Weekly Unlocks Digest - Week 4, April 2025

As token unlocks continue to shape the dynamics of the crypto market, this week’s analysis focuses on the impact of significant supply changes and upcoming unlocks. From $TRUMP's surprising price increase driven by strong demand to $MELANIA's decline as hype fades, the latest data shows that the market’s response to unlocks isn’t always predictable. With over $800 million in token unlocks expected next week, we examine the most notable projects and the potential effects on their price movements. Join us as we dive into the latest trends, including insights on new TGEs like $ZORA and $HYPER, and what they mean for the broader market.

Weekly Unlocks Recap

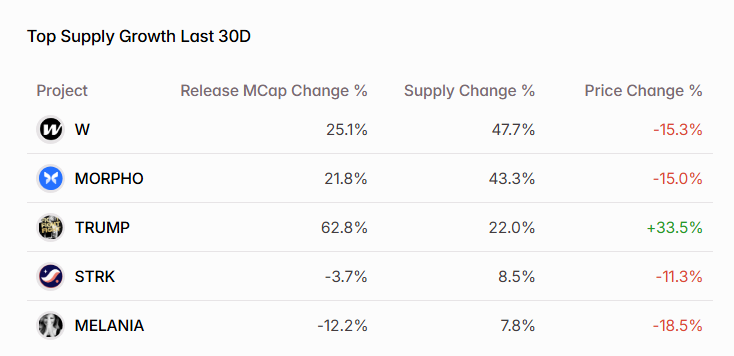

Over the past 30 days, the token with the highest percentage increase in circulating supply was $W, with a 47.7% emission. As a result, the market experienced a 15.3% price decline, illustrating how increased token supply can exert downward pressure when not matched by equivalent demand.

One of the most notable tokens this week was $TRUMP, which experienced a supply increase of over 20%. Despite this significant unlock, the token's price continued to rise — a rare dynamic that highlights exceptionally strong market demand. Rather than causing downward pressure, the newly vested supply was absorbed smoothly by buyers. This unusual resilience was driven by news that President Donald Trump announced a private gala dinner for the top 220 $TRUMP holders, sparking renewed interest and accumulation among investors.

To put this into a wider perspective, the anticipation of massive unlocks led many traders to open short positions on $TRUMP, pushing funding rates deeply negative. However, when unexpected demand surged following the announcement, a short squeeze played out — forcing short sellers to cover their positions and driving the price even higher. This event serves as a rare example that token unlocks do not always result in negative price action; under certain conditions, strong demand catalysts can completely offset the typical sell pressure from newly vested tokens.

On the other side, $MELANIA — a token launched by the First Lady during the inauguration event — performed poorly as supply increased. This follows a more typical pattern for meme or celebrity-driven tokens, where initial hype fades quickly without sustained demand. As momentum dried up and no new buyers stepped in, the price entered a prolonged downtrend. $MELANIA has dropped over 18% over the past month, illustrating the common risk of relying solely on celebrity narratives without strong token utility or ongoing catalysts.

Upcoming Events

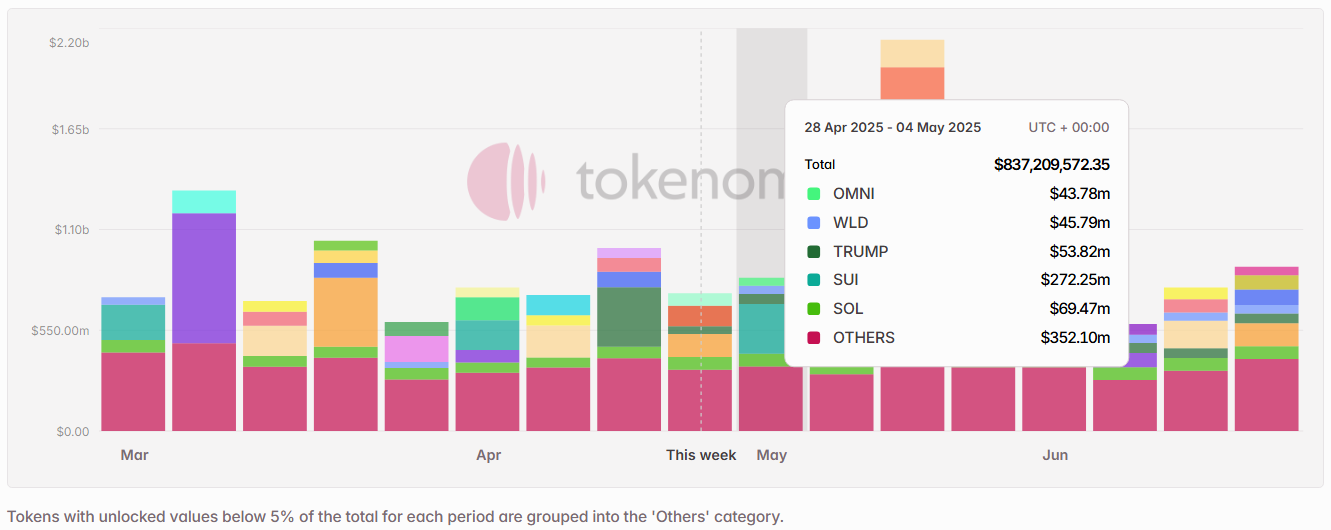

Looking ahead, next week’s total unlocks are projected to exceed $800 million in value. Of this amount, approximately 22% qualifies as insider unlocks based on Tokenomist’s standard — meaning allocations to founders, teams, or private investors. Among the most significant unlocks by dollar value are $SUI, $SOL, $TRUMP, $WLD, and $OMNI, respectively. These upcoming events could introduce notable supply pressure into the market, particularly for tokens with high insider allocations and limited liquidity.

Unlocks Spotlight: $SUI

- Unlock Date: May 1, 2025

- Unlock as % of Circulating Supply: 2.28%

- Current Unlock Progress: 33% unlocked

- Vested Allocations: Community Reserves, Series B Investors, Early Contributors, Mysten Labs Treasury

As the largest unlock of the week, $SUI’s release spans across a mix of ecosystem funds and insider allocations, which could create both sell pressure and redistribution opportunities depending on market conditions.

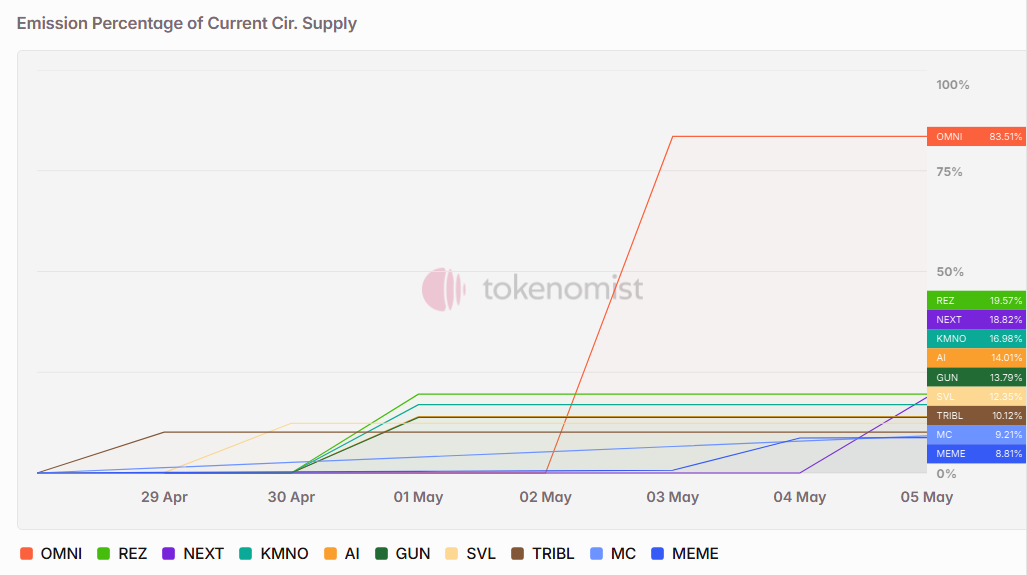

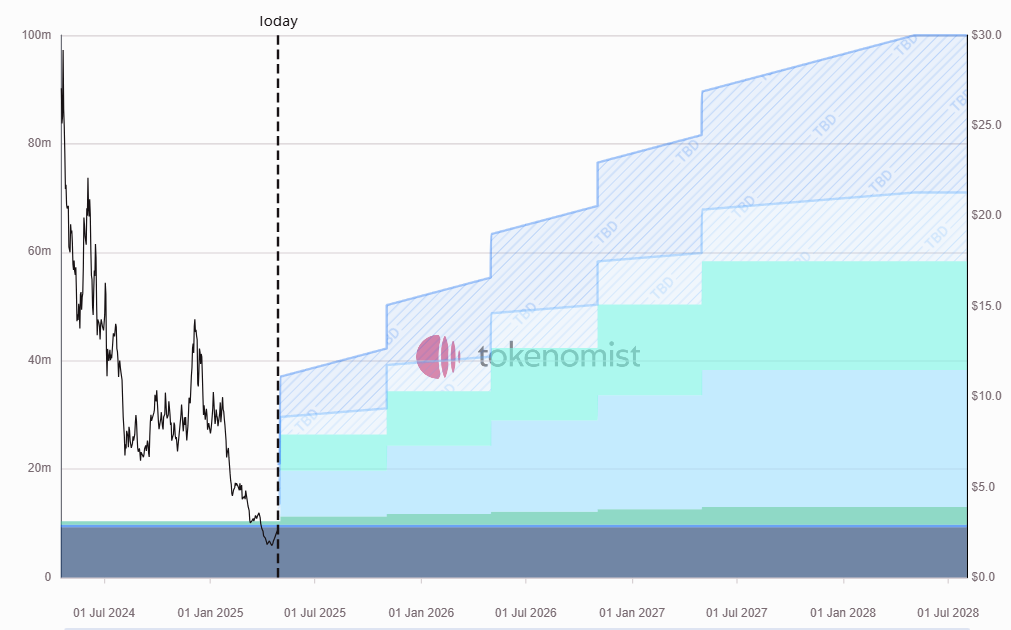

Unlocks Spotlight: $OMNI

- Unlock Date: May 2, 2025

- Unlock as % of Circulating Supply: 83.51%

- Current Unlock Progress: 10% unlocked

- Vested Allocations: Core Contributors, Investors, and Advisors

$OMNI stands out this week with an exceptionally large unlock relative to its circulating supply, with over 80% of the current supply set to be released. Given that the allocations are heavily insider-based, this event poses significant potential sell pressure if holders choose to realize gains.

New TGEs on the Radar

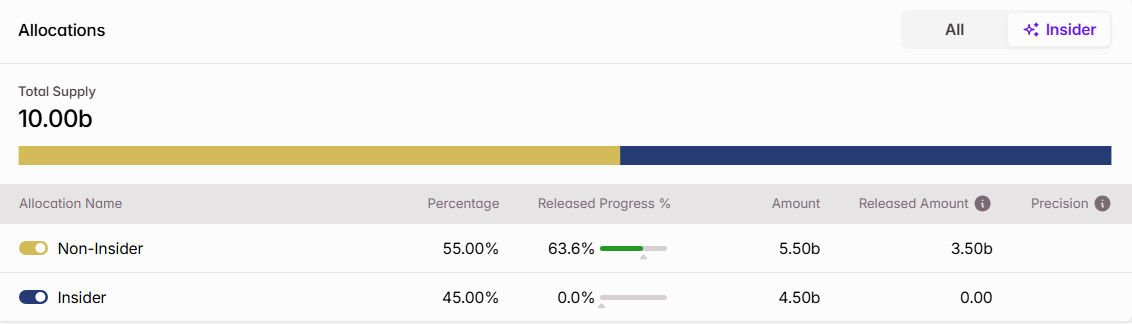

Several new TGEs were tracked by Tokenomist over the past week, including $ZORA, $HYPER, and $INIT. Among them, $ZORA stands out due to its notable price performance post-launch. Originally starting as an NFT marketplace, Zora later expanded by launching its own Layer 2 network — Zora Network. However, despite having its own L2, the $ZORA token was launched on the Base chain, with a total supply of 10 billion tokens, following a similar approach to $PENGU’s launch on Solana. $ZORA is positioned as “a coin for fun,” with no formal utility or governance rights attached. Sentiment around the $ZORA TGE has been mixed on Crypto Twitter, largely due to concerns over a significant portion of the token supply being allocated to insider cohorts despite being a ‘fun coin’.

In addition, Zora previously raised funds at a fully diluted valuation (FDV) of over $600 million from venture capital firms. However, following the TGE, the current FDV has dropped sharply to around $170 million — a decline of over 52%. Some critics argue that $ZORA was launched at an overly ambitious valuation, leaving little room for upside potential for new investors. This stands in contrast to projects like Hyperliquid, which structured their launches more favorably to attract sustained post-TGE demand.

Another perfect example of why teams shouldn’t chase sky-high valuations pre-TGE:@zora raised at a 600M FDV.

— Simon (@sjdedic) April 23, 2025

Being under pressure (understandably), $ZORA listed at 350M - and instantly dumped -50% to 175M.

When will teams finally get it?

List low.

Create max upside.

Let the… pic.twitter.com/xjkQrzXfpX

Notable Crypto News

Institutional

- SOL Strategies raises $500M in convertible notes issuance to buy Solana tokens (CoinTelegraph)

- Tether, Bitfinex, Cantor Fitzgerald, and SoftBank are launching Twenty One, a publicly traded bitcoin-focused company (Cantor)

- Charles Schwab CEO eyes spot Bitcoin trading by April 2026 (CoinTelegraph)

Regulation

- Crypto advocate Paul Atkins officially sworn in as SEC chairman (The Block)

Tokenomics

- a16z crypto doubled down on its investment in Layer Zero with a new $55m acquisition of ZRO with a 3-year lock-up period commitment (CoinStats)

- Mantra announced it plans to burn 300m $OM, including 150m from its founder, as it attempts to recover from last week’s crash (Mantra)

General