like token vesting, e-signatures, and automated contract execution. The $SIGN token powers verification, incentivizes participation, and enables governance across the network.

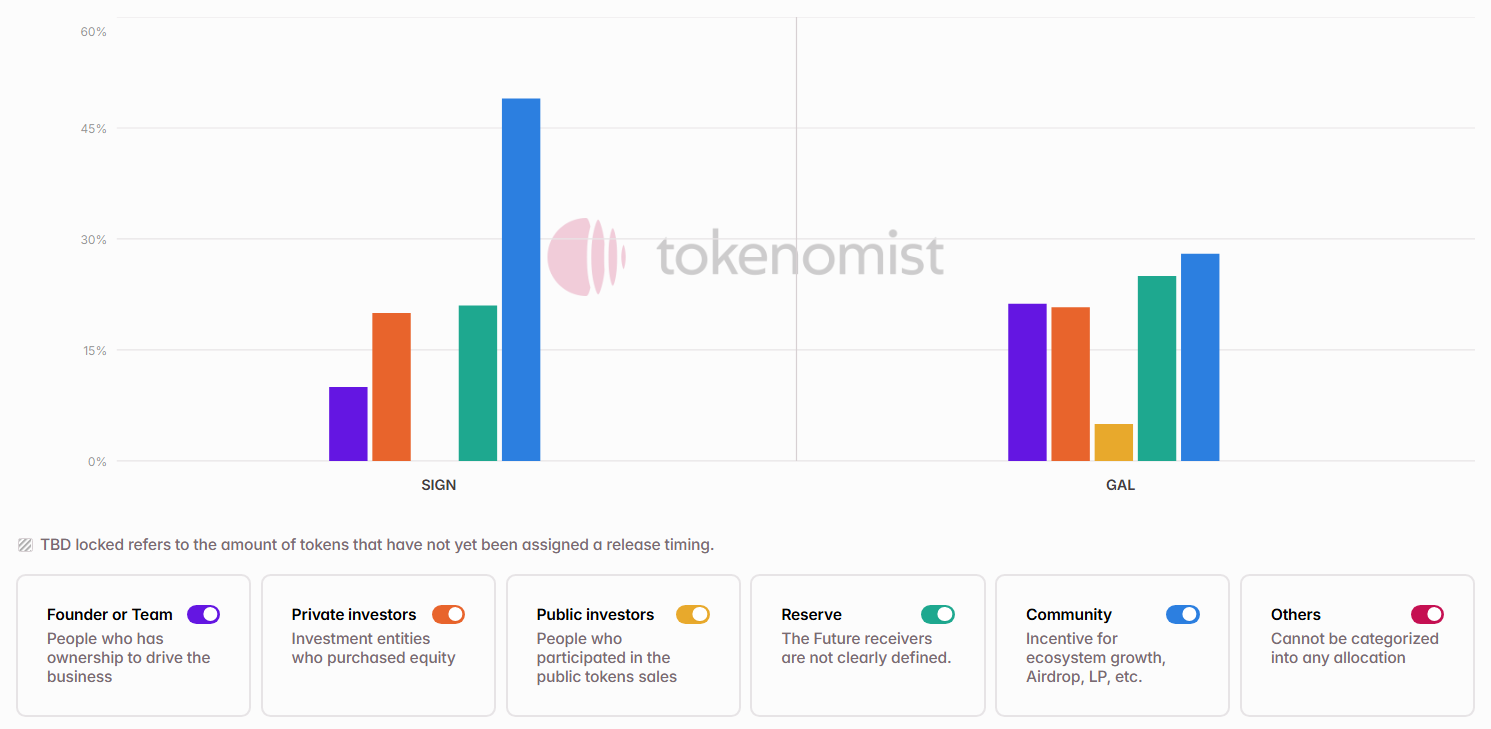

Since $SIGN is newly launched and there are few direct competitors with comparable token models, we’ve chosen to compare it to $GAL (Galxe) — a more established Web3 infra token. While they serve different functions — Sign Protocol focuses on attestations and onchain agreements, whereas Galxe powers identity and credential systems — both play critical roles in Web3 infrastructure and digital identity.

Both Sign Protocol ($SIGN) and Galxe ($GAL) currently hold similar valuations, each with a market capitalization exceeding $100 million. However, a key distinction lies in their respective token unlock schedules. As of now, approximately 12% of $SIGN tokens are unlocked, compared to 78% of unlocked $GAL.

This indicates that $SIGN follows a "low float, high FDV" model, which can support early price action but introduces considerable future unlock risk. Conversely, $GAL’s high circulating supply suggests a more mature token distribution with less near-term dilution.

On the allocation side, both projects exhibit broadly similar structures, distributing tokens across core contributors, investors, and the ecosystem. One key distinction is that $SIGN allocates a smaller share to the founding team, while assigning a larger portion to community and ecosystem incentives — reinforcing its positioning as a network-driven protocol in early growth stages.

Notable Crypto News

Institutional

- Charles Schwab eyes crypto trading launch (The Block)

Regulation

- SEC drops probe into PayPal's PYUSD stablecoin (Decrypt)

Tokenomics

- LetsBonk Launchpad to Use Revenue for $BONK Buybacks and Burns, Strengthening Ecosystem Value (X)

- Sky introduced a governance proposal to replace MKR with SKY as the ecosystem’s sole governance token (Cointelegraph)

General

- Circle rejected a $4-5b acquisition offer from Ripple (Cointelegraph)

- Coinbase to launch Bitcoin Yield Fund, offering 4-8% annualized returns to non-US institutional investors through a cash-and-carry trade strategy (Cointelegraph)